Press release

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses, or real estate. Different capital gain tax rates apply to other tax brackets and profits made upon purchase. Capital gains are also of several types, depending on how long the investment is being held. If the asset is sold before the owner has owned it for a year, the profits acquired are referred to as short-term capital gain, and the ones held for more than a year are referred to as long-term capital gain. The long-term capital gain tax rates are lower than the short-term capital gain tax rates. That is why investors prefer to hold on to their investments for as long as possible.

Different types of capital gains:

Short-term capital gains: If the owner cashes out on an investment before completing a year of ownership, the profits from the transaction are referred to as short-term gains. These gains are generally taxed at the same tax rate as the rate at which the regular income of a taxpayer is taxed, which leads to a higher tax bill. An example of a short-term capital gain would be the profits made by selling off equity stocks at a profit within a year.

Long-Term capital gains: If the owner has held on to an asset for more than a year before selling it off and making a profit, the profits are referred to as long-term capital gains. These capital gains are taxed at a much lower rate, and the capital gains tax rates for this category have been explained below. An apt example of long-term capital gains would be the profits made by selling a real estate property that has been under one's ownership for more than a year.

How capital Gains are taxed

Capital gains are only taxed once they have been "realized." They are only realized once an asset is sold at a profit. The profit made by the taxpayer is taxed at the capital gain tax rate for the relevant year. These rates vary along with the tax brackets for each year. The capital gain for an individual is calculated by subtracting the asset's original cost from the amount it was sold for. However, in addition to the profits made, other factors also come into play, including the duration of ownership of the asset, any amount of money spent on holding that asset, the tax bracket you fall under, and your tax filing status.

What is the capital gain tax rate, and do these apply to specific tax brackets?

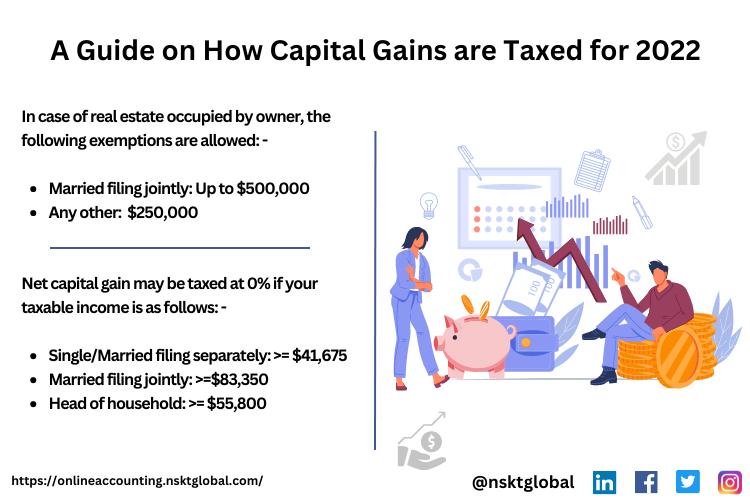

The Capital Gains Tax Rates have not changed in recent years. However, the tax brackets have substantially been elevated, which might help some taxpayers lower their tax bills as they fall into a lower tax bracket for 2022. The long-term capital gains tax rates are charged at three rates, and this tax rate depends upon the taxpayer's taxable income for the year. The table below shows the long-term capital gains tax 2022 rates for different tax brackets:

Let us understand the tax structure with a real-world example. Suppose that Mr. Willson makes $260,000 a year and he files his taxes jointly. He would have to pay a 15% tax on his capital gains for 2022, as he falls in the 15% tax bracket defined by his income.

However, the Short Term Capital Gains are not changed at the same rate and are treated as if they were a salary or a wage. Therefore, short-term capital gains tax is calculated by adding those gains to the taxpayer's earned income on Form 1040. Dividends received by an asset owned by a taxpayer for more than a year are also treated as short-term capital gains.

Exceptions and special capital gains rates:

Collectibles: Art, jewelry, antiques, and precious metals are categorized as collectibles, and they are taxed at 28%. The capital gain tax rates on collectibles are not dependent on your income.

Real estate occupied by the owner: In case a taxpayer is about to sell their principal residence, an individual's $250,000 worth of capital gains from the sale of their home is excluded ($500,000 if they are married and are filing jointly). However, the owner must have lived in this house for more than two years.

Exceptions on investments: A taxpayer might be subjected to another levy called the net investment income tax, which imposes an extra 3.8% tax upon the income from your investments. This tax applies if your Modified AGI is more than $250,000 if you file your taxes jointly, $200,000 if you're single, or if you file taxes online as the head of the household. However, if you are married but file taxes separately, the limit would be $112,500.

Tax saving strategies

The overall tax returns a taxpayer obtains are often affected by the capital gain tax rates that apply to taxpayers according to their income. However, there are ways of lowering your capital gain taxes, which are discussed as follows:

Consider using capital losses: If you use the capital losses incurred throughout the year to offset your capital gains, you will have to pay a lower tax bill. If your capital losses amount to up to $3,000 more than the gains, you can claim the difference against your income. Suppose you made a capital gain of $4,000 but incurred a capital loss of $15,000. The $4,000 capital gain will be balanced against the capital losses, and the remaining $11,000 will be used to lower your taxable income by $3,000. The remaining $8,000 of capital losses to be claimed can be carried over to reduce your taxable income next year, and so on.

Obey the wash-sale rule: If a taxpayer sells a stock share at a loss to get tax advantages and repurchases them within 30 days, they might run afoul of the wash-sale rule. The wash-sale rule states that if you sell a security, such as a stock, at a loss and buy a substantially similar amount of the same securities back within 30 days, you will not be able to list the loss you have incurred as a capital loss on your tax return.

Contribute to tax-advantaged retirement plans: Leveraging retirement accounts allows taxpayers to delay capital gains tax payments. For example, the retirement contribution is tax-exempt if a taxpayer contributes to a 401K plan. This tax-exempt contribution has a high growth rate as well.

Changes in capital gain tax rates in recent years

The tax percentages have remained the same. However, the tax brackets have increased because of inflation, implying that some people might be entitled to lower tax bills while making the same amount of money.

How to report capital gain tax?

If you want to report capital losses or gains, you must inform them on Form 1040 and Schedule D, Capitals Losses and Gains. Once this is done, the information regarding the same is transferred to the 7th Line of Form 1040. It is suggested that you file taxes online because the processing of e-filed tax returns is quicker, and they save the hassle of buying so many forms and posting them via mail. Form 1040 requires taxpayers to report all taxable income and mention expenses and dividends as tax deductions and credits. For a taxpayer to accurately file taxes online, a lot of time would go into tax planning and filing, which can be a problem for taxpayers that handle a lot of time-taking responsibilities.

Sourcing help from a tax accounting firm would be the best choice for such individuals, as letting professional tax preparers handle their tax affairs ensures timely, error-free, and hassle-free filing of taxes. NSKT Global specializes in tax strategization, and the tax professionals working for the company are well-versed in ways of lowering their clients' tax bills. Click here to land on the official NSKT Global homepage, and find out how you can benefit from the services offered by the company, along with the pricing for the same! Book an appointment with an expert tax consultant, and sign up for the affordable tax-related services NSKT Global provides!

Schedule a Free Consultation

Charlotte City Center, 25 North Tryon Street, Suite 1600, Charlotte, North Carolina, 28202

North Tryon Street

NSKT Global, is a Global consulting firm with a team of certified public accountants, certified fraud examiners (CFE), certified sarbanes-oxley experts (CSOE), Business Advisers, Internal Auditors, Data Scientist and IT experts. We extend all kinds of help to our clients and assist them at all possible junctures of their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A Guide on How Capital Gains are Taxed for 2022 here

News-ID: 2884734 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

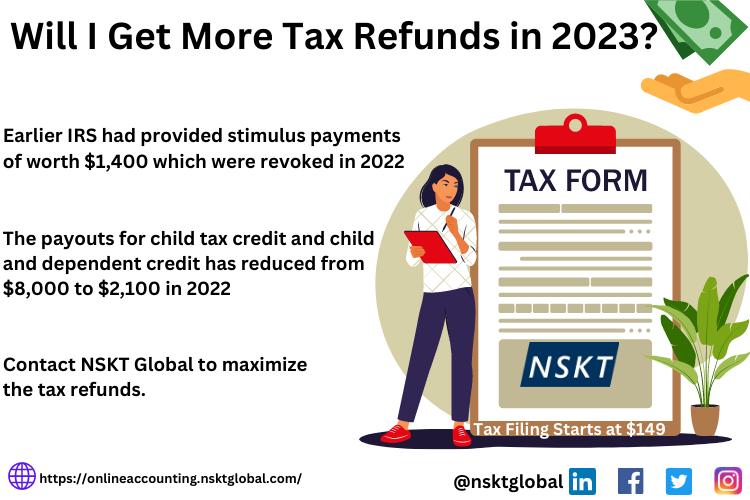

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Capital

Venture Capital Investment Market Is Booming Worldwide | Accel, Benchmark Cap …

Venture Capital Investment Market: The extensive research on Venture Capital Investment Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Venture Capital Investment Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Risk Capital Investment Market Business Development Strategies 2020-2026 by Majo …

Risk Capital Investment Market - Global Analysis is an expert compiled study which provides a holistic view of the market covering current trends and future scope with respect to product/service, the report also covers competitive analysis to understand the presence of key vendors in the companies by analyzing their product/services, key financial facts, details SWOT analysis and key development in last three years. Further chapter such as industry landscape and…

Global Venture Capital Investment Market, Top key players are Accel, Benchmark C …

Global Venture Capital Investment Market Report 2019 - History, Present and Future

The global market size of Venture Capital Investment is $XX million in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Global Venture Capital Investment Market Report 2019 - Market Size, Share, Price, Trend and Forecast is a professional…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…