Press release

Indonesia, Philippines and Thailand are the most favourable markets for fintech lending in SEA

Indonesia, Philippines and Thailand provide the most favourable conditions for the development of fintech lending in Southeast Asia. They got 147.5, 64.9, 52.1 points respectively in the Index of short-term prospects of fintech lending conducted by Robocash Group. In a short term perspective, it promises to result in the inflow of investments in the local projects.Indonesia provides the most fertile environment for the development of alternative lending in Southeast Asia. The country got 147.5 points in the index of the financial holding Robocash Group. To distinguish the prospects for fintech lending in the eleven SEA countries at a numerical scale, the company studied sixteen different aspects associated with social and economic development, financial inclusion, digital adoption etc.

The most significant factors placing Indonesia to the top are the population size, widespread use of mobile phones, growing need for finance with remaining low access to financial services. Thus, in 2017, only 48.9% of the Indonesian had a bank account, but 54.8% borrowed money. According to Financial Services Authority (OJK), as of December 2018, the volume of P2P loans issued in the country amounted to over US$1.15 bln.

Taking second place in the index (64.9), the Philippines has several strong points too. Compared to Indonesia, there are more young people, who will be active consumers soon. Also, Filipinos are the first in the world by the time spent online and on social media. However, the territorial fragmentation still leaves people underserved by banks: only 34.5% had a bank account in 2017. The fact of borrowing among 58.6% of people in 2017 confirmed the gap between the real demand for finance and financial inclusion.

Thailand (52.1) also demonstrates readiness to embrace fintech solutions. The country has higher GDP (US$17,872 in 2017) than Indonesia (US$12,284) and the Philippines (US$8,343). The population feels at ease with the Internet (82% of Internet users in 2018) and digital services (62.3% made or received digital payments in 2017).

Two more countries in the TOP 5 are Singapore (50.1) and Vietnam (49.4). The long-standing reputation of Singapore speaks for itself. The main hindering factor is the limit of the market volume. Therefore, local fintechs expand to neighbouring countries with lower competition and higher customer potential. The third largest population size in SEA makes Vietnam a good example. Low financial inclusion (30.8% of people had an account in 2017), high demand for finance (49.0% borrowed money in 2017) and Internet penetration (66% in 2018) and mobile connectivity altogether raise the attractiveness of the local alternative lending market for foreign investments.

In the background of the apparent leaders, the rest of the SEA region may seem less attractive for fintech lending. Nevertheless, there are Myanmar (22.4), Laos (15.2) and Cambodia (14.6) that look promising in a longer-term perspective.

---

ABOUT

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates its own EU-based investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.

https://robocash.group/

ROBOCASH GROUP

Duntes iela 23A, Rīga, LV-1005

Presscontact

Olga Davydova

Head of Media Relations

pr@robo.cash

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia, Philippines and Thailand are the most favourable markets for fintech lending in SEA here

News-ID: 1758967 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

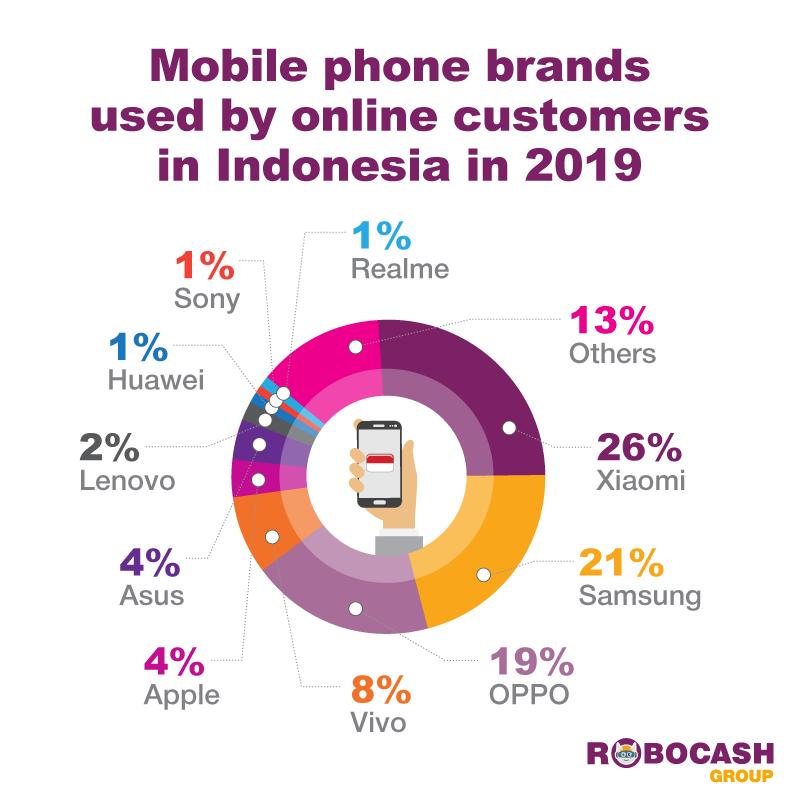

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

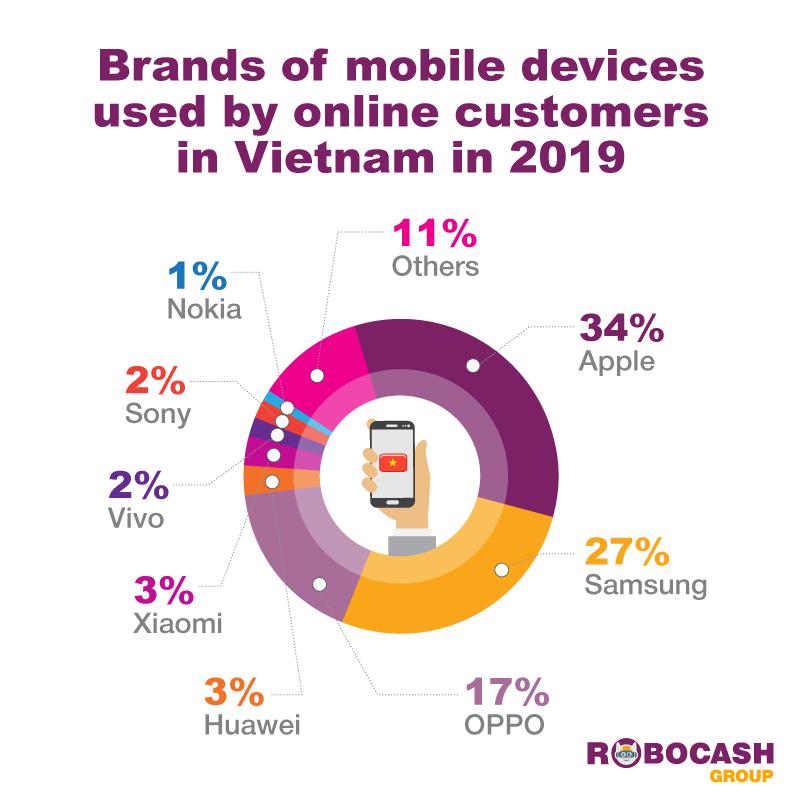

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

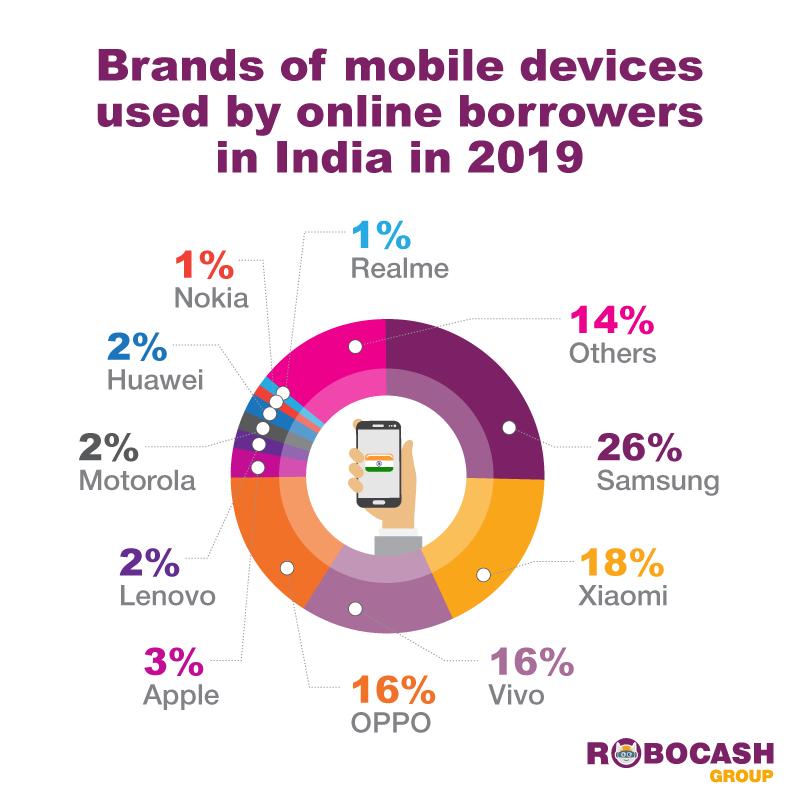

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Indonesia

Indonesia Oil and Gas Market Size, Share Projections 2031 by Key Manufacturer- P …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Oil and Gas Market size was valued at USD 281.50 Billion in 2024 and is projected to reach USD 499.94 Billion by 2032, growing at a CAGR of 7.66% during the forecast period 2026-2032.

What is the current outlook and growth potential of the Indonesia Oil and Gas Market?

The Indonesia Oil and Gas Market is showing signs of gradual…

Indonesia Amino Acid Fertilizer Market Anticipated for Positive Growth by 2031 | …

Indonesia Amino Acid Fertilizer Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Indonesia Amino Acid Fertilizer market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

MICE Market to Witness Massive Growth with PT Pamerindo Indonesia, GEM INDONESIA

HTF MI Published the Latest Global MICE Market Study that provides by in-depth analysis of the current scenario, the Market size, demand, growth pattern, trends, and forecast. Revenue for MICE Market has grown substantially over the six years to 2022 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown Industry Players are seeing the big impact in operations and identifying ways to keep momentum.…

Overview of Indonesia MICE Market | SHIFTinc, Venuerific Indonesia, Werkudara Gr …

Astute Analytica, a leading provider of market research and analysis, released its highly anticipated Market Analysis Report on the Indonesia MICE Market. This comprehensive report aims to equip businesses with invaluable insights and data, enabling them to make informed decisions and stay one step ahead of the competition.

Access the Comprehensive PDF Market Research Analysis Report Here: https://www.astuteanalytica.com/request-sample/indonesia-mice-market

Indonesia MICE Market was valued at US$ 2,095.95 million in 2022 and is…

Clinical Laboratory Market in Indonesia, Clinical Laboratory Industry in Indones …

"Increase in healthcare expenditure from the Indonesian government has driven the growth of clinical laboratory market in Indonesia."

Increase in Healthcare Awareness: Largely driven by increase in healthcare spending by aging population (~$ 260 per person by 2050), rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government's healthcare measures.

Developments in Testing and Preference for Evidence based testing: There is also a rising number…

Baby Food Sector in Indonesia Market 2019 By PT Nestlé Indonesia, Danone, PT Ka …

"The Baby Food Sector in Indonesia, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Indonesian market.

Dietary habits have inhibited sales of commercially prepared baby foods in Indonesia. With the exception of Jakarta, many Indonesians have a traditional diet, based on rice, fresh fruit, and vegetables, supplemented with meat, although, 80% of the population is Muslim, and do not…