Press release

Taxpayers are facing a long list of tax changes for the 2022 tax year

Smart taxpayers will start planning for those nowTax planning is an important part of finances for both the individual as well as a business. However proper tax planning requires a lot of information regarding the tax changes and tax laws in the country. Another year of fighting with the Coronavirus has led to several changes in the tax law for the year 2021. While we all plan for taxes at the end of the year, it gives an added advantage of planning the taxes from the very beginning of the year itself. After all, the more tax planning you do, the more money you may be able to save. So, in order to be a smart taxpayer, you will have to be aware of the changes in the tax law. Some of the biggest changes in the tax law are:

Read the complete blog on What Taxpayers are facing a long list of tax changes for the 2022 tax year here:-

https://nsktglobal.com/taxpayers-are-facing-a-long-list-of-tax-changes-for-the-2022-tax-year

Expanded child tax credit- The American Rescue Plan increased the child tax credit for the year 2021 to $3,000 for families with kids 17 and under, with an extra $600 for children under age 6. While many American children and families with children received advanced credits, there are many people who earned more than the given credit limit as well. Those people might have to return the credit to the government. To qualify for the full child tax credit, single filers need a modified adjusted gross income of less than $75,000 and married couples filing together must earn under $150,000. The smart payers, those who wish to claim the full credit will start planning from the very beginning and will collect all documents and files on time to get the full return.

Charitable deductions- Taxpayers who are planning for a year-end charitable donation can take advantage of a special write-off for cash gifts in 2021. There are some major changes in the tax write off for cash donations even if they don’t itemize deductions on their federal tax return. So, if you wish to save some money from the tax, give donations in cash so that you can save your money from the tax. You can collect slips of the donations done in cash to use them for tax filing and become a smart tax payer. For 2021, single filers may claim a tax break for cash donations up to $300 and married couples may get up to $600.

Health insurance premiums- The government increased health insurance premium subsidies making coverage more affordable for millions of Americans. While the exchange has temporarily capped premiums at 8.5% of household income, the tax return filers may have to repay some of the benefits if earnings exceed the thresholds for the year 2021. So, in case any citizen has more income than the prescribed one, they might have to return some money to the government. It can really be a very unpleasant and stressful situation for those folks that have to pay the money back.

Required minimum distributions- There is a change in the minimum distribution as well. The contribution limit for traditional IRAs and Roth IRAs also stays steady at $6,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and up. However, the income ceilings on Roth IRA contributions went up. Contributions phase out in 2021 at adjusted gross incomes (AGIs) of $198,000 to $208,000 for couples and $125,000 to $140,000 for singles (up from $196,000 to $206,000 and $124,000 to $139,000, respectively, for 2020).

Email us Get a free tax consultation on Business

usoffice@nsktglobal.com

Or fill the contact form here

https://www.nsktglobal.com/usa/contact-us.php

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Taxpayers are facing a long list of tax changes for the 2022 tax year here

News-ID: 2528201 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

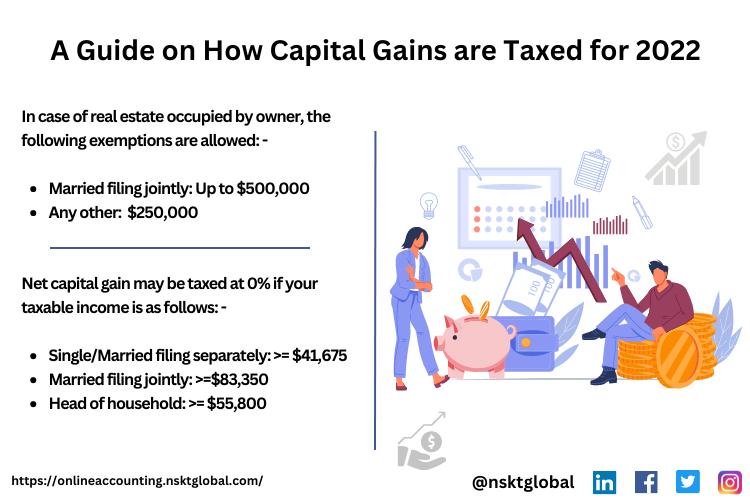

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

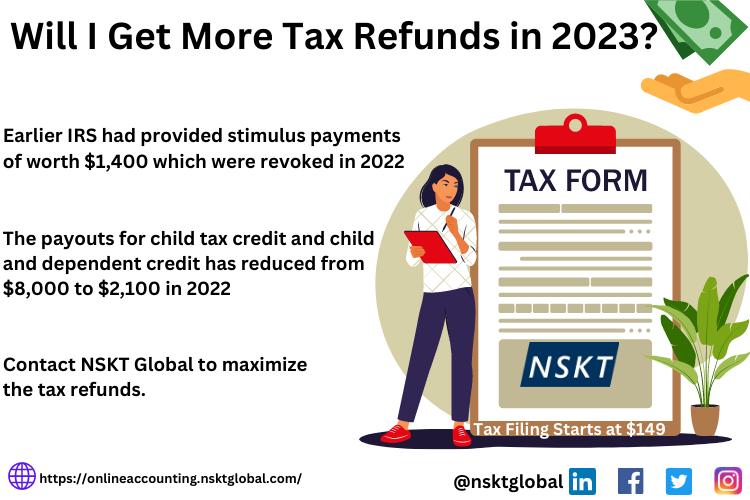

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…