Press release

How to Choose Mutual Funds for Yourself?

Indian mutual fund market is offering 1000 plus equity and debt funds which are open ended in nature, further than 51 asset management companies selecting the right funds for self and it includes so many parameters having so much of technical and fundamental aspects of those funds & then to choose it whether it suits you or not can be a enormous job.Investors who don’t recognize the complexities of various fund style, tactic and risk management, seek nowadays online guidance to get the correct answer to influence their economic aims, one such way is looking at the rating which in my mind is not less than Rudali of fund management industry, Thus investors need to select schemes after examining the pros and cons of each fund category, the schemes, long term and short term attributes along with liquidity and what kind of time horizon investor is carrying with objective and the objective of the fund whether it matches or not .

Imperial Finsol is bringing here for you to how you go about selecting the right funds for your investments, please remember that asset allocation is most important aspects when you design the portfolio, here’s a look at the most important filters they apply while choosing funds.

ASSET MANAGEMENT COMPANY (AMC)

While outperformance from the standard is significant, some investors are also keeping a close eye on the pedigree of the fund house. “Imperial Finsol normally take a top-down tactic. To start with, IFPL look at the fund house pedigree. Whether the fund house is acting in investor interest or not? Is it complying with all regulations? In last 4 years we imperial did not worked with 2 or else 3 fund houses purposely looking into their portfolio style and it pays a lot to us. The ownership of the fund house also matters. It should have a stable management. When it comes to choosing funds, IFPL look at the risk-adjusted performance in equity funds. Beta is also an important parameter. We look at consistent performance.

Strong Base

We at IFPL (IMPERIAL FINSOL PVT.LTD.) strongly believe that the process is more important than having any star fund manager. If he quits then its seen in the industry that funds gets badly impacted, so is the fund house capable of managing the funds well? To address this aspect we need to make sure that the fund house has a good processed driven and fundamentally strong team, recently one of the big fund house has 2 big names exited, however the performance of the funds has not impacted however it has been outperformed the peers, this has because of a defined fund management process, supported by experienced analysts and senior fund managers.

Risk management is top Priority

Most mutual fund houses have a dedicated risk management team that operates independently of the fund management team. This team is responsible for putting in place a proper risk management framework and ensure the fund management team operates within these boundaries. Such processes have become extremely important in the light of recent downgrade/credit episodes. Recently in few credit events of few fund houses have done extremely well and few were the laggard so this is one of the most important criteria when you choose the fund for yourself.

Safety First

The credit events in the fixed income space has brought forth the importance of liquidity risk and credit risk in debt funds, which have been pushed debt funds as an alternative to FD’s.

Several investors are now trying to invest in mostly safe categories of funds like liquid, overnight and arbitrage. They are of the view that they might take risk with equity funds and use debt funds to protect capital. Retail investors looks for debt funds for margin of safety. Retail investors still didn’t digest that even in debt fund can give negative returns and Franklin event has shaken up entire industry that scheme can get closed as well and fund will get lock in as well for some time unless resolution is not getting in place. Debt funds that have a conservative approach towards managing their debt portfolios and have a predictable style and clear thought process. Some other factors are fund size, vintage, percentage of allocation in securities, segment which are liquid & attentiveness risks within funds’ portfolio (to instruments and issuers), expense trends, etc.”

Values & Principles by Ethics

Honesty is most difficult aspect to find in world.

Besides fund performance and processes, Investors are becoming increasingly conscious of avoiding AMCs that are too focused on increasing their bottom-line at the cost of investors. fund house delicacies its investors. Is it reducing the total expense ratio (TER) where performance is hard to come by? Some fund houses ask investors to lower their return expectations. As few Amc’s are listed now so they have margin pressure on them to increase their profits than the returns of the investors, but they don’t reduce TER if the performance is slipping. Please escape such AMCs.

Most Important Agenda is Portfolio

Past performance of an equity fund does not guarantee of future returns. We track the portfolio of the funds very consistently and we have in house system of cross verifying the funds and funds portfolio with communication of fund manager and in our view most of the fund those who get high rating, won’t sustain long run with that rating, instead we analyses the current portfolio of funds and the thought process of a fund manager. “Since we have experience in analyzing companies and managing our Broking business too and equity portfolios, IFPL look at the current portfolio of any fund. This gives an idea of how a fund is positioned to benefit in the future. Past performance does not matter to us because it cannot be repeated in the future, and we strongly recommend that do not come in trap of rating of the fund as you may not even know how they got this rating.

Who Runs Fast, Elephant or Horse?

Fund leaders frequently say that fund size is not a chief factor of presentation; however our finding is opposite to this thought. Especially when the scheme size becomes large, we avoid funds which are too large in size. For instance, in Multi cap we invest only in the funds which are anything in between 1000 to 3500 cr., in small and mid-cap, we avoid funds with AUM of more than 2000 crore. In mid-caps, the upper threshold is Rs 2,000 crore and in large caps we avoid schemes having AUM of more than Rs 5,000 crore. We have done an internal study of fund returns over 20 years which shows that smaller sized funds have delivered better than large-sized funds, even where the fund manager is same. We don’t exit funds that go beyond this AUM upper limit; we don’t add more allocation to such funds. Thus, the fund size has to be not too small and too large either.”

Is that fund getting regular inflow of Money?

It goes without saying that a good fund will attract inflows while a bad fund will see investors exiting. So, funds that get consistent inflows indicate that investors have conviction on the fund manager philosophy and framework.

“The fund should be getting regular inflows even if the inflows are small. This helps the fund manager look for new opportunities as well as the buying good quality stocks at lower levels by which he can add more value to the Funds. When fund see the outflow it dent the overall performance of the fund and manager has to sell good liquid stocks at cheap price and give money back to investors.

New fund suggestions remain reasonable

Afterward SEBI’s recategorization standards, there has been a considerable reduction in new fund offers. But are all new fund launches bad? “We don’t mind recommending NFO if the concept is novel, unique and valuer proposition is good looking into the market scenario. The portfolio is good and if it comes from a fund house with is known for its performance then it makes investors more comfortable.

Is fund manager most Important?

Mostly before I meet with fund manager, I ask him about the fund style, Proposition, sectors which he is bullish for 3 year down and how dynamically he will be managing the fund. Whether it is concentrated approach or more diversified across sectors and most importantly what are overall earnings of the portfolio with conservative or aggressive approach. We try to know the past track record along with his character and thought process. We believe that manager should be dependable and trustworthy even nevertheless he may not be the most popular fund manager.

When to say good bye to fund?

No fund can live up to its hopes forever. While short term deficit can be ignored, steady loss for a continued period is a clear red flag. If the fund is not undertaking thriving, it is advisable to monitor the performance for a year time and if doesn’t recover, we believe it is superlative to departure or halt allocating fresh money to such funds.

Just before wrap up, picking the correct fund for your client is an art & science both. Investors must concentrate on both quantifiable and qualitative reasons while zeroing in on the ideal outlines for self.

Happy Investing!!!

IMPERIAL FINSOL

Contact Us : 8446686863, 9595889988

Email Us : wecare@imperialfin.com

Follow Us : https://www.facebook.com/imperialfinsol

Follow US: https://www.linkedin.com/company/imperialfinsol/

Subscribe YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Visit Us : www.imperialfin.com

Imperial Finsol Pvt.Ltd.

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

Phone - 0712-2454477

Imperial Finsol, a Firm committed for providing a personalized solution for your Wealth Management needs. We help you to make smart investment choices with your money to get maximize returns. Knowledge of the financial markets and dedicated Client service team, are the pillars of our success. We now catering to 2000 plus clients. We are a preferred choice of Clients when it comes to Wealth Management.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to Choose Mutual Funds for Yourself? here

News-ID: 2110136 • Views: …

More Releases from Imperial Finsol Pvt.Ltd.

How to Find the Best Mutual Fund Advisor in India?

How to Find the Best Mutual Fund Advisor in India?

Among the decisions to make when you wish to invest in life, Mutual Funds are what company to select. With countless Mutual Funds advisors competing for your business, you can be attracted to select a Mutual Fund Distributor based on the service alone. However, numerous other aspects are just as vital as service. It is often even a lot more vital…

Do You Want to Know Where Market Will Be Going? Solution in Volatile Market

Solution for Investors in Volatile Market

Volatility is one thing which nobody likes, and the biggest reason most people don’t want to invest the money in the market place, however, it’s very much correlated to the human heart in terms of ECG GRAPH.

To Earn Profits in any type of Market Conditions, Download the Imperial Money App at - https://play.google.com/store/apps/details?id=com.iw.imperialmoney

But still, everyone wants to know always “Baazar kya bolta hai?” and the…

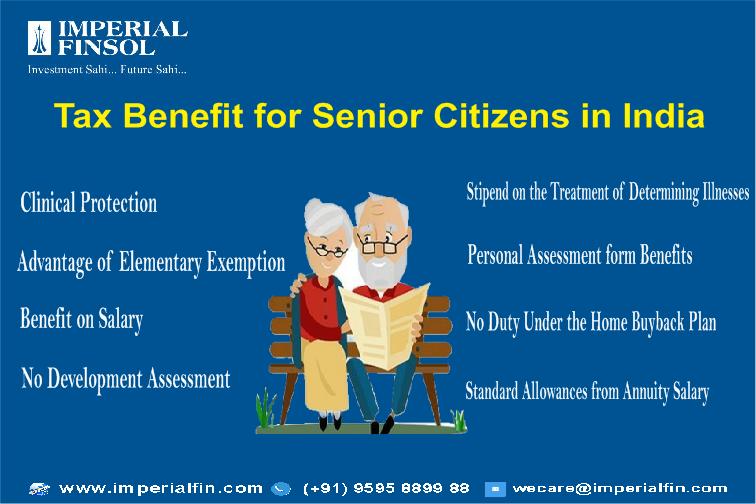

Tax Benefits for Senior Citizens in India

Tax Benefits for Senior Citizens in India:-

The Indian government has granted the significance of backing out the monetary weight of those in their retirement years. This has been reflected in the spending recommendations of 2018 and 2019, the two of which have presented a few changes that just offer tax reduction to senior citizens.

Download the Mutual Fund Investment App For Better Retirement Planning at -

https://www.imperialfin.com/mutual-fund-investment-app/

For annual duty purposes, those…

How to Get Back Your Home Loan Interest Amount?

How to Get Back Your Home Loan Interest Amount?

Today in this Blog we are going to tell one story and the story is about the “LOAN”.

Loan is basically in our view is;

L: Loads

O: Of

A: Absolute

N: Nothing

And today we are going to see various types of roles of Loans in our day to day life.

Loan is the important part for all of us in our life. And this is the…

More Releases for IFPL

Global Airport Charging Stations Market 2022 Key Companies | Arconas, IFPL, Velo …

MarketsandResearch.biz has released a report titled Global Airport Charging Stations Market containing growth factors of the industry. The report covers a significant global Airport Charging Stations market, the factors boosting the market, factors restraining the market, and the opportunities that will provide market growth.

The report provides an all-inclusive analysis of global Airport Charging Stations market trends, macroeconomic indicators, and driving factors, along with market attractiveness by segment. The news is…

Airport Charging Stations Market 2022 Strategic Assessment- Arconas, IFPL, Velox …

The Airport Charging Stations market outlook looks extremely promising is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain, future roadmaps and its distributor analysis. This Market study provides comprehensive data that enhances the understanding, scope, and application of this report.

Top Companies in…

Airport Charging Stations Market 2021 Growing Demand, Size and Business Outlook …

The Airport Charging Stations Market report provides a detailed analysis of the area marketplace expanding, competitive landscape, global and regional market size, growth analysis. It also provides market share, opportunities analysis, product launches as well as recent developments with sales analysis, segmentation growth, market innovations and value chain optimization, SWOT analysis. Airport Charging Stations Market latest report covers the current COVID-19 impact on the market. This has brought along several changes…

Mobile Phone Charging Station Market Share, Global Size 2020 - Development Analy …

Global "Mobile Phone Charging Station Market" report provides helpful analysis for future strategy development, and to know about market drivers, restraints and opportunities, and global market size, share, growth, trends, and key players forecast to 2026. Mobile Phone Charging Station market report is a detailed breakdown analysis of industry segments including product type, application, and end-user analysis. The report talks about the major trends and developments taking place in…

Airport Charging Stations Market: Getting Back To Growth | IFPL, Arconas, Veloxi …

A new business intelligence report released by HTF MI with title "Global Airport Charging Stations Market Research Report 2012-2024" is designed covering micro level of analysis by manufacturers and key business segments. The Global Airport Charging Stations Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and…

Airport Charging Stations Market Trends 2025; Analysis by Top Business Players I …

'International Airport Charging Stations Market, 2019-2025 Research Report' gives a special instrument to assessing the market, featured openings, and supporting key and strategic basic leadership. This Airport Charging Stations report perceives that in this quickly advancing and aggressive condition, up-coming promoting data is fundamental to screen execution and settle on basic choices for Airport Charging Stations development and productivity. It gives data on patterns and advancements, and spotlights on global…