Press release

Contactless Payments Market: Industry Analysis and Opportunity Assessment

The presence of several small and large service providers renders a highly competitive vendor landscape, notes one of the recent reports by Transparency Market Research (TMR). Competition in the market has further intensified with the entry of banks, card companies, telecom companies, and payment companies of late. The ease of entry in the market is expected to witness inflow of new participants to add to the fragmentation and competition in terms of service costs.Some of the prominent names in the global Contactless Payment Transaction Market are Apple Inc., Barclays, Giesecke & Devrient GmbH, Gemalto N.V., Ingenico Group, On Track Innovations Ltd., Verifone Systems Inc., Heartland Payment Systems, Inside Secure, Samsung Elecrronics Ltd., and Wirecard AG.

Sample With Latest Advancements @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2566

As per a report by Transparency Market Research, the global contactless payment transaction market is likely to expand at a jaw-dropping 55.5% CAGR for the forecast period between 2017 and 2025 for the market to be worth US$801.44 bn by 2025.

Rising Popularity of Wireless Devices for Communication Pushes Europe to Lead Position

In terms of mode of payment, the segment of contactless cards accounted for the dominant share in the market in 2016 revenue-wise and volume-wise. The segment is expected to stay in the lead in terms of rate of adoption displaying a massive 94.3% CAGR vis-à-vis revenue in the global contactless payment transaction market over the report’s forecast period.

Browse Our Press Releases For More Information @ https://www.transparencymarketresearch.com/pressrelease/contactless-payments-market.htm

From a geographical standpoint, Europe is expected to be at the forefront in terms of growth in the global contactless payment transaction market. In 2016, Europe held a massive 59.4% share of the overall market. The region is expected to register strong growth over the report’s forecast period chiefly driven by the rising use of NFC-enabled smart wearable devices and increased adoption of contactless cards.

Rising Use of Mobile Phones Majorly Fuelling Growth

At the forefront of driving growth in the global contactless payment transaction market is the rising demand for fast and convenient means for completing transactions, predominantly in the retail and transport sectors underpinned by the rising use of smartphones for payments. Businesses are increasingly recognizing the direct benefits of contactless payment transaction options in the form of speedy counter sales processes and a considerable increase in the number of transactions during a business day. This is leading to the swift uptake of contactless payment systems across industry sectors such as hospitality, healthcare, and media and entertainment for its tangible benefits.

Browse Our Table of Content @ https://www.transparencymarketresearch.com/report-toc/2566

The increasing uptake of smartphones or basic mobile phones is having a profound impact on the adoption of contactless payment systems. These devices allow payment to be completed without having to carry cash and credit/debit cards which is encouraging consumers as well merchants to use contactless payment systems as one of the primary mode for completing transaction.

Apart from this, mobile phones that are equipped with advanced features such as mobile wallets eliminate the need for NFC-based PoS machines to complete transactions, which is boosting the acceptance for contactless payment transactions.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Contact

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Contactless Payments Market: Industry Analysis and Opportunity Assessment here

News-ID: 777305 • Views: …

More Releases from Transparency Market Research

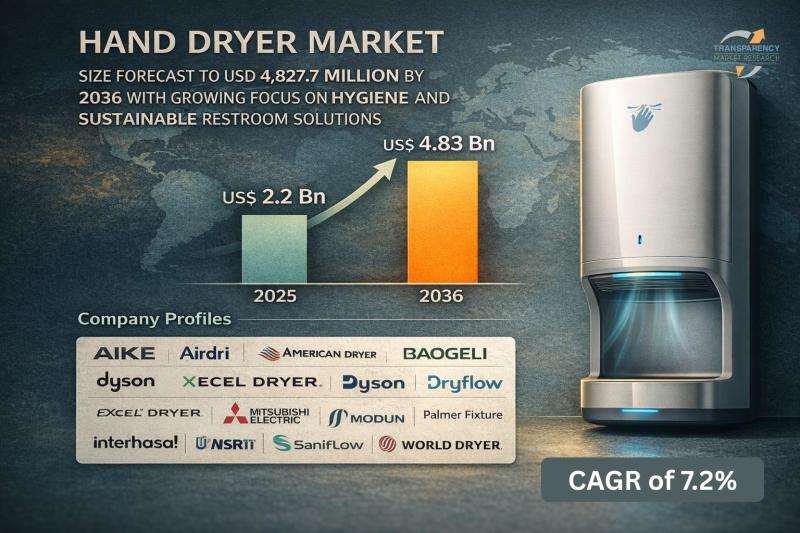

Hand Dryer Market Size Forecast to USD 4.83 Billion by 2036 with Growing Focus o …

Hand Dryer Market Outlook 2036

The global hand dryer market was valued at US$ 2.23 Billion in 2025 and is projected to reach US$ 4.83 Billion by 2036, expanding at a steady CAGR of 7.2% from 2026 to 2036. Market growth is driven by increasing emphasis on hygiene and sanitation, rising adoption in commercial infrastructure, and growing preference for eco-friendly and cost-effective hand drying solutions.

👉 Get sample market research report copy…

Smart Glass Market Outlook 2036: Projected to Reach USD 35.8 Billion at 14.5% CA …

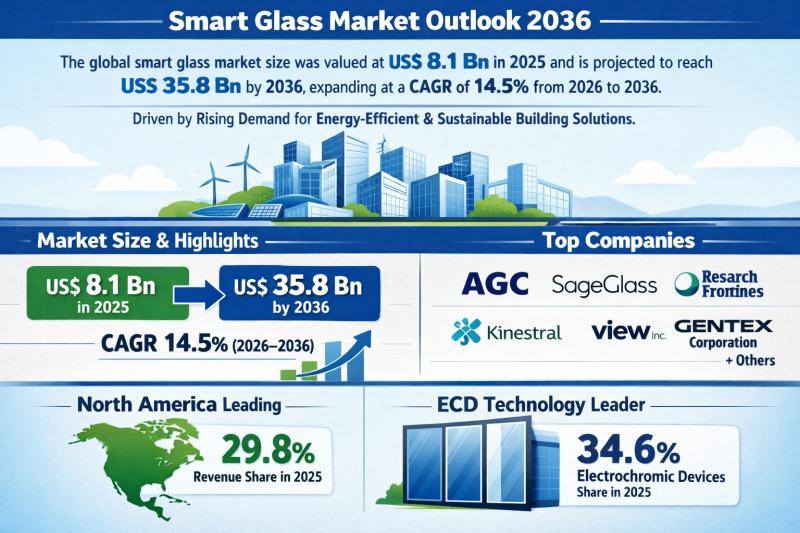

The global smart glass market was valued at US$ 8.1 Bn in 2025 and is projected to surge to US$ 35.8 Bn by 2036, expanding at a robust CAGR of 14.5% from 2026 to 2036. This nearly 4.4x growth over eleven years underscores the accelerating demand for intelligent glazing solutions across commercial, residential, automotive, and infrastructure sectors.

North America emerged as the leading regional market in 2025, accounting for 29.8% of…

Smoking Cessation and Nicotine De-Addiction Market to Reach USD 46.4 Bn by 2036, …

The global smoking cessation and nicotine de-addiction market is witnessing strong and sustained growth, fueled by intensifying public health initiatives and rising awareness about the long-term consequences of tobacco use. Valued at USD 15.5 Bn in 2025, the market is projected to expand at a robust CAGR of 10.5% from 2026 to 2036, reaching USD 46.4 Bn by 2036.

Smoking cessation solutions encompass a wide range of products and services designed…

3D Imaging Market to be Worth USD 266 Bn by 2036 - By Component Type / By End-Us …

The global 3D imaging market is witnessing exponential growth, reflecting strong demand across healthcare, manufacturing, media, and industrial sectors. Valued at US$ 50 billion in 2025, the market is projected to reach US$ 266 billion by 2036, expanding at a robust CAGR of 18.2% from 2026 to 2036.

Get a concise overview of key insights from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2743

This impressive trajectory highlights the rapid integration of advanced imaging…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…