Press release

B2B2C Insurance Market Set For Rapid Growth, Business Perspectives, And Innovative Trends By 2022-2031

'B2B2C Insurance Global Market Report 2022 -Market Size, Trends, And Global Forecast 2022-2026' by The Business Research Company is the most comprehensive report available on this market, with analysis of the market's historic and forecast growth, drivers and restraints causing it, and highlights of the opportunities that companies in the industry can take on. The b2b2c insurance market research report helps gain a truly global perspective of the b2b2c insurance industry as it covers 60 geographies worldwide. Regional and country breakdowns give an analysis of the market in each geography, with information on the size of the market by region and by country.The regions covered in the b2b2c insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. Among these regions, Asia Pacific accounts for the largest b2b2c insurance market share.

Request for a Sample of the B2B2C Insurance Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5231&type=smp

The B2B2C insurance market consists of sales of B2B2C insurance services by entities (organizations, sole traders, and partnerships) that are engaged in providing both life insurance and general insurance services. Business-to-business-to-consumer (B2B2C) insurance applies to the sale of life and general insurance products and services through non-insurance mediators other than traditional insurance intermediaries such as brokers, independent financial advisors, and agents. It also includes the direct sale of insurance to consumers.

Key competitors in the b2b2c insurance market include AXA, Allianz, Assicurazioni Generali, Zurich Insurance, Prudential, China Life Insurance.

The global B2B2C insurance market size is expected to grow from $3.27 billion in 2021 to $3.55 billion in 2022 at a compound annual growth rate (CAGR) of 8.7%. The global B2B2C insurance market size is then expected to grow to $4.49 billion in 2026 at a CAGR of 6%.

Need more for your business growth? Directly purchase the report here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5231

TBRC's report segments the global b2b2c insurance market:

1) By Type: Life Insurance, Non-Life Insurance

2) By Distribution Channel: Online, Offline

3) By End-Use Industry: Bank and Financial Institutions, Automotive, Utilities, Retailers, Telecom, Others

Read further on the b2b2c insurance market here:

https://www.thebusinessresearchcompany.com/report/b2b2c-insurance-global-market-report

The Table of Contents includes:

1. Executive Summary

2. B2B2C Insurance Market Characteristics

3. B2B2C Insurance Market Trends And Strategies

4. Impact Of COVID-19 On B2B2C Insurance Market

5. B2B2C Insurance Market Size And Growth

.....

27. B2B2C Insurance Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The B2B2C Insurance Market

29. B2B2C Insurance Market Future Outlook And Potential Analysis

30. Appendix

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

And check out our Blog: http://blog.tbrc.info/

Interested to know more about The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. Located globally, it has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services, chemicals, and technology.

The World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market Set For Rapid Growth, Business Perspectives, And Innovative Trends By 2022-2031 here

News-ID: 2617358 • Views: …

More Releases from The Business research company

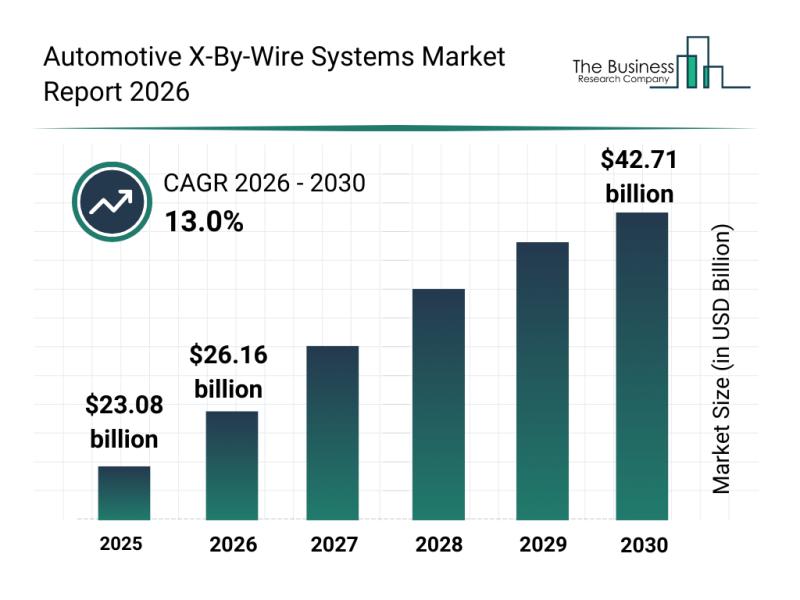

Leading Companies Spearheading Innovation and Growth in the Automotive X-By-Wire …

The automotive industry is undergoing a major transformation driven by innovative technologies that replace traditional mechanical linkages with electronic controls. Among these advancements, automotive x-by-wire systems are gaining significant attention for their potential to improve vehicle performance, safety, and efficiency. Let's explore the market size, key players, dominant trends, and segmentation within this rapidly evolving sector.

Projected Market Size and Growth of the Automotive X-By-Wire Systems Market

The automotive x-by-wire…

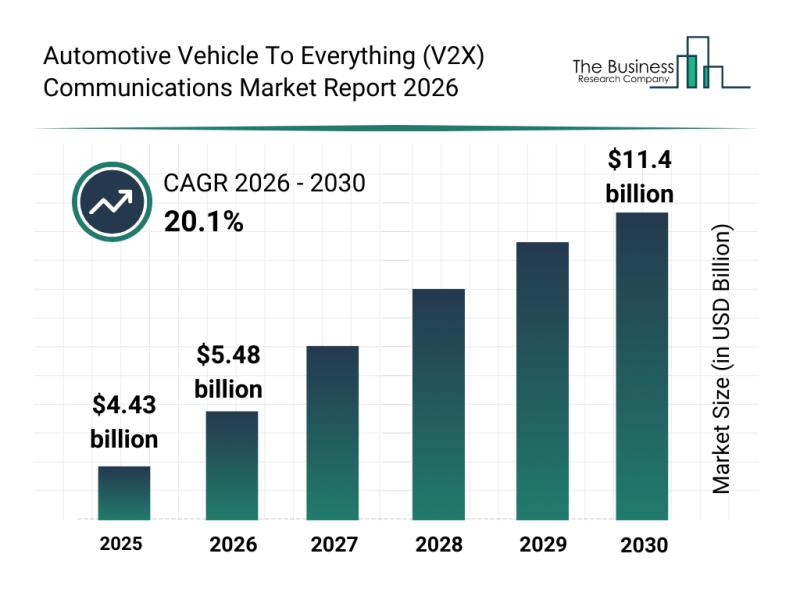

Automotive Vehicle to Everything (V2X) Communications Market Overview: Major Seg …

The automotive vehicle-to-everything (V2X) communications market is positioned for rapid expansion over the coming years as advanced technologies reshape transportation. With innovations in connectivity and safety playing critical roles, the market is set to evolve significantly, impacting how vehicles interact with each other and their surroundings. Below is an overview of the market's growth prospects, leading companies, emerging trends, and key segments shaping this dynamic industry.

Forecast for Growth in the…

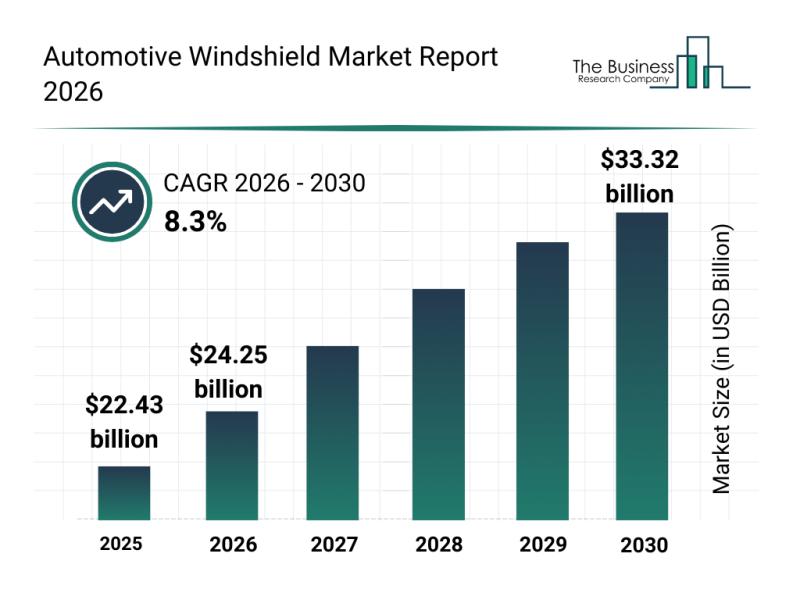

Key Players and Competitive Environment in the Automotive Windshield Market

The automotive windshield market is on track for significant expansion in the coming years, driven by technological advancements and evolving vehicle designs. With the rise of electric and autonomous vehicles, alongside innovations in safety and display integration, this sector is set to see remarkable growth. Let's explore the market size forecasts, key players, emerging trends, and the segmentation that shapes this dynamic industry.

Forecasted Growth and Market Size of the Automotive…

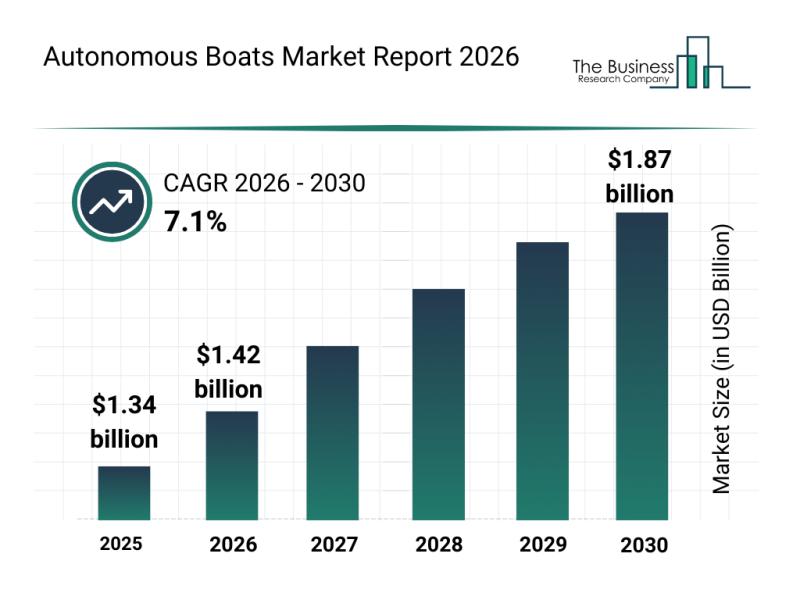

Leading Companies Solidify Their Presence in the Autonomous Boats Market

The autonomous boats sector is gaining significant traction as technological advancements and industry demands evolve. With increasing interest in unmanned operations and sustainable marine solutions, this market is set for notable expansion over the coming years. Let's explore the current market size, key players, emerging trends, and segmentation to understand the direction this innovative industry is heading.

Projected Growth and Market Size of Autonomous Boats

The autonomous boats market is…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…