Press release

B2B2C Insurance Market to Partake Significant Development during 2030

Transparency Market Research delivers key insights on the global B2B2C insurance market. In terms of revenue, the global B2B2C insurance market is estimated to expand at a CAGR of ~9% during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in the global B2B2C insurance market report.In the report, TMR predicts that the global B2B2C insurance market would be largely driven by factors such as increasing awareness about insurance products across the globe.

Get More Information @ https://www.transparencymarketresearch.com/b2b2c-insurance-market.html

In the B2B2C insurance market report, the type segment includes life insurance and non-life insurance. Non-life insurance is further bifurcated into household content insurance, building insurance, monitor vehicle liability insurance, personal liability insurance, animal owner liability insurance, accident, transport, credit insurance, extended warranty, care, global assistance, travel, private unemployment, animal insurance, and others. Based on nature of business, the market has been segmented into brick & mortar, e-Commerce, multi-channel, non-commercial, and service company. In terms of company size, the B2B2C insurance market is segmented into large enterprise and small & medium enterprise. Based on distribution channel, the market is segmented into online and offline. The B2B2C insurance market on the basis of industry is segmented into banks & financial institutions, automotive, utilities, retailers, travel, housing, lifestyle, and telecom.

Rapid growth in acceptance of insurance product services is expected to propel the growth of the B2B2C insurance market in the future. The B2B2C insurance market is widely fragmented. Large number of small, medium, and large companies operate in the market at the global and domestic level. Companies are focusing on offering innovative solutions to increase their market reach. In recent years, increasing urban population and growing disposable income are factors influencing the growth of the B2B2C insurance market. Developing markets are witnessing rapid growth in middle-class population with better spending propensity, expecting value added service and seamless experiences. Developing countries are gaining demand for insurance product services, which is likely to drive the B2B2C insurance market, as this service is influencing them to opt for better lifestyles and better services.

The B2B2C insurance market is likely to remain popular among consumers over the next few years. The market growing at a rapid pace is also providing several opportunities to insurers. National and multi-country players have opportunities to target untapped markets of the globe for expansion of their business. Age groups from 18 to 35, majorly engaging in digital platforms provides an opportunity for insurers to invest in digital platforms by providing their customers with innovative solutions. In addition to this, prominent insurers have the opportunity to indulge in strategic partnerships with banks, financial services, and other third parties to enable smooth operations, continuous engagement with their clients, and offer unique services.

Get PDF brochure for Industrial Insights and business Intelligence @ https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=79708

B2B2C Insurance Market: Prominent Regions

Asia Pacific is expected to remain a popular region in the B2B2C insurance market, due to rapid growth in sales of premium insurance, increase in the disposable income of middle class population, and penetration of multinational players in emerging countries such as India, China, Australia, and other Asian countries. This is expected to expand the growth of the B2B2C insurance market in Asia Pacific at a lucrative growth rate in the future as compared to other regions.

The demand for B2B2C insurance in Europe and North America is estimated to expand at a significant pace in the near future, owing to rising preference of customers for insurance products. The U.K., Germany, France, Italy, the U.S., and Canada are anticipated to be prominent markets for B2B2C insurance during the forecast period.

The B2B2C insurance market in South America and Middle East & Africa are anticipated to grow at a rapid growth rate in the upcoming years. GCC, South Africa, and Brazil are anticipated to be potential markets for B2B2C insurance.

Major promising players are likely to focus on the expansion of business by undertaking strategic alliances and mergers and collaborations to strengthen their footprints in the global B2B2C insurance market. Companies are expanding their business by providing their premium through several distribution channels. Companies are also focusing on offering digital solutions to their consumers to increase profitability for sustainable growth of businesses.

Get COVID-19 Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=79708

B2B2C Insurance Market: Key Players

The competitive landscape of the B2B2C insurance market is moderately fragmented with leading players accounting for major portion of the revenue share. Key players operating in the global B2B2C insurance market include AXA SA, Allianz SE, Assicurazioni Generali S.p.A, Berkshire Hathaway Inc., Zurich Insurance Group, and Prudential plc.

Global B2B2C Insurance Market: Segmentation

B2B2C Insurance Market, by Type

Life Insurance

Non-life Insurance

Household Content Insurance

Building Insurance

Monitor Vehicle Liability Insurance

Personal Liability Insurance

Animal Owner Liability Insurance

Accident

Transport

Credit Insurance

Extended Warranty

Others

B2B2C Insurance Market, by Nature of Business

Brick & Mortar

e-Commerce

Multi-channel

Non-commercial

Service Company

B2B2C Insurance Market, by Company Size

Large Enterprise

Small & Medium Enterprise

Enquiry Before Buying: https://www.transparencymarketresearch.com/sample/sample.php?flag=EB&rep_id=79708

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyse information. Now avail flexible Research Subscriptions, and access Research multi-format through downloadable databooks, infographics, charts, interactive playbook for data visualization and full reports through MarketNgage, the unified market intelligence engine. Sign Up for a 7 day free trial!

Contact

Transparency Market Research

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Blog: https://tmrblog.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market to Partake Significant Development during 2030 here

News-ID: 2565796 • Views: …

More Releases from Transparency Market Research

North America Commercial Fuel Cards Market Growth Accelerates Toward USD 312.5 B …

The North America commercial fuel cards market is expanding steadily as businesses seek greater control over fuel expenses, fleet efficiency, and operational transparency. Commercial fuel cards are payment tools designed specifically for businesses that operate vehicle fleets, enabling them to monitor fuel usage, manage expenses, reduce fraud, and simplify accounting processes. These cards are widely used across transportation, logistics, construction, utilities, and service industries.

The North America Commercial Fuel Cards Market…

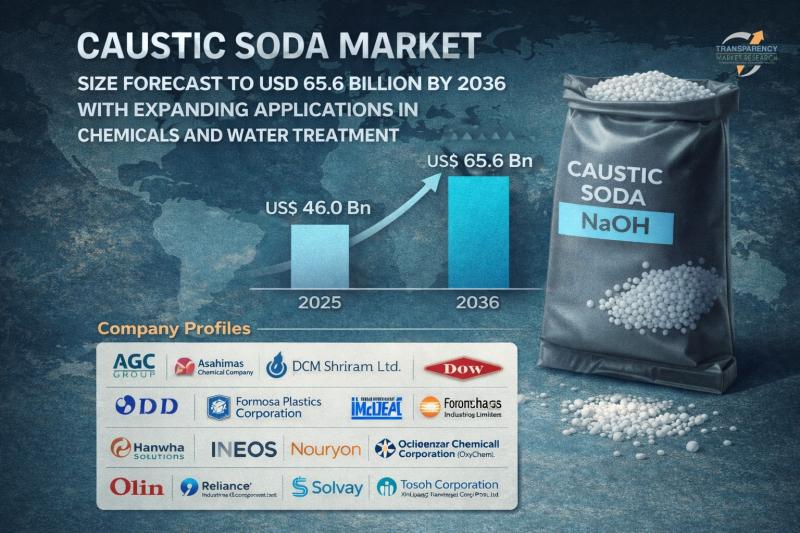

Caustic Soda Market Size Forecast to USD 65.6 Billion by 2036 with Expanding App …

Caustic Soda Market Outlook 2036

The global caustic soda market was valued at US$ 46.0 Billion in 2025 and is projected to reach US$ 65.6 Billion by 2036, expanding at a steady CAGR of 3.2% from 2026 to 2036. Market growth is driven by increasing demand from the pulp & paper industry, rising alumina production, expanding chemical manufacturing activities, and growing applications in water treatment and textiles.

👉 Get your sample market…

Global Baby Diaper Market Outlook 2036: Industry to Reach US$ 75.1 Billion by 20 …

The global baby diaper market was valued at US$ 44.5 Bn in 2025 and is projected to reach US$ 75.1 Bn by 2036, expanding at a steady CAGR of 4.9% from 2026 to 2036. This consistent upward trajectory reflects the essential nature of diapers in infant hygiene and the growing consumer preference for high-performance and convenient baby care products.

In 2025, North America accounted for 42.1% of the global revenue share,…

Rare Earth Metals Market to be Worth USD 30.9 Bn by 2036 - By Metal Type / By Ap …

The rare earth metals market has evolved from a niche industrial segment into a strategically critical global industry. In 2025, the market stood at US$ 14.1 Billion, driven primarily by increasing deployment of electric vehicles (EVs), renewable energy systems, defense electronics, and advanced industrial machinery.

Review critical insights and findings from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=823

By 2036, the market is expected to nearly double to US$ 30.9 Billion, supported by…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…