Press release

Mobile Payment Technologies Market Reporting & Evaluation of Recent Industry Developments

The global mobile payment technologies market is foreseen to grow manifolds in coming times. Rising interest for cutting edge payment innovation and expanding center around making cashless economy has prompted the solid emergence of mobile payment innovation suppliers in the market. A portion of the significant players in worldwide mobile payment technologies market are Visa, Inc., Boku, Inc., PayPal, Inc., Vodafone Ltd., AT and T, Inc., Apple, Inc., Microsoft Corporation, MasterCard International Inc., American Express, Co., Fortumo, Bharti Airtel Ltd., and Google, Inc.Download exclusive Sample of this report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=157

According to a recent research report by Transparency Market Research (TMR) the global mobile payment technologies market is anticipated to flourish with a tremendously strong CAGR of 20.5% within its forecast period from 2016 to 2024. In year 2015 the overall mobile payment technologies market was evaluated to be worth US$ 338.72 bn. This value is expected to reach around worth US$ 1,773.17 bn by the end of year 2024. Based on type, near field communication (NFC) segment is expected to dominate the other segments because of advancement in technologies in mobile payment sector all over the world. Geographically, Asia Pacific will stand out in the coming time as it is slated to represent an offer of 42.5% in the worldwide market before the finish of 2024.

Integration of IoT with Payment Application to Boost the Global Market Demand

Mobile payment is an innovation which enables buyers to make quick payments for items and administrations by utilizing a versatile electronic gadget, for example, tablets, smartphones, and cell phones which are worked as a payment vehicles. Developing selection of cutting edge technologies, for example, wearable gadgets, near field communication, and mobile point-of-sale are relied upon to lift the interest for mobile payment technologies in anticipated years. The appropriation of prompt payment technologies are persistently expanding in developing districts, for example, Middle East and Africa and Asia Pacific. This is likewise a central point which is relied upon to help the mobile payment technologies market in the coming years.

Obtain Report Details @ https://www.transparencymarketresearch.com/mobile-payments-market.html

Aside from this, fast advancements in the mobile payment answers for give better payment administration to the end-clients are additionally foreseen to fuel the development of the mobile payment technologies market. What's more, developing government drove activities and expanding appropriation of shrewd machines are expected to drive the market. Besides, combination of IoT with payment applications gives real chances to expand payment arrangement offerings and create upgraded payment technologies. Thusly, it is foreseen that the Internet of Things will support more payments through advanced wallets amid the figured time frame.

Lack of Engagement among the Users to Hamper the Mobile Payment Technologies Market

In any case, low consumer demand for picking new innovation is a major aspect controlling the development of the mobile payment technologies market. On the other side, there are a lot of chances in market to help up the development. Top-end security highlights, speedier and more secure exchanges, joining of traditional exchange strategies in the present working framework will draw in more clients.

Despite the fact that the mobile payment innovation market is thriving, there is a lack of engagement among clients about tolerating the new innovation. It is one of the enormous limiting elements for the development of the market. Shoppers are likewise put off by the deferrals in exchange some still like to direct the exchange in the antiquated ways. Both the clients and shippers are not completely mindful of the working framework of the mobile payment innovation and that is a reason for worry for the general development of the market.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

US Office Contact

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Technologies Market Reporting & Evaluation of Recent Industry Developments here

News-ID: 844520 • Views: …

More Releases from Transparency Market Research

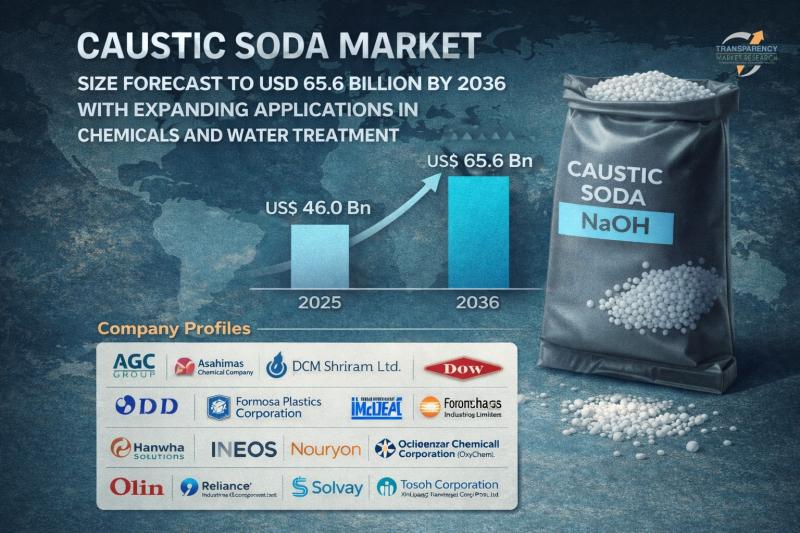

Caustic Soda Market Size Forecast to USD 65.6 Billion by 2036 with Expanding App …

Caustic Soda Market Outlook 2036

The global caustic soda market was valued at US$ 46.0 Billion in 2025 and is projected to reach US$ 65.6 Billion by 2036, expanding at a steady CAGR of 3.2% from 2026 to 2036. Market growth is driven by increasing demand from the pulp & paper industry, rising alumina production, expanding chemical manufacturing activities, and growing applications in water treatment and textiles.

👉 Get your sample market…

Global Baby Diaper Market Outlook 2036: Industry to Reach US$ 75.1 Billion by 20 …

The global baby diaper market was valued at US$ 44.5 Bn in 2025 and is projected to reach US$ 75.1 Bn by 2036, expanding at a steady CAGR of 4.9% from 2026 to 2036. This consistent upward trajectory reflects the essential nature of diapers in infant hygiene and the growing consumer preference for high-performance and convenient baby care products.

In 2025, North America accounted for 42.1% of the global revenue share,…

Rare Earth Metals Market to be Worth USD 30.9 Bn by 2036 - By Metal Type / By Ap …

The rare earth metals market has evolved from a niche industrial segment into a strategically critical global industry. In 2025, the market stood at US$ 14.1 Billion, driven primarily by increasing deployment of electric vehicles (EVs), renewable energy systems, defense electronics, and advanced industrial machinery.

Review critical insights and findings from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=823

By 2036, the market is expected to nearly double to US$ 30.9 Billion, supported by…

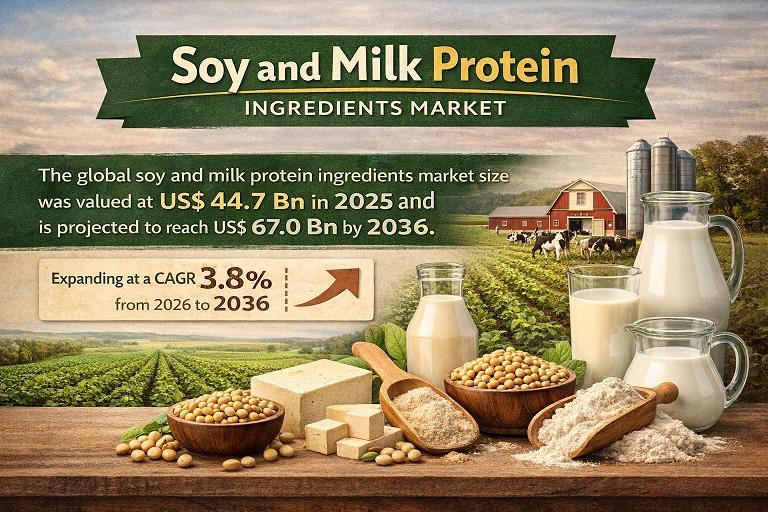

Soy and Milk Protein Ingredients Market to Reach USD 67.0 Billion by 2036 Amid R …

The global Soy and Milk Protein Ingredients Market is witnessing significant momentum as consumers increasingly prioritize high-protein diets, functional nutrition, and clean-label ingredients. With the surge in plant-based alternatives, sports nutrition products, and fortified food offerings, soy and milk protein ingredients have become critical components across multiple industries including food & beverages, pharmaceuticals, animal nutrition, and personal care.

The global Soy and Milk Protein Ingredients Market is projected to reach US$…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…