Press release

Construction sector in Romania 2009

Construction was the most important factor of the strong economic growth of Romania over the past several years, which topped 7.1% in 2008. However, the problems on the international financial markets affected the construction industry, which was heavily dependent on banking credit. Non-residential construction, which accounts for half of the construction output, will be strongly hit, while residential will decrease only slightly in 2009 and civil engineering, which depends on public funding, will be the only one maintaining above the line.According to the “Construction sector in Romania 2009 – Development forecasts for 2009-2011” report recently published by PMR, a research and consulting company, in 2008, the value of construction and assembly works in Romania increased by 34% nominally (26% in real terms), to RON 83bn (€22.5bn). The fastest growing segment was non-residential, which increased by 37%. The situation is due to the fact that Romania, a country with a very rapidly developing economy, needed mainly non-residential buildings, such as office space for services and industrial buildings. Structural works are by far the ones covering the largest share of costs of a construction project, followed by installation and equipment and site preparations. The smallest shares are held by finishings and rental of construction equipment.

Despite the €20bn financial aid from the IMF and EU meant to stabilise the volatile local currency and reduce the budget deficit, investor confidence in Romania is expected to continue to decline, resulting in lower levels of FDI. In addition, investments in fixed assets will also decrease. These are premises for a decrease of the construction output in 2009, after a period of very high growth rates. This situation will also have an important effect on GDP growth, which was relying greatly on construction.

“The most affected year will be 2009, but the following few years may not see a major recovery if the international economic circumstances do not improve. The construction sector will, however, be supported by the spending of EU funds allocated for Romania, which will be directed mainly into infrastructure.”, says Robert Obetkon, a senior construction market analyst at PMR.

Non-residential construction, which used to be the fastest growing segment of the Romanian construction market, is likely to be the most affected, mainly due to its overdependence on credit. There were many projects, particularly on the retail property market and the office market, which developers launched before even ensuring their financing. This, in addition to the decrease in demand for these buildings, are the reasons why many projects have been postponed or even cancelled. Only those of which construction works were already begun before Q4 2008 will be completed in 2009. Since there were many delays even before, which were caused either by frequent changes in the projects and by contractors, the number of retail facilities and office buildings to be delivered this year is limited. In the market for industrial buildings and warehouses, where the largest part of the market is concentrated by large multinational developers, the situation is slightly better, considering that financing problems are less frequent and the demand has not decreased as dramatically as in the abovementioned cases.

The present situation of residential construction in Romania has been determined by the property market. After two years of constantly growing demand which powered the rising prices of homes, the residential property market started to contract in Q4 2008. This was mainly the result of the fact that banks have been unwilling to grant mortgage loans to the population. Similarly, developers are facing crediting difficulties and therefore in 2009 only a few projects will be delivered, generally those which were either delayed from last year or are in an advanced construction state. Still, residential construction output is expected to witness only a mild decrease, due to several governmental programmes for housing construction and the activity on individual housing construction, stimulated by the drop in the price of construction materials.

The segment which will continue to grow in 2009 is civil engineering. “As Romania will face a falloff in GDP in 2009, the government will want to overcome its effects by increasing public spending, and infrastructure is a top destination for state-funded investments.”, says Robert Obetkon. For that, the funding coming mainly from the EU has to be unblocked, by improving and simplifying procedures which have been dragging investments in infrastructure – particularly in the case of road construction, which accounts for roughly half of the civil engineering construction output. Additionally, civil engineering construction can benefit from the lower prices of construction materials compared to the past few years.

This press release is based on information contained in the latest PMR report entitled: “Construction sector in Romania 2009 – Development forecasts for 2009–2011”.

More information on the report:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrpublications.com

About PMR

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). With over 13 years of experience, highly skilled international staff and coverage of over 20 countries, PMR is one of the largest companies of its type in the region.

PMR

ul. Supniewskiego 9, 31-527 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

www.pmrcorporate.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Construction sector in Romania 2009 here

News-ID: 76731 • Views: …

More Releases from PMR Publications

Russian retail market recovered after the economic slowdown

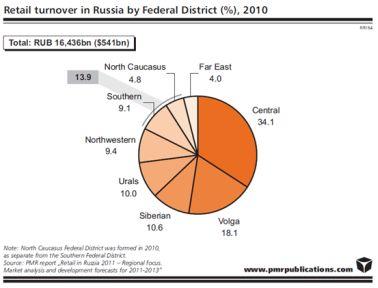

Retail markets in all Russian Federal Districts increased in 2010 by total $80bn

In 2010, Russian retail market recovered after the economic slowdown observed in the previous year and increased by 12.6% to RUB 16.4tr ($541bn). However, the latest PMR report „Retail in Russia 2011 – Regional focus. Market analysis and development forecasts for 2011-2013” shows that particular regional retail markets still reveal differences in their development due to their unique…

Construction output in Poland up by 10% in 2011

The forthcoming year 2011 can be a breakthrough year for the construction industry in terms of construction output. Provided that the winter weather conditions are relatively favourable, the 2011 average annual growth rate can be up to 10%, driven by large civil engineering projects and major improvement in the building construction sector.

According to a report prepared by research company PMR, which is entitled "Construction sector in Poland, H2 2010 -…

Russian construction industry recovers after the downturn

For the first time this decade, in 2009 the construction industry in Russia, which was severely affected by the global economic downturn, shrank in comparison with the preceding year. In the current year, a recovery has begun, prompted by the numerous projects supported or directly funded by the government. In the next few months, growth in the construction industry will be driven by the civil engineering and residential construction subdivisions…

Retail market in Russia to grow by almost 10% in 2010

The growth rate of the Russian retail sector dropped severely last year due to worsening economic conditions, weakening purchasing power growth and the depreciating rouble. As a result, the retail market's value increased by only 5% in 2009 after several years of roughly 25% annual growth. Nevertheless, the situation has improved this year, and the retail market is expected to once again reach double-digit growth rates in subsequent years.

According to…

More Releases for Romania

New crypto exchange platform Romania

www.abarai.ro is revolutionizing how Romanian users access cryptocurrencies with an innovative platform that promises a fully secure, fast, and transparent experience. As the first non-custodial cryptocurrency exchange in the country, Abarai marks a significant shift in the digital financial ecosystem, offering users complete control over their funds and eliminating the risks associated with centralized custody.

Simplified Access to Cryptocurrencies

Whether you're an experienced investor or just starting your crypto journey, Abarai makes…

Telecommunications Market Statistics, Development and Growth 2021-UPC Romania, V …

Telecommunications Market with COVID-19 Impact by Component, Application, Services, and Region- Forecast to 2025

The Telecommunications market size is expected to be growing at a 7.76% CAGR from 2021 to 2025.

According to the new Telecommunications market research report 2021-2025 is easy to understand the detailed analysis. The report published by Market Insights Reports represents the context of current and future trends driving global Telecommunications market growth. The research report is thoroughly…

Romania Agriculture Market, Romania Agriculture Industry, Romania Agriculture Li …

Romania has an agricultural capability of roughly 14.7 million hectares, of that solely 10 million are utilized as tillable land. In November 2008, an evaluation unconcealed that 6.8 million hectares don’t seem to be used. In 2018 Romania was the third biggest agricultural producer of the EU and created the biggest quantity of maize. The most issues encountered by Romanian agriculturists are a scarcity of major investments in agriculture, owing…

Romania Market Overview 2019-2025: Country Intelligence Key players (Vodafone Ro …

HTF Market Intelligence released a new research report of 42 pages on title 'Romania: Country Intelligence Report' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) or Latin America and important players such as Vodafone Romania, Telekom Romania, orange Romania, RCS&RDS (Digi), Lycamobile, UPC romania, Nextgen

Request a sample report @ https://www.htfmarketreport.com/sample-report/871934-romania-country-intelligence-report

Summary

Romania: Country Intelligence Report

"Romania:…

Agrochemicals Market in Romania

ReportsWorldwide has announced the addition of a new report title Romania: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Romania: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

Stada Romania Deploys MediaSoft CRM

Cakovec Croatia – 10 , April 2017 - After several Stada countries who run with Mediasoft CRM solutions, Stada Romania joins the club of satisfied users. Stada Romania had an very comprehensive tender on which many international Pharma CRM vendors participated but at the end Mediasoft won.

The whole implementation started end of 2016 and from 1st of April 2017 Stada Romania started to use Mediasoft CRM by it’s full potential…