Press release

Latest Innovative Report On Tax Management Software Market 2020-2025 With Provides Detailed Profile And Data Information Analysis

A new informative report of Tax Management Software Market has recently been published by Market Research Inc. The report comprises of various verticals of the businesses. It is aggregated on the basis of different dynamic aspects of industry study. The statistical report is compiled by applying primary and secondary research methodologies. Comprehensive Porter's five analysis and SWOT analysis are also used to examine the strength, weaknesses, threats and opportunities of the market.The report further also presents the details on financial attributes such as pricing structures, shares and profit margins. Among other salient features, the report includes a summary of top-notch companies such as Tax Management Software Market. The competitive landscape of the Tax Management Software Market is also provided by analyzing various successful and startup industries. The economic aspects of the businesses are also presented by using facts and figures.

Get Sample Copy of this Report @ https://www.marketresearchinc.com/request-sample.php?id=64254

Key Players :

Avalara

Wolters Kluwer

Longview

TaxSlayer

TaxJar

Xero

Intuit

Thomson Reuters

H&R Block

Drake Software

SOVOS

Canopy

TaxACT

Outright

Shoeboxed

Rethink Solutions

ClearTAX

WEBTEL

Inspur

Seapower

The research study covers North America, Latin America, Asia-Pacific, Europe and Africa on the basis of productivity, thus focusing on the leading countries from the global regions. The report further highlights the cost structure including cost of raw material and cost of manpower. It offers cogent analysis of business stimulants of the Tax Management Software Market. This market study also analyzes and accurate data which helps to gauge the overall framework of the businesses. Technological advancements in Tax Management Software Market sector is meticulously examined by experts. Macro and micro factors of the Tax Management Software Market are also explained in detail. To discover the global opportunities, several methodologies are listed in the report.

Key Reasons to Buy This Report:

1. To recognize the most affecting driving and constraining forces in the Tax Management Software and its impact on the worldwide market.

2. To learn the perspective and overview of Tax Management Software.

3. To comprehensively analyze the growth strategies of the key players, global market share, value and strategically profile them.

4. Assesses the Tax Management Software key problems, their solutions, and production growth to soothe the improvement risk.

5. To get an insightful study of the Tax Management Software and have an intensive understanding of the Tax Management Software and its financial landscape.

6. In conclusion, the Global Tax Management Software report provides a comprehensive analysis of the current market depend on leading players, present, past and upcoming period information which will give as a useful guide for all the Tax Management Software participants.

Table of Contents:

1. Market Overview

2. Global Market Status and Future Forecast

3. Asia-Pacific Market Status and Future Forecast

4. Asia-Pacific Market by Geography

5. Europe Market Status and Future Forecast

6. Europe Market by Geography

7. North America Market Status and Future Forecast

8. North America Market by Geography

9. South America Market Status and Future Forecast

10. South America Market by Geography

11. Middle East & Africa Market Status and Future Forecast

12. Middle East & Africa Market by Geography

13. Key Companies

14. Conclusion

Ask for Discount: https://www.marketresearchinc.com/ask-for-discount.php?id=64254

Contact Us:

Name: Kevin

US Address: 51 Yerba Buena Lane, Ground Suite,

Inner Sunset San Francisco, CA 94103, USA

Phone: +1 (628) 225 1818

Email: sales@marketresearchinc.com

Tax Management Software Market

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latest Innovative Report On Tax Management Software Market 2020-2025 With Provides Detailed Profile And Data Information Analysis here

News-ID: 1934710 • Views: …

More Releases from Market Research Inc.

Bone Graft Substitutes Market 2023 Global Industry Size, Share, Growth and Key P …

The new report by Market Research Inc titled, Global Bone Graft Substitutes Market Report and Forecast 2023-2031', gives a top to bottom analysis of the global Bone Graft Substitutes Market, evaluating the market based on its segments like types, distribution channels, processes, applications, and regions. The report tracks the most recent trends in the industry and studies their effect on the overall market. It also evaluates the market dynamics, covering…

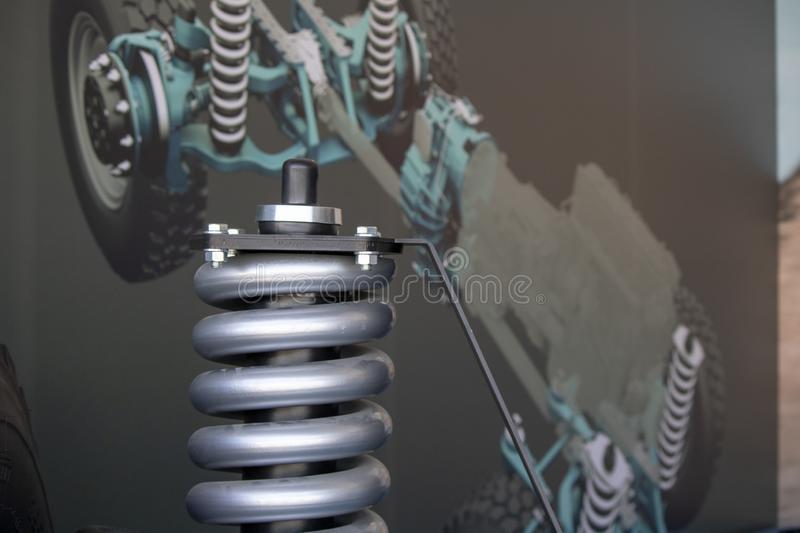

Automotive Suspension Spring Market to Eyewitness Increasing Revenue Growth duri …

Market Research, INC. has recently published a report on Automotive Suspension Spring market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

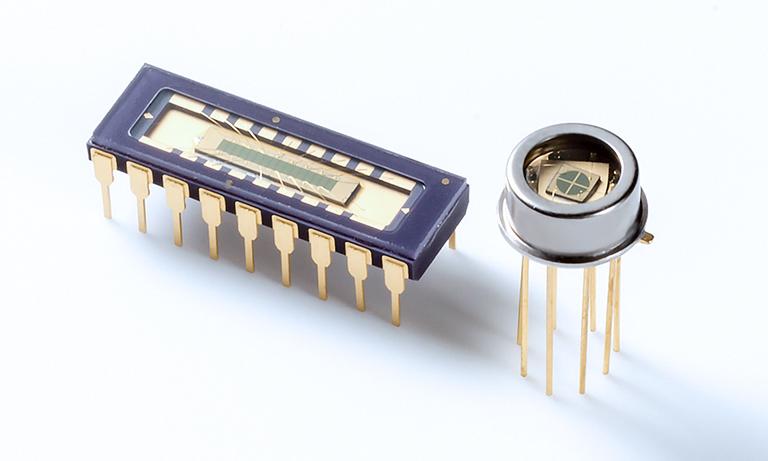

Automotive Tantalum Capacitors Market Report Covers Future Trends with Research …

Market Research, Inc. has published a new report on Automotive Tantalum Capacitors Market, taking into consideration the new trends, risk factors, challenges, market drivers along with its opportunities. Our research experts have prepared this report by conducting primary interviews and implementing secondary research techniques, which provides the Porter Five Forces and PESTLE Analysis, SWOT Analysis as well as geometric information about market dynamics, growth factors, major challenges and market entry…

Digital-Led Consumer Banking Market to Witness Stunning Growth to Generate Huge …

Market Research, INC. has recently published a report on Digital-Led Consumer Banking market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…