Press release

Payment Bank Solutions Market Share, Size, Trends, Growth Rate and Forecast to 2027

Presently with the growing usage of digital and online banking, many banks have started offering various options for banking payments. These Payment banks are helping in modernization of banking by offering unique payment solutions to customers. The concept of payment bank solution is growing at a faster pace due to rising usage of mobile technology to provide financial assistance in remote areas. These payment bank solutions are developed specifically for unbanked segments and locations which do not have banks.This payment bank concept has been launched by Reserve Bank of India (RBI) in which a payment bank operates at smaller level that as an actual bank. In this payment bank can make payments and do some work of banks but cannot lend money or issue credit card. A payment is allow to accept deposit, enable mobile payments, net banking services, fund transfers, issuance of ATM or debit card and can sell third party financial products. Payment Bank solutions are precisely tailored for organizations looking for payments banks and small finance banks licenses from the Reserve Bank of India (RBI). With these solutions, licensees can set up the required technology backbone and become operational quickly.

Request for Sample @ https://www.futuremarketinsights.com/reports/sample/rep-gb-4403

Payment Bank Solution Market: Drivers and Challenges

The major factor driving the adoption of Payment bank solutions is the rising usage of mobile technology among individuals. In India, rural and urban both places, individuals have been adopted mobile technology significantly for online shopping, online banking and others. The concept of Payment bank solution is also getting adopted by individuals due to internet facilities and easy to understand concept.

The key challenge for Payment bank solution is the lack of knowledge payment banking solutions. RBI has issued license to 11 entities to launch payment banks due to which only these 11 companies are offering solutions to areas where they already exist. This concept is in introductory stage due to which it will take time for individuals to adopt.

Payment Bank Solutions Market: Segmentation

Segmentation on the basis of type:

Hardware

ATM cards

Debit cards

Forex cards

Software

Platforms

Mobile Apps

Request for Table of Contents @ https://www.futuremarketinsights.com/toc/rep-gb-4403

Key Developments:

In February 2017, MasterCard has entered into the partnership with Airtel Payment Bank to provide payment processing solution. The MasterCard is offering online debit card to Airtel customers to make digital payments up to 1 lakhs. This will help Airtel to offer safer, innovative and faster payments experience to its customers.

In October 2015, Mahindra Comviva has entered in the Payment Bank Solutions market in India to offer technological solutions and infrastructure to payment banks. Mahindra Comviva’s technological product has been deployed with Idea and is expected to be adopted by Tech Mahindra as well when it rolls out its own payments bank.

In September 2015, Infosys Finacle, a subsidiary of EdgeVerve Systems has launched solution for Payment banks named as Finacle Payments Bank and Finacle Small Finance Bank solutions for the India market. hese solutions are specifically tailored for organizations seeking payments banks and small finance banks licenses from the Reserve Bank of India (RBI).

In Payment Bank Solution market there are vendors are Infosys Finacle, MasterCard, Mahindra Conviva and others.

Regional Overview

Presently, India is holding the largest market share for Payment Bank Solution market due to high adoption of mobile banking and net banking apps among individuals in various industries for improved payment services, to increase real time financial assistance and other.

Report Overview @ https://www.futuremarketinsights.com/reports/payment-bank-solutions-market

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Bank Solutions Market Share, Size, Trends, Growth Rate and Forecast to 2027 here

News-ID: 858973 • Views: …

More Releases from Future Market Insights

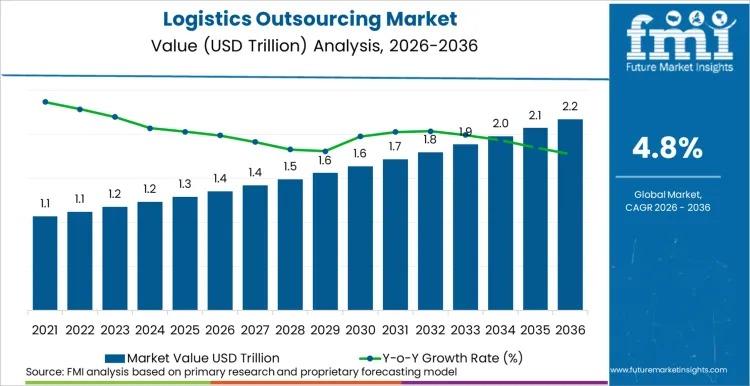

Global Logistics Outsourcing Market to Reach USD 2.2 Trillion by 2036 at 4.8% CA …

The global Logistics Outsourcing Market is projected to expand from USD 1.4 trillion in 2026 to USD 2.2 trillion by 2036, registering a CAGR of 4.8% during the forecast period. According to Future Market Insights (FMI), enterprises are accelerating outsourcing strategies to enhance supply chain resilience, digital transparency, and operational flexibility in an increasingly volatile global trade environment.

Demand dynamics are heavily influenced by the need for end-to-end visibility, omnichannel fulfillment…

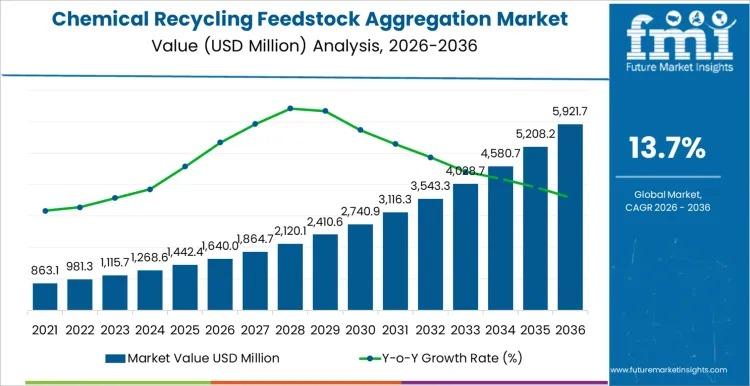

Chemical Recycling Feedstock Aggregation Market to Reach USD 5,921.7 million by …

The global Chemical Recycling Feedstock Aggregation Market is projected to grow from USD 1,640.0 million in 2026 to USD 5,921.7 million by 2036, registering a CAGR of 13.7%. The expansion reflects structural scaling of chemical recycling plants that depend on consistent, specification-aligned plastic waste streams rather than fragmented sourcing models.

As pyrolysis and depolymerization capacities expand worldwide, aggregators are investing in centralized hubs that integrate pre-sorting, blending, contamination control, and logistics…

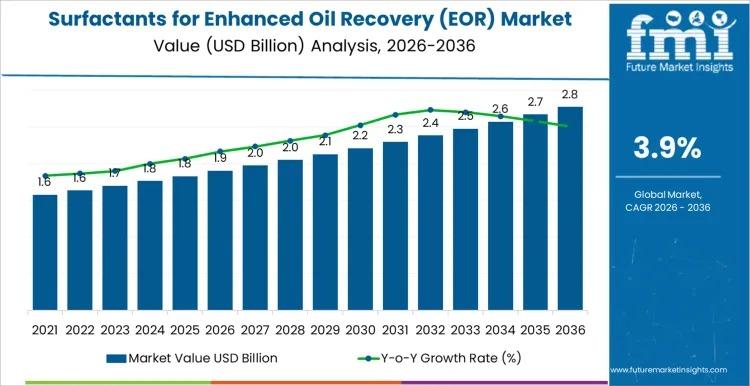

Global Surfactants for Enhanced Oil Recovery Market to Reach USD 2.9 Billion by …

The global Surfactants for Enhanced Oil Recovery (EOR) Market is projected to grow from USD 1.9 billion in 2026 to USD 2.9 billion by 2036, registering a CAGR of 3.85%. Market expansion is closely tied to mature oilfield economics, where incremental recovery gains justify chemical investment. Rather than broad upstream expansion, growth is concentrated in technically validated, project-specific deployments.

Long evaluation timelines, pilot testing requirements, and reservoir heterogeneity slow rapid scale-up,…

UK Hydrocarbon Accounting Solution Market to Reach USD 110.7 Mn by 2036 at 5.8% …

The Demand for Hydrocarbon Accounting Solution in United Kingdom is projected to expand from USD 63.0 million in 2026 to USD 110.7 million by 2036, registering a CAGR of 5.8% over the forecast period. The market's growth trajectory reflects accelerating regulatory oversight, digital oilfield deployment, and enterprise-level data governance initiatives across upstream and midstream operations.

As operators confront tightening volumetric reporting standards and emissions accountability frameworks, hydrocarbon accounting solutions are becoming…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…