Press release

Remote Mobile Payment Market Driven by Ubiquity of Smartphones

The demand in the global remote mobile payment market is projected to escalate an exponential CAGR of 44.9% during the forecast period of 2017 to 2022, gaining traction from a number of factors such as ubiquity of smartphones, technological advancements that have enabled instantaneous authentication of personals, and growing fields of Big Data and the internet of things.The advent of near field communication (NFC) technology is likely to have an impressive future in e-commerce as well as retail shops. Though the remote mobile payment market is still in nascent stage and data security remains the most glaring restraint, the future seems highly prosperous, with the opportunities exceeding a global worth of 7,526,127.9 mn by 2022, rapidly mounting from its evaluated worth of US1,176,712.6 mn in 2017.

Obtain Report Details @

https://www.transparencymarketresearch.com/remote-mobile-payment-market.html

M-Commerce Remains Most Profitable Mode of Payment Segment

Based on mode of payment, the global remote mobile payment market has been segmented into peer-to-peer and m-commerce. In 2017, m-commerce accounted for 89.9% of the overall demand, which was worth US$1,058,366.1 mn. By the end of 2022, this segment is expected to remain the leader, serving 94.0% of the total demand in the global remote mobile payment market, which will be of valuation US$7,070,810.1 mn. Revenue in this segment is growing at US$1,202,488.8 mn over the course of the forecast period, and this absolute growth is larger than any other segment.

On the basis of end-use industry, the market for remote mobile payment has been bifurcated into retail, hospitality and tourism, IT and telecommunication, banking, financial services, and insurance (BFSI), media and entertainment, airline, and healthcare. Nearly all of these sectors have high hopes from the remote mobile payment market.

Request Sample @

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30908

APEJ Emerging as Highly Lucrative Regional Market for Remote Mobile Payment

Among all geographical regions, the North America remote mobile payment market is most lucrative, owing to high adoptability rate of new technology among the citizens of the developed countries of the U.S. and Canada, ubiquity of smartphones, and existing penetration of e-commerce. Evaluated to be worth US$264.646.3 mn in 2017, the North America remote mobile payment market is estimated to reach a valuation of 1,900,332.8 mn by 2022, incrementing the demand at an above-average CAGR of 48.3% during the forecast period of 2017 to 2022.

The region of Asia Pacific except Japan (APEJ) is projected to overtake and reach a worth of US$1,511,056.3 mn by 2022. This surge of demand in the APEJ remote mobile payment market is a reflection of vast population of two of the fastest growing economies in China and India.

Some of the key players currently holding position of strength in the global remote mobile payment market are: Samsung Electronics Co Ltd., Apple Inc., ACI Worldwide, Inc., Alphabet Inc., DH Corporation, Visa Inc., Square, Inc., Mastercard Incorporated., PayPal Holdings, Inc., Fidelity National Information Services, Inc., and Fiserv, Inc.

Most of these companies are working on the robustness of the process and aggressive market in order to differentiate themselves from the competitors.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Contact

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Remote Mobile Payment Market Driven by Ubiquity of Smartphones here

News-ID: 875675 • Views: …

More Releases from Transparency Market Research

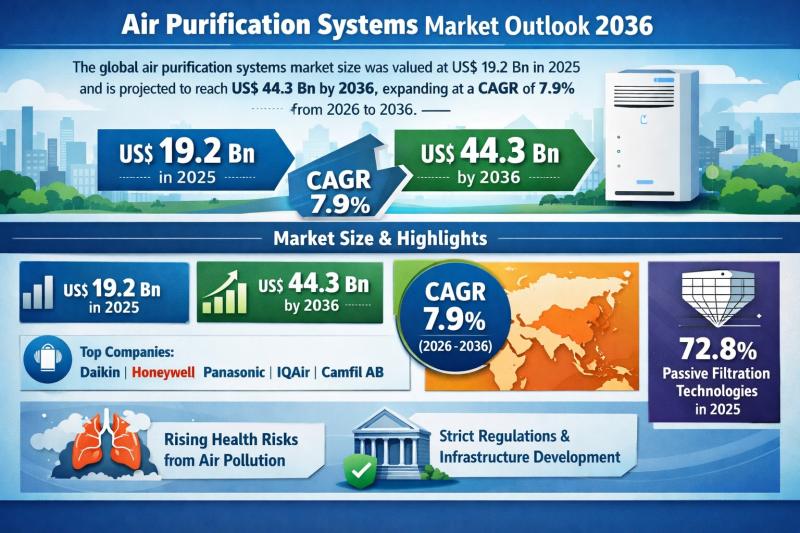

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

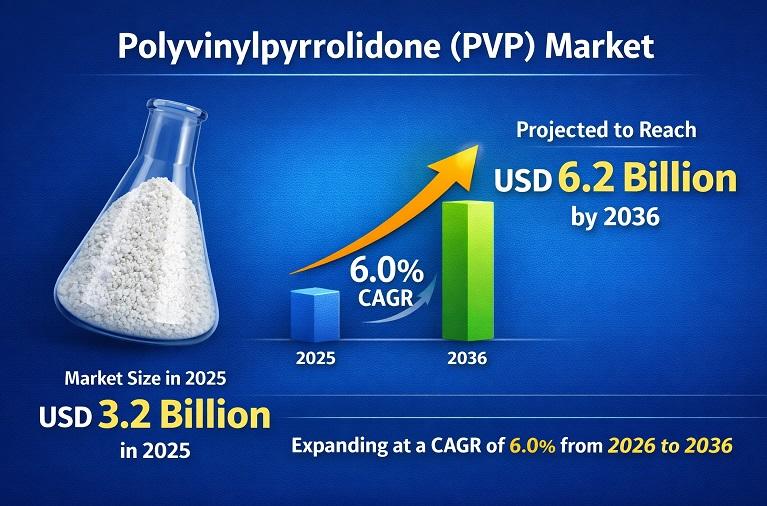

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

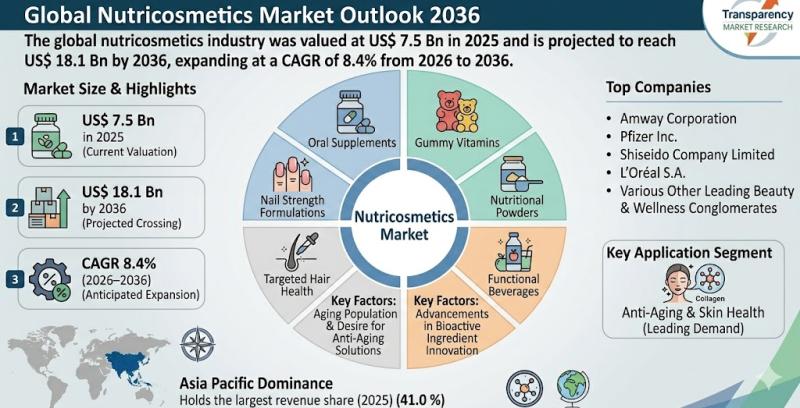

Nutricosmetics Market to Reach US$ 18.1 Bn by 2036, Expanding at 8.4% CAGR Drive …

The global nutricosmetics market was valued at US$ 7.5 Bn in 2025 and is projected to reach US$ 18.1 Bn by 2036, expanding at a robust CAGR of 8.4% from 2026 to 2036. Nutricosmetics-nutritional supplements and functional products designed to enhance skin, hair, and nail health from within-are gaining substantial traction worldwide. The growing consumer shift toward holistic wellness, preventive healthcare, and clean-label beauty solutions is significantly driving market expansion.

Nutricosmetics…

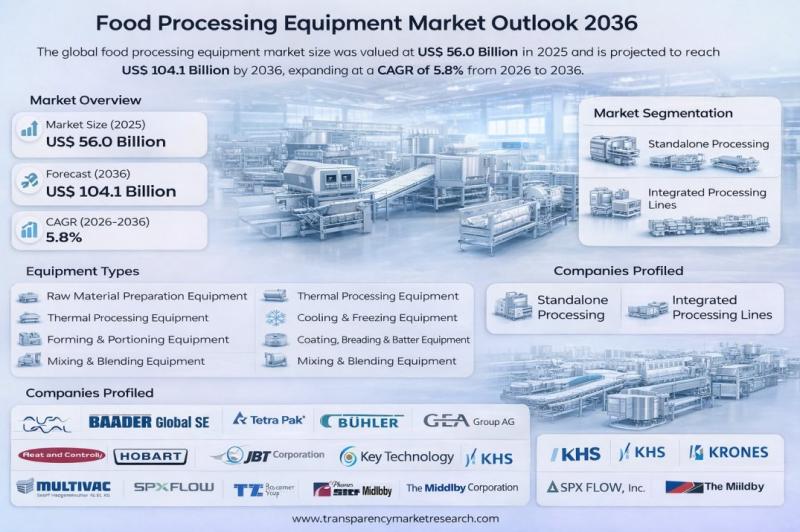

Food Processing Equipment Market to Reach US$ 104.1 Billion by 2036, Driven by A …

The global food processing equipment market was valued at US$ 56.0 Billion in 2025 and is projected to reach US$ 104.1 Billion by 2036, expanding at a CAGR of 5.8% from 2026 to 2036. Market expansion is being driven by rising demand for processed and convenience foods, expanding urbanization, increasing automation in food manufacturing, stringent food safety regulations, growing meat and dairy consumption, technological advancements, adoption of energy-efficient machinery, industrialization…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…