Press release

PAX Global Technology Announces 2017 Annual Results

Overseas revenues surge more than 57.1%Record high shipment volume of over 6.4 million terminals worldwide

(Hong Kong, PRC, 7th March 2018) PAX Global Technology Limited (“PAX” or the “Company” or the “Group”, HKSE stock code: 00327.HK), one of the world’s leading providers of electronic payment terminal (“E-Payment Terminals”) solutions and related services, is pleased to announce its annual results for the year ended 31st December 2017.

During the year, the Group’s revenue increased by 23.2% to HK$3,591.1 million. This surge was mainly attributable to a sales increase of 57.1% in international markets. All regional overseas business units recorded growth, especially in the LACIS (Latin America & Commonwealth of Independent States) and USCA (United States & Canada) regions. Overall, revenues from international markets accounted for 72% of the Group’s total revenue. The number of PAX’s E-payment Terminals shipped reached an all-time record high in 2017, with over 6.4 million units sold worldwide.

Basic earnings per share was HK$36.7 cents (2016: HK$53.9 cents). The Board of Directors of the Company has recommended to declare a final dividend of HK$0.04 per ordinary share. During the year, the Group maintained a strong financial position, with cash and cash equivalents and short-term bank deposits of HK$2,165.2 million and net current assets of HK$3,521.8 million.

Strong growth momentum internationally

In 2017, overseas markets achieved outstanding performance, with revenues growing from HK$1,656.7 million to HK$2,602.5 million, representing an increase of 57.1%.

LACIS

In 2017, PAX continued to maintain its leading position in Brazil’s mobile payment terminals (“mPOS”) market. Since the successful launch of traditional payment terminals in 2016, shipment volumes in the LACIS region grew rapidly, contributing to significant sales growth and positioning PAX as one of the major E-Payment Terminals providers in the region. Sales in other parts of Latin America grew rapidly, with demand for PAX payment solutions continuing to rise in Argentina, driven by the government’s launch of cashless payment initiatives. In the CIS countries where the high quality of PAX products is well recognized by major acquiring banks, stronger demand for payment terminals in Russia is expected to be driven by preparation for 2018 World Cup.

EMEA

PAX continued to achieve solid results in the EMEA region, where more acquiring banks, payment service providers and retail groups have chosen to use PAX’s innovative solutions. In Europe, PAX achieved significant sales growth in Germany, Poland and Belgium. PAX’s market share in the Middle East region grew further, as more acquiring banks in the Gulf Cooperation Council (GCC) region transition to PAX payment solutions. In Africa, the Group began market development in the mostly French speaking West African countries, where E-payment Terminals solutions are comparatively under-developed.

APAC

In most of the Asia Pacific region, PAX continues to be a leading market player. The Group established subsidiaries in Japan and India to focus on opportunities arising from the ongoing preparation of the Tokyo Olympics, the EMV (“Europay, MasterCard and Visa”) migration in Japan, and the promotion of a cashless society by the Indian government. In November 2017, PAX further penetrated into Korea’s payment market by acquiring Kwang Woo Information & Communication Co. Ltd (“Kwang Woo”), a local payment terminals company. These strategic measures are expected to further drive sales in APAC and inject momentum into the Group’s future revenue growth.

USCA

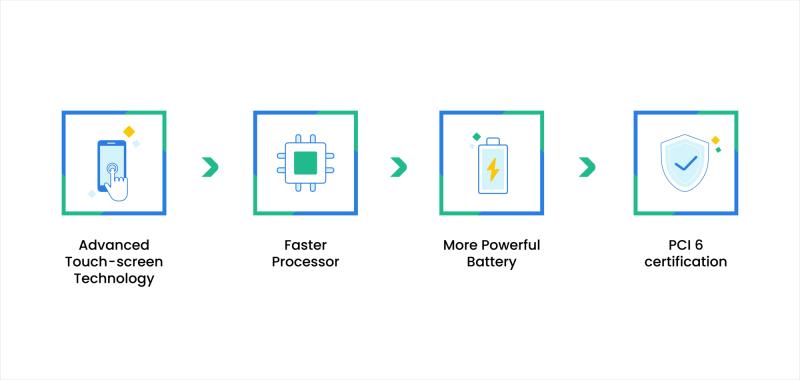

PAX made excellent progress in the US market. In addition to working with several large new customers to expand their businesses, the E-Series was successfully launched at the end of 2017, a new generation of smart electronic cash registers, which have been popular among customers.

CHINA

During the year, revenue in China declined by 21.4% to HK$988.6 million (2016: HK$1,258.2 million) and represented 28% of the Group’s total revenue. This drop was mainly due to a changing product mix and ongoing local market price competition. The Chinese government continued to implement payment related regulations and standards, which are expected to bring significant benefits to the payment ecosystem by enhancing the security of E-Payment Terminals and ensuring certain product quality levels. With the growing popularity of QR code and other new forms of mobile payment, PAX is well-positioned and provides innovative solutions that fully support those payment methods.

Merger & acquisition and other developments

With the objective of further improving the Group’s business structure and enhancing the diversity of its portfolio of payment-related products and services, PAX remained proactive in seeking quality assets and identifying distinct M&A opportunities. In 2017 and 2018, the Group completed several mergers and acquisitions and other developments:

1) Expansion of the Group’s sales channels into new markets

• The Group acquired a 51% equity stake in a Korean company, Kwang Woo, for an aggregate consideration of US$4.08 million in November 2017. Kwang Woo is principally engaged in the manufacturing and sales of E-Payment Terminals in the Korean market.

• The Group established subsidiaries in Japan and India in 2017 and 2018, with the aim of strengthening local sales and preparing for future opportunities in the local payment markets.

2) Expansion of diversified solutions and services

• The Group acquired and subscribed for an aggregate of a 60% equity stake in an Italian company, CSC Italia S.r.l. (“CSC Italia”), for an aggregate consideration of EUR3.0 million in April 2017. CSC Italia is one of the Italy’s leading installation and service support companies for E-payment Terminals, personal computers, cash handling equipment and automatic teller machines.

• The Group subscribed for a 20% equity stake in a Swedish company, Onslip AB (“Onslip”), for a consideration of EUR2.1 million in April 2017. Onslip is principally engaged in the development and marketing of a software-as-a-service platform for managing payments and other value-added applications, deployed on merchant point-of-sale solutions globally.

• The Group subscribed for a 20% equity stake in a Chinese company Shanghai Coshine Software Co., Ltd. (“Shanghai Coshine”), for a consideration of RMB17.0 million. Shanghai Coshine is an advanced systems and services provider in payment infrastructure, electronic business software solutions and outsourcing operations.

3) Exploration of innovative technologies

• In September 2017, the Group invested in a fund based in Beijing, with the investment totaling RMB51.0 million for the year. The objective is to further strengthen PAX’s competitive and technological edge in the rapidly changing fintech environment in China. This fund invests primarily in numbers of outstanding emerging technology projects and startups.

4) Enhancement of the Group’s operational efficiency

• Keeping up with the growth of our business and human resources, the Group, through its subsidiary, acquired the land use right of a plot at Pinghu, Longgang District, Shenzhen, Guangdong Province with a total planning construction area of more than 25,000 square meters, for a term of 20 years for a consideration of RMB73 million, pursuant to an agreement entered into with the Urban Planning, Land and Resources Commission of Shenzhen Municipality (Longgang Authority) in 2017. The land will be principally used as the Group’s headquarters in China.

Mr. Jack LU, Chief Executive Officer of PAX, commented:

“PAX has actively pursued the growth of its international footprint, where the PAX brand, technology, product quality and a customer-focused attitude have all contributed to the Group’s excellent reputation in many international markets.

During the year, PAX recorded impressive growth in the United States and Brazil, which helped drive a substantial increase in overseas revenue. The ongoing evolution and development of cashless societies and omni channel payment requirements around the world ensures that the future of our E-Payment Terminals industry looks bright. More policies are being introduced in fast developing payment markets, such as China and India, which are helping to standardize and regulate local payment markets, bringing more opportunities to E-Payment Terminals solution providers. In view of the emergence of more new and innovative payment methods around the world, the Group will continue to strengthen its R&D efforts in our Android platforms and related “Smart” terminals solutions, as these are becoming key future payment trends.

PAX also completed a number of M&A projects in 2017, further enriching our business spectrum, expanding our international footprint, enhancing the diversity of our hardware and payment software related products and services and enhancing the Group’s long-term benefits. Looking ahead, PAX will continue to expand the payment value chain and explore new innovative technologies to deliver better value to customers and shareholders.”

End

PAX is one of the worlds largest suppliers of secure electronic point of sale terminal solutions

PAX Technology Limited

Shenzhen

China

www.paxglobatechnology.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PAX Global Technology Announces 2017 Annual Results here

News-ID: 973089 • Views: …

More Releases from PAX Technology Limited

PAX Technology unveils seven new Android payment devices at EuroShop

PAX Technology, the world's leading payment terminal solutions provider, will further broaden its Android portfolio by launching at least seven new Android products this March.

With the increasing demand for contactless payments and the rise of digital transactions, PAX recognizes the importance of utilizing cutting-edge technology to meet the evolving needs of payment service providers and the merchants they serve. The broadening of the company's Android offering reflects PAX Technology's commitment…

PAX Technology 2019 Interim Financial Results

PAX Global Technology Limited, one of the world’s leading providers of electronic payment terminal solutions and related services, published the unaudited interim financial results for the six months ended 30th June 2019 (the “Period”).

The Group achieved impressive growth, yet again, during the interim period, as more Acquiring Banks and Payment Service Providers (PSPs) around the world use PAX Technology solutions. The Group's overall revenue increased by 26.2% to HK$ 2,366.3…

Free PAX Terminals for Scandinavian Merchants through GoAppified’s iGO Initiat …

GoAppified, a payment service provider that specializes in digital and mobile payment solutions, announced the launch of its iGO campaign, offering free of charge PAX S920 mobile terminals packaged with very competitive acquiring rates, for small and mid-sized merchants in the Nordic countries.

Merchants can choose from the iGOPay, iGOPlus or iGOPro packages, where they deploy a state-of-the-art PAX payment terminal, offering the latest PCI and NFC Contactless certifications, for a…

More Releases for Group

Specialty Insurance Market 2023 | Futuristic Technology- State Farm Group, Progr …

The Specialty Insurance market research report delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. The Specialty Insurance report also incorporates the current and future global market outlook in the emerging and developed markets. Moreover, the report also investigates regions/countries expected to witness the fastest growth rates during the forecast period.

The Specialty Insurance research report also provides insights of different regions that are…

Transit Packaging Market Top Key Players - STI Group, Crown Cork Group, GWP Grou …

Freight transport in transit receives a wide range of vibrational intensities over a period of time. Based on the origin, destination and network of carriers, ocean-going vessels with aircraft will vibrate with the proper amplitude. Cargo handling and sorting operations contribute to lower levels of compressive force than movement in transit. The only exception to this is when the cargo moves in transit. This allows heavier packages to slip into…

Global Baijiu Market 2019-2024 - Kweichow Moutai Group, Wuliangye, Yanghe Brewer …

Global Baijiu Market 2019-2024:

“Global Baijiu Market” report focuses on the comprehensive study of the market involving technological developments, future plans, supply, sales revenue, production, dimensions, overview, manufacturers, growth rate, price, deals, and revenue for the detailed analysis of the Baijiu Market. Moreover, report of the Baijiu efficiently offers the needed characteristics of the global Baijiu market for the individuals and people looking for the business for investments, mergers & acquisitions…

White Spirits Market 2019 Wuliangye Kweichow Moutai Group Yanghe Brewery Daohuax …

As per global White Spirits market report for the period of 2018 to 2023, the White Spirits market is likely to reach an estimate of USD xx million at the end of the 2023 rising at the rate of CAGR xx% throughout the forecast period of 2019 to 2024. The global White Spirits market report covers an exhaustive understanding of the White Spirits that encompasses various important factors like the…

Automotive Metal Market ’size 2019 by Top Key Players: ArcelorMittal, China Ba …

The ‘Automotive Metal Market’ research report assembled by Market Study Report, LLC, provides a succinct analysis on the recent market trends. In addition, the report offers a thorough abstract on the statistics, market estimates and revenue forecasts, which further highlights its position in the industry, in tandem with the growth strategies adopted by leading industry players.

This report focuses on the Automotive Metal in global market, especially in North America, Europe…

Steel Ingot Market Outlook and Forecasts 2018 to 2025 and Key Players: ArcelorMi …

The “Global Steel Ingot Analysis to 2025” is a specialized and in-depth study of the Steel Ingot industry with a focus on the global market trend. The report aims to provide an overview of global Steel Ingot with detailed market segmentation by component, type, application and geography. The global Steel Ingot market is expected to witness high growth during the forecast period. The report provides key statistics on the market…