Press release

A2iA and Softpro Combine Technologies in Their First Globally Marketed Check Fraud Prevention Solution

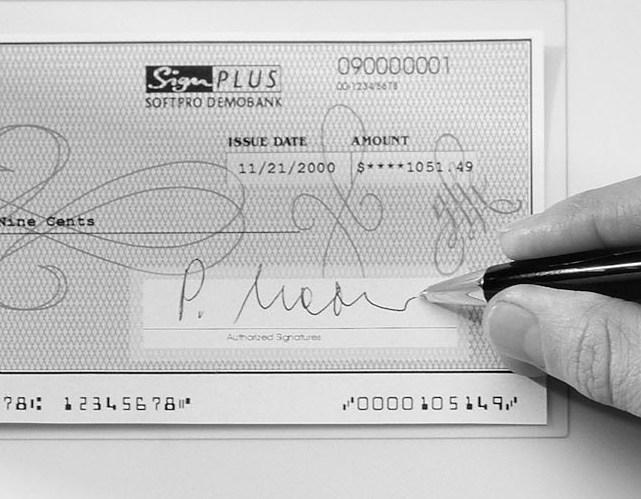

FraudOne/SignPlus Applications Leverage Handwriting Recognition and Signature Verification Tools[NEW YORK / PARIS / BOEBLINGEN] - 2006-09-07: A2iA and Softpro announced today the first collaboration to combat check fraud worldwide. The companies have pioneered a unique solution which will be marketed globally under Softpro’s FraudOne and SignPlus brands. The solution combines proven handwriting recognition, signature verification, and fraud detection technologies to create a holistic check fraud prevention solution for the world’s financial institutions. FraudOne and SignPlus are available in six languages and on five continents: The Americas, Africa, Europe, Asia and Australia.

In a strategic meeting in July, Frank Fuchs, CEO of Softpro, and Jean-Louis Fages, Chairman of the Board and CEO of A2iA, signed an agreement that further intensifies the companies’ already successful partnership by allowing Softpro to market and sell A2iA products. The recently released version 3.9 of Softpro’s FraudOne and SignPlus products will be refreshed to incorporate A2iA CheckReader. The combined offering enhances the range of check processing applications and provides unparalleled fraud prevention capabilities. The alliance also represents a team approach to addressing local market needs in countries that rely heavily on checks such as the United States, Brazil, France, and the UK. As an example, Softpro will be using functionality from A2iA’s CheckReader that has been created specifically for this alliance such as the ability to interpret handwritten dates on Brazilian checks. One of Brazil’s largest banks has already contracted the new solution.

Overview of Strategic Collaboration

The combined solution will derive revenue primarily from North & amp; South America as well as Europe. The solution will also enable the companies to capitalize on

- A strong and proven position in handwriting recognition and signature verification technologies.

- A unique fraud detection and prevention solution for addressing the increasing global threat of check fraud

- World class R&D capabilities from France, Germany and the United States

- Excellent relationships with major Value Added Resellers (VARs), systems integrators and solution providers in the banking and financial services industries and Business Process Outsourcing (BPO).

- A large and diversified customer base in worldwide major banks with installations in twenty countries

For financial institutions worldwide, check processing and clearing is a significant cost factor in the payment process. However, reduction in processing costs leads to higher check fraud risk exposure. Check fraud is consistently rising year-over-year and is expected to continue to rise as fraud perpetration using other payment instruments such as credit cards becomes increasingly difficult.

According to the American Banker’s Association, check fraud accounted for more than $5.5 billion in losses in the United States alone in 2003. This was up from the 2001 losses of $4.3 billion. Similarly in the UK, check fraud attempts increased by 20% between 2003 and 2004 to a total of £665 million in potential fraud losses. This indicates that the use of checks as a vehicle for fraudulent transactions is a global phenomena.

Up until now, the challenge to fighting this fraud has been to reduce check processing costs while increasing, rather than decreasing, protection against fraud losses. The new FraudOne/SignPlus solution will result in substantial savings for banks’ back-office check processing centers by automating tedious and error-prone manual verification while significantly improving the detection of fraudulent items. This solution will enable banks to take necessary precautions to secure the paper-based payment process and prevent losses from check fraud in a truly cost-effective manner.

Softpro has a proven track record with its systems for the validation of handwritten signatures and fraud prevention in payment processes. The company provides the FraudOne/SignPlus suite of products, which were initially conceived in cooperation with a consortium of the largest U.S. banks. The solution is considered by many of the US Tier 1 banks to be a “best practice industry initiative” to combat check fraud and has been successfully deployed at many of the world’s largest financial institutions since its inception.

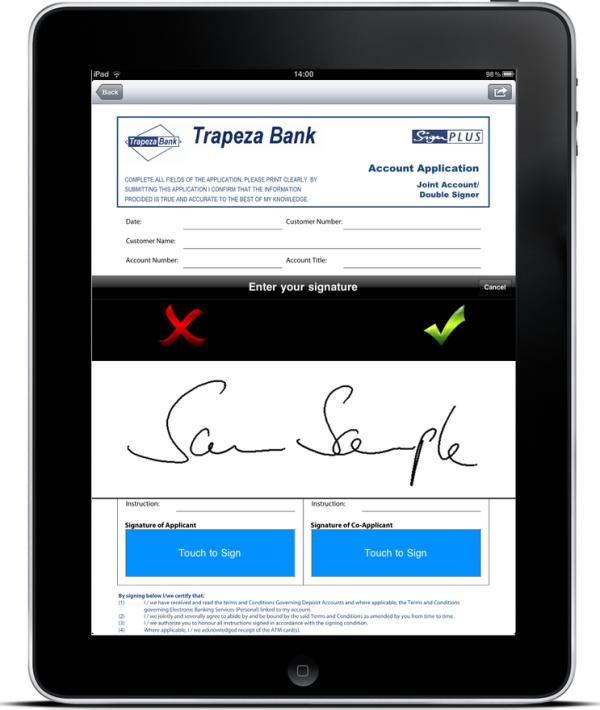

A2iA CheckReader automatically reads cursive handwriting, handprint and machine print from key check fields – including courtesy and legal amounts, address block, payee name, and date – and converts the information into computer-usable, actionable data. With the inclusion of A2iA CheckReader in FraudOne and SignPlus, banks will not only be able to automatically verify the signatures on check images using Softpro’s award-winning technology, but also be able to analyze the data contained within key check fields. The image analysis is complemented by Softpro’s unique rules-based risk identification module, Combined Risk Score (CRS), which allows the incorporation of the bank’s internal fraud rules to provide unprecedented accuracy levels in suspect check identification.

"We are confident that banks using FraudOne and SignPlus will achieve time and labor savings in their back-office check processing centers, while also ensuring that the risk of clearing a fraudulent check is alleviated," said Frank Fuchs. "A2iA’s proven recognition engines complement Softpro’s automatic signature verification tools perfectly, driving powerful applications that will fight check fraud on a global level."

"We are excited about the new product offerings our strengthened partnership with Softpro has made possible," said Jean-Louis Fages. "A2iA CheckReader integrated into Softpro applications enhances banks’ ability to provide crucial information about check transactions, more quickly and more accurately. This will minimize risks while improving operational efficiency. The combination of our technologies delivers powerful built-in safeguards that give users the timely information they need to make sound decisions and reduce risks – wherever check processing is performed."

Recommended links for additional information

>> American Bankers Association (ABA): Deposit Account Fraud Survey Report (released November 2004)

http://www.aba.com/Surveys+and+Statistics/SS_Depositfraud.htm

>> British Bankers' Association (BBA): Fraud Managers Reference Guide (released in March 2005)

http://www.bba.org.uk/bba/jsp/polopoly.jsp?d=145&a=5409

SOFTPRO GmbH

Joerg-M. Lenz

Manager PR

Wilhelmstrasse 34

71034 Boeblingen

Germany

Phone: +49 7031 6606 0

Fax: +49 7031 6606 66

http://www.softpro.de

mailto:jle@softpro.de

A2iA S.A.

40 bis rue Fabert

75007 Paris

France

Phone +33 1 44 42 00 80

Fax +33 1 44 42 00 81

Venceslas Cartier

EMEA Marketing and Communication Director

v.cartier@a2ia.com

Jean-Marc Besnier

EMEA Sales Director

jmb@a2ia.com

Media Contact

Christine Duchêne

H&B Communication

c.duchene@hbcommunication.fr

Phone +33 1 58 18 32 56

About SOFTPRO

The SOFTPRO group is headquartered in Boeblingen, Germany and has local subsidiaries for North America (Wilmington, Delaware), the United Kingdom (near London) and Asia-Pacific (Singapore). The group currently employs an international staff of over 60.

SOFTPRO is the leading vendor of systems for the verification of handwritten signatures, worldwide. The company’s portfolio contains solutions for authentic processes and documents as well as for fraud prevention in paper based payment transactions. SOFTPRO operates in two divisions:

Biometric Division: Securing PC and network access as well as electronic documents and transactions through handwritten signatures. For this purpose static and dynamic (biometric) characteristics of signatures are extracted and evaluated.

Fraud Prevention Solutions: Systems for Fraud Detection and Prevention and Signature Verification for banks in paper based payment transactions.

More than 200 companies are using SOFTPRO’s software including American Express, ABN Amro, Bank of America, Barclays, Citigroup, Discover Financial, HypoVereinsbank, Ingolstadt Hospital, JPMorgan Chase, Lloyds TSB, Saudi Chamber of Commerce, SEB, Standard Bank of South Africa and Wachovia.

Since 2002, the offer to secure electronic documents with handwritten signatures extended the customer portfolio of SOFTPRO to other industries such as banking and insurance, health/pharma, retail, government, automotive and logistics.

SOFTPRO's shareholders are GE Capital (since 1998), AdCapital (since 2001) founders and management.

SOFTPRO's partners include: A2iA, BancTec, Beta Systems (Kleindienst), Carreker, DISOFT Pro, Fujitsu Siemens Computers / Fujitsu, Gijima AST, House of Development, HP, IBM, Interlink, Lenovo, Microsoft, Mitek, Motion Computing, NCR, Toshiba, UNISYS and Wacom as well as APP Informatik Davos.

About A2iA

A2iA (Artificial Intelligence & Image Analysis), founded in 1991, headquartered in New York and Paris, is known as the worldwide leading developer of Intelligent Word Recognition (IWR), Classification & Data Extraction (IDR) technologies for extracting information from natural freeform and cursive handwriting on paper documents.

The company’s technology has been helping paper-intensive industries reduce data entry costs and improve business process automation for over 15 years. A2iA’s recognition engines harmonize their OCR, ICR, IWR and IDR technologies with their image analysis, artificial intelligence and neural network systems to enhance solutions from the world’s leading systems integrators and other independent software vendors.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A2iA and Softpro Combine Technologies in Their First Globally Marketed Check Fraud Prevention Solution here

News-ID: 11079 • Views: …

More Releases from SOFTPRO

CeBIT 2014: Softpro Partner Olivetti shares many Best Practice Cases for E-Signi …

Olivetti is demonstrating its solution portfolio in the E-Signing booth area in hall 3 at the stands of its partners Wacom (E29) and Softpro (D30). The document management specialists from Italy will be sharing their expertise based on many successful E-Signing Projects completed in recent months.

Two years ago Olivetti received broad attention at CeBIT when showing its Olipad Graphos in the Softpro booth. The Olipad Graphos was the world's first…

CeBIT 2014: Samsung presents Softpro Signature Solutions

During CeBIT 2014 the Signature Professionals of Softpro are demonstrating trustworthy signing on tablets and smartphones with appropriate apps like SignDoc Mobile and Sign2Phone at the main booth of Samsung.

The signature experts were invited by the world's largest provider of mobile devices to display their solutions in the "Finance" section of the stand in Hall 2 (B30). A dedicated focus will be the consultation of Samsung's business visitors about methods…

Cintas Deploys Paperless Delivery Enabled by SOFTPRO E-signatures

SignDoc Software Enables Secure Signing of Electronic Forms on a tablet computer with Adobe Reader and LiveCycle ES

SOFTPRO today announced that Cintas Corporation, the leading supplier of uniform services, has deployed an automated electronic process for capturing customer signatures remotely. The environmentally friendly solution is enabled by SOFTPRO’s SignDoc software which captures a customer’s electronic signature on a tablet PC and securely binds it to the electronic PDF form via…

iPads Business Value Increases through E-Signing

Opportunities for Apple’s iPad and other tablets in the business world are becoming more and more versatile. Until recently, tablets were mostly used for showcasing products, but they are capable of more. For example, it is now possible to display and fill out electronic documents on tablets. At the DMS EXPO in Stuttgart from the September 20-22, SOFPTRO will introduce the building block that completes the process – a robust…

More Releases for A2iA

Global Artificial Intelligence in Medical Coding Automation Market 2021 Top Grow …

The Global Artificial Intelligence in Medical Coding Automation Market Report recently published by QY Reports is a professional and in-depth study on the current state of the industry. Different exploratory techniques such as, qualitative and quantitative analysis have been used to give data accurately. For better understanding of the customers, it uses effective graphical presentation techniques such as graphs, charts, tables as well as pictures. The report is studied with…

Skyrocketing growth in Artificial Intelligence in Medical Coding Automation Mark …

Medical billing is an integral component of healthcare. The Artificial Intelligence in Medical Coding Automation Market alone is projected to reach $+14 billion by 2027.

Medical billing: AI has the capacity to automatically conduct audits, self-adjusting known values to the audit results. Artificial intelligence (AI) has worked its way into many different industries, as machine learning technologies become more advanced. The ability to analyze large amounts of data and then make…

Netherlands Forensic Institute selects SOFTPRO as a partner to advance Forensic …

[THE HAGUE / BOEBLINGEN] Softpro, the world's leading vendor of systems for fraud prevention solutions, capture and verification of handwritten signatures, and the Netherlands Forensic Institute (NFI, www.forensicinstitute.nl), a departmental agency of the Dutch Ministry of Justice announce to partner in the research and development of innovative tools focusing on the science of verifying signatures.

In the future the NFI might leverage Softpro's technology to aid forensic experts in detecting forgeries…

SOFTPRO: Ralph Maute and Ulrich Pantow define Product Strategy

Softpro GmbH, the world\'s leading vendor of systems for capture and verification of handwritten signatures, today announced the appointment of Ulrich Pantow as product manager for the Fraud Prevention Solutions portfolio. Mr. Pantow replaces Alain Sarraf who has taken over the position as Chief Technology Officer of the Softpro Group. Ralph Maute continues to manage Softpro\'s e-signing product suite.

Maute and Pantow are now defining the company\'s product strategy and…

RSA Conference 2008: Softpro presents Next Generation Signature Tablet

Signature Verification and Fraud Detection Detection Solution Specialist Softpro presents its Next Generation Signature Tablet at the RSA Conference in San Francisco. The company is exhibiting together with 13 other specialist in IT security in the German pavilion under the umbrella of \"IT security made in Germany\". The Signature experts will showcase their innovation in booth 1332 along with their newly released and highly innovative end-to-end electronic account opening application.…

SOFTPRO: Alain Sarraf named new CTO

Softpro GmbH, the leading the worldwide leading vendor of systems for capture and verification of handwritten signatures, today announced the appointment of Alain Sarraf, 40, as Chief Technical Officer (CTO). In his new role he will be responsible for the company's product and business strategy as well as the entire technology areas such as development, professional services, and research.

Sarraf joined Softpro in 2003. In his previous role with the…