Press release

Peer-to-Peer Lending Market to Surpass Valuation of US$ 1.3 Trn by 2031

Transparency Market Research delivers key insights on the global peer-to-peer lending market. In terms of revenue, the global peer-to-peer lending market is estimated to expand at a CAGR of 28.3% during the forecast period, owing to numerous factors, regarding which TMR offers thorough insights and forecasts in its report on the global peer-to-peer lending market.Get Report Details- https://www.transparencymarketresearch.com/peer-to-peer-lending-market.html

Peer-to-peer lending is a form of lending money to an individual or business without the interference of a bank or a financial institution. The peer-to-peer (P2P) lending platform is an online money lending platform generally used to lend money to potential borrowers and offers secured and unsecured loans. Credit scores and social media activity are used by P2P platforms to connect borrowers and lenders at low interest rates. The peer-to-peer lending platform acts as a mediator between the borrower, lender, and partner bank; the platform is subject to fewer regulatory restrictions, allowing them to keep fees and rates low.

Request A Sample- https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=10835

The growing integration of smart payment gateways with different financial institutions is a major factor that drives the growth of the peer-to-peer lending market.

Peer-to-Peer Lending Market: Dynamics

The growing number of students who require educational loans is a key factor expected to propel the growth of the peer-to-peer lending market during the forecast period. Peer-to-peer lending platforms charge lower fees with simple application processes to students who apply for educational loans, leading to a rise in demand for these platforms. Lower operating costs and lower market risk for lenders and borrowers are key drivers of the global peer-to-peer (P2P) lending market. However, the market faces challenges due to technical and manual errors in security control of peer-to-peer lending platforms. Lack of data privacy and security due to the risk of disclosure of names of borrowers and lenders on the website of peer-to-peer lending platforms is expected to hamper the growth of the market during the forecast period. Nevertheless, increasing technological developments in the financial sector is expected to boost the adoption of peer-to-peer lending platforms among various end users.

Request For Customization- https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=10835

Peer-to-Peer Lending Market: Prominent Regions

The peer-to-peer lending market in North America is expected to account for largest share during the forecast period due to innovations in P2P lending platforms to reduce manual errors and secure the data of borrowers & lenders from internal & external theft in the U.S. and Canada. This is expected to boost the adoption of peer-to-peer lending platforms in the region during the forecast period. Apart from significant presence of market players in the region, the U.S. Government has increased investment in the finance sector, which is fueling the growth of the peer-to-peer lending market.

The peer-to-peer lending market in Asia Pacific is likely to expand at the highest CAGR during the forecast period due to increasing demand for student educational loans that considerably increases the demand for peer-to-peer lending platforms in the region. The Europe market is projected to rise at notable CAGR during the forecast period, owing to rising demand for property loans that generate huge demand for the adoption of peer-to-peer lending platforms among various end users.

Enquiry Before Buying- https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=10835

Peer-to-Peer Lending Market: Key Players

Key players operating in the global peer-to-peer lending market are Avant Inc., CircleBack Lending, Inc., Clear, Daric Inc., Funding Circle Limited, LendingPad Corporation, Kabbage Inc., Peerform, Payoff, Prosper Marketplace, Inc., Social Finance Inc. and Upstart Network Inc.

More Trending Reports By Transparency Market Research-

· SCADA Market - https://www.transparencymarketresearch.com/global-scada-market.html

· Managed Security Services Market - https://www.transparencymarketresearch.com/managed-security-services-market.html

· Mobile Wallet Market - https://www.transparencymarketresearch.com/mobile-wallet.html

· Smart Home Market - https://www.transparencymarketresearch.com/smart-homes-market.html

· Enterprise Mobility Market - https://www.transparencymarketresearch.com/enterprise-mobility-market.html

· Digital Experience Monitoring [DEM]

Market - https://www.transparencymarketresearch.com/digital-experience-monitoring-dem-market.html

· Edutainment Market - https://www.transparencymarketresearch.com/edutainment-market.html

· Sales Enablement Software Market - https://www.transparencymarketresearch.com/sales-enablement-software-market.html

About Transparency Market Research

Transparency Market Research registered at Wilmington, Delaware, United States, is a global market research firm that offers market analysis reports and business consulting. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

For More Research Insights on Leading Industries, Visit our YouTube channel -

https://www.youtube.com/channel/UC8e-z-g23-TdDMuODiL8BKQ

Contact Us:

Rohit Bhisey

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

Original Source- https://bit.ly/3dOogVh

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Market to Surpass Valuation of US$ 1.3 Trn by 2031 here

News-ID: 2710930 • Views: …

More Releases from Transparency Market Research

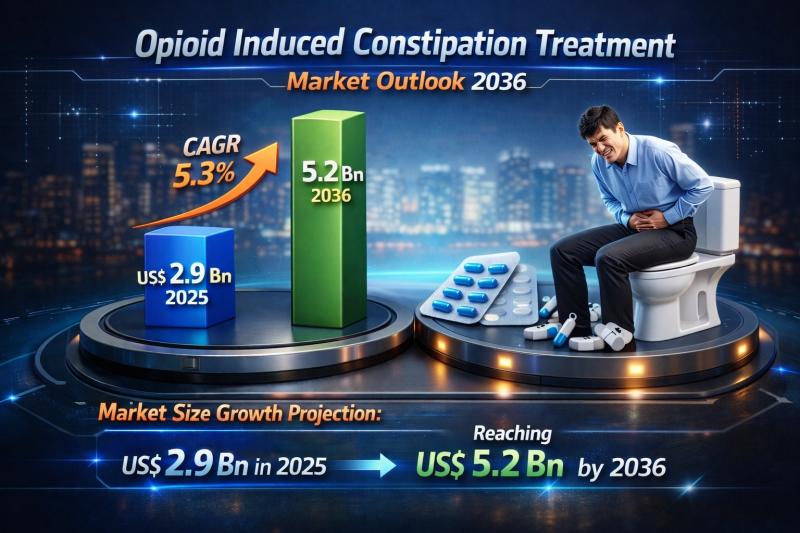

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

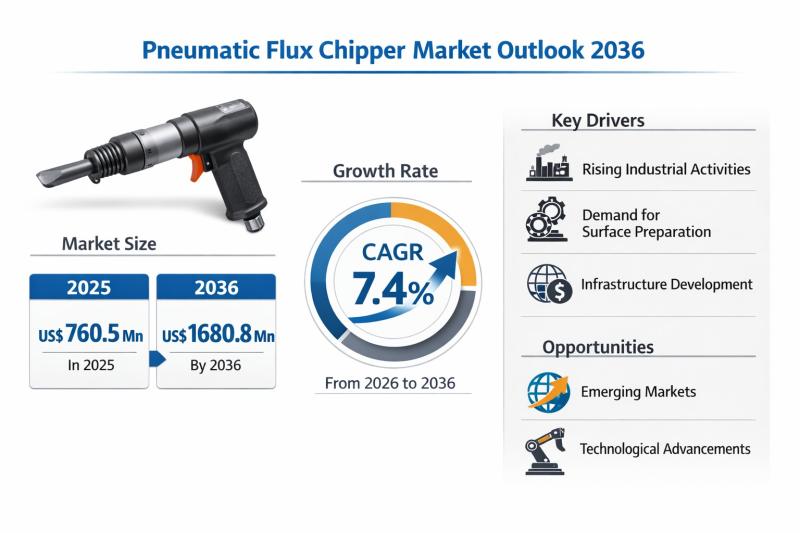

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

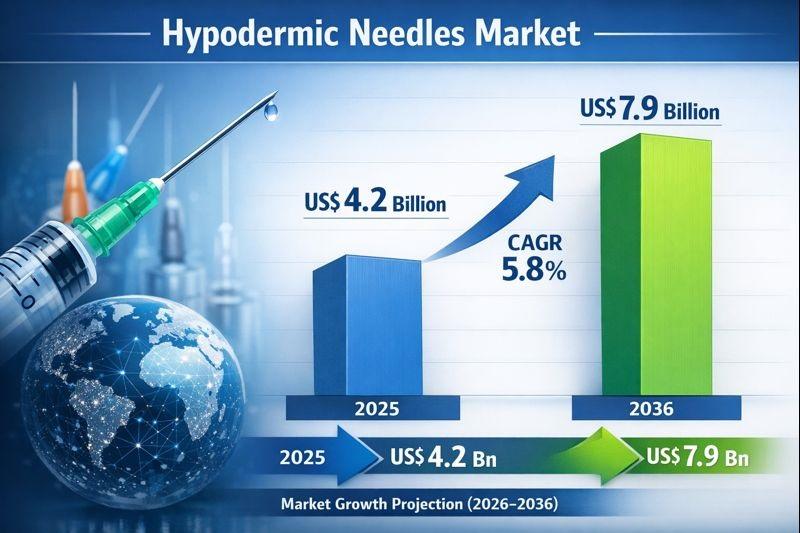

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…