Press release

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new entrants, and stakeholders in formulating strategies for the future and taking steps to strengthen their position in the market.Download Free Sample Report : https://www.alliedmarketresearch.com/request-sample/17702

Report coverage & details:

Report Coverage Details

Forecast Period 2022-2031

Base Year 2021

Market Size in 2021 $11.48 billion

Market Size in 2031 $27.50 billion

CAGR 9.5%

No. of Pages in Report 363

Segments covered Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate, Provider, and Region

Drivers Increase in innovations in software designs to speed up the mortgage-application process

Lower costs for the lender

Need to improve the overall customer experience

Opportunities Increase in digitization in mortgage lending market

Restrains Higher interest rate on mortgage loans and additional costs

Covid-19 Scenario:

The Covid-19 pandemic had a moderate impact on the industry as some lenders struggled to keep up with the workload and had no choice but to raise rates.

Mortgage debt represents the single largest source of debt for individual homeowners and had a significant impact on their financial situation and capacity to maintain financial stability in case of pay reductions or wage loss.

The report offers detailed segmentation of the global mortgage lending market based on type of mortgage loan, mortgage loan terms, interest rate, provider, and region. The report provides analysis of each segment and sub-segment with the help of tables and figures. This analysis helps market players, investors, and new entrants in determining the sub-segments to be tapped on to achieve growth in the coming years.

Based on type of mortgage loan, the conventional mortgage loans segment accounted for the highest share in 2021, contributing to nearly three-fourths of the total share, and is expected to maintain its leadership status during the forecast period. However, the jumbo loans segment is expected to manifest the highest CAGR of 13.7% from 2022 to 2031.

Interested to Procure the Data? Inquire here @: https://www.alliedmarketresearch.com/purchase-enquiry/17702

Based on mortgage loan terms, the 30-year mortgage segment held the largest share in 2021, accounting for more than half of the market, and is expected to maintain its dominance in terms of revenue by 2031. However, the 15-year mortgage segment is estimated to witness the largest CAGR of 13.7% during the forecast period.

On the basis of interest rate, the fixed-rate mortgage loan segment dominated the market in terms of revenue in 2021, accounting for more than two-thirds of the market, and is expected to maintain its leading position during the forecast period. However, the adjustable-rate mortgage loan segment is estimated to register the highest CAGR of 11.3% during the forecast period.

Based on provider, the primary mortgage lender segment held the largest share in 2021, accounting for nearly three-fourths of the market, and is expected to continue its dominance through 2031. However, secondary mortgage lender segment is expected to showcase the highest CAGR of 12.1% during the forecast period.

Based on region, North America accounted for the highest share in 2021, contributing to nearly half of the total market share, and is projected to continue its leadership status by 2030. However, Asia-Pacific is projected to portray the fastest CAGR of 13.2% during the forecast period.

Leading players of the global mortgage lending market analyzed in the research include Bank of America Corporation, Ally Financial Inc., Citigroup, Inc., BNP Paribas Fortis, JPMorgan Chase & Co, Fannie Mae, PT Bank Central Asia Tbk, Mr. Cooper Group Inc., Royal Bank of Canada, QNB, Social Finance, Inc., Rocket Mortgage, LLC, Truist, Standard Chartered, Wells Fargo, ClearCapital.com, Inc. and Roostify, Inc.

The report analyzes these key players of the global mortgage lending market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments by every market player.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mortgage lending market analysis from 2021 to 2031 to identify the prevailing mortgage lending market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the mortgage lending market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global mortgage lending market trends, key players, market segments, application areas, and market growth strategies.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/17702

Key Market Segments

Type of Mortgage Loan

Conventional Mortgage Loans

Jumbo Loans

Government-insured Mortgage Loans

Others

Mortgage Loan Terms

30-year Mortgage

20-year Mortgage

15-year Mortgage

Others

Interest Rate

Fixed-rate Mortgage Loan

Adjustable-rate Mortgage Loan

Provider

Primary Mortgage Lender

Primary Mortgage Lender

Banks

Credit Unions

NBFC's

Others

Secondary Mortgage Lender

By Region

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Netherlands

Rest of Europe

Asia-Pacific

China

Japan

India

Australia

South Korea

Singapore

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

Related Reports:

Personal Loans Market: https://www.alliedmarketresearch.com/personal-loans-market-A07580

Payday Loans Market : https://www.alliedmarketresearch.com/payday-loans-market-A10012

Trade Loans Services Market : https://www.alliedmarketresearch.com/trade-loan-services-market-A08281

Loan Origination Software Market: https://www.alliedmarketresearch.com/loan-origination-software-market-A15124

Property Loan Market: https://www.alliedmarketresearch.com/property-loan-market-A15131

Florida Digital Lending Market : https://www.alliedmarketresearch.com/florida-digital-lending-market-A11092

United States

USA/Canada :

+1-800-792-5285

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Lending Market : Increased focus toward digitalizing lending process here

News-ID: 2840534 • Views: …

More Releases from Allied Market Research

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Indoor Farming Equipment Market Outlook, Top Key Players Analysis, Current Trend …

The report highlights numerous factors that influence the growth of the global Indoor farming equipment market such as market demand & forecast and qualitative and quantitative information. The qualitative data of market report includes pricing analysis, key regulations, macroeconomic factors, microeconomic factors, key impacting factors, company share analysis, market dynamics & challenges, strategic growth initiatives, and competition intelligence. The study cracks market demand in 15+ high-growth markets in the…

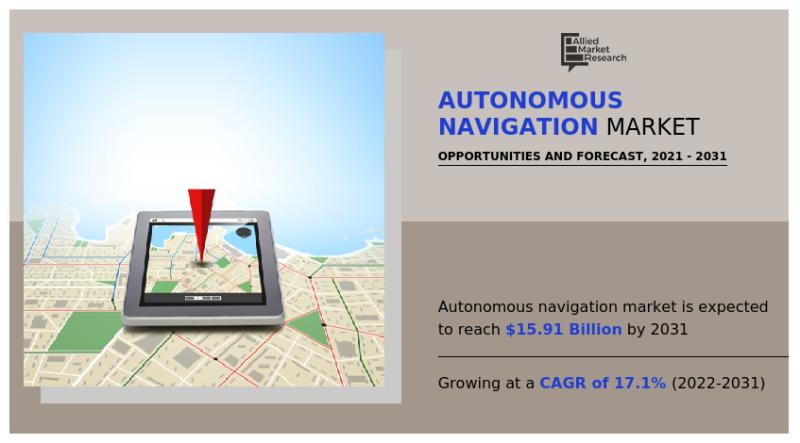

Autonomous Navigation Market Analysis and Forecast with a CAGR of 17.1% (2022-20 …

The global autonomous navigation market garnered $3.27 billion in 2021, and is estimated to generate $15.91 billion by 2031, manifesting a CAGR of 17.1% from 2022 to 2031.

Increase in demand for sense & avoid systems in autonomous system, rise in adoption of autonomous robot in commercial & military applications, and surge in demand for real-time data in military applications drive the growth of the global autonomous navigation market. During…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…