Press release

Polish road construction market to grow nearly 25% in 2011

Activity in Polish road construction will peak in 2011 and 2012.Driven by substantial capital expenditure by the General Directorate for National Roads and Motorways (GDDKiA), the value of roadwork will exceed PLN 30bn (€7.5bn) already in 2011. Delays in the implementation of projects related to Euro 2012 and sustained investments in local roads will prepare the road market for the anticipated period of reduced spending on the construction of new motorways and expressways.

According to the report "Road construction in Poland 2011-Development forecast for 2011-2014" published by PMR, a market research company, following the growth exceeding 40% in H1 2011, the second half of the year will see a moderate slowdown in construction output generated by road and bridge projects. As a result, the value of roadwork projects in 2011 as a whole is expected to increase by nearly a quarter to just under PLN 31bn (€7.7bn).

The value of projects completed by the road construction industry will peak in 2011 and the sector will report steady declines of several percent starting from 2012, which will be due to a lower number of motorway and expressway sections under construction. PMR researchers anticipate that the road construction sector will bottom out in 2014 when its output is expected to be a little more than PLN 19bn (€4.7bn). However, construction output generated by road projects can start to grow again from 2015, partly driven by the positive financial perspective for 2014-2020 benefitting Poland and at least one PPP motorway construction project planned around that date.

Due to numerous delays in the implementation of expressway and motorway construction projects, GDDKiA's plan providing for expenditure of PLN 33bn (€8.2bn) in 2011 is highly unfeasible. Accordingly, part of payments will be put off until 2012 and 2013. As a result of delays in the implementation of road projects, the road construction market will be less exposed to a shock resulting from a fall in the number of new large road construction contracts expected in 2013.

According to PMR researchers, it is rather unlikely for expenditure on national road construction in Poland to fall back to levels recorded before 2007 when GDDKiA's spending was less than PLN 10bn (€2.5bn) annually, partly due to many legal incentives facilitating project preparation introduced ever since and more possibilities for obtaining EU funding. “Investment projects gained so much momentum in the last three years that there is hardly a way to stop them at this point", says Bartlomiej Sosna, Senior Construction Analyst at PMR and the author of the report.

In addition to GDDKiA's dwindling budget, in 2011 the road market will be adversely affected by investment projects undertaken by licencees, which will fall to virtually zero in 2012 (two large PPP projects are scheduled for completion by the end of 2011). New projects by private licencees will not start earlier than 2014, depending on the success of negotiations concerning the construction of a 140 km Tuszyn-Pyrzowice section of the A1 motorway.

Since spending on national road investment projects is anticipated to fall after 2012, funds expended under the local road reconstruction programme, which will be continued in 2012-2015, will gain more significance as a source of funding for road projects. The fact that the programme will go on is very good news, especially given the anticipated reduction in the number of large road construction contracts. It is possible that local contracts will increasingly attract large construction companies which have access to free capacity in a given region.

“We are also of the opinion that the standing of smaller companies involved in road work can improve on the back of the expected increase in investment spending in the power construction industry, which is expected to be the key growth driver for the civil engineering construction market in Poland in the future. A large number of power construction projects scheduled after 2013 would greatly enhance books of orders of the major civil engineering construction companies. As a result, these companies would be able to employ medium-sized providers of road construction services as subcontractors in future road work contracts. However, if power projects are not launched or if there are any delays in their implementation, the large contractors will perform nearly all future road work contracts exclusively using their internal resources, as they will have to face thinner books of orders and maintain workforce numbers. Were this scenario reality, it would be put an end to many medium-sized companies operating in the road construction market", adds Bartlomiej Sosna, Senior Construction Analyst at PMR and the author of the report.

This press release is based on information contained in the latest PMR report entitled "Road construction in Poland 2011-Development forecast for 2011-2014" (http://www.pmrpublications.com/online_shop/Road-construction-sector-Poland-2011.shtml).

For more information on the report please contact:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrcorporate.com

PMR permits the republishing of this press release in part or in whole provided that all portions of text, graphics, diagrams and tables identify PMR in a proper citation format: "Source: PMR". All citations should be accurate and quoted without manipulation and must not be used out of context.

For more information about citing PMR, please consult our Citation Policy.

PMR (www.pmrcorporate.com) is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR's key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.

PMR

Dekerta 24, 30-703 Kraków, Polska

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polish road construction market to grow nearly 25% in 2011 here

News-ID: 188201 • Views: …

More Releases from PMR Ltd.

Roads to be a driving force of the Bulgarian construction market

Access to EU funding and the investments in the energy sector are the predominant factors determining the development of the Bulgarian civil engineering construction sector in the next three years. It is expected that this segment will lead the development of the construction market in Bulgaria.

According to the research company PMR’s latest report, entitled “Construction sector in Bulgaria 2012 – Development forecasts for 2012-2014”, the absorption rate of the programmes…

Construction industry in Romania expected to stabilise in 2011

Prior to the start of the crisis, the Romanian construction industry was one of the most vibrant in the European Union.

This changed dramatically in 2009, when construction output fell by 15%, with a similar reduction following in 2010. The current year should finally lead to a measure of stabilisation on the market, but growth is not likely to return before 2012.

Romania was the region's best performer in construction a…

Pharmaceutical contract manufacturing and API sourcing: why not Central Europe?

At present, only a few companies based in Central Europe and the Balkans emphasise their contract manufacturing and API sourcing services. There is relatively strong competition from companies from the Far East and from Western Europe.

On the other hand, the potential of the region seems to be considerable, with Poland and the Czech Republic still the most attractive locations, according to the latest report from PMR, a research and…

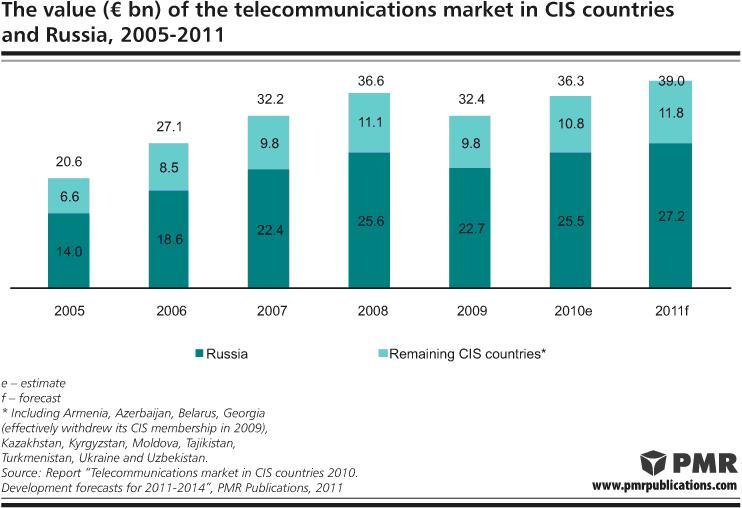

Telecoms market in CIS region to reach €39bn in 2011

The CIS telecommunications market is recovering after the crisis period. In euro terms, the market closed 2010 with double-digit growth, chiefly due to the improvement of macroeconomic indicators and the gradual strengthening of local currencies. This year, the market is also expected to increase fuelled by further development of broadband services.

Russia leading

The telecommunications market in Russia is by far the largest among all CIS countries. Revenues generated only on the…

More Releases for Poland

Poland Agriculture Market, Poland Agriculture Industry, Agriculture Livestock Ma …

Poland is a significant European and global producer of numerous agricultural products. The agricultural land market in country is divided in two parts: privately owned farms and land owned farms by the State Treasury. Privately owned farm is an enterprise to cultivate various agricultural products under the control of one or more investor. Poland is among the world's primary producers of potatoes, rye, and apples, as well as pork and…

MAUSER Poland Celebrates 5th Anniversary

Bruehl/Germany, June 27, 2017

MAUSER Group, a worldwide leading company in industrial packaging, celebrates the 5th anniversary of its factory in Gliwice, Poland. Ideally located in the industrial heartland of Upper Silesia, and operated by a strong local management team, the plant offers high-quality industrial packaging solutions and services.

MAUSER Poland serves customers with a comprehensive product range of Composite Intermediate Bulk Containers (CIBCs) and plastic tight-head drums. In line with…

Agrochemicals Market in Poland

ReportsWorldwide has announced the addition of a new report title Poland: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Poland: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

A+ ratings on Poland

Jelenia Gora/Poland, 20.09.2011 - In August 2011 two rating agencies i.e. Standard & Poor's and Moody's Investors Service affirmed their A+ rating on Poland with a stable outlook. Both agencies noted that the Polish economy is competitive and increasingly diversified. Moody's evaluated Poland as relatively well placed to withstand global turmoil with its relatively resilient economy. Both agencies stressed that the Polish economy continued to expand in 2009, in contrast…

IT market in Poland

IT providers in Poland are starting the post-crisis period in actually quite good moods and are already beginning to predict what solutions will be most sought after by their customers during prosperity.

However last year hardware distributors recorded significant reduction in the number of orders placed, especially by business customers, software and IT services providers performed far better. A majority of them had similar sales as in previous periods, while some…

VoIP in Poland

At the end of 2008 the Polish VoIP telephony market was worth PLN 440m, with CaTV operators having generated the largest share of revenue in the segment. In recent years also fixed-line operators have included VoIP services into their offer.

According to research and consulting company PMR Polish VoIP market continues to represent a small share of the fixed-line telecommunications market. In 2008 it accounted for approximately five percent of the…