Press release

Fintech Market to Witness Huge Growth by 2030 - Exclusive Report by TMR

Fintech is also known as financial technology. Companies are using different financial technologies or platforms to provide efficient financial services and enhance customer experiences. Banks and financial institutes are adopting financial technology such as banking apps, online banking, and web-based and app-based insurance services to increase the productivity and efficiency of business operations.Solution providers are offering financial services with innovative and new technologies in social trading, e-commerce, wealth management, payments, and other financial transactions. Solution providers are also integrating advanced technologies such as artificial intelligence, robotic process automation, blockchain, and cryptography in financial services to enhance the performance of business operations.

Financial companies offer mobile-based financial apps to improve the financial services offered; it also helps to reach more customers and increase awareness about online services. Solution providers are offering financially secure e-commerce platforms with increasing demand for e-commerce apps among users.

Request a Sample –

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=78741

Key Drivers of the Fintech Market

• Increasing demand for mobile banking applications and e-commerce platforms among users for a more user-friendly platform to perform financial transactions is expected to drive the fintech market.

• Increasing adoption of advanced technologies in business operations by banks and insurance companies instead of using legacy operating systems, is expected to boost the demand for fintech among companies.

• Investors are collaborating with wealth management solution companies to consolidate their position in the market and provide advanced solutions in financial technologies. This is expected to offer significant opportunities to solution providers of fintech.

Government rules and regulations for financial technology applications expected to hinder the market

• Government rules and regulation change as per market demand, affecting the operability of financial technology applications. This is expected to restrain the growth of the fintech market.

• Lack of awareness about advanced payment or transaction apps, and several platforms charging extra amount per transaction is also expected to hamper the fintech market.

Impact of COVID-19 on the Global Fintech Market

• Financial companies are adopting digitalization of business processes due to the lockdown measures and to provide user-friendly and reliable platforms to manage financial and business activities. Companies are adopting advanced financial technologies to secure their digital footprints and money transaction processes. Furthermore, the ever-increasing threat of COVID-19 is projected to boost the demand for fintech solutions during the forecast period.

PreBook Our Premium Research Report@

https://www.transparencymarketresearch.com/checkout.php?rep_id=78741

North America to Hold Major Share of the Global Fintech Market

• North America holds a prominent share of the global fintech market due to an increase in the adoption of e-commerce platforms and increasing demand for advanced technological solutions to provide security to the financial data and records of users.

• The fintech market in Asia Pacific is expected to expand at a rapid pace during the forecast period due to increasing investment by major players to provide solutions across the region and also due to the increasing adoption of digital platforms by companies and mobile applications among users in Asia Pacific.

Key Players Operating in the Global Fintech Market

• Avant, LLC

Avant, LLC is a global leading financial technology company based in Chicago, Illinois, U.S. The company provides services in personal loans and credit cards to users and commercial sectors. The company offers financial services to more than 800,000 customers worldwide.

• Social Finance, Inc.

Social Finance, Inc. was founded in 2011 and is based in San Francisco, California, U.S. The company is a global online personal finance service provider in personal loan, mortgages, student loan refinancing, banking, and investing services.

Other key players operating in the global fintech market include ZhongAn Online P&C Insurance Co. Ltd., Kreditech Holding SSL GmbH, Shanghai Lujiazui International Financial Asset Exchange Co., Ltd., Atom Bank plc, and Nu Pagamentos S.A.

Contact

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com/

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Market to Witness Huge Growth by 2030 - Exclusive Report by TMR here

News-ID: 2464833 • Views: …

More Releases from Transparency Market Research

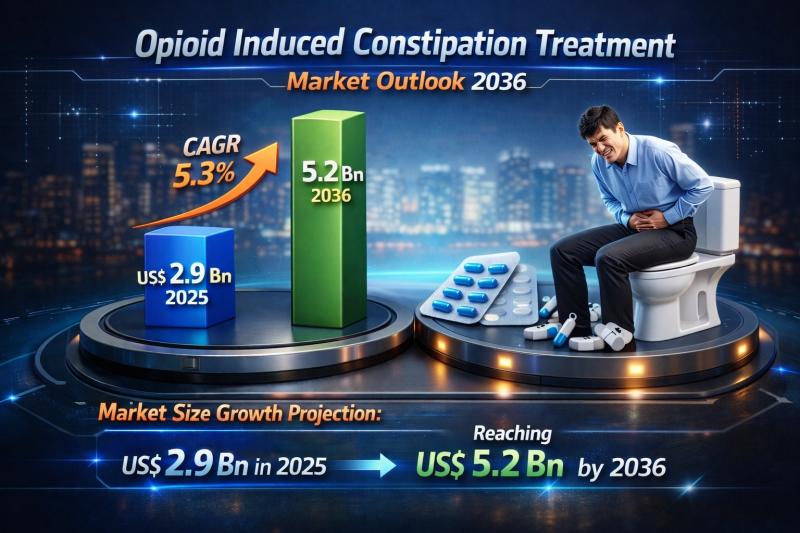

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

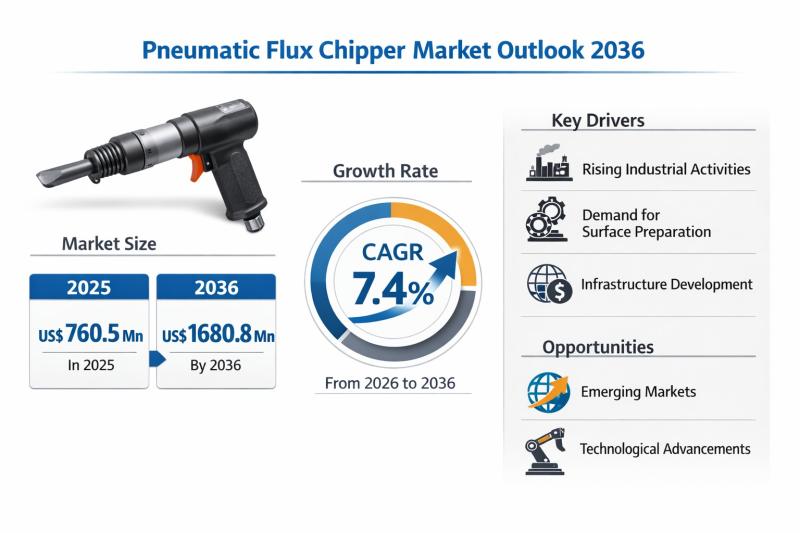

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

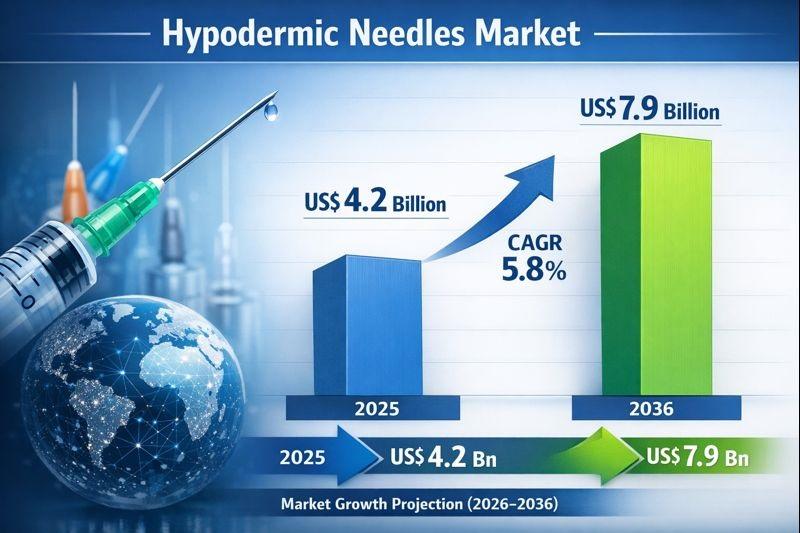

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…