Press release

Challenging times for clothing and footwear retailers in Poland

2009 has been a very difficult year for clothing and footwear retailers. With falling sales and rising operational costs, most companies are facing financial difficulties. As a result, many are launching restructuring programmes while actively looking for an investor which could help them to survive.According to estimates included in PMR’s latest report, “Clothing and footwear retail market in Poland 2009. Market analysis and development forecast for 2009–2011,” the value of the clothing and footwear market will shrink by more than 6% to PLN 25.5bn in 2009, in the wake of declining demand and falling spending on clothing and footwear as a result of rising unemployment, slower growth of salaries and poorer consumer confidence caused by the financial and economic crisis in Poland and worldwide.

PMR expects that in the subsequent years, the clothing and footwear market should return to the upward trend—for 2010 sales growth is forecast at 5%. “With the more optimistic situation in the economy, the overall consumer climate will improve as well and consumers will be again more willing to spend on clothing and footwear. This view was also shared by retailers who participated in research carried out by PMR for the purpose of the report: two-thirds of respondents expect improvement in the market situation in 2010,” according to Patrycja Nalepa, Retail Analyst at PMR.

Threats and opportunities

“2009 has been a very difficult year for clothing and footwear retailers,” states Patrycja Nalepa of PMR. “The more challenging financial standing of consumers has forced them to limit their clothing and shoe shopping. The retailers’ situation is made worse still by rising costs which have inched up as a consequence of the low zloty exchange rate—EUR-denominated rates for the lease of space in shopping centres as well as the costs of importing goods are both upward bound. As a consequence, most companies are experiencing financial difficulties, and many are looking for an investor who would make it possible for them to continue to operate.

On the other hand, the crisis may create an opportunity for one-of-a-kind conditions enabling the takeover of companies which have fallen on hard times. In addition, it is now easier to find a good location and to enter a lease on good terms and conditions, as shopping centres are now looking for new tenants to replace the liquidated shops. The crisis will be beneficial also for those companies that offer inexpensive clothing and footwear as their goods are now in highest demand.”

For the purposes of this report, PMR carried out a survey amongst operators of the 157 clothing and footwear chains operating in Poland. One of the questions concerned the assessment of current threats to their development.

The companies were to assess the proposed current threats, using a scale on which ‘0’ signifies that the given obstacle does not constitute a threat to the company’s development and ‘5’ signifies the maximum impediment to the development of the respondent’s company.

It appears that increased rents at shopping centres, a direct result of the higher euro/zloty exchange rate, currently constitute the greatest threat to clothing and footwear retailers. The second most serious threat to companies is represented by increases in the prices of imported goods and materials, which are associated with the weak zloty/dollar exchange rate. The third most important threat, as perceived by the companies surveyed, is reduced demand, resulting from deterioration in the financial standing of households.

Countering the crisis

“In order to survive and cushion the impact of the economic slowdown as much as possible, companies launch restructuring programmes—reduce operating costs, abandon the least profitable concepts and limit or suspend investment projects both in Poland and abroad. This is the time of firms’ strategy review and an opportunity to strengthen the position for the best-managed companies,” Patrycja Nalepa added.

When asked about steps taken to respond to the difficult market situation, most companies said that they had cut marketing and advertising spending (73%). The second most common action taken to limit the effects of the crisis is the introduction of discounts and more frequent discount sales (56%). In addition, more than half of the companies are closing the least profitable stores, whereas fewer than half are reining in plans for new establishments. Other actions currently being taken by clothing and footwear retailers include: workforce reductions, the development of a cheaper range, with simpler and more conservative garments, and a focus on the development of a franchise chain.

This press release is based on information contained in the latest PMR report entitled “Clothing and footwear retail market in Poland 2009. Market analysis and development forecast for 2009–2011.”

For more information on the report please contact:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrcorporate.com

About PMR

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). With over 13 years of experience, highly skilled international staff and coverage of over 20 countries, PMR is one of the largest companies of its type in the region.

PMR

ul. Supniewskiego 9, 31-527 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Challenging times for clothing and footwear retailers in Poland here

News-ID: 93418 • Views: …

More Releases from PMR Publications

Russian retail market recovered after the economic slowdown

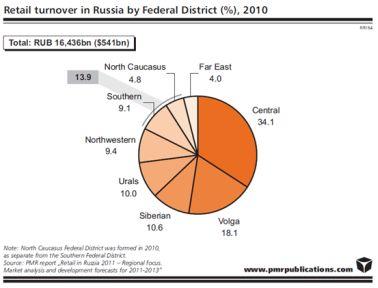

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Poland

Poland Agriculture Market, Poland Agriculture Industry, Agriculture Livestock Ma …

Poland is a significant European and global producer of numerous agricultural products. The agricultural land market in country is divided in two parts: privately owned farms and land owned farms by the State Treasury. Privately owned farm is an enterprise to cultivate various agricultural products under the control of one or more investor. Poland is among the world's primary producers of potatoes, rye, and apples, as well as pork and…

MAUSER Poland Celebrates 5th Anniversary

Bruehl/Germany, June 27, 2017

MAUSER Group, a worldwide leading company in industrial packaging, celebrates the 5th anniversary of its factory in Gliwice, Poland. Ideally located in the industrial heartland of Upper Silesia, and operated by a strong local management team, the plant offers high-quality industrial packaging solutions and services.

MAUSER Poland serves customers with a comprehensive product range of Composite Intermediate Bulk Containers (CIBCs) and plastic tight-head drums. In line with…

Agrochemicals Market in Poland

ReportsWorldwide has announced the addition of a new report title Poland: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Poland: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

A+ ratings on Poland

Jelenia Gora/Poland, 20.09.2011 - In August 2011 two rating agencies i.e. Standard & Poor's and Moody's Investors Service affirmed their A+ rating on Poland with a stable outlook. Both agencies noted that the Polish economy is competitive and increasingly diversified. Moody's evaluated Poland as relatively well placed to withstand global turmoil with its relatively resilient economy. Both agencies stressed that the Polish economy continued to expand in 2009, in contrast…

IT market in Poland

IT providers in Poland are starting the post-crisis period in actually quite good moods and are already beginning to predict what solutions will be most sought after by their customers during prosperity.

However last year hardware distributors recorded significant reduction in the number of orders placed, especially by business customers, software and IT services providers performed far better. A majority of them had similar sales as in previous periods, while some…

VoIP in Poland

At the end of 2008 the Polish VoIP telephony market was worth PLN 440m, with CaTV operators having generated the largest share of revenue in the segment. In recent years also fixed-line operators have included VoIP services into their offer.

According to research and consulting company PMR Polish VoIP market continues to represent a small share of the fixed-line telecommunications market. In 2008 it accounted for approximately five percent of the…