Press release

Most Singaporean CFOs Made Bad Hires and Here's Why

Robert Haft, an American HR consulting firm, has conducted a survey on 150 Singaporean CFOs to collect the results and the accuracy of their hiring decisions. Surprisingly, the majority of the surveyed CFOs (98%) admitted having made the wrong decision when hiring new employees. With 24% (one in four) of them took only two weeks to realise that they have hired the wrong person.What is the cost of a bad hire?

The main reasons that led to the failed hires are: 43% is because of a mismatch of skills, while another one-third of the surveyed CFOs said that the new member is either underqualified or overqualified, and the last case is because the candidate fails to fit in the existing workplace culture (34%).

As frequent as hiring the wrong person occurs, its consequences are inevitable: inflated workload and stress for both of the colleagues and managers when dealing with the troubles caused by the false placement. Resulting in a loss in productivity, overall performance and raise the recruitment costs.

Besides the substantial consequences, Singaporean companies also struggled to precisely calculate the costs caused by hiring the wrong person. According to the report, 41% of the respondents said that one of the main reasons is that they do track the costs, yet they fail to compile all the data related to these costs in a single overview. In some cases, the surveyed CFOs claimed that there are costs that are unable to measure accurately. Moreover, few companies admitted that they have not looked at doing it or track the costs closely enough.

The cost of the bad hires has long been a major concern for firms, because, apart from the tangible losses: lost of ROI and recruiting and training costs, decreased turnover rate and overall performance, one wrong hire can trigger significant disruption and negatively affect morale, bringing down staff productivity and causing even more HR headaches in the process.

Establish a streamlined recruitment process

In order to deal with the wrong employee placement, 35% of CFOs choose to dismiss the employee contract. On one hand, 33% of the respondents decide to apply a training program to further develop the employee’s skills to the desired level. On the other hand, some CFOs fix the problem internally by finding another position within the organisation that is a better fit for the individual. Either way, this problem can be well-avoided with an efficient, streamlined recruitment process.

Today’s hiring process is far more complicated compared with how it used to be. The candidate’s experience is no longer the decisive element for the hiring choice as the transferable skills like leadership, communication, resilience, and problem-solving are more likely to predict the candidate’s future success better than work experience.

Therefore, recruiting managers must define their expected hiring criteria as well as the “candidate persona” prior to the actual hiring stages. Consider training and onboarding as part of the hiring process, since providing proper training for the right candidate is more effective than hiring the wrong-but-experienced candidate. Finally, constantly review and update the hiring process to balance the recruitment process with the right level of efficiency and rigour and prepare the organisation for all the upcoming trends and demands in the Talent management market.

The War for Talent shows no signs of decline. The searches for qualified candidates are as tedious as ever. The screening and selection processes are as tiring as ever. Fortunately, rapid technology advancement is significantly changing the way recruiters work.That’s why we bring to you the White paper Recruitment Reinvented. In this white paper, we will examine the latest tools every HR department should have in their arsenal. You can download the white paper at https://blog.trginternational.com/recruitment-reinvented

ABOUT TRG INTERNATIONAL

TRG International is an IT, Talent and F&B company. We help people and businesses to shine. We help people be the best they can possibly be by selecting the right people for the right job and developing them to their full potential. We help companies by providing an IT solution that works quietly and brilliantly in the background, freeing them up to focus on their core and not having to worry about their IT systems. We do this for more than 1,000 clients in 80 countries. Learn more at: www.trginternational.com

Contact-Details: Ngoc Doan

ngoc.doan@trginternaltional.com

PR Communication Officer

TRG International - 2nd Floor, 145 – 147 Nguyen Co Thach Street, An Loi Dong Ward, District 2, Ho Chi Minh City, Vietnam

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Most Singaporean CFOs Made Bad Hires and Here's Why here

News-ID: 1360005 • Views: …

More Releases from TRG International

TRG International Announces Court-Ordered Transfer and Sale of All Shares Held b …

Enforcement Proceedings For Unpaid Arbitration Award also Underway in the United States and Pakistan

WASHINGTON, D.C. - January 26, 2026 - TRG International today announced that on January 19, 2026, the Bermuda Supreme Court ordered the transfer of all shares held in the company by former Chairman Zia Chishti to a court-appointed receiver for sale, with proceeds to be applied toward satisfying an outstanding arbitration award.

The order follows enforcement proceedings…

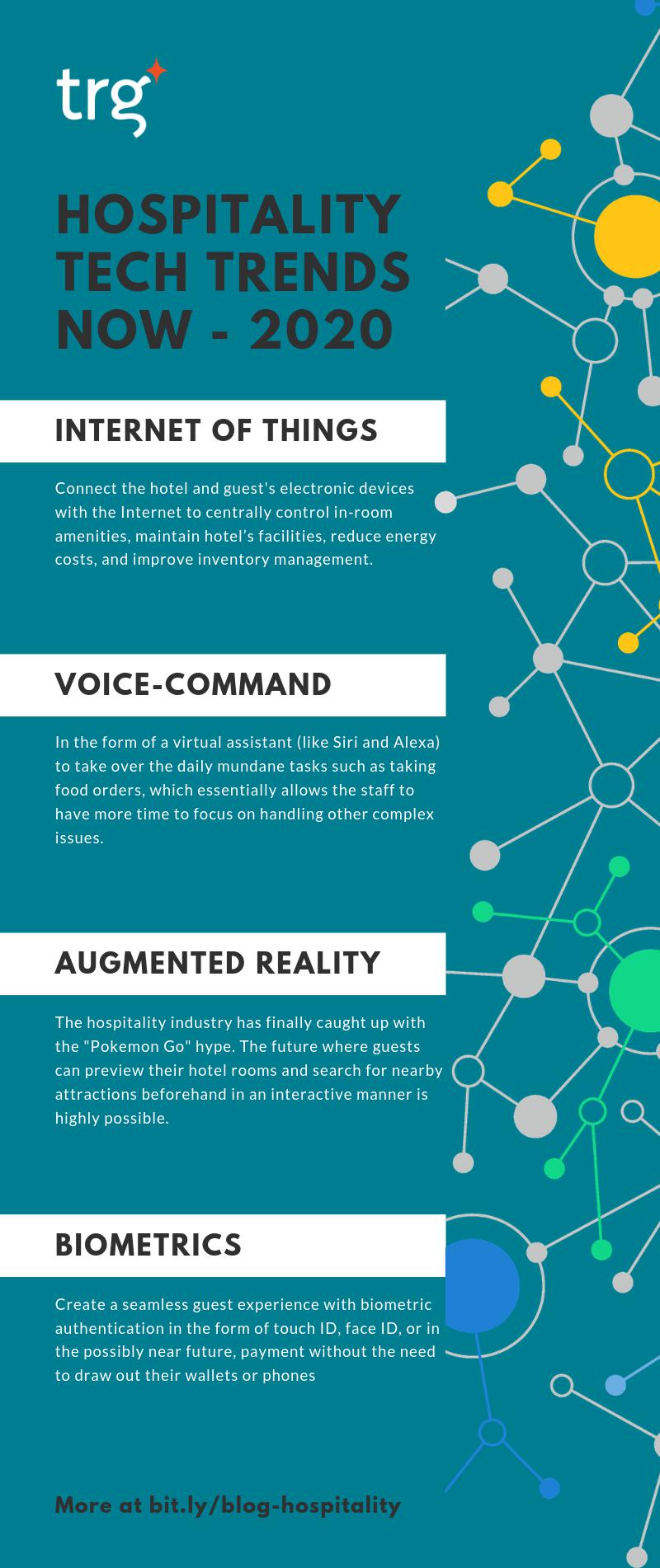

The Undeniable Impact of Technology in Hospitality Industry

“Transformation in Hospitality - Southeast Asia 2019” hosted by TRG International is a 2-day event that aimed at providing hoteliers with an in-depth understanding of the latest emerging technologies as well as the potential impact that these technologies can have on the entire hotel industry.

The event marked the first time ever the participation of leading IT experts from TRG International, Infor, VinaData, HotTab and many more as well as prestigious…

Hotel Technology 2020: Which Trends Will Drive the Changes?

More people travel now than ever. In a study conducted by Amadeus, 83 per cent of respondents strongly agreed or agreed that “People will view travel as a right rather than a luxury and consider it an increasingly important part of their lives.”

This in conjunction with the fact that one-third of the world’s hotel guests today are tech-savvy Millennials who have strong desires for truly unique travel experiences. From now…

The next generation of Hotel technology is not just for the guests

Over the last few years, there has been a significant focus on technologies that can enhance the guest experience. In-room Wi-Fi, mobile check-in, and guest interaction are all aimed at providing a smooth and stress-free experience throughout their stay. Much of the hotel technology investment has been focused in this area. But what about the hotel owners and operators themselves? What advances are available that they can benefit from?

With a…

More Releases for CFOs

CFOs Turn to AR Automation to Combat Rising DSO Challenges

As global businesses continue to face cash flow pressures, Chief Financial Officers (CFOs) are adopting advanced accounts receivable (AR) automation tools to address one of the most persistent challenges in finance: reducing Days Sales Outstanding (DSO). Recent shifts in credit cycles, customer payment behaviors, and increased operational costs have intensified the urgency for CFOs to modernize their receivables management strategies.

According to industry research, companies that rely on manual AR processes…

Invoice Process Automation from IBN Technologies Becomes a Strategic Priority fo …

Nevada companies are adopting invoice process automation to enhance control, reduce manual processing, and improve financial workflow efficiency. With growing invoice volumes and complex vendor structures, automation is helping finance teams handle approvals faster and ensure better audit readiness.

Miami, Florida - 26 June, 2025 - Finance departments are upgrading their operating models to match the pace of modern billing. Supplier invoicing continues to grow more frequently and diverse, placing added…

IBN Technologies' Account Receivable Automation Takes Hold Across Texas as CFOs …

IBN Technologies brings Account Receivable Automation to Texas businesses looking to improve invoicing accuracy, reduce reconciliation delays, and strengthen cash flow. This release explores how automation improves financial visibility, accelerates collections, and integrates smoothly with existing finance systems.

Miami, Florida - 3 June, 2025 - Texas businesses are advancing their finance functions by incorporating innovative solutions into their core systems. The adoption of Accounts Receivable Automation [https://www.ibntech.com/ap-ar-automation/] enables organizations to reduce…

The Hidden Cost of Payment Reconciliation: Why CFOs Are Losing Millions in Manua …

Optimus Fintech launches industry-first report revealing how outdated reconciliation practices are draining profits - and how automation can reverse the trend.

Optimus Fintech, a leading provider of AI-powered payment reconciliation solutions, has unveiled a new industry report titled "The Hidden Cost of Payment Reconciliation." The report reveals a stark reality: enterprises lose millions annually due to manual errors, delayed settlements, and fragmented reconciliation systems - with nearly 40% of finance…

How CFOs are Transforming Finance Through Change Leadership in ERP

As businesses step up their digital transformation processes, CFOs are playing a significant role in ensuring timely enterprise resource planning (ERP) changes.

Unstructured change management processes could prevent organizations from achieving peak efficiencies, thereby deteriorating employee engagement and resulting in expensive operational interruptions. Research just released highlights the importance of CFOs providing ERP direction ( https://businessprocessxperts.com/how-cfos-can-lead-erp-change-for-long-term-success/ ) through active leadership, keeping up with developments, and facilitating two-way communication.

"Implementing an ERP is…

Will Smart Technologies Replace CFOs?

From cloud computing and robotic process automation to analytics, AI, and machine learning, a new class of digital disruptors is transforming the role of finance. Will all the automation and technology that CFOs have at their fingertips ultimately replace the need for a traditional finance chief, or will CFOs be able to harness that technology to improve their bottom lines?

Will smart machines replace smart CFOs?

Probably not. Most analysts agree that technology will play a pivotal role in increasing…