Press release

Digital-Led Consumer Banking Market to Witness Stunning Growth to Generate Huge Revenue Forecast to 2023-2031

Market Research, INC. has recently published a report on Digital-Led Consumer Banking market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market research report, which provides comprehensive insights into the industry.Our report is a comprehensive study of the industry, covering a range of topics from market size, growth drivers, and competitive landscape to consumer behavior, trends, and preferences. We have conducted extensive research and analysis to provide valuable insights that can help businesses develop effective strategies and make informed decisions. We have implemented a mix of primary and secondary research methodologies in order to provide insights for the key players' portfolio and calculate its market share & segment revenue.

Digital-led Consumer Banking is the integration of new technologies and development technologies throughout the financial services entity, combined with related changes in internal and external corporate and human relationships, to effectively and efficiently provide enhanced customer service and experience.

Get a Sample of the Report here https://www.marketresearchinc.com/request-sample.php?id=115735

Our report provides insights into the latest industry trends and growth drivers, including technological advancements, regulatory changes, and macroeconomic factors. We have analyzed the impact of these trends on the industry and provided recommendations on how businesses can leverage them to drive growth and stay ahead of the competition. Among other salient features, the report includes a summary of top -notch companies such as

List of TOP KEY PLAYERS in Digital-Led Consumer Banking Market report are:

Tandem, Atom Bank, N26, Revolut, Monzo, Iam Bank, Babb, Ffrees, Fidor Bank, Starling Bank, Zopa

One of the key features of our report is its detailed analysis of the industry's competitive landscape. We have identified the leading players in the market and analyzed their market share, product portfolio, and strategic initiatives. This information can help businesses to benchmark their performance against competitors and identify areas where they need to improve. The competitive landscape of the Digital-Led Consumer Banking market is also provided by analyzing various successful players in the industry. The economic aspects of the market is presented by using detailed facts and figures.

Digital-Led Consumer Banking Market Segment Analysis:

The research report is segmented by Type and Application. By understanding the market segments, decision-makers can leverage targeted product, sales, and marketing strategies. Market segmentation can empower product development cycles by informing how to create offerings for different segments.

Digital-Led Consumer Banking Market, By Type:

• Software

• Service

Digital-Led Consumer Banking Market, By Application:

• Transactional Accounts

• Savings Accounts

• Debit Cards

• Credit Cards

• Loans

• Others

Digital-Led Consumer Banking Market Regional Analysis:

The research study covers North America, Latin America, Asia-Pacific, Europe, Middle East and Africa on the basis of productivity, thus focusing on the leading countries from the global regions. Our report also provides a deep dive into the consumer behavior and preferences, which can help businesses understand their target audience better. We have analyzed consumer trends and preferences, including buying behavior, decision-making processes, and product preferences. This information can help businesses to tailor their products and marketing strategies to meet the needs of their customers.

Years Considered for the Digital-Led Consumer Banking Market:

• Historic Years: 2016-2021

• Base Year: 2022

• Forecast Years: 2023-2031

Don't miss our Early Access Discount of up to 40%: https://www.marketresearchinc.com/ask-for-discount.php?id=115735

Our report is designed to provide businesses with the insights they need to succeed in the industry. Whether you're a startup looking to enter the market or an established player looking to grow your business, our report can provide you with the information you need to make informed decisions and stay ahead of the competition.

Major Points Covered in TOC:

Market Summary: It incorporates six sections, research scope, major players covered, market segments by type, Digital-Led Consumer Banking market segments by application, study goals and years considered.

Market Landscape: Here, the global Digital-Led Consumer Banking Market is dissected, by value, income, volume, market rate, and most recent patterns. The development and consolidation of the overall industry and top organizations is provided through graphs and piece of the pie for organizations.

Profiles of Companies: Here, driving players of the worldwide Digital-Led Consumer Banking market are considered depending on sales across regions, key innovations, net income, cost, and other factors.

Market Status and Outlook by Region: In this segment, the report examines the net deals, income, creation and portion of the overall industry, CAGR and market size by locale. The global Digital-Led Consumer Banking Market is profoundly examined based on regions like North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Segment Analysis: Accurate and reliable foretell about the market share of the essential sections of the Digital-Led Consumer Banking market is provided

Market Forecasts: In this section, accurate and validated values of the total market size in terms of value and volume are provided by the research analysts. Also, the report includes production, consumption, sales, and other forecasts for the global Digital-Led Consumer Banking Market.

Market Trends: Deep dive analysis of the market's recent and future trends are provided in this section.

In conclusion, our market research report is an essential tool for businesses looking to gain a competitive edge in the industry. With its comprehensive analysis of the industry's competitive landscape, consumer behavior, and industry trends, our report provides valuable insights that can help businesses develop effective strategies and make informed decisions. Don't miss out on this opportunity to gain a competitive advantage in the market - order our report today!

For any Enquiries before Buying please reach us at https://www.marketresearchinc.com/enquiry-before-buying.php?id=115735

OR Write Us @ sales@marketresearchinc.com

Contact Us

Market Research, Inc.

Author: Kevin

US Address: 51 Yerba Buena Lane, Ground Suite,

Inner Sunset San Francisco, CA 94103, USA

Call Us: +1 (628) 225-1818

Write Us: sales@marketresearchinc.com

About Us

Market Research, Inc. is farsighted in its view and covers massive ground in global research. Local or global, we keep a close check on both markets. Trends and concurrent assessments sometimes overlap and influence the other. When we say market intelligence, we mean a deep and well-informed insight into your products, market, marketing, competitors, and customers. Market research companies are leading the way in nurturing global thought leadership. We help your product/service become the best they can with our informed approach.

Visit Our Website: https://www.marketresearchinc.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital-Led Consumer Banking Market to Witness Stunning Growth to Generate Huge Revenue Forecast to 2023-2031 here

News-ID: 2996056 • Views: …

More Releases from Market Research Inc.

Bone Graft Substitutes Market 2023 Global Industry Size, Share, Growth and Key P …

The new report by Market Research Inc titled, Global Bone Graft Substitutes Market Report and Forecast 2023-2031', gives a top to bottom analysis of the global Bone Graft Substitutes Market, evaluating the market based on its segments like types, distribution channels, processes, applications, and regions. The report tracks the most recent trends in the industry and studies their effect on the overall market. It also evaluates the market dynamics, covering…

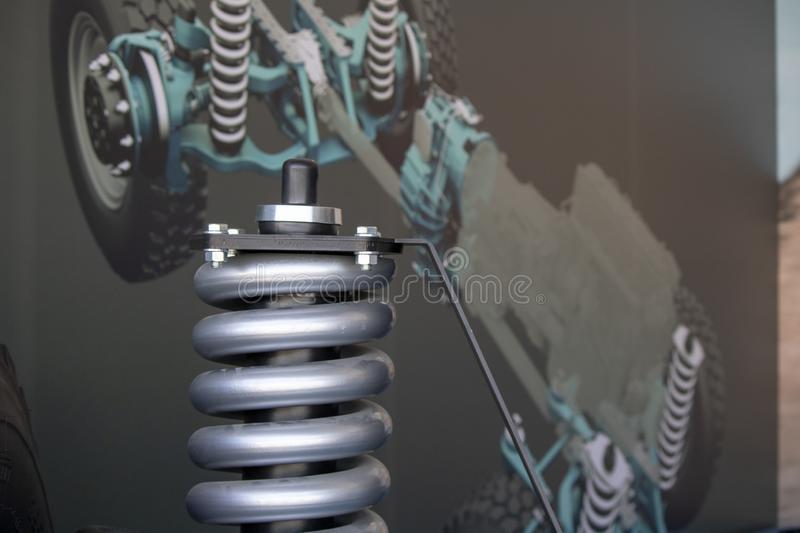

Automotive Suspension Spring Market to Eyewitness Increasing Revenue Growth duri …

Market Research, INC. has recently published a report on Automotive Suspension Spring market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

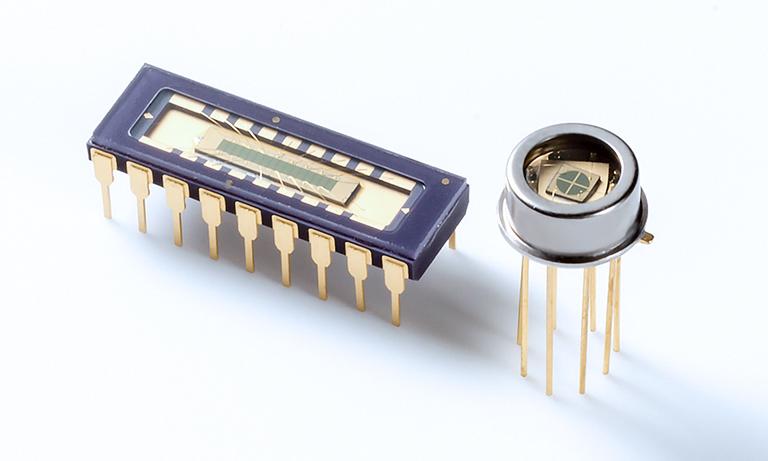

Automotive Tantalum Capacitors Market Report Covers Future Trends with Research …

Market Research, Inc. has published a new report on Automotive Tantalum Capacitors Market, taking into consideration the new trends, risk factors, challenges, market drivers along with its opportunities. Our research experts have prepared this report by conducting primary interviews and implementing secondary research techniques, which provides the Porter Five Forces and PESTLE Analysis, SWOT Analysis as well as geometric information about market dynamics, growth factors, major challenges and market entry…

Enterprise Video Content Management Market Projected To Garner Significant Reven …

Market Research, Inc. has published a new report on Enterprise Video Content Management Market, taking into consideration the new trends, risk factors, challenges, market drivers along with its opportunities. Our research experts have prepared this report by conducting primary interviews and implementing secondary research techniques, which provides the Porter Five Forces and PESTLE Analysis, SWOT Analysis as well as geometric information about market dynamics, growth factors, major challenges and market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…