Press release

Foreign Exchange Market Report Share & Size 2020 | Global Industry, Covid-19 Impact Analysis, Trends and Forecast Till 2025

According to the latest report by IMARC Group, titled "Foreign Exchange Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2020-2025," the global foreign exchange market experienced healthy growth during 2014-2019. Foreign exchange (forex) is the systematic process of converting one currency into another. The system is used to facilitate the flow of money that is derived from international trade. With no centralized location, the forex market consists of an electronic network of banks, brokers, institutions, and individual traders who trade through banks or brokers. The system utilizes credit instruments, such as bills of foreign currency, bank drafts and telephonic transfers, to not only convert the currency of one nation into another but also to support the exchange of various goods and services between multiple countries.Request for a free sample copy of this report: https://www.imarcgroup.com/foreign-exchange-market/requestsample

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs, HSBC Holdings plc, JPMorgan Chase & Co., The Royal Bank of Scotland, UBS AG, Standard Chartered PLC, State Street Corporation, XTX Markets Limited, etc.

Global Foreign Exchange Market Trends:

The global market is primarily driven by the confluence of various factors, including rapid urbanization, inflating disposable income levels and changing lifestyle patterns. This has led to a significant increase in the influx of tourists on a global level, which has influenced the demand for foreign exchange positively. This is further supported by the numerous benefits associated with forex, which include 24x7 trading opportunities, minimal trading costs, enormous trading volume, high liquidity and high transactional transparency. The forex market also attracts international traders by offering numerous lucrative opportunities and early profits, which is creating a positive outlook for the market. Moreover, the advent of multiple internet-based platforms has also contributed to the market growth. These platforms offer convenience during currency exchanges and ensure the delivery of goods and services in a secure and centralized setting. Furthermore, various companies are investing in the development of the overall infrastructure to provide improved security mechanisms for trading, thereby providing traction to the market growth. Other factors, such as increasing digitization and several technological advancements, are expected to contribute to the market growth further. On account of the aforementioned factors, the market is anticipated to grow at a CAGR of around 6% during the forecast period (2020-2025).

Breakup by Counterparty:

Reporting Dealers

Other Financial Institutions

Non-financial Customers

Breakup by Instruments:

Currency Swap

Outright Forward and FX Swaps

FX Options

Explore full report with table of contents: https://www.imarcgroup.com/foreign-exchange-market

Breakup by Region:

North America

Asia Pacific

Europe

Latin America

Middle East and Africa

Note: As the novel coronavirus (COVID-19) crisis takes over the world, we are continuously tracking the changes in the markets, as well as the purchase behaviors of the consumers globally--our estimates about the latest market trends and forecast values after considering the impact of this pandemic.

Contact US:

IMARC Group

30 N Gould St, Ste R

Sheridan, WY 82801, USA

Website: https://www.imarcgroup.com/

Email: sales@imarcgroup.com

USA: +1-631-791-1145

Follow us on twitter: @imarcglobal

Linkedin: https://www.linkedin.com/company/imarc-group

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Foreign Exchange Market Report Share & Size 2020 | Global Industry, Covid-19 Impact Analysis, Trends and Forecast Till 2025 here

News-ID: 2054799 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

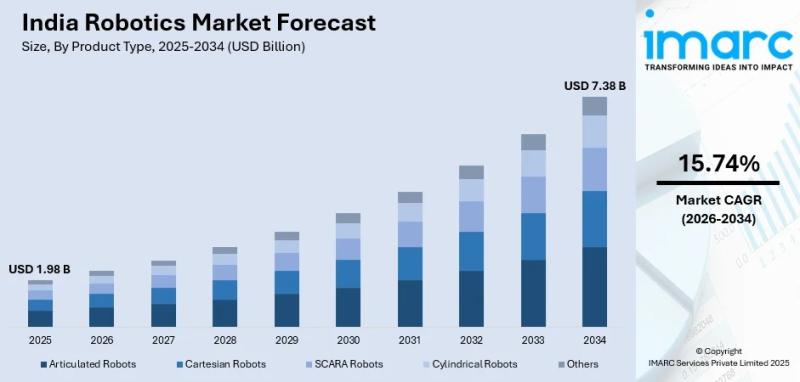

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

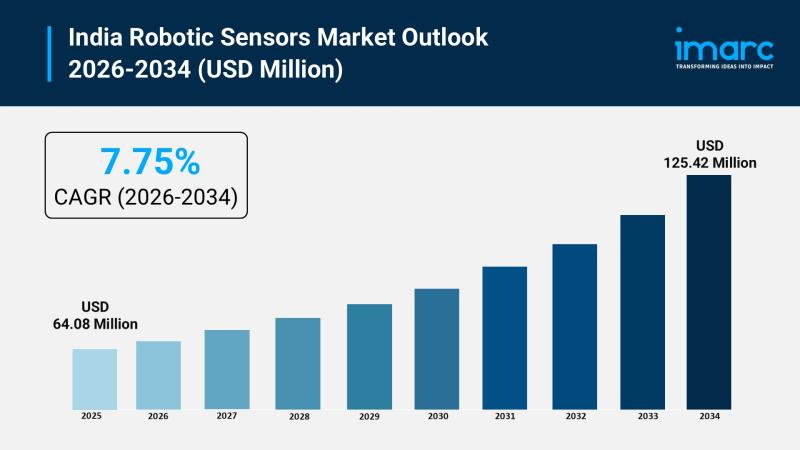

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

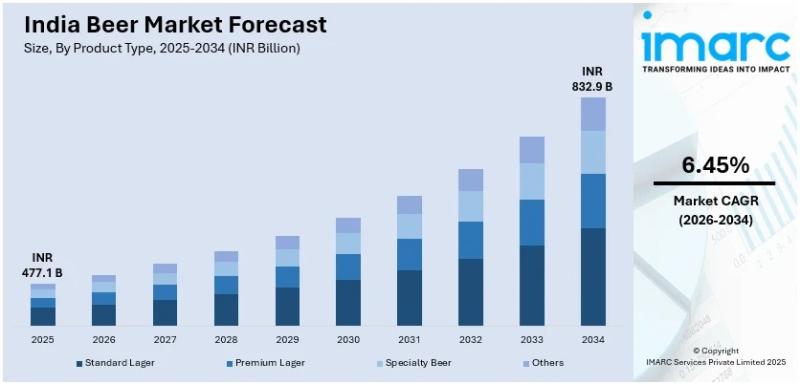

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Foreign

New York City Foreign Investment Lawyer Natalia Sishodia Explains Property Optio …

Natalia Sishodia (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), a New York City foreign investment lawyer and the managing attorney at Sishodia PLLC, has recently published a comprehensive blog post titled, "What Type of Property Can a Foreigner Buy in New York?" This insightful article provides a detailed overview of the various types of properties available for purchase by foreign investors in New York, a subject that is increasingly relevant in today's globalized real estate market.

As…

New York State Foreign Investment Attorney Natalia A. Sishodia Releases Comprehe …

New York State foreign investment attorney Natalia A. Sishodia (https://sishodia.com/step-by-step-guide-for-foreigners-buying-real-estate-in-new-york-city/) of Sishodia PLLC has released a pivotal article aimed at clarifying the complex process of purchasing real estate in New York City for foreign investors. The detailed guide provides invaluable insights and a clear path for international buyers navigating the bustling New York real estate market.

The real estate landscape in New York presents a unique set of opportunities and challenges,…

China courts concluded 295,000 foreign-related civil, commercial and foreign-rel …

Wang Shumei, the President of the Fourth Civil Trial Division of the Supreme People's Court of China, reported at a press conference on the 27th that from January 2013 to June 2022, China's courts at all levels concluded 295000 foreign-related civil, commercial and maritime cases in the first instance.

At the meeting, when introducing the main achievements of foreign-related commercial maritime trials in the new era, Wang Shumei talked about "the…

FOREIGN INVESTMENT IN SAUDI ARABIA

The Saudi Arabian government, in recent years, have taken steps to make company set up and operating in the Kingdom easier. Through economic reforms, the government have created a market that’s welcoming to foreign investors. The introduction of online portals, easing of processes and implementing new licenses have all contributed to the rapid increase in foreign investment in the Kingdom.

We created this whitepaper to give insight into setting up a…

A Foreign Exchange Solution to optimize the foreign currency value and control

The transaction of foreign exchange greatly depends on the current exchange rates. To ensure the stability of the currency value, our Sweden-based client required a Foreign Exchange Solution that administered the transaction of the various currencies in an organization. TatvaSoft had developed a Windows-based Application that controls the currency sell and buy, current currency value, and administer ledger by imposing the branch specific validations and rules.

A large amount of foreign…

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

With Foreign Staffing’s global presence expanding each month, clients have been growing as well. They have not only been seeking a solution to find new staff in other countries but they have also been seeking an efficient and compliant way to quickly employee this staff without having to establish a legal entity in the foreign country.

Foreign Staffing has spent the last…