Press release

The popularity of online loans has not increased in Singapore

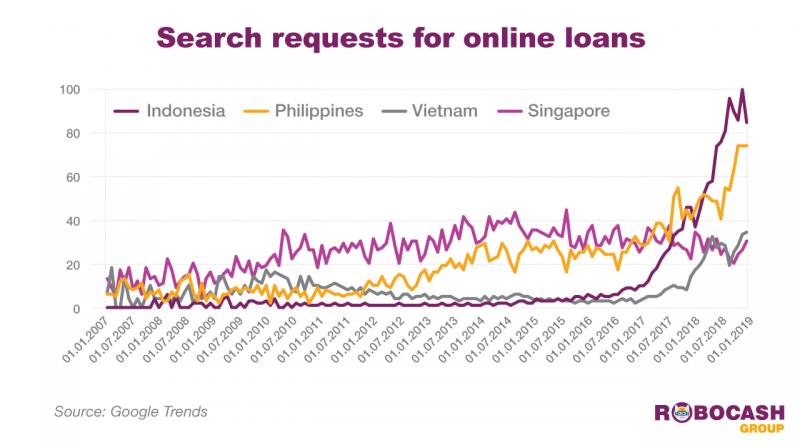

The demand for online loans in Singapore is significantly lower than in other countries of Southeast Asia, as reported by a recent study of the international alternative lending holding Robocash Group.Analyzing statistics of search requests, analysts of the company compared trends of demand for online loans in Singapore, Indonesia, Vietnam and the Philippines. The findings show that the situation in Singapore differs from other countries significantly. The demand in Indonesia, Vietnam and the Philippines demonstrates a clear ascending trend and fast development. However, in Singapore, with low development of online loans issued by alternative lending companies, there is no significant growth of their demand recorded by the systems for search analytics. At the same time, looking at the frequency of the search request of “online credit”, the increase is observed from late 2007 to 2015 and stops afterwards.

The reason is the faster economic development and dense area of Singapore, as opposed to its multi-island neighbours. Consequently, the country has an advanced financial sector, which is accessible for all residents. Taking into account the general maturity of the digital sphere, it’s obvious that the fintech services started developing here earlier, but within the traditional banking sector.

The legislative regulation of lending in Singapore also makes an impact. Limited interest rates make it more profitable for alternative lenders to work with the business community. According to the University of Cambridge, in 2017, 99% of issued alternative loans there fell under the business segment. In the Philippines and Vietnam, the situation is opposite: only 7% and 10% of loans respectively accounted for business sector. In Indonesia, the distribution is more balanced: 72% were business loans and 28% - consumer loans.

Moreover, the demand for online loans is affected by the age of the population. According to the United Nations, the average age of Singaporeans is 40, Filipinos - 24, Indonesians - 28 and Vietnamese - 30. The young age and lack of access to banking products are the main driver for the development of alternative lending in Indonesia, Vietnam and in the Philippines. This is confirmed by the statistics on 200,000 online loans issued by the companies of Robocash Group in Southeast Asia (the Philippines, Vietnam, Indonesia), where 49.9% of borrowers are under 30.

Robocash Group

Duntes iela 23A, Rīga, Latvia, LV-1005

Press contact:

Olga Davydova

Head of Media Relations

E-Mail: pr@robo.cash

Tel.: +371 67660860

---

About:

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates the own EU-based p2p investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.

https://robocash.group

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The popularity of online loans has not increased in Singapore here

News-ID: 1794716 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

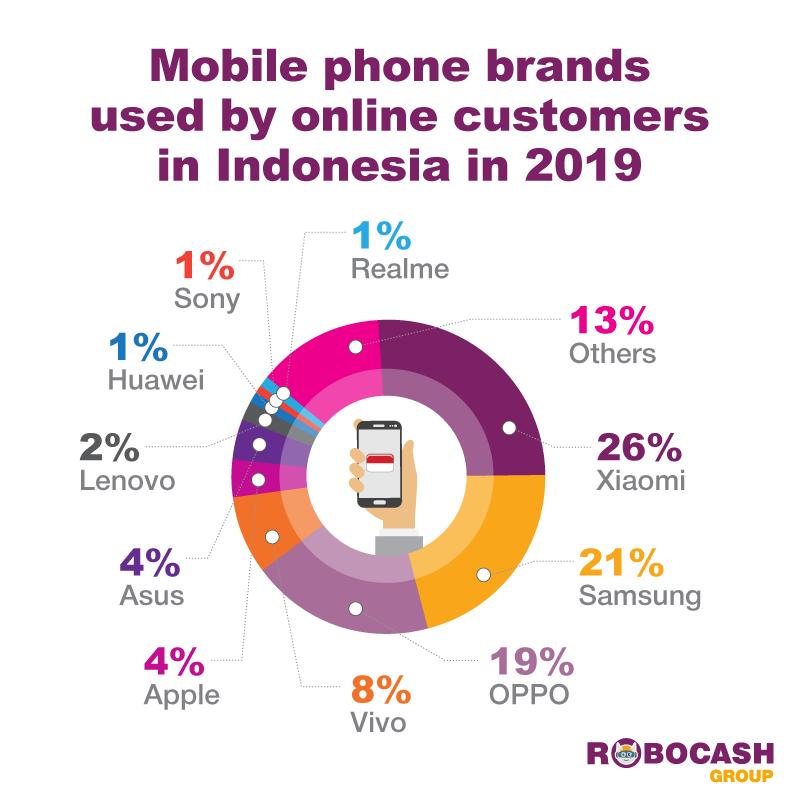

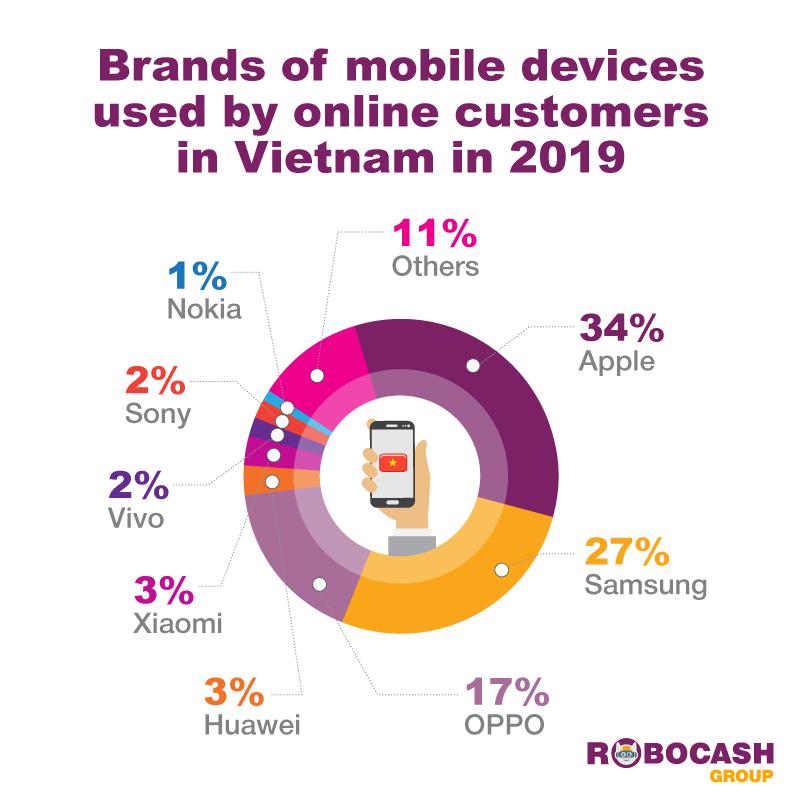

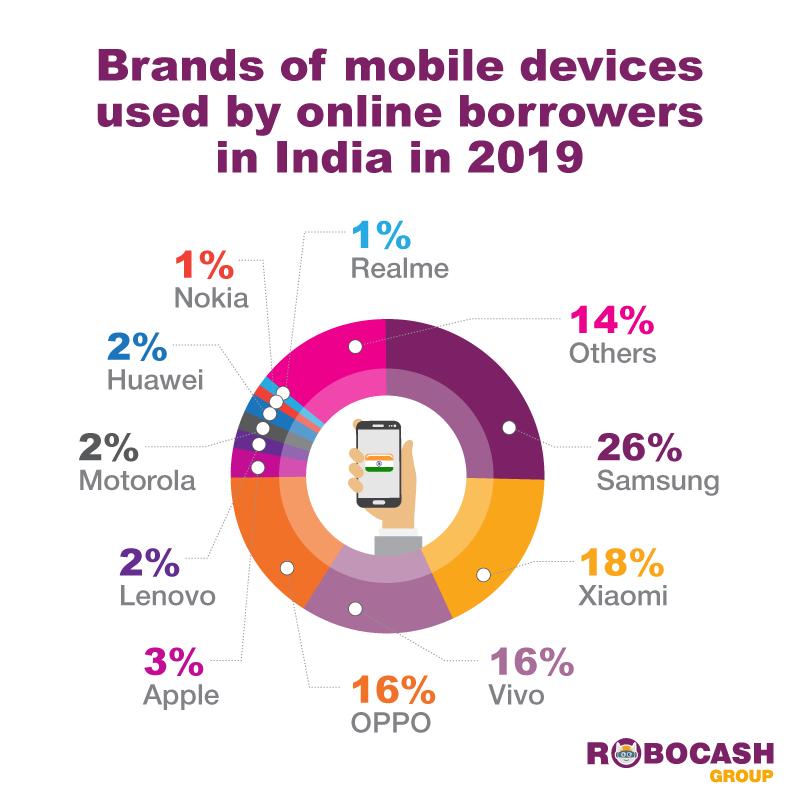

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Singapore

Singapore Tour Packages

TripNest Launches "Explore Singapore Your Way" - A Customized Singapore Tour Package for Every Traveler

Mysore, India - [Date] - TripNest, a leading travel and holiday planning company, proudly announces the launch of its new "Explore Singapore Your Way" tour package - an exclusive travel experience crafted for Indian travelers seeking the perfect balance of adventure, leisure, and luxury in the Lion City.

Designed with flexibility and personalization in mind, TripNest's Singapore…

Singapore Probiotic Food Supplement Market Statistical Forecast, Growth Insights …

Singapore Probiotic Food Supplement Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Singapore Probiotic Food Supplement market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Singapore Memories: The Pinnacle of Perfumery in Singapore

In the heart of Singapore lies an olfactory haven that has garnered acclaim and admiration from both locals and tourists alike. Singapore Memories, widely celebrated as the best perfume shop in Singapore, continues to captivate scent enthusiasts with its exquisite collection of fragrances that pay homage to the rich cultural heritage and diverse flora of the region.

Unparalleled Perfumery Craftsmanship

Singapore Memories stands out in the competitive landscape of the perfume industry…

Singapore Bunker Fuel Market: Fueling Maritime Commerce | Singapore 3.5% Growing

According to a new report published by Allied Market Research, The Singapore bunker fuel market size was valued at $17.6 billion in 2020, and is projected to reach $24.5 billion by 2030, growing at a CAGR of 3.5% from 2021 to 2030.

Singapore is one of the world's largest bunkering ports and is a significant hub for the supply and trading of bunker fuel. Bunker fuel is a type of fuel…

Payroll services Singapore: Automating Businesses In Singapore Becoming More Pop …

What is payroll

Payroll is the method used to pay employees' salaries. Making a list of the personnel who need to be paid comes first, and recording the expenses comes last. It's a complicated procedure that requires cooperation from numerous teams, including payroll, HR, and finance.

1. Save money on the best payroll processing available.

In order to give you the finest service possible, a payroll services firm is always updating…

Peoplewave selected for Startup Station Singapore by Facebook and IMDA Singapore

20 February 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, has been selected to participate in Startup Station Singapore 2019.

Startup Station Singapore is a partnership between Facebook and the Infocomm Media Development Authority (IMDA) Singapore. Kicking off in February 2019, this programme will empower data-driven startups to accelerate their businesses in new and cutting-edge ways, while continuing to keep peoples’ trust, transparency and control over their data at…