Press release

Progressive Report on Global Tax Management Software Market 2020 | Growth, Demand & In-depth Analysis by 2026 | Top Key Players: Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar, Xero, Intuit

Market Research Inc has declared that analytical data entitled "Global Tax Management Software Market" will be newly added to its extensive repository. This research report provides an in-depth analysis of various market segments such as type, size, application, and end-user. It covers various aspects of the business that are beneficial in driving or restraining market growth.The tax management software market has grown steadily over the past decade and CAGR is expected to improve over the forecast period (2020-2025). It could also be one of the industries affecting global revenue generation. Rapidly growing demand, abundant raw materials, population growth, economic stability, and product awareness are some of the factors that directly and indirectly advance in the market.

Ask for sample copy of this Report@

https://www.marketresearchinc.com/request-sample.php?id=64254

Profiling Key players:

Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar, Xero, Intuit, Thomson Reuters, H&R Block, Drake Software, SOVOS, Canopy, TaxACT, Outright, Shoeboxed, Rethink Solutions, ClearTAX, WEBTEL, Inspur, Seapower

Market by Key Regions:

North America (United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, and Italy)

Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

In order to uncover a variety of global opportunities, this report lists various effective sales strategies, including the global tax management software market. The market size of each region is detailed based on sales and revenue.

The competitive landscape of the global tax management software market is detailed by describing the key players operating in global regions. Finding this statistical report will not only help you get directions to improve your company's growth, but it will also help you plan for future expansion. It also describes various strategies and standard operating procedures implemented by top-tier companies.

Ask for a discount on this report @

https://www.marketresearchinc.com/ask-for-discount.php?id=64254

Benefits of Purchasing Global Tax Management Software Market Report:

Inimitable Expertise: Analysts will provide deep insights into the reports.

Analyst Support: Get you to query resolved from our team before and after purchasing the report.

Customer's Satisfaction: Our team will assist with all your research needs and customize the report.

Assured Quality: We focus on the quality and accuracy of the report.

Market Report includes major TOC points:

Tax Management Software Market Overview

Global Economic Impact on Industry

Global Market Competition by Manufacturers

Global Production, Revenue (Value) by Region

Global Supply (Production), Consumption, Export, Import by Regions

Global Production, Revenue (Value), Price Trend by Type

Global Market Analysis by Application

Manufacturing Cost Analysis

Industrial Chain, Sourcing Strategy and Downstream Buyers

Marketing Strategy Analysis, Distributors/Traders

Market Effect Factors Analysis

Tax Management Software Market Forecast

For more information ask our experts @

https://www.marketresearchinc.com/enquiry-before-buying.php?id=64254

Conclusively, all aspects of the Tax Management Software Market are quantitatively as well qualitatively assessed to study the Global as well as regional market comparatively. This market study presents critical information and factual data about the market providing an overall statistical study of this market on the basis of market drivers, limitations and future prospects.

Contact Us:

Author Kevin

US Address: 51 Yerba Buena Lane, Ground Suite,

Inner Sunset San Francisco, CA 94103, USA

Call Us: +1 (628) 225 1818

Email:sales@marketresearchinc.com

About Us:

Market Research Inc is farsighted in its view and covers the massive ground in global research. Local or global, we keep a close check on both markets. Trends and concurrent assessments sometimes overlap and influence the other. When we say market intelligence, we mean a deep and well-informed insight into your products, market, marketing, competitors, and customers. Market research companies are leading the way in nurturing global thought leadership. We help your product/service become the best they can with our informed approach.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Progressive Report on Global Tax Management Software Market 2020 | Growth, Demand & In-depth Analysis by 2026 | Top Key Players: Avalara, Wolters Kluwer, Longview, TaxSlayer, TaxJar, Xero, Intuit here

News-ID: 1931572 • Views: …

More Releases from Market Research Inc.

Bone Graft Substitutes Market 2023 Global Industry Size, Share, Growth and Key P …

The new report by Market Research Inc titled, Global Bone Graft Substitutes Market Report and Forecast 2023-2031', gives a top to bottom analysis of the global Bone Graft Substitutes Market, evaluating the market based on its segments like types, distribution channels, processes, applications, and regions. The report tracks the most recent trends in the industry and studies their effect on the overall market. It also evaluates the market dynamics, covering…

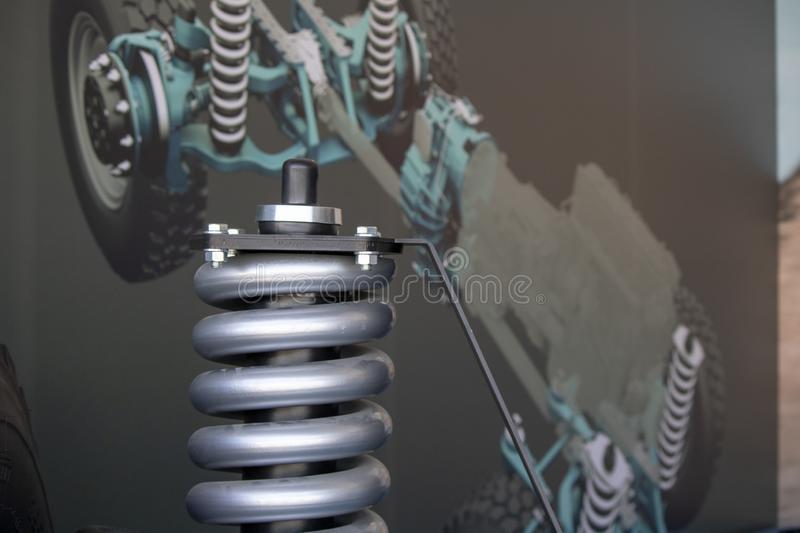

Automotive Suspension Spring Market to Eyewitness Increasing Revenue Growth duri …

Market Research, INC. has recently published a report on Automotive Suspension Spring market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

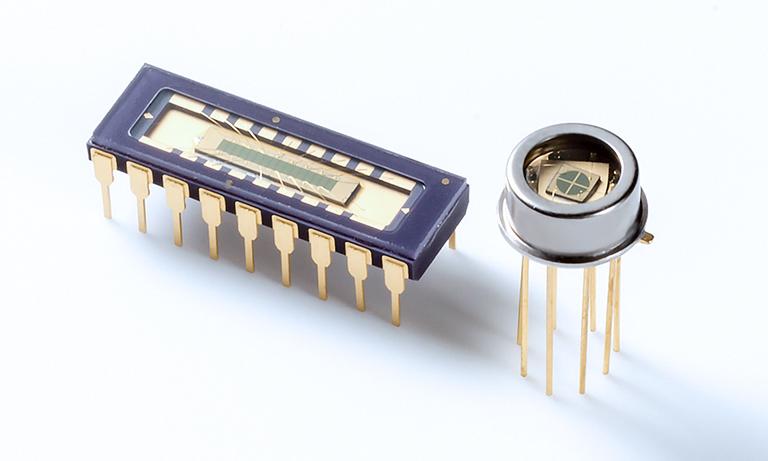

Automotive Tantalum Capacitors Market Report Covers Future Trends with Research …

Market Research, Inc. has published a new report on Automotive Tantalum Capacitors Market, taking into consideration the new trends, risk factors, challenges, market drivers along with its opportunities. Our research experts have prepared this report by conducting primary interviews and implementing secondary research techniques, which provides the Porter Five Forces and PESTLE Analysis, SWOT Analysis as well as geometric information about market dynamics, growth factors, major challenges and market entry…

Digital-Led Consumer Banking Market to Witness Stunning Growth to Generate Huge …

Market Research, INC. has recently published a report on Digital-Led Consumer Banking market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…