Press release

Big Boom in Fintech Law Market that is Significantly Growing with Top Key Players Oracle, Trendmicro, Beyondtrust

FinTech has caused significant disruption in payments and lending in India. Rapid developments in mobile and telecommunications technology coupled with the Indian Government’s incentivized support for digital payments have led to tremendous innovation and growth of FinTech products. The Fintech Law Market is expected to reach XX% CAGR during forecast period 2019-2026.Get Sample copy of this Report @:

https://www.marketresearchinc.com/request-sample.php?id=65622

Key Players in this Fintech Law Market are: –

Oracle, Trendmicro, Beyondtrust, NCR, Cigital, Tripwire And More

the obtainability of a new statistical data to its repository titled as, Fintech Law market. It covers the wide-ranging aspects of the businesses such as pillars, features, sales strategies, planning models to get better insights for the businesses. Furthermore, it throws light on recent developments and technological platforms, several tools, and methodologies that help to boost the performance of industries.

Early Buyers will Get up to 40% Discount on This Premium Research now @:

https://www.marketresearchinc.com/ask-for-discount.php?id=65622

The regional outlook of top-level industries such as Fintech Law has been analyzed across several global areas such as North America, Asia-Pacific, Latin America, Africa, Europe, and India. In addition to this, it gives a detailed description about major pillars of the businesses such as strengths, weaknesses, and challenges in front of the businesses to get a clear idea about ups-downs stages of the businesses.

Reason to Buy

– Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global Fintech Law Market

– Highlights key business priorities in order to assist companies to realign their business strategies.

– The key findings and recommendations highlight crucial progressive industry trends in the Fintech Law Market, thereby allowing players to develop effective long-term strategies.

– Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

– Examine in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

– Improve the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

Access complete Report @:

https://www.marketresearchinc.com/enquiry-before-buying.php?id=65622

In this study, the years considered to estimate the size of Fintech Law are as follows:

History Year: 2013-2019

Base Year: 2019

Estimated Year: 2020

Forecast Year 2020 to 2026.

Table of Contents

Global Fintech Law Market Research Report

Chapter 1 Fintech Law Market Overview

Chapter 2 Global Economic Impact on Industry

Chapter 3 Global Market Competition by Manufacturers

Chapter 4 Global Production, Revenue (Value) by Region

Chapter 5 Global Supply (Production), Consumption, Export, Import by Regions

Chapter 6 Global Production, Revenue (Value), Price Trend by Type

Chapter 7 Global Market Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Global Market Forecast

Contact:

Market Research Inc

Kevin

51 Yerba Buena Lane, Ground Suite,

Inner Sunset San Francisco, CA 94103, USA

Call Us: +1 (628) 225-1818

Write Us@ sales@marketresearchinc.com

https://www.marketresearchinc.com

About Us

Market Research Inc is farsighted in its view and covers massive ground in global research. Local or global, we keep a close check on both markets. Trends and concurrent assessments sometimes overlap and influence the other. When we say market intelligence, we mean a deep and well-informed insight into your products, market, marketing, competitors, and customers. Market research companies are leading the way in nurturing global thought leadership. We help your product/service become the best they can with our informed approach.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Big Boom in Fintech Law Market that is Significantly Growing with Top Key Players Oracle, Trendmicro, Beyondtrust here

News-ID: 1890053 • Views: …

More Releases from Market Research Inc.

Bone Graft Substitutes Market 2023 Global Industry Size, Share, Growth and Key P …

The new report by Market Research Inc titled, Global Bone Graft Substitutes Market Report and Forecast 2023-2031', gives a top to bottom analysis of the global Bone Graft Substitutes Market, evaluating the market based on its segments like types, distribution channels, processes, applications, and regions. The report tracks the most recent trends in the industry and studies their effect on the overall market. It also evaluates the market dynamics, covering…

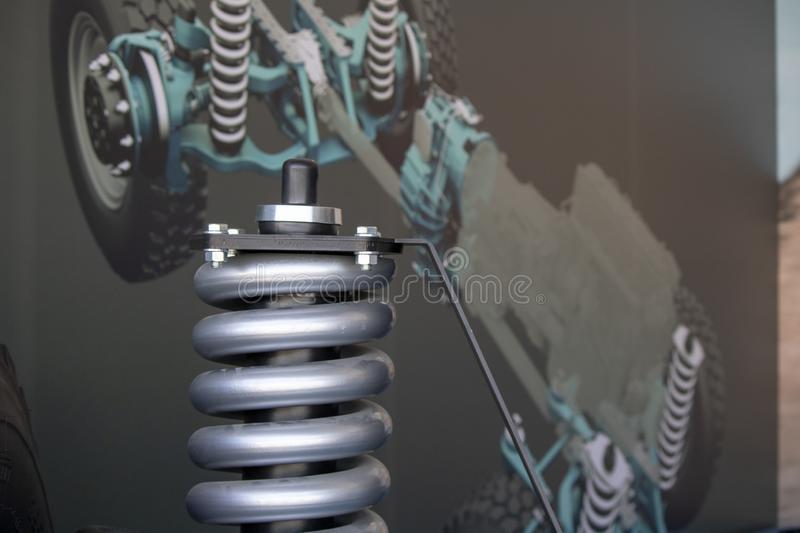

Automotive Suspension Spring Market to Eyewitness Increasing Revenue Growth duri …

Market Research, INC. has recently published a report on Automotive Suspension Spring market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

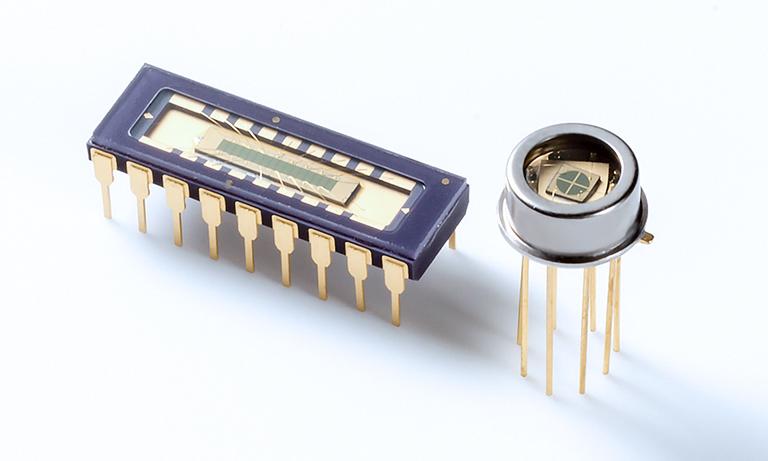

Automotive Tantalum Capacitors Market Report Covers Future Trends with Research …

Market Research, Inc. has published a new report on Automotive Tantalum Capacitors Market, taking into consideration the new trends, risk factors, challenges, market drivers along with its opportunities. Our research experts have prepared this report by conducting primary interviews and implementing secondary research techniques, which provides the Porter Five Forces and PESTLE Analysis, SWOT Analysis as well as geometric information about market dynamics, growth factors, major challenges and market entry…

Digital-Led Consumer Banking Market to Witness Stunning Growth to Generate Huge …

Market Research, INC. has recently published a report on Digital-Led Consumer Banking market which is an essential tool for businesses to gather critical insights about their target markets, competitors, and industry trends. With the increasing complexity of the global business environment, companies need accurate and up-to-date information to make informed decisions and stay ahead of the competition. That's why we are excited to announce the release of our latest market…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…