Press release

The top players Real-Time Payments Market industry ACI Worldwide, FIS, Fiserv, Mastercard, Worldline , PayPal , Visa, Apple, Ant Financial, trends to watch in 2026

Global Real-Time Payments Market: OverviewReal-time payments are also referred to as immediate payments and instant payments. They are gaining ground, driven by consumer demand for speed and convenience. Financial institutions must respond to this demand. They cannot rely on traditional payment instruments to be competitive.

The key difference between real-time payments and other traditional payment modes is that real-time payments guarantee immediate accessibility of funds to the beneficiary of the transaction. In contrast to this, real-time authorization of a deal on a card is not the same and the buyer is committed to pay and the recipient is guaranteed to receive the funds. However, the availability of funds is not immediate. But, real-time payments could potentially replace other payment methods such as cards, checks, and automated clearing houses.

Request a Sample of Real-Time Payments Market @ http://bit.ly/2AP8vr7

Global Real-Time Payments Market: Growth Factors

Massive use of Smartphones and IoT devices along with burgeoning customer demand for quick payment settlement is anticipated to spur real-time payments market growth over the next few years. Large-scale adoption of real-time payments across the world has created business environment in which many consumers, traders, and banks are able to pay friends and customers, settle bills, and transfer money quickly.

With real-time payment systems offering an instant 24/7, interbank electronic fund transfer service that can be initiated through one of many channels such as Smartphones, tablets, digital wallets, and the web, business analysts have forecast that the real-time payments market growth will gain momentum over the coming years.

Download Brochure of Real-Time Payments Market: http://bit.ly/2SSTBqC

Real-time payments can benefit financial institutions, dealers, consumers and society by offering enhanced visibility into payments, by enabling better cash flow management and by helping businesses better manage day-to-day operations by improving liquidity. The liquidity improvement can be especially impactful to small merchants who may be used to waiting day for their settlement, possibly creating a positive impact on their cash flow and daily sales outstanding. All these factors are slated to contribute remarkably towards real-time payments market size in the near future.

Global Real-Time Payments Market: Segmentation

The global real-time payments market can be divided based on nature of payment, component, deployment mode, enterprise size, and vertical. Based on the nature of payment, the market is segmented into P2P, B2P, and P2B. On the basis of component, the real-time payments market is sectored into solutions and services. Solutions segment is further sub-segmented into payment gateway, payment processing, payment security, and fraud management.

Request For Discount for Real-Time Payments Market: http://bit.ly/2FE9dub

Global Real-Time Payments Market: Regional Analysis

Based on regions, the global real-time payments market can be divided into five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific is expected to hold the largest market size and grow at the highest CAGR during the forecast period. In the APAC region, the growth rate can be attributed to various factors, including the acceptance & implementation of advanced technologies, economic growth, increasing rate of digitalization, and high investments from real time payments solution and service providers. The driving forces for the Asia Pacific real-time payments market are the rapidly increasing population that has contributed significantly towards the volume of business deals along with the regional and global enterprises that are making huge investments in this region as a result of supportive foreign direct investments policies of the regional governments.

With inception of new technologies witnessed in the payments systems in the countries such as the U.S. and Canada, North America real-time payments market growth will receive a boost in the coming years. Experts have projected that European region is likely to hold huge market growth potential along with LATAM.

Browse detail report @ http://bit.ly/2DaqTvS

Global Real-Time Payments Market: Competitive Players

The key players of the global real-time payments market include CI Worldwide, FIS, Fiserv, Mastercard, Worldline , PayPal , Visa, Apple, Ant Financial , INTELLIGENT PAYMENTS, Tmenos, Global Payments, IntegraPay, Obopay, Ripple , Pelican , Finastra, Nets , Montran , REPAY, and Icon Solutions.

Global Real-Time Payments Market: Regional Segment Analysis

North America

The U.S.

Europe

The UK

France

Germany

The Asia Pacific

China

Japan

India

Latin America

Brazil

The Middle East and Africa

Top Selling Report :-

IT Asset Disposition (ITAD) Market http://bit.ly/2MdXx2J

Learning Management System Market http://bit.ly/2VUCuGW

Medical Connectors Market http://bit.ly/2FzPgF3

Cable Television Networks Market http://bit.ly/2TSm7cc

Clinical Nutrition Market http://bit.ly/2T2eAHO

What Reports Provides

Full in-depth analysis of the parent market

Important changes in market dynamics

Segmentation details of the market

Former, on-going, and projected market analysis in terms of volume and value

Assessment of niche industry developments

Market share analysis

Key strategies of major players

Emerging segments and regional markets

Testimonials to companies in order to fortify their foothold in the market.

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles.

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The top players Real-Time Payments Market industry ACI Worldwide, FIS, Fiserv, Mastercard, Worldline , PayPal , Visa, Apple, Ant Financial, trends to watch in 2026 here

News-ID: 1502929 • Views: …

More Releases from zion market research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

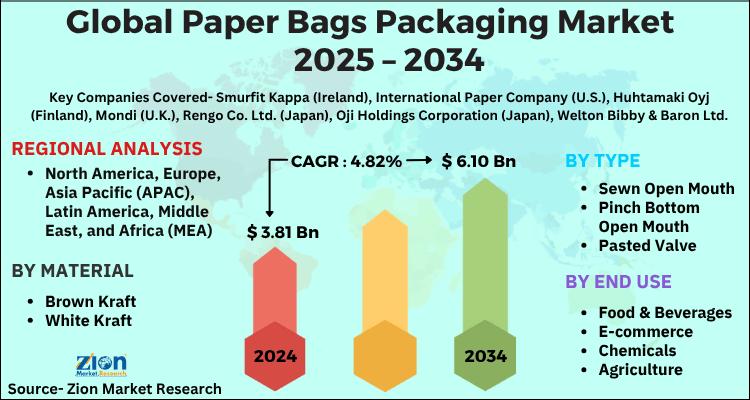

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

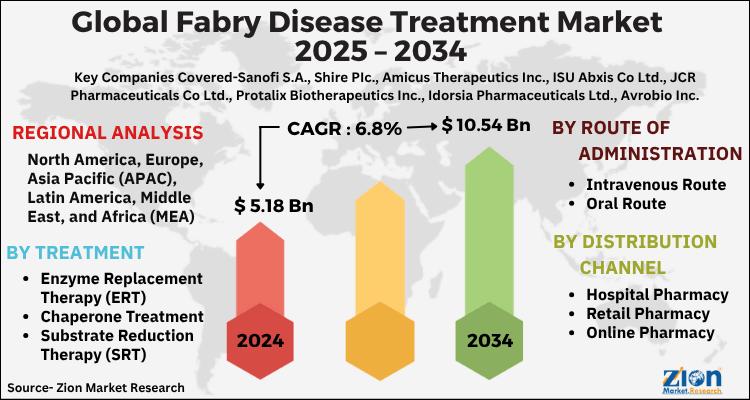

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Payments

Credit Card Payments Market Secured Transactions, Seamless Payments: The Future …

Credit Card Payments Market

Credit Card Payments Market to reach over USD 327.68 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Credit Card Payments Market Size, Share & Trends Analysis Report By Card Type (General Purpose Credit Cards and Specialty & Other Credit Cards), Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars,…

Unveiling QuickBooks Payments Gateway WHMCS Module for Securing Payments

Discover seamless payment security with the QuickBooks Payments Gateway WHMCS Module. Safeguard your transactions and streamline payment processes effortlessly.

Feature News

Summers & Zim's Expands Services with Tommy's Electric Acquisition, Enhancing Electrical Offerings in Lancaster and Chester

Relief Allergy & Sinus Institute Welcomes Dr. Griffith Hsu to the Team, Expanding Best ENT and Allergy Care Locations

Watch the first major AI music video generated by Runway Artificial Intelligence

The Beer Connoisseur® Magazine & Online…

Payments Landscape Market Analysis 2023 Global Future Outlook 2029, Key Applicat …

The research looks at factors like segmentation, description, and applications in the Payments Landscape Market. It derives accurate insights to provide a comprehensive view of the dynamic features of the business, such as shares and profit generation, directing attention to the critical aspects of the business. Market methodologies adopted in the report offer precise data analysis and provide a tour of the entire market. Both primary and secondary approaches to…

Payments Landscape in Russia Industry, Mobile Proximity Payments, Bill Payments, …

Market Research Hub (MRH) has actively included a new research study titled Payments Landscape in Russia: Opportunities and Risks to 2022 to its wide online repository. The concerned market is discoursed based on a variety of market influential factors such as drivers, opportunities and restraints. This study tends to inform the readers about the current as well as future market scenarios extending up to the period until forecast period limit;…

Top Players in India Mobile Payments Market forecasts 2025: Transaction Services …

Mobile payments are payment methods that use mobile phones. India's Mobile Payment Forum (MPFI) is an umbrella organization responsible for mobile payments in India. India is the world's largest mobile payment market.

A mobile payment is money paid for a product or service through a portable electronic device such as a tablet or cell phone. Mobile payment technology can also be used to send money to friends or family members. Mobile…

The Russian Consumer Payments Country Snapshot : Payment cards, Online payments, …

"The Report Consumer Payments Country Snapshot: Russia 2016 provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

The Russian payments market is showing significant change as it slowly moves towards digital payments. In spite of cash playing a dominant role, new payment technologies will progressively gain in importance, with mobile payments and online commerce expected to contribute to increasing the level…