Press release

Medical Mutual Insurance Market Trends and Forecast Report 2022 | By Players, Types, Applications and Regions

The QY Research released a latest market research report on the global and United States Medical Mutual Insurance market, which is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Medical Mutual Insurance market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.For United States market, this report focuses on the Medical Mutual Insurance market size by players, by Type and by Application, for the period 2017-2028. The key players include the global and local players, which play important roles in United States.

For More Information About This Report, Please Enter:

https://us.qyresearch.com/reports/350743/medical-mutual-insurance

Medical Mutual Insurance Market Segment by Type

Medical Insurance

Dental Insurance

Vision Insurance

Short-Term Health Plans

Accident and Critical Illness

Life Insurance

Medical Mutual Insurance Market Segment by Application

Individual/Family

Group

The report on the Medical Mutual Insurance market covers the following region (country) analysis:

North America

United States

Canada

Europe

Germany

France

U.K.

Italy

Russia

Asia-Pacific

China

Japan

South Korea

India

Australia

China Taiwan

Indonesia

Thailand

Malaysia

Latin America

Mexico

Brazil

Argentina

Colombia

Middle East & Africa

Turkey

Saudi Arabia

UAE

The report mentions the prominent market player consisting of:

Liberty

Medical Mutual

eHealth

WMI

Rural Mutual

Physicians

PG Mutual

State Mutual

Maine Hospital Association

Curi

Mutual Medical Plans

OhioCleveland

OPERS

MedMutual

Mutual of Omaha

The Goal of the Report

To study and analyze the global Medical Mutual Insuranceconsumption (value & volume) by key regions/countries, type and application, history data from 2017 to 2022, and forecast to 2028.

To understand the structure of Medical Mutual Insurancemarket by identifying its various subsegments.

Focuses on the key global Medical Mutual Insurancemanufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Medical Mutual Insurancewith respect to individual growth trends, prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges, and risks).

To project the consumption of Medical Mutual Insurancesubmarkets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies.

Target Audience

> Medical Mutual Insurance companies

> Research organizations

> Government Organizations

> Research/Consultancy firms

Table of Contents

1 Study Coverage

1.1 Medical Mutual Insurance Revenue in Medical Mutual Insurance Business (2017-2022) & (US$ Million) Introduction

1.2 Global Medical Mutual Insurance Outlook 2017 VS 2022 VS 2028

1.2.1 Global Medical Mutual Insurance Market Size for the Year 2017-2028

1.2.2 Global Medical Mutual Insurance Market Size for the Year 2017-2028

1.3 Medical Mutual Insurance Market Size, United States VS Global, 2017 VS 2022 VS 2028

1.3.1 The Market Share of United States Medical Mutual Insurance in Global, 2017 VS 2022 VS 2028

1.3.2 The Growth Rate of Medical Mutual Insurance Market Size, United States VS Global, 2017 VS 2022 VS 2028

1.4 Medical Mutual Insurance Market Dynamics

1.4.1 Medical Mutual Insurance Industry Trends

1.4.2 Medical Mutual Insurance Market Drivers

1.4.3 Medical Mutual Insurance Market Challenges

1.4.4 Medical Mutual Insurance Market Restraints

1.5 Study Objectives

1.6 Years Considered

2 Medical Mutual Insurance by Type

2.1 Medical Mutual Insurance Market Segment by Type

2.1.1 Medical Insurance

2.1.2 Dental Insurance

2.1.3 Vision Insurance

2.1.4 Short-Term Health Plans

2.1.5 Accident and Critical Illness

2.1.6 Life Insurance

2.2 Global Medical Mutual Insurance Market Size by Type (2017, 2022 & 2028)

2.3 Global Medical Mutual Insurance Market Size by Type (2017-2028)

2.4 United States Medical Mutual Insurance Market Size by Type (2017, 2022 & 2028)

2.5 United States Medical Mutual Insurance Market Size by Type (2017-2028)

3 Medical Mutual Insurance by Application

3.1 Medical Mutual Insurance Market Segment by Application

3.1.1 Individual/Family

3.1.2 Group

3.2 Global Medical Mutual Insurance Market Size by Application (2017, 2022 & 2028)

3.3 Global Medical Mutual Insurance Market Size by Application (2017-2028)

3.4 United States Medical Mutual Insurance Market Size by Application (2017, 2022 & 2028)

3.5 United States Medical Mutual Insurance Market Size by Application (2017-2028)

4 Global Medical Mutual Insurance Competitor Landscape by Company

4.1 Global Medical Mutual Insurance Market Size by Company

4.1.1 Top Global Medical Mutual Insurance Companies Ranked by Revenue (2021)

4.1.2 Global Medical Mutual Insurance Revenue by Player (2017-2022)

4.2 Global Medical Mutual Insurance Concentration Ratio (CR)

4.2.1 Medical Mutual Insurance Market Concentration Ratio (CR) (2017-2022)

4.2.2 Global Top 5 and Top 10 Largest Companies of Medical Mutual Insurance in 2021

4.2.3 Global Medical Mutual Insurance Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

4.3 Global Medical Mutual Insurance Headquarters, Revenue in Medical Mutual Insurance Business (2017-2022) & (US$ Million) Type

4.3.1 Global Medical Mutual Insurance Headquarters and Area Served

4.3.2 Global Medical Mutual Insurance Companies Revenue in Medical Mutual Insurance Business (2017-2022) & (US$ Million) Type

4.3.3 Date of International Companies Enter into Medical Mutual Insurance Market

4.4 Companies Mergers & Acquisitions, Expansion Plans

4.5 United States Medical Mutual Insurance Market Size by Company

4.5.1 Top Medical Mutual Insurance Players in United States, Ranked by Revenue (2021)

4.5.2 United States Medical Mutual Insurance Revenue by Players (2020, 2021 & 2022)

5 Global Medical Mutual Insurance Market Size by Region

5.1 Global Medical Mutual Insurance Market Size by Region: 2017 VS 2022 VS 2028

5.2 Global Medical Mutual Insurance Market Size by Region (2017-2028)

5.2.1 Global Medical Mutual Insurance Market Size by Region: 2017-2022

5.2.2 Global Medical Mutual Insurance Market Size by Region (2023-2028)

6 Segment in Region Level & Country Level

6.1 North America

6.1.1 North America Medical Mutual Insurance Market Size YoY Growth 2017-2028

6.1.2 North America Medical Mutual Insurance Market Facts & Figures by Country (2017, 2022 & 2028)

6.1.3 United States

6.1.4 Canada

6.2 Asia-Pacific

6.2.1 Asia-Pacific Medical Mutual Insurance Market Size YoY Growth 2017-2028

6.2.2 Asia-Pacific Medical Mutual Insurance Market Facts & Figures by Region (2017, 2022 & 2028)

6.2.3 China

6.2.4 Japan

6.2.5 South Korea

6.2.6 India

6.2.7 Australia

6.2.8 China Taiwan

6.2.9 Indonesia

6.2.10 Thailand

6.2.11 Malaysia

6.3 Europe

6.3.1 Europe Medical Mutual Insurance Market Size YoY Growth 2017-2028

6.3.2 Europe Medical Mutual Insurance Market Facts & Figures by Country (2017, 2022 & 2028)

6.3.3 Germany

6.3.4 France

6.3.5 U.K.

6.3.6 Italy

6.3.7 Russia

6.4 Latin America

6.4.1 Latin America Medical Mutual Insurance Market Size YoY Growth 2017-2028

6.4.2 Latin America Medical Mutual Insurance Market Facts & Figures by Country (2017, 2022 & 2028)

6.4.3 Mexico

6.4.4 Brazil

6.4.5 Argentina

6.4.6 Colombia

6.5 Middle East and Africa

6.5.1 Middle East and Africa Medical Mutual Insurance Market Size YoY Growth 2017-2028

6.5.2 Middle East and Africa Medical Mutual Insurance Market Facts & Figures by Country (2017, 2022 & 2028)

6.5.3 Turkey

6.5.4 Saudi Arabia

6.5.5 UAE

7 Company Profiles

7.1 Liberty

7.1.1 Liberty Company Details

7.1.2 Liberty Business Overview

7.1.3 Liberty Medical Mutual Insurance Introduction

7.1.4 Liberty Revenue in Medical Mutual Insurance Business (2017-2022)

7.1.5 Liberty Recent Development

7.2 Medical Mutual

7.2.1 Medical Mutual Company Details

7.2.2 Medical Mutual Business Overview

7.2.3 Medical Mutual Medical Mutual Insurance Introduction

7.2.4 Medical Mutual Revenue in Medical Mutual Insurance Business (2017-2022)

7.2.5 Medical Mutual Recent Development

7.3 eHealth

7.3.1 eHealth Company Details

7.3.2 eHealth Business Overview

7.3.3 eHealth Medical Mutual Insurance Introduction

7.3.4 eHealth Revenue in Medical Mutual Insurance Business (2017-2022)

7.3.5 eHealth Recent Development

7.4 WMI

7.4.1 WMI Company Details

7.4.2 WMI Business Overview

7.4.3 WMI Medical Mutual Insurance Introduction

7.4.4 WMI Revenue in Medical Mutual Insurance Business (2017-2022)

7.4.5 WMI Recent Development

7.5 Rural Mutual

7.5.1 Rural Mutual Company Details

7.5.2 Rural Mutual Business Overview

7.5.3 Rural Mutual Medical Mutual Insurance Introduction

7.5.4 Rural Mutual Revenue in Medical Mutual Insurance Business (2017-2022)

7.5.5 Rural Mutual Recent Development

7.6 Physicians

7.6.1 Physicians Company Details

7.6.2 Physicians Business Overview

7.6.3 Physicians Medical Mutual Insurance Introduction

7.6.4 Physicians Revenue in Medical Mutual Insurance Business (2017-2022)

7.6.5 Physicians Recent Development

7.7 PG Mutual

7.7.1 PG Mutual Company Details

7.7.2 PG Mutual Business Overview

7.7.3 PG Mutual Medical Mutual Insurance Introduction

7.7.4 PG Mutual Revenue in Medical Mutual Insurance Business (2017-2022)

7.7.5 PG Mutual Recent Development

7.8 State Mutual

7.8.1 State Mutual Company Details

7.8.2 State Mutual Business Overview

7.8.3 State Mutual Medical Mutual Insurance Introduction

7.8.4 State Mutual Revenue in Medical Mutual Insurance Business (2017-2022)

7.8.5 State Mutual Recent Development

7.9 Maine Hospital Association

7.9.1 Maine Hospital Association Company Details

7.9.2 Maine Hospital Association Business Overview

7.9.3 Maine Hospital Association Medical Mutual Insurance Introduction

7.9.4 Maine Hospital Association Revenue in Medical Mutual Insurance Business (2017-2022)

7.9.5 Maine Hospital Association Recent Development

7.10 Curi

7.10.1 Curi Company Details

7.10.2 Curi Business Overview

7.10.3 Curi Medical Mutual Insurance Introduction

7.10.4 Curi Revenue in Medical Mutual Insurance Business (2017-2022)

7.10.5 Curi Recent Development

7.11 Mutual Medical Plans

7.11.1 Mutual Medical Plans Company Details

7.11.2 Mutual Medical Plans Business Overview

7.11.3 Mutual Medical Plans Medical Mutual Insurance Introduction

7.11.4 Mutual Medical Plans Revenue in Medical Mutual Insurance Business (2017-2022)

7.11.5 Mutual Medical Plans Recent Development

7.12 OhioCleveland

7.12.1 OhioCleveland Company Details

7.12.2 OhioCleveland Business Overview

7.12.3 OhioCleveland Medical Mutual Insurance Introduction

7.12.4 OhioCleveland Revenue in Medical Mutual Insurance Business (2017-2022)

7.12.5 OhioCleveland Recent Development

7.13 OPERS

7.13.1 OPERS Company Details

7.13.2 OPERS Business Overview

7.13.3 OPERS Medical Mutual Insurance Introduction

7.13.4 OPERS Revenue in Medical Mutual Insurance Business (2017-2022)

7.13.5 OPERS Recent Development

7.14 MedMutual

7.14.1 MedMutual Company Details

7.14.2 MedMutual Business Overview

7.14.3 MedMutual Medical Mutual Insurance Introduction

7.14.4 MedMutual Revenue in Medical Mutual Insurance Business (2017-2022)

7.14.5 MedMutual Recent Development

7.15 Mutual of Omaha

7.15.1 Mutual of Omaha Company Details

7.15.2 Mutual of Omaha Business Overview

7.15.3 Mutual of Omaha Medical Mutual Insurance Introduction

7.15.4 Mutual of Omaha Revenue in Medical Mutual Insurance Business (2017-2022)

7.15.5 Mutual of Omaha Recent Development

8 Research Findings and Conclusion

9 Appendix

9.1 Research Methodology

9.1.1 Methodology/Research Approach

9.1.2 Data Source

9.2 Author Details

9.3 Disclaimer

Access full Report Description, Table of Figure, Chart, FREE sample, etc. please click

https://us.qyresearch.com/reports/350743/medical-mutual-insurance

Any doubts and questions will be welcome.

Customization of the Report:

This report can be customized to meet the client's requirements. Please contact with us (global@qyresearch.com), who will ensure that you get a report that suits your needs.

About Us:

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 15 years' experience and professional research team in various cities over the world,QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 59,000 clients across five continents. Let's work closely with you and build a bold and better future.

Contact Us

QY Research

E-mail: global@qyresearch.com

Tel: +1-626-842-1666(US) +852-5808-0956 (HK)

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

Website: https://us.qyresearch.com

The QY Research released a latest market research report on the global and United States Medical Mutual Insurance market, which is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Medical Mutual Insurance market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 15 years' experience and professional research team in various cities over the world,QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 59,000 clients across five continents. Let's work closely with you and build a bold and better future.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Medical Mutual Insurance Market Trends and Forecast Report 2022 | By Players, Types, Applications and Regions here

News-ID: 2606651 • Views: …

More Releases from QY Research

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee,…

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

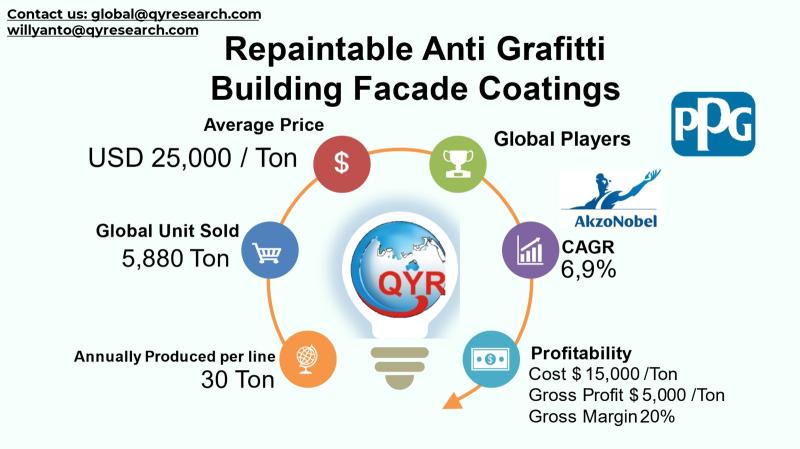

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

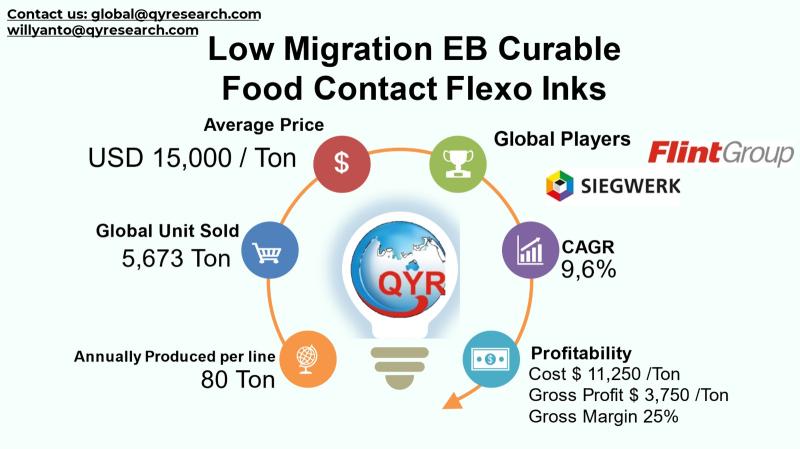

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

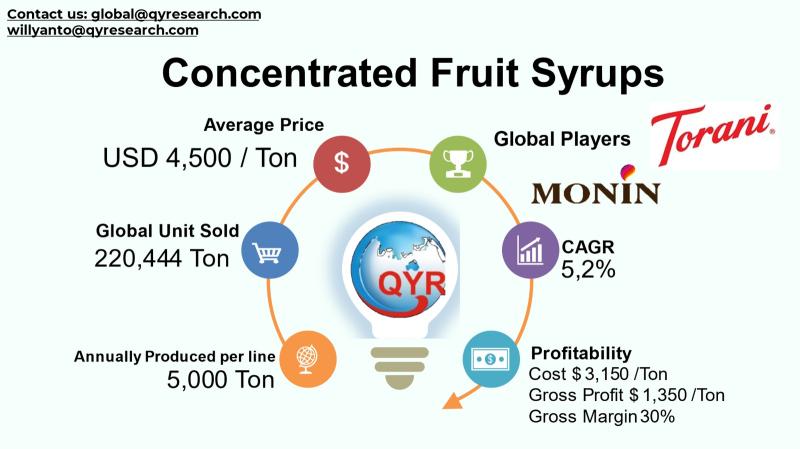

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

More Releases for Mutual

Mutual Fund Assets Market Is Booming So Rapidly | Major Giants SBI Mutual Fund, …

HTF Market Intelligence (HTF MI) has published the latest edition of its Global Mutual Fund Assets Market Study, a comprehensive 143+ page research covering market dynamics, industry scope, and future outlook for the period 2025-2032. The study highlights emerging opportunities, challenges, and competitive strategies while offering segmentation by type, application, and geography.

Key Players Profiled in the Report

• SBI Mutual Fund

• ICICI Prudential Mutual Fund

• HDFC Mutual Fund

• Nippon India Mutual Fund

• Kotak Mahindra Mutual Fund

• Aditya…

Mutual Insurance Market Market Comprehensive Study Explores Huge Growth in Futur …

According to HTF Market Intelligence, the Global Mutual Insurance Market market to witness a CAGR of 9% during forecast period of 2023-2028. Global Mutual Insurance Market Breakdown by Type (Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Liability Insurance, Others) by Policyholder (Individuals, Businesses, Organizations) by Coverage (Personal Coverage, Commercial Coverage) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The Mutual Insurance Market market size is estimated…

Poultry Insurance Market Worth Observing Growth | Prudential, CUNA Mutual, Farme …

A Latest intelligence report published by AMA Research with title "Poultry Insurance Market Insights, Forecast to 2030" provides latest updates and strategic steps taken by competition along with growth estimates of market size. The Poultry Insurance Market report gives clear visions how the research and estimates are derived through primary and secondary sources considering expert opinion, patent analysis, latest market development activity and other influencing factors.

Free Sample Report +…

Mutual Insurance Market To Witness Astonishing Growth With Liberty Mutual, Amica …

LOS ANGELES, UNITED STATES - The report on the global Lighting Distribution Box market is comprehensively prepared with main focus on the competitive landscape, geographical growth, segmentation, and market dynamics, including drivers, restraints, and opportunities. It sheds light on key production, revenue, and consumption trends so that players could improve their sales and growth in the Global Lighting Distribution Box Market. It offers a detailed analysis of the competition and…

Mutual Fund Apps for Direct Investment Market Growing Enormously with Top Key Pl …

A wide-ranging analysis of Mutual Fund Apps for Direct Investment Market has recently published by Report Consultant. It has been compiled by using primary and secondary research methodologies. Different dynamic aspects of the businesses have been listed to get a clear idea of business strategies. It includes a blend of several market segments and sub-segments.

Analyzed in a descriptive manner, the global Mutual Fund Apps for Direct Investment market report presents…

Homeowners Insurance Market Share 2019- Farmers Insurance Group, USAA Insurance, …

Homeowners insurance is a form of property insurance designed to protect a home—or possessions in the home—by providing financial reimbursement to the owner in the event of damages or theft. Homeowners insurance may also provide liability coverage against accidents in the home or on the property.

Request a Sample of this Report@ https://www.orbisresearch.com/contacts/request-sample/2572396

In 2018, the global Homeowners Insurance market size was xx million US$ and it is expected to reach xx…