Press release

Payment Security Software Market - The Biggest Trends to Watch out for 2017-2025

According to a research report by Transparency Market Research (TMR), the global payment security software market is characterized by innovation in technology. Strategic alliances among software and hardware providers is also a key trend in this market. The leading vendors of payment security software, such as Symantec, Intel, Cisco Systems, HCL Technologies, and Thales e-Security, are engaging into mergers, acquisitions, and partnerships increasingly in a bid to strengthen their presence across the world. Over the forthcoming years, the market is expected to move towards consolidation, which is anticipated to intensify the competition between the companies, notes the research study.Download exclusive Sample of this report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30509

The report estimates the opportunity in the worldwide market for payment security to expand at a CAGR of 8.90% during the period from 2017 to 2025, reaching US$23.7 bn by the end of the forecast period. Currently, security information and event management (SIEM) software reports a greater demand from end users and this trend is projected to continue over the next few years. Among end users, the banking, financial services, and insurance (BFSI) sector is registering a high adoption of this software. Mobile payments have surfaced as the most preferred mode of payment for cashless transaction, which is reflected on demand for payment security software in this segment.

Thanks to the increased uptake of online payment methods, North America has emerged as the leading regional market for payment security software. With the rising investment in online payment technology, this market is anticipated to retain its position over the period of the forecast, states the research report.

Browse Market Research Report @ https://www.transparencymarketresearch.com/payment-security-software-market.html

Digital Transformation in Payment Methods to Fuel Demand for Payment Security Software

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a TMR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging them to come up with technical competence that ensure fast, secure, and easy financial transaction and exchange of information over the Internet. As online payment is susceptible to a number of security threats, the need for payment security software is increasing constantly to prevent the losses incurred due to frauds and data breaches.

Stringent Government Regulations to Act as Hindrance

Although the global market for payment security software is anticipated to witness a thriving future over the forthcoming years, it may face several roadblock on the way. The stringent regulations governing the introduction and implementation of innovative security systems and solutions may pose a challenge to this market in the years to come. The increasing apprehension of consumer towards online payments, triggered by the surge in cyber-attacks and cases related to fraud, is also projected to hamper the market’s growth over the forthcoming years. However, technological advancements in payment security systems are expected to reduce the impact of these factors in the near future, states the research report.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

US Office Contact

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Software Market - The Biggest Trends to Watch out for 2017-2025 here

News-ID: 821890 • Views: …

More Releases from Transparency Market Research

Diabetes Supplements Market to Reach USD 13.4 Billion by 2031 as Preventive Nutr …

The Diabetes Supplements Market is witnessing steady expansion as rising diabetes prevalence and increasing emphasis on preventive healthcare drive demand for nutritional products that support blood sugar management and metabolic health. Valued at approximately US$ 8.4 billion in 2020, the market is projected to grow at a healthy pace and reach around US$ 13.4 billion by 2031

With diabetes emerging as one of the most pressing global health challenges, consumers are…

Drugs of Abuse Testing Market to Reach US$ 18.7 Billion by 2031, Growing at 13.5 …

The global drugs of abuse testing market was valued at US$ 5.9 Bn in 2022 and is projected to expand at a robust CAGR of 13.5% from 2023 to 2031, reaching US$ 18.7 Bn by the end of 2031. The market is witnessing strong momentum due to the rising incidence of drug abuse worldwide, increasing regulatory oversight, and the introduction of technologically advanced screening solutions.

Access key findings and insights from…

Power Lawn and Garden Equipment Market Size Forecast to USD 188.4 Billion by 203 …

Power Lawn and Garden Equipment Market Outlook 2036

The global power lawn and garden equipment market was valued at US$ 93.9 Billion in 2025 and is projected to reach US$ 188.4 Billion by 2036, expanding at a steady CAGR of 6.6% from 2026 to 2036. Market growth is driven by increasing residential landscaping activities, rising demand for battery-powered equipment, expanding commercial landscaping services, and growing consumer interest in outdoor aesthetics.

👉 Get…

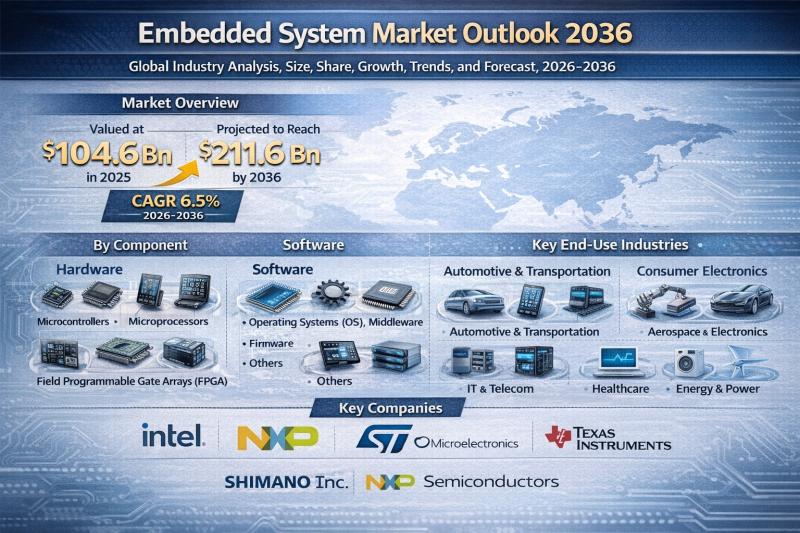

Global Embedded System Market to Reach USD 211.6 Bn by 2036, Expanding at 6.5% C …

The global embedded system market is poised for steady and sustained growth over the next decade, driven by rapid digital transformation across industries. Valued at US$ 104.6 Bn in 2025, the market is projected to reach US$ 211.6 Bn by 2036, expanding at a CAGR of 6.5% from 2026 to 2036. The increasing integration of embedded systems in automotive electronics, industrial automation, and IoT-enabled devices is positioning the industry as…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…