Press release

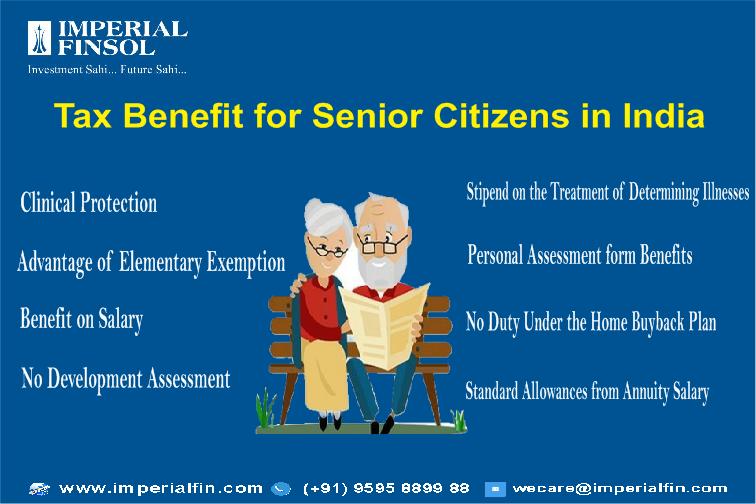

Tax Benefits for Senior Citizens in India

Tax Benefits for Senior Citizens in India:-The Indian government has granted the significance of backing out the monetary weight of those in their retirement years. This has been reflected in the spending recommendations of 2018 and 2019, the two of which have presented a few changes that just offer tax reduction to senior citizens.

Download the Mutual Fund Investment App For Better Retirement Planning at -

https://www.imperialfin.com/mutual-fund-investment-app/

For annual duty purposes, those over the age of 60 and fewer than 80 years are named senior citizens while those over 80 years old are named as very senior citizens.

To begin with, it is significant to completely comprehend the qualification in tax breaks for senior and very senior citizens.

In the Association Spending plan 2020-2021, another expense system for citizens was reported by the legislature of India. The Legislature of India gives citizens the decision to pick between the current assessment structure and the upgraded one when recording charges from FY2020-21 onwards.

Let us comprehend this by a method of a table:

New Income Tax Slab for Individual (New Regime)

Income Tax Slab

Tax Rate

Up to Rs. 2.5 Lakh

No Tax

Between Rs. 2.5 Lakh to 5 Lakh

5% (tax rebate of Rs. 12,500 is under section 87A )

Between Rs. 5 Lakh to 7.5 Lakh

10%

Between Rs. 7.5 Lakh to 10 Lakh

15%

Between Rs. 10 Lakh to 12.5 Lakh

20%

Between Rs.12.5 Lakh to 15 Lakh

25%

Above Rs. 15 Lakh

30%

Under this new duty system, there is no higher assessment exclusion limit for senior citizens (between the age of 60 and 80) or for very senior citizens (over the age of 80).

Income Tax Slabs For Senior Citizens for Financial Year 2019–20

Income Tax Slabs

Rate of Tax

Health and Education Cess

Income up to Rs.3 Lakh

No Tax

NA

Income between Rs.3 Lakh to Rs.5 Lakh

5%

4% of Income Tax

Income between 5 Lakh to Rs.10 Lakh

20%

4% of Income Tax

Income that exceeds Rs.10 Lakh

30%

4% of Income Tax

Income tax slabs for super senior citizens (more than 80 years of age) for FY 2020-2021

Income Tax Slabs

Rate of Tax

Health and Education Cess

Income up to Rs.5 Lakh

No Tax

NA

Income between Rs.5 Lakh to Rs.10 Lakh

20%

4% of Income Tax

Income that exceeds Rs.10 Lakh

30%

4% of Income Tax

INCOME TAX BENEFITS FOR SENIOR CITIZENS

1. Clinical Protection

The senior citizens are offered an advantage by virtue of installment of the medical coverage expense up to Rs.50, 000 Prior, this constraint of allowance for wellbeing premium installment was Rs.30, 000 for senior citizens.

For super citizens, under segment 80 D, the derivation for the installment of clinical premium just as the real costs caused on their treatment are permitted.

2. Advantage of Elementary Exemption

Each person in India, who falls under the level of pay to settle charge, is taken into account some rudimentary waivers. While for the senior citizens, the administration has set up this essential exception limit up to Rs.3 lakhs.

For the following 3 lakhs-5 lakhs piece, a senior resident should pay an expense of 5%. Super citizens get a higher bit of leeway, thinking about their pay and age. For them, this waiver is of up to Rs.5, 00,000 in one money related year.

Other than the senior or super citizens, this exception for conventional citizens is up to Rs.2, 50,000/ - just which drives them to cover more charges.

3. Benefit on Salary

The senior citizens who are inhabitants of India should pay no duty on their advantage earned up to Rs.50, 000 in a budgetary year.

Appropriate under area 80 TTA of Annual Expense, this will consider premium earned in the reserve funds ledger, stores in a bank, as well as stores in the mail center.

When documenting their Annual Assessment form, the senior citizens should fill the structure 15H. The measure of premium earned over Rs.50, 000/ - would pull in the assessment according to the section pace of senior citizens.

4. No Development Assessment

While customary people need to cover a development charge if their duty obligation is Rs.10, 000/ - or more in a budgetary year, senior citizens are liberated from this weight except if they make a salary from business or calling. Those not possessing a business just need to pay the Self-Appraisal Duty.

Advance Duty is a sum paid ahead of time to the Indian Government which all citizens will undoubtedly pay. Getting senior citizens a similar section isn't basically reasonable.

5. Stipend on the treatment of determining illnesses

The Administration of India gives a stipend to its common citizens to not make good on a charge if the expense of treatment is near Rs.40,000/ -

Under area 80DDB of the Annual Assessment, senior citizens get an allowance breaking point of Rs.1 lakh on the off chance that they attempt any treatment for determining ailment/basic disease in a budgetary year.

6. Personal Assessment form benefits

Too Senior Citizens (people over 80 years) can petition for their Annual Expense form through either Sahaj (ITR 1) or Sugam (ITR 4). They can decide to do it either physically or electronically.

7. No duty under the Home buyback Plan

A senior resident may invert contract any of his convenience to make month to month income. The responsibility for property stays with the senior resident and they are given regularly scheduled installments for it. The sum paid in portions to the proprietor is excluded from the Annual Expense.

8. Standard Allowances from Annuity Salary

Senior citizens are permitted a standard allowance of ?50,000 because of their annuity salary.

Enjoy the Retirement Life with Imperial Finsol Pvt.Ltd.

Happy Investing!!!

Contact Us : 8446686863, 9595889988

Email Us : wecare@imperialfin.com

Follow Us : https://www.facebook.com/imperialfin/

Follow US: https://www.linkedin.com/company/imperialfinsol/

Subscribe YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Visit Us : www.imperialfin.com

Imperial Finsol Pvt.Ltd.,

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

Imperial Finsol, a Firm committed for providing a personalized solution for your Wealth Management needs. We help you to make smart investment choices with your money to get maximize returns. Knowledge of the financial markets and dedicated Client service team, are the pillars of our success. We now catering to 2000 plus clients. We are a preferred choice of Clients when it comes to Wealth Management.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Benefits for Senior Citizens in India here

News-ID: 2172373 • Views: …

More Releases from Imperial Finsol Pvt.Ltd.

How to Find the Best Mutual Fund Advisor in India?

How to Find the Best Mutual Fund Advisor in India?

Among the decisions to make when you wish to invest in life, Mutual Funds are what company to select. With countless Mutual Funds advisors competing for your business, you can be attracted to select a Mutual Fund Distributor based on the service alone. However, numerous other aspects are just as vital as service. It is often even a lot more vital…

Do You Want to Know Where Market Will Be Going? Solution in Volatile Market

Solution for Investors in Volatile Market

Volatility is one thing which nobody likes, and the biggest reason most people don’t want to invest the money in the market place, however, it’s very much correlated to the human heart in terms of ECG GRAPH.

To Earn Profits in any type of Market Conditions, Download the Imperial Money App at - https://play.google.com/store/apps/details?id=com.iw.imperialmoney

But still, everyone wants to know always “Baazar kya bolta hai?” and the…

How to Get Back Your Home Loan Interest Amount?

How to Get Back Your Home Loan Interest Amount?

Today in this Blog we are going to tell one story and the story is about the “LOAN”.

Loan is basically in our view is;

L: Loads

O: Of

A: Absolute

N: Nothing

And today we are going to see various types of roles of Loans in our day to day life.

Loan is the important part for all of us in our life. And this is the…

How to Choose Mutual Funds for Yourself?

Indian mutual fund market is offering 1000 plus equity and debt funds which are open ended in nature, further than 51 asset management companies selecting the right funds for self and it includes so many parameters having so much of technical and fundamental aspects of those funds & then to choose it whether it suits you or not can be a enormous job.

Investors who don’t recognize the complexities of various…

More Releases for Lakh

Winners Institute Donates ₹12.44 Lakh to Support Families of Martyrs on Indepe …

Winners Institute Indore, a leading coaching institute for competitive and government exams, marked India's 79th Independence Day with a remarkable act of social responsibility. The institute donated ₹12,44,818 towards the welfare of martyrs' families, honoring the sacrifices of soldiers and supporting their families with dignity, education, and care.

This initiative was driven by Aditya Sir's Special Calculation Batch, launched in June 2025. Priced at just ₹99, the course enrolled 6,289 students,…

Top Economical Bikes Under ₹3 Lakh in India 2025 | Bangalore

Bangalore, India - April 18, 2025 - Khivraj Motors, one of India's most trusted names in the automobile industry, has announced its curated list of the Best Economical Bikes Under ₹3 Lakh in India for 2025. Designed for today's value-conscious riders, this collection brings together motorcycles that blend affordability, performance, and cutting-edge features.

With fuel prices on the rise and the growing need for reliable, efficient transportation, Khivraj Motors aims to…

Schneider Electric: This multibagger stock turned 1 lakh into over 4 lakh in jus …

Schneider Electric Infrastructure has shown remarkable growth with shares climbing 327% in a year, positioning it as a standout performer in Indian equity markets. The company stands to benefit significantly from the Revamped Distribution System Scheme, holding immense potential for future growth.

Schneider Electric Infrastructure has consistently delivered remarkable gains over the last four years.

Schneider Electric Infrastructure, a prominent player in the heavy electric equipment industry, has emerged as a significant…

India needs 4 lakh organ transplants every year

The demand for the continuous need for organ transplants has always been higher than its supply. Dr. Sandeep Attawar, president of the Indian Society for Heart and Lung Transplantation (INSHLT), stated during a two-day conference of INSHLT that "India needs four lakh organ transplants annually." Even with this demand for organ transplants, in India, only up to 1000 transplants are being made possible. This decrease in the number is a…

New Residential Projects on Sohna Road Gurgaon Starting from Rs. 60 Lakh*

Sohna Road Gurgaon: The following press release briefly describes Most Luxury Residential and Commercial Projects available Sohna Road Gurugram Haryana.

May - 2022 Unifit Realty is a well-known and trusted real estate channel partner of the most renowned builder in the real estate industry Gurgaon Haryana.

Sohna is a rapidly expanding town on the borders of Gurgaon. The area's strong connectivity to the National Capital Region via National Highway 8…

Dollartune campaign on `A Million Thanks to 1 Lakh’

Targets five-fold expansion in user base in a year

Dollartune, an opt-in an Android based application that acts as an advertising delivery platform on a smart phone, has achieved the milestone of 100,000 downloads. The users engagement with Dollartune is such that more than a million of pages are being viewed every day.

Dollartune is an innovative and effective marketing platform for advertisers through a mobile application…