Press release

This Start-Up Beats Rivals Including Big Guys

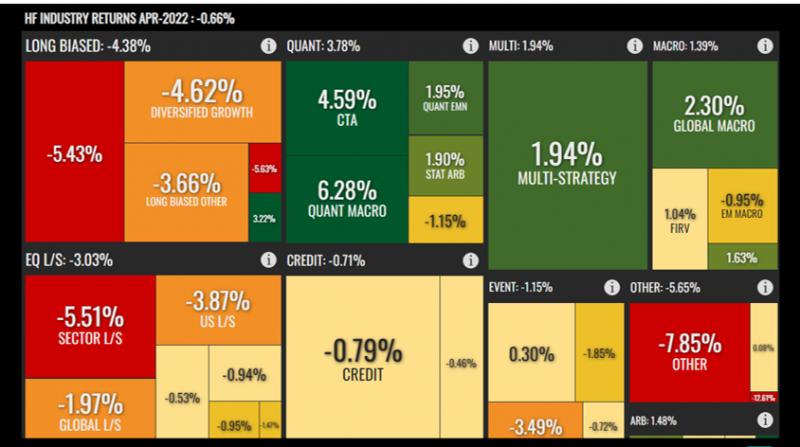

Most of the hedge funds in the US are suffering from their negative return this year. And the situation might getting worse. However, to our delight, some start-ups got their chance to shine in this bear market. Seedorm Asset Management (SAM), for example, has made its way to outstand with their fantastic strategies. This Delaware based company has made an average return above 30% YTD. SAM uses machine-driven multi-strategies to manage equity assets, and their strategies are proofed to have adapted well enough in the transition from Bull to Bear markets. Most of their strategies made 50%+ returns for the past two years. SAM also distinct itself in our Strategy Contest 2022 so far. We think this company might deserve some more attention from the investors.Emerging Hedge Funds Association

1 Augusta Court

Purchase NY 10577

Press contact: Simon Lee.

9176236536

info@finew.org

Seedorm Asset Management LLC is featured for their strategies with high return and low drawdown. It focuses mainly on small sized investment from accredit investors. www.seedorm.com

Emerging Hedge Funds Association hosts Strategy Contest in their forum. www.finew.org

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release This Start-Up Beats Rivals Including Big Guys here

News-ID: 2645814 • Views: …

More Releases for YTD

Wego's GCC Android Downloads Reach 838K YTD 2025

Sensor Tower data (Jan-Aug) confirms strong region-wide adoption across the GCC; high store ratings and travel-tech awards underscore trust and leadership.

Dubai, UAE - September 16, 2025 - Wego (https://www.wego.com/), a top-rated global travel app and website, and the #1 travel brand in the Middle East and North Africa (MENA), today announced that its Android downloads in the Gulf Cooperation Council (GCC) totaled 837,642 YTD 2025 (Jan-Aug), according to Sensor Tower.…

Glass Cutting Machine Market Size, Share and Forecast By Key Players-Anhui Ruilo …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global Glass Cutting Machine market is anticipated to grow at a compound annual growth rate (CAGR) of 9.55% between 2024 and 2031. The market is expected to grow to USD 8.84 Billion by 2024. The valuation is expected to reach USD 16.74 Billion by 2031.

The market for glass cutting machines is expected to develop significantly. The building industry is seeing tremendous growth,…

Ultra Thin Glass Cutting Machine Market Size, Share and Forecast By Key Players- …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global Ultra Thin Glass Cutting Machine market is anticipated to grow at a compound annual growth rate (CAGR) of 9.56% between 2024 and 2031. The market is expected to grow to USD 8.1 Billion by 2024. The valuation is expected to reach USD 15.33 Billion by 2031.

The market for ultra-thin glass cutting machines is expanding quickly due to rising demand from the…

A strong July brings the German True Fleet Market back to YTD growth

In July 2018, the German passenger car market grew by an impressive +12.3% which is the highest growth rate in 2018 up to now. Let’s have a closer look where this drive is coming from. The Private Market was certainly in very good shape with a +16.1% over July 2017. This is at least partly based on the prolongation of attractive offers by the OEMs for private customers replacing their…

"Alternative Alternatives" investment funds gained 1.92% in April, +2.38% YTD

Opalesque Ltd., a leading provider of online information services to the alternative investment industry, announced the results of the Opalesque A SQUARE ('alternative-alternatives') indices covering the performance of niche alternative investment funds. The indices are calculated based on the net performance of 608 single- and multi-manager funds currently listed in 21 categories in the Opalesque Solutions A SQUARE Fund Database (http://www.opalesquesolutions.com/asquare).

The Opalesque A SQUARE Index posted its strongest month so…

"Alternative Alternatives" investment funds lost 0.14% in March, +0.66% YTD

Opalesque 5th May 2011: Opalesque Ltd., a leading provider of online information services to the alternative investment industry, announced the results of the Opalesque A SQUARE ('alternative-alternatives') indices covering the performance of niche alternative investment funds. The indices are calculated based on the net performance of 605 single- and multi-manager funds currently listed in 22 categories in the Opalesque Solutions A SQUARE Fund Database.

The Opalesque A SQUARE Index lost 0.14%…