Press release

CFOs Turn to AR Automation to Combat Rising DSO Challenges

As global businesses continue to face cash flow pressures, Chief Financial Officers (CFOs) are adopting advanced accounts receivable (AR) automation tools to address one of the most persistent challenges in finance: reducing Days Sales Outstanding (DSO). Recent shifts in credit cycles, customer payment behaviors, and increased operational costs have intensified the urgency for CFOs to modernize their receivables management strategies.According to industry research, companies that rely on manual AR processes experience 30-40% higher DSO on average compared to those leveraging automation. With mounting evidence linking delayed collections to weakened liquidity positions, CFOs are now seeking AI-driven AR automation platforms that not only streamline collections but also provide actionable insights into customer payment trends.

The Strategic Shift: AR Automation as a CFO Tool

CFOs are no longer viewing AR automation as a back-office utility; instead, it is being positioned as a strategic lever for cash flow optimization. Platforms like Kapittx demonstrate how automation can bring CFO-level visibility into receivables and support critical decision-making.

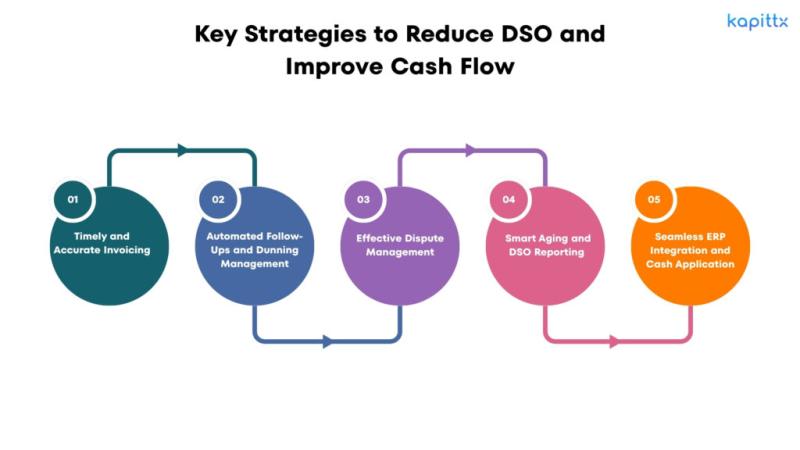

Key strategies CFOs are adopting with AR automation include:

Automated Payment Reminders - Ensuring timely, consistent, and personalized communication with customers to accelerate collections.

Credit Risk Monitoring - Using predictive analytics to assess payment behaviors and adjust credit terms proactively.

Cash Application Automation - Leveraging AI to reconcile payments faster, reducing delays caused by manual processes.

Portfolio Segmentation - Identifying high-risk accounts and prioritizing collections to minimize overdue balances.

Data-Driven Forecasting - Using AR analytics dashboards to predict cash inflows and strengthen working capital planning.

Why DSO Reduction is Critical for CFOs

High DSO has ripple effects across business operations - from restricted reinvestment capacity to increased borrowing needs. In volatile markets, delayed receivables can create significant liquidity risks. By integrating AR automation into their strategy, CFOs are shifting from a reactive stance to proactive credit and collections management.

"Reducing DSO is not simply about getting paid faster," said Kumar Karpe, CEO of Kapittx "It's about building a sustainable cash flow model that supports growth while mitigating risk. AR automation enables this shift by providing transparency, predictability, and efficiency at scale."

The Road Ahead: AR Automation as a CFO Imperative

The future of receivables management lies in AI-powered, predictive, and integrated solutions. For CFOs, the transition from manual to automated AR workflows is becoming less of a choice and more of a necessity to stay competitive in a cash-sensitive economy.

As AR automation adoption grows, finance leaders are expected to measure success not only in terms of reduced DSO but also in improved customer relationships, reduced operational costs, and enhanced financial agility.

For more insights, visit: www.kapittx.com

Bootstart coworking, VCC Vantage 9, Pashan Rd, Baner, Pune

At Kapittx, we champion the digital transformation objectives of CFOs. Our AI-powered, cloud-based platform specializes in invoice-to-cash accounts receivable automation, subscription management, and payment reconciliation. Seamlessly integrated with B2B payments and a sophisticated document management system, Kapittx empowers enterprises to reduce Days Sales Outstanding (DSO) and streamline payment collections.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release CFOs Turn to AR Automation to Combat Rising DSO Challenges here

News-ID: 4175836 • Views: …

More Releases from Kapittx

Can AI and Accounts Receivable Automation Help Reduce DSO?

As businesses face increasing pressure to maintain liquidity and financial stability, reducing Days Sales Outstanding (DSO) has become a top strategic priority for CFOs. The growing adoption of AI-driven Accounts Receivable (AR) automation is emerging as a critical solution to streamline collections, accelerate cash inflows, and enhance working capital efficiency.

According to industry analysts, companies that leverage AI in their receivables processes report an average DSO reduction of 20-30%, compared to…

Five Trends Reshaping Accounts Receivable Automation

As digital transformation accelerates across finance functions, accounts receivable automation is undergoing a significant shift. According to insights from Kapittx, an enterprise-grade AR automation platform, five major trends are expected to define the future of receivables management in 2025 and beyond.

With economic volatility, elongated payment cycles, and a renewed focus on cash flow, businesses are turning to advanced AR tools to enhance predictability and resilience. Kapittx's latest analysis highlights five…

More Releases for CFO

Virtual CFO Services in Mumbai: Why Startups & SMEs Are Scaling Faster | CFO Wor …

Mumbai's startup and SME ecosystem is evolving rapidly, but along with growth comes a new set of financial challenges. From managing cash flow and ensuring compliance to planning budgets and preparing investor-ready reports, many growing businesses find themselves stretched thin. In this changing landscape, Virtual CFO Services in Mumbai are emerging as a powerful solution and CFO Works LLP is at the center of this shift.

Over the past few years,…

Terradepth Welcomes Peter Bardwick as CFO

Image: https://www.getnews.info/wp-content/uploads/2024/11/1732170594.jpg

AUSTIN, Texas - Terradepth, a leading ocean data-as-a-service company, announced the appointment of Peter Bardwick as Chief Financial Officer, effective November 1, 2024. With over three decades of strategic, operational, and capital markets expertise, Peter has raised approximately $11 billion throughout his career and has been instrumental in leading two successful technology IPOs and a major public company turnaround.

Peter's career began on Wall Street with Citicorp and Salomon Brothers.…

New Avenga CFO Mario Wilhelm

Cologne, February 10th, 2021 – Avenga, a specialist for implementing complex digital transformation projects, has recruited Mario Wilhelm as its new CFO. In this role, he is responsible for Finance, Reporting and BI, as well as Legal and Compliance at the international IT service provider, which has more than 2,500 professionals at 19 locations in Europe, Asia, and the USA. CFO Wilhelm reports to Jan Webering, CEO of Avenga. …

Dion CFO Gopala Subramanium named “Fintech CFO of the Year 2019” at Acquisit …

27 May 2019 (UK): Dion Global Solutions today announced that Gopala Subramanium, their Chief Financial Officer, was named the Fintech CFO of the Year 2019 - South Asia award by Acquisition International.

With several years of success to its name, Acquisition International’s Global CFO Excellence Awards celebrate the pioneering work and tireless efforts of the Chief Financial Officers (CFOs) who nurture their company’s financial stability and growth. The awards are…

LIFE SCIENCE CFO STRATEGIC GOVERNANCE FORUM

Financial Life Science Executives to Gather for Finance-Related Boardroom Event

(Chicago, IL) – Financial executives within the life science industry will gather on September 11-12, for Life Science CFO Strategic Governance Forum in San Jose, CA. Hosted by Q1 Productions, this event will feature small group, boardroom discussions focusing on pressing financial challenges within executive leadership.

Confirmed discussion leaders for this year’s event include prominent healthcare management experts from Novo Nordisk, Daiichi…

Enatel Appoints New CFO

Enatel Limited is delighted to announce the appointment of Aaron Gale as Chief Financial Officer. Most recently, Aaron served as CFO for HydroWorks and earlier to that as CFO for General Cable Oceania. He has over 20 years’ experience working in manufacturing, distribution, finance and media both in New Zealand and the United Kingdom. Aaron holds a BCom in Accounting from the University of Otago, qualified as a Chartered Accountant…