Press release

Online Payment Security Market: Investments, Digitization Across Various Industries Globally

Online payments and transactions are the order of the day. Not just the millennial generation, but those from the older demographic too have been lapping it up because of the convenience it accords – fast and easy transfer with just a few taps or clicks on smartphones or laptops.From banks, becoming increasingly keen on customer retention, to the numerous online wallets – all of them are serving to drive up online payments by focusing on innovative solutions.

A crucial element of online payments and transactions are is safety. With data theft, hacking attacks, and phishing attacks on the rise, it has become increasingly necessary to bulwark the sensitive data of customers and bring about secure transaction between a merchant and its customers via web, PoS machines, or mobile.

Payment security platforms – comprising of both solutions and services – enable both private and public entities to thwart payment frauds and secure business transactions carried out online. Payment security solutions help organizations to minimize the loss of financial data through control and regular monitoring of malicious activities across various payment modes.

The demand for payment security software is expected to increase in the coming years owing to the investments in payment security software technologies, partnership between payment security software providers and financial organization, FinTech investments, and digitization across various industries globally. The payment security software market is compressive of a large number of private and public companies.

North America is expected to have the largest market share and dominate the payment security market during the forecast period, due to the presence of a large number of payment security vendors in this region

APAC, on the other hand, offers potential growth opportunities in the payment security market as there is a wide presence of Small and Medium-Sized Enterprises (SMEs) in this region. These SMEs are turning toward payment security services to defend against advanced payment frauds.

Request Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=30200

Global Online Payment Security Market: Snapshot

Online payment systems are quickly being actualized because of advancement in innovation. Security concerns are ascending with the expanding utilization of associated gadgets and a huge number of computerized payments.

Protection and classification of data, particularly identified with money related information is harming to consumer loyalty. There are heaps of money related exchanges performed online on consistent schedule including payments to online shopping sites, dealer stores, charge payments or bank exchanges.

Every single such exchange make immense measure of secret information that should be secured against security breaks. Secure execution of web based business payment framework incorporates recognizing burglary and online cheats and lightening them.

There are different strategies utilized for execution of secure online payment framework. Encryption and tokenization are utilized to enhance payment security process, and make it without vulnerabilities and dangers. Secure attachment layer (SSL) encryption guarantees client's classified card information isn't bargained or presented to outsiders amid exchanges.

Equipment ensured alter safe security module (TRSM) is use for ensuring information before it enters the shipper framework, keeping up security amid a basic piece of the exchange lifecycle. Firewalls are likewise being introduced to perform secure online payment exchanges.

Global Online Payment Security Market: Trends and Prospects

Online payment security arrangements are helpful for both entrepreneurs and clients. Secure exchanges guarantees that venders or entrepreneurs will safely get the sum paid by the customers.

While secure payment arrangements empower security of secret information gave by shoppers. Execution of online payment security frameworks empower digital security and evacuates danger concerning secret information. There is increment sought after of cutting edge payment security arrangements in E-trade applications.

There is quick development being used of online payment applications crosswise over different industry verticals, for example, purchaser hardware, media and stimulation, BFSI and others. This is relied upon to make different open doors development of online payment security framework market.

There is expanded appropriation of computerized payment modes facilitating the way toward purchasing and offering of merchandise and items. Along these lines, online security payment apparatuses are required for secure and strong payment.

Online payment security arrangements are expected to stick to rules accommodated payment card industry information security standard (PCI DSS).It helps in dealing with all exchanges associated with significant card plans. With the fast development of E-trade, there is increment in deceitful exercises which should be dispensed with. Every single such factor are required to drive the development of market amid the conjecture time frame.

There is absence of trust on online keeping money security frameworks. Alongside that, there is less attention to online payment instruments among rustic zones which is turning into a boundary for the online payment security market. Also propelled payment security arrangements are taken a toll incapable. Every such factor are required to control the market development in not so distant future.

Global Online Payment Security Market: Regional Account

On the premise of geographic regions, the market has been divided into Asia Pacific (APAC), North America, Europe, the Middle East and Africa (MEA), and South America. There is high concentrate on advancements acquired from innovative work (R&D) and payment security advances in the created areas, for instance, the U.S. also, Canada.

Global Online Payment Security Market: Competitive Landscape

The companies operating in the market are Tokenex, LLC, TNS Inc., Signifyd Inc., Sisa Information Security, Shift4 Corporation, Geobridge Corporation, Intelligent Payments, Ingenico Epayments, Elavon Index, Cybersource Corporation, Braintree, and Bluefin Payment Systems.

The report offers a comprehensive evaluation of the market. It does so via in-depth qualitative insights, historical data, and verifiable projections about market size. The projections featured in the report have been derived using proven research methodologies and assumptions. By doing so, the research report serves as a repository of analysis and information for every facet of the market, including but not limited to: Regional markets, technology, types, and applications.

Book Now: https://www.transparencymarketresearch.com/online-payment-security-market.html?secure=NTIxNS41&type=PB

About TMR

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

TMR’s data repository is continuously updated and revised by a team of research experts so that it always reflects the latest trends and information. With extensive research and analysis capabilities, Transparency Market Research employs rigorous primary and secondary research techniques to develop distinctive data sets and research material for business reports.

Contact TMR

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email:sales@transparencymarketresearch.com

Website:http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Security Market: Investments, Digitization Across Various Industries Globally here

News-ID: 914223 • Views: …

More Releases from Transparency Market Research

Leisure Boat Market Size Forecast to USD 77.6 Billion by 2036 with Growing Deman …

Leisure Boat Market Outlook 2036

The global leisure boat market was valued at USD 54.1 Billion in 2025 and is projected to reach USD 77.6 Billion by 2036, expanding at a steady CAGR of 3.3% from 2026 to 2036. Market growth is driven by rising recreational boating activities, increasing disposable incomes, expanding marine tourism, and growing interest in water sports and luxury lifestyles.

👉 Get your sample market research report copy today@…

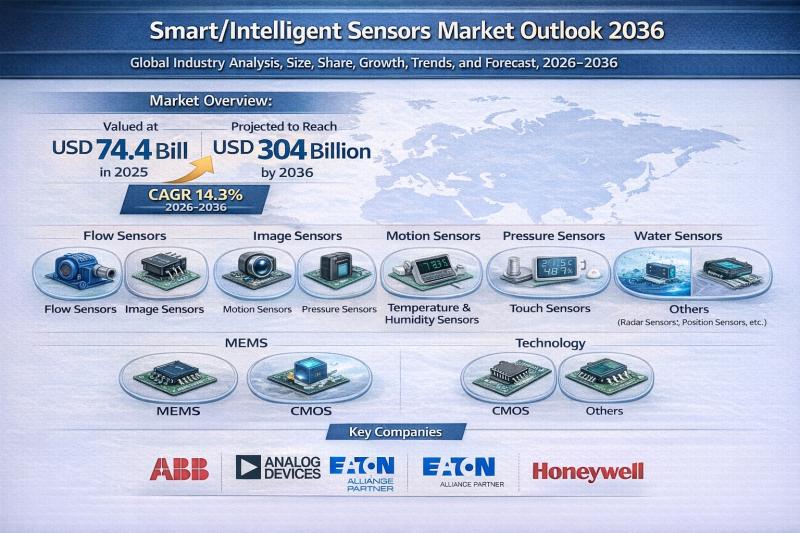

Smart/Intelligent Sensors Market to Reach USD 304 Billion by 2036, Expanding at …

The global smart/intelligent sensors market is witnessing robust expansion as connected ecosystems, automation technologies, and edge computing redefine digital infrastructure worldwide. Valued at USD 74.4 Billion in 2025, the market is projected to surge to USD 304 Billion by 2036, registering a strong CAGR of 14.3% from 2026 to 2036.

Smart or intelligent sensors go beyond conventional sensing capabilities by integrating embedded processing, data analytics, wireless connectivity, and decision-making intelligence directly…

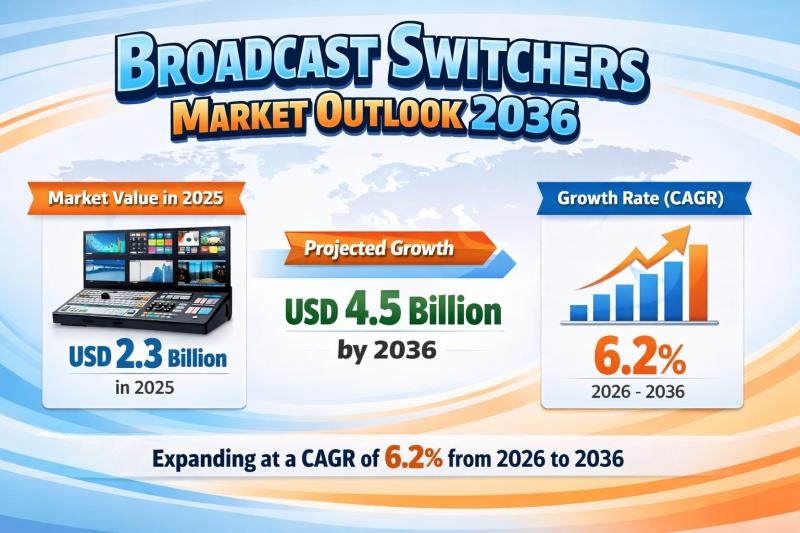

Broadcast Switchers Market to be Worth USD 4.5 Bn by 2036 - By Production, Routi …

The global Broadcast Switchers Market is poised for sustained expansion over the next decade, driven by technological innovation and rising global demand for high-quality live content production. Valued at USD 2.3 Billion in 2025, the market is projected to grow to USD 4.5 Billion by 2036, expanding at a compound annual growth rate (CAGR) of 6.2% from 2026 to 2036.

Review critical insights and findings from our Report in this sample…

Global Tablet Coatings Market Outlook 2031: Projected to Surpass USD 1,543 Milli …

The global tablet coatings market was valued at US$ 824 Mn in 2021 and is projected to expand at a steady CAGR of 5.3% from 2022 to 2031, reaching more than US$ 1,543 Mn by 2031. This consistent growth trajectory reflects the rising consumption of coated pharmaceutical and nutraceutical tablets across developed and emerging markets.

Between 2017 and 2020, the market experienced moderate expansion driven by generics penetration and increasing oral…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…