Press release

How to Get Back Your Home Loan Interest Amount?

How to Get Back Your Home Loan Interest Amount?Today in this Blog we are going to tell one story and the story is about the “LOAN”.

Loan is basically in our view is;

L: Loads

O: Of

A: Absolute

N: Nothing

And today we are going to see various types of roles of Loans in our day to day life.

Loan is the important part for all of us in our life. And this is the biggest driver of the Economy in all over the world.

Everyone’s largest part of income is going to pay the Home Loan Interest Rate Amount.

Home Loan Interest Rate is perhaps the biggest monthly expense item for a number of people in today’s scenario. On top of it, most people want to buy the house of their dream, which means the home loans taken are huge. And with big loans come astronomical interest costs.

So, in this Blog we will See 4 Important Formulas for Getting Financial Freedom from Home Loan which is,

1) How to Reduce Your Interest Burdon of Home Loan?

2) How to Get Back Your Interest Amount of Home Loan?

3) How to Buy Home on Interest Free Amount?

4) How to Create the Wealth Out of Home Loan?

So coming to first point that how we look on Loan, Banks are the technically advanced Sahukar and gives loan to you no matter where you are situated from Kashmir to Kanyakumari!!!

So when you are taking Home Loan whatever money you pay, most of your amount going in Interest part for first 5 years, and your principle amount more or less stagnant for the given time period. To lower down your interest component, you need to go first in the bank and ask bank manager to reduce your Home Loan Interest Rate, which subsequently lowering down your EMI.

Below Image will clear your thoughts on reduced EMI and how will you find the difference between paid EMI and Interest Rates of Home Loan Principle Amount. This is very big savings you do if you shorten your Home Loan EMI.

Now, coming to the next point How to get Home Loan at 0 %?

Average EMI for 50 Lakhs Home Loan is 42,000/-

The Most Important Solution is that recover the home loan interest amount you will pay by investing in mutual funds with Imperial Money App. By starting a SIP (Systematic Investment Plan) your home loan amount in a mutual fund’s investment scheme, you recover the interest amount.

To get your Home Loan at 0% start one SIP (Systematic Investment Plan) which will going to give you a Return on Investment of 12%.

So by doing smart investments you will get back your interest rates amount which you paid for your Home Loan EMI. And your New Home will be Interest Free.

You will get Financial Freedom in your lifetime by doing Mutual Fund Investment Planning’s with Imperial Finsol Pvt. Ltd., and in our opinion this is very important option to get your dream home without any EMI interest rates. The Happiness for buying your home from your saved money is not calculated in any terms.

To start Your Mutual Fund Investment Planning today, download the Imperial Money App at - https://www.imperialfin.com/mutual-fund-investment-app/

Let’s see the third point, if you want to build luxurious house then the budget will need 1Cr.

Below Image will clear your view for an Investment. Extend your home buying plan for 10 Years and invest that money in Lumpsum investment with 12% of interest rate.

The Important aspect of this is that if your home value will reach 50 Lakh to 1 Cr, then also you will buy your dream house with the Cash amount which you saved in your 10 years of time span in mutual fund investment.

And main point is there will be no headache of interest rates for your Home Loan EMI. This is really very amazing trick to get financial freedom and enjoy your life with your loved ones with higher standard of living.

And this will be achieved by disciplined mutual fund investment steps which are very important point to get financial freedom in your life for Home Loan Interest Rate Amount.

Happy Investing!!!

IMPERIAL FINSOL

Contact Us : 8446686863, 9595889988

Email Us : wecare@imperialfin.com

Follow Us : https://www.facebook.com/imperialfin/

Follow US: https://www.linkedin.com/company/imperialfinsol/

Subscribe YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Visit Us : www.imperialfin.com

Imperial Finsol Pvt.Ltd.

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

Contact at - 7887800057

Imperial Finsol, a Firm committed for providing a personalized solution for your Wealth Management needs. We help you to make smart investment choices with your money to get maximize returns. Knowledge of the financial markets and dedicated Client service team, are the pillars of our success. We now catering to 2000 plus clients. We are a preferred choice of Clients when it comes to Wealth Management.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to Get Back Your Home Loan Interest Amount? here

News-ID: 2140218 • Views: …

More Releases from Imperial Finsol Pvt.Ltd.

How to Find the Best Mutual Fund Advisor in India?

How to Find the Best Mutual Fund Advisor in India?

Among the decisions to make when you wish to invest in life, Mutual Funds are what company to select. With countless Mutual Funds advisors competing for your business, you can be attracted to select a Mutual Fund Distributor based on the service alone. However, numerous other aspects are just as vital as service. It is often even a lot more vital…

Do You Want to Know Where Market Will Be Going? Solution in Volatile Market

Solution for Investors in Volatile Market

Volatility is one thing which nobody likes, and the biggest reason most people don’t want to invest the money in the market place, however, it’s very much correlated to the human heart in terms of ECG GRAPH.

To Earn Profits in any type of Market Conditions, Download the Imperial Money App at - https://play.google.com/store/apps/details?id=com.iw.imperialmoney

But still, everyone wants to know always “Baazar kya bolta hai?” and the…

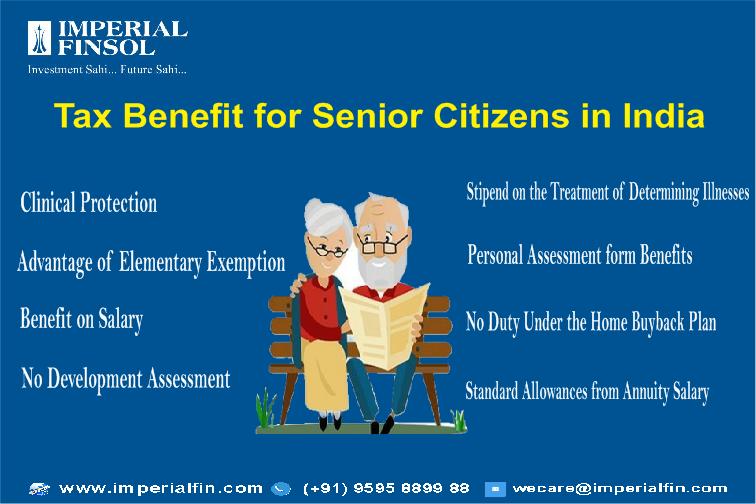

Tax Benefits for Senior Citizens in India

Tax Benefits for Senior Citizens in India:-

The Indian government has granted the significance of backing out the monetary weight of those in their retirement years. This has been reflected in the spending recommendations of 2018 and 2019, the two of which have presented a few changes that just offer tax reduction to senior citizens.

Download the Mutual Fund Investment App For Better Retirement Planning at -

https://www.imperialfin.com/mutual-fund-investment-app/

For annual duty purposes, those…

How to Choose Mutual Funds for Yourself?

Indian mutual fund market is offering 1000 plus equity and debt funds which are open ended in nature, further than 51 asset management companies selecting the right funds for self and it includes so many parameters having so much of technical and fundamental aspects of those funds & then to choose it whether it suits you or not can be a enormous job.

Investors who don’t recognize the complexities of various…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…