Press release

Payment Security Software Market : Digital Transformation in Payment Methods to Fuel Demand for Payment Security Software

Global Payment Security Software Market: OverviewOnline payment offers a fast and cheaper medium of carrying out online transaction and online transfer. The adoption of payment security software in financial services sector has gained traction. Banking sector is willing to explore opportunities which would make the banking transactions easier to process. Increased penetration of digital technology in the banking and other sectors has resulted in the development of easy to use online platforms and applications. This drives the need to carry out the online transactions in a secure manner. Payment security software offers a secure medium to carry out online transactions and can help eliminate the frauds due to errors and identity theft to a large extent. Hence, the payment security sector has made tremendous investments in exploring the technology along with the wide scale deployment of the security software and systems. This technology can benefit several by offering easy, safe and secure access and exchange of money over the Internet.

Obtain Report Details @https://www.transparencymarketresearch.com/payment-security-software-market.html

The demand for payment security software is expected to increase in the coming years owing to the investments in payment security software technologies, partnership between payment security software providers and financial organization, FinTech investments, and digitization across various industries globally. The payment security software market is compressive of a large number of private and public companies. The growth of payment security software startups was aided by huge venture capital investments during the period from 2013 to 2015. The market is expected to be hit by a huge wave of mergers and acquisitions in the coming years.

Global Payment Security Software Market: Segmentation

This research report provides an in-depth analysis of the global payment security software market based on solution, mode of payment, end-use, and geography. The global payment security software market is categorized based on solution into software and services. The software segment is further classified into firewalls, anti-virus/anti-malware, intrusion detection and prevention (IDS/IPS), data encryption, tokenization, multi-factor authentication, Security Information and Event Management, Data Loss Prevention, and Others.

The payment security market has been segmented in mobile payment security software, Point-of-Sale (PoS) systems and security, and online payment security software on the basis of mode of payment. The end-use segment consists of BFSI, retail, healthcare, government, and others. The report analyzes each of these segments for the various geographies considered under the scope of the study.

Digital Transformation in Payment Methods to Fuel Demand for Payment Security Software

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a TMR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

Request to download and view full ToC @https://www.transparencymarketresearch.com/report-toc/30509

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging them to come up with technical competence that ensure fast, secure, and easy financial transaction and exchange of information over the Internet. As online payment is susceptible to a number of security threats, the need for payment security software is increasing constantly to prevent the losses incurred due to frauds and data breaches.

Stringent Government Regulations to Act as Hindrance

Although the global market for payment security software is anticipated to witness a thriving future over the forthcoming years, it may face several roadblock on the way. The stringent regulations governing the introduction and implementation of innovative security systems and solutions may pose a challenge to this market in the years to come. The increasing apprehension of consumer towards online payments, triggered by the surge in cyber-attacks and cases related to fraud, is also projected to hamper the market’s growth over the forthcoming years. However, technological advancements in payment security systems are expected to reduce the impact of these factors in the near future, states the research report

Transparency Market Research (TMR) is a next-generation provider of syndicated research, customized research, and consulting services. TMR’s global and regional market intelligence coverage includes industries such as pharmaceutical, chemicals and materials, technology and media, food and beverages, and consumer goods, among others. Each TMR research report provides clients with a 360-degree view of the market with statistical forecasts, competitive landscape, detailed segmentation, key trends, and strategic recommendations

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Software Market : Digital Transformation in Payment Methods to Fuel Demand for Payment Security Software here

News-ID: 787139 • Views: …

More Releases from Transparency Market Research

RF Chip Inductor Market Size to Reach over USD 1.8 billion by 2031 - Transparenc …

RF Chip Inductor Market are essential components in various electronic devices, providing inductance and functioning as filters, oscillators, and transformers. They play a crucial role in ensuring the efficiency and performance of RF circuits. With the rapid advancement in telecommunications, consumer electronics, and automotive industries, the demand for RF chip inductors has seen a significant rise. These components are integral in applications such as smartphones, IoT devices, and automotive electronics,…

Solid Tires Market Expected to Witness Impressive Growth at a 8.1% CAGR by 2031

The latest research study released by Transparency Market Research on "Solid Tires Market Forecast to 2023-2031 ″ research provides accurate economic, global, and country-level predictions and analyses.

Solid Tires market is estimated to attain a valuation of US$ 760.0 Mn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 8.1% during…

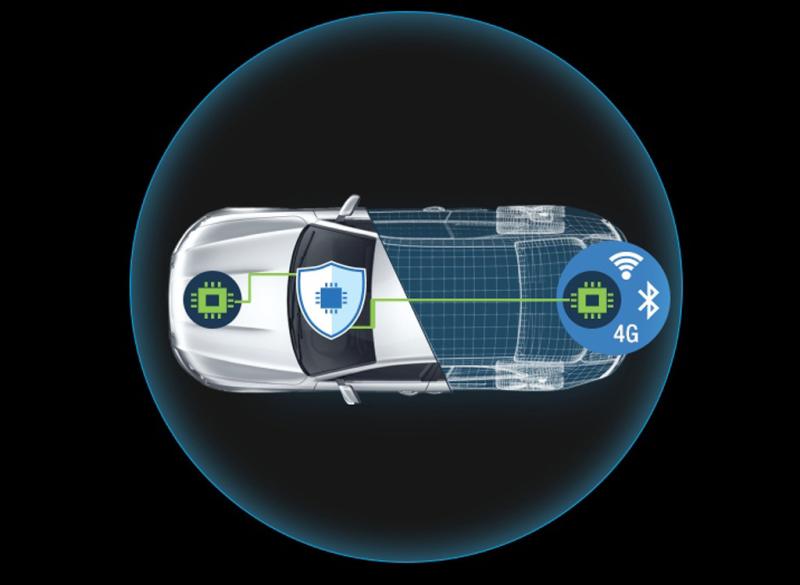

Automotive Cyber security Market Sales Estimated to Hit USD 10.5 Billion by 2031 …

The latest research study released by Transparency Market Research on "𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐲𝐛𝐞𝐫 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Automotive Cyber security industry, as…

Ready-mix Concrete Market to Witness Exponential Growth with a CAGR of 6.1% from …

The latest research study released by Transparency Market Research on "𝐑𝐞𝐚𝐝𝐲-𝐦𝐢𝐱 𝐂𝐨𝐧𝐜𝐫𝐞𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Ready-mix Concrete industry, as well as…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…