Press release

Russian retail market recovered after the economic slowdown

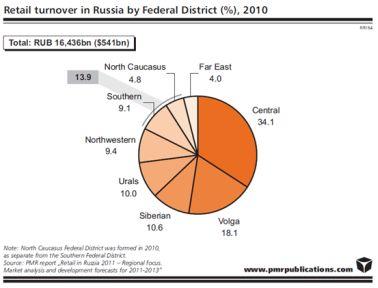

Retail markets in all Russian Federal Districts increased in 2010 by total $80bnIn 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique nature and local characteristics. Some companies went bankrupt, the majority had to focus on efficiency rather than dynamic expansion, still, the most prominent of them kept their positions.

After years of dynamic development, Russian retail market experienced a sharp drop in the growth rates, from 28% in 2008 to less than 5% in 2009. In 2010, the retail market in Russia began to reveal signs of recovery after the financial crisis and grew by nearly 13% y-o-y, reaching RUB 16.4tr ($541bn). According to the latest PMR report, each Federal District (Central, Volga, Southern, Siberian, Urals, Northwestern and Far East) enjoyed an increase in the retail sales, of at least 8% reported by the Urals. However, the growth in real terms (4.4%) reveals that last year retail sales were mainly driven by the increase in prices.

Central Federal District again sets the tone for the Russian retail

The retail industry in Russia varies significantly among the Federal Districts both in terms of value and the character of development. Being the smallest and the most populous region of Russia, the Central Federal District remains the largest retail market in the country, accounting for 34% of country sales in 2010. The Far East traditionally had the lowest share of retail sales among the Federal Districts in Russia. At the same time, the Far East is the largest District in terms of area with the population that comprises only 6% of Russians.

The variations in the retail market development between the regions result from the number of inhabitants, population density, level of urbanisation, as well as average monthly income and expenditures, existing competition and other regional characteristics.

The Central Federal District boasts the lowest unemployment rate (4.4% for the first nine months of 2010), the highest average monthly income per capita ($763) as well as expenditures on goods and services ($529). It is the second urbanised region, with more than 300 cities and the highest population density. It also leads by retail sales per person ($4,970).

At the opposite end of the scale there are the newly formed Northern Caucasus Federal District – with 15.9% of the unemployed, monthly income reaching only $410 and expenditures of $308 – as well as the Siberian Federal District, where the level of spending hardly exceeds $300 and retail sales per capita are the lowest among all the districts ($2,926).

Southern catches up, Central regains its significance

Considering the pace of retail development in 2010, the Southern Federal District (including the Northern Caucasus) demonstrated the most dynamic sales growth (17%), whereas the Urals experienced the weakest increase in Russia (8%). The Siberian Federal District recovered, after negative development recorded in 2009, and reached 9% growth rate.

The Central Federal District grew by 14%, which also exceeds the country’s average. After the years when the District has been developing at the lower pace than the other ones and as a result has lost its share in the total retail turnover of the country, the financial crisis stopped this trend. Over the last two years, the retail sales in the District have grown stronger compared to total Russia. The majority of the largest retailers in Russia originate from Moscow, which gives the Central Federal District the special status of the region accommodating the leading domestic operators as well as foreign retailers establishing their presence in Russia (as they have tended to start their operations from the country’s capital).

In dollars, retail market in Russia gained 80bn in 2010, of which 60bn excluding an effect of exchange rates. The majority, i.e. more than one-third, was worked out in the Central Federal District. The Southern and Volga Federal Districts contributed to the Russian growth evenly. Owing to these three districts, the Russian retail market gained nearly $57bn in 2010.

Winners and losers

Despite certain recovery of the retail market of Russia, in 2010 some international retailers ceased their operations in the country (i.e. Carrefour). In addition, several national retail operators went bankrupt in 2010, for example, the Mir consumer electronics chain. As PMR research shows, the crisis forced most retail operators to focus on the efficiency of their business activity and to cease expansion. Another result of the financial crisis was a change in consumer behaviour, which led, among others, to increased interest in less expensive goods and, as result, a significant growth of popularity of private labels.

The major victims of the financial crisis were the local retail operators, while the leading national players tend to retain their positions on the market on the threshold of increasing competition from foreign retailers. Thus, for example, local grocery retail chains which went bankrupt include Smartkauff in the Volga, V dvukh shagakh in the south of Russia, Samokhval in the Central, Alpi in the Siberian, Nakhodka in the Northwestern and Slavyansky in the Urals Federal District. As for DIY, in the Northwestern Federal District, the Iskrasoft and the Santa Haus chains went bankrupt, and some retailers in other districts had to reduce their storecount. However, in general, local DIY retailers managed to withstand the financial crisis.

The level of activity on the part of foreign retailers on the Russian retail market varies and depends on the retail sector, although they are widely represented with regard to groceries and DIY retailing. Nevertheless, still many prominent players successfully operate locally in those segments.

The expectations of local retail operators regarding future development after the financial crisis vary considerably depending on the retail sector. Thus, in grocery retailing the financial crisis has stimulated market consolidation. One of the biggest deals in 2010 was the acquisition of the Kopeyka chain by the market leader, X5 Retail Group. In addition, the segment witnessed many other takeovers across the country. On the other hand, in the mobile phones retailing, local players became even more optimistic, and got the opportunity for further geographical expansion, when such giants as Dixis and Tsifrograd went bankrupt. Generally, according to PMR report, the retailers remain optimistic regarding the future development of the market.

PMR www.pmrcorporate.com is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR's key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.

PMR Publications

ul. Dekerta 24, 30-703 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

Contact Person: Anna Rojek, marketing@pmrcorporate.com

www.pmrpublications.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Russian retail market recovered after the economic slowdown here

News-ID: 170073 • Views: …

More Releases from PMR Publications

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

Polish Private Label Market Grows In Crisis

The value of the Polish private label market jumped by 29% in 2009, according to estimates presented in “Private label in Poland 2010”, a new report from PMR. The high rate of market growth was a consequence of buoyant sales at hypermarkets and discount stores, which surged by 34% and 31%, respectively.

The robust growth in the value of the Polish private label market in 2009 was no doubt helped…

More Releases for Russia

Russia Agriculture Market, Russia Agriculture Industry, Russia Agriculture Lives …

The agriculture sector of Russia country is the most steadily developing sector of the national economy. Country’s most important crops are sunflower oil, grains and corn. Russia country is a world champion for the export of wheat & buckwheat and amongst the top ten in terms of the export of many other crops. The country has also exporting a variety of livestock products and value-added food products. Country also produces…

Russia General Insurance Market Next Big Thing | Major Giants Allianz - Russia, …

HTF Market Intelligence released a new research report of 77 pages on title 'Russia General Insurance - Key Trends and Opportunities to 2025’ with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe or Asia and important players such as Reso-Garantia, Alfa Strakhovanie, Ingosstrakh, VSK, Rosgosstrakh, Sogaz, Soglasie Insurance Company Ltd, Renaissance Group Insurance, YUZHURAL - ASKO, NSG-ROSENERGO Ltd, Sberbank Insurance Company LLC, VTB…

Russia Analysis of Viscosupplementation Market: Russia Industry & Opportunity As …

The single injection viscosupplementation segment in the Russia Viscosupplementation Market is expected to expand at the fastest and highest CAGR of 6.0% over the forecast period, due to relatively less competition across the product type segments. The three injection viscosupplementation product type segment was estimated to account for more than 69.4% share of the Russia viscosupplementation market in 2016, which is projected to increase to over 68.8% by the end…

Consumer Electronics in Russia

Summary

After the collapse of retail volume sales of consumer electronics in 2015, the negative trend continued in 2016. Although prices of oil were partly restored, business investments and the real income of Russians continued to decline, making a fast recovery of Russia’s economy questionable. As a result, consumers in Russia became very cautious when making their purchasing decisions. Despite the strong overall decline in retail volume sales, the performances of…

Consumer Health in Russia

Summary

Russian consumers are becoming more restrained in terms of spending money on consumer health products. The trend towards economising has become more widespread due to an economic slowdown in Russia and the consequent decrease in consumers’ disposable incomes. Russians are showing a greater preference for cheaper remedies or refusing to purchase any in the case of mild ailments that can be cured by traditional medicines. This is particularly so for…

Russia Hotels – Best Hotels Available in Russia

Are you tired of searching for best hotels in Russia through search engines, now there is no need to waste your valuable time digging search engines, because we proudly announce besthotelsrussia.com here you get all details about hotels available in Russia. Russia is the largest country in the world this place covers almost the whole of Asia and 40% of Europe. It also has huge population ranking in ninth position…