Press release

Oil and Gas Risk Management Market Outlook 2020

No industry is devoid of risk and the Oil and Gas industry is not an exception either. Companies invested in the business of oil and gas face their own unique set of risks, be it natural, manmade or inherent in their daily operations. Risk management solutions for the oil and gas business vary in general with the environment of business, the stakeholders and the nature of operations. Efficient risk management solutions not only need to be tailor made according to the industry but also to the specific business environment being faced. Project risk management is an integral part of any project in the oil and gas business. Companies providing risk management services need not only identify major risks in the business but also communicate risk management solutions in an effective manner. Risks when not managed diligently can have dire consequences on any Oil and Gas Company’s balance sheet.The oil and gas business is capital intensive in nature and operates with a large asset base and in highly risky environments. This drives the need for such companies to effectively manage their catastrophic risk portfolio. These market players need to continuously strive to optimize and strengthen their risk management models. General risk management models comprise of two primary phases namely the initial risk management and residual risk management. As the name suggests initial risk management is carried out initially to identify all risks associated comprehensively. Risks remaining after identifying initial risks are the residual risks. The residual risks are generally those having the potential to cause very high economic loss to the company and must be handled with extreme care and diligence. The types of risk management can be segmented as initial risks and residual risks.

Browse The Report: http://www.transparencymarketresearch.com/oil-gas-risk-management.html

Market players in the oil and gas business also face multiple exposures to risk. These risk exposures generally include exposures to business interruption, exposures to damage of assets, exposures to damages caused by third parties, exposure to people harm and finally exposures to environmental pollution. Management of all these exposures benefits the firm in many ways through adoption of the prevention before cure philosophy. Robust risk management not only increases the level of control oil and gas companies exercise over their business environment but also increases flexibility. An effective risk allocation between parties reduces risk perception of investors and results in cheaper financing of projects as well. Some of the risk management services include Hazard Identification and Evaluation, Pipeline Risk Analysis, Security Threat Management, Facility Site Evaluation, Blast Resistant Design & Construction Management, Quantitative Risk Analysis and Catastrophe Evacuation Modeling among others. Risk management can be applied for both onshore and offshore oil and gas facilities.

Make an Enquiry @ http://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=2530

The global market for oil and gas risk management is poised for growth in the future. This is driven by the increased sensitivity of investors towards risk management and the dire consequence to the environment in the event of major risks being realized. Catastrophes like oil spills among others not only harm the environment but also cost the oil and gas companies billions of dollars in punitive damages. The major focus of these oil and gas giants is to effectively allocate risks to parties involved and minimize chances of occurrence which require strong risk management procedures. The regional market segmentation for these risk management services can be done as North America, Asia-Pacific, Middle East and Africa and Europe. Areas where exploration activities are the most concentrated are likely to require such services the most. Some of the major players dealing in such services include ABS Consulting, Tullow Oil Plc., Intertek Group Plc. and DNV GL AS. among others.

Transparency Market Research (TMR) is a next-generation provider of syndicated research, customized research, and consulting services. TMR’s global and regional market intelligence coverage includes industries such as pharmaceutical, chemicals and materials, technology and media, food and beverages, and consumer goods, among others. Each TMR research report provides clients with a 360-degree view of the market with statistical forecasts, competitive landscape, detailed segmentation, key trends, and strategic recommendations

Transparency Market Research

90 Sate Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Oil and Gas Risk Management Market Outlook 2020 here

News-ID: 604234 • Views: …

More Releases from Transparency Market Research

RF Chip Inductor Market Size to Reach over USD 1.8 billion by 2031 - Transparenc …

RF Chip Inductor Market are essential components in various electronic devices, providing inductance and functioning as filters, oscillators, and transformers. They play a crucial role in ensuring the efficiency and performance of RF circuits. With the rapid advancement in telecommunications, consumer electronics, and automotive industries, the demand for RF chip inductors has seen a significant rise. These components are integral in applications such as smartphones, IoT devices, and automotive electronics,…

Solid Tires Market Expected to Witness Impressive Growth at a 8.1% CAGR by 2031

The latest research study released by Transparency Market Research on "Solid Tires Market Forecast to 2023-2031 ″ research provides accurate economic, global, and country-level predictions and analyses.

Solid Tires market is estimated to attain a valuation of US$ 760.0 Mn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 8.1% during…

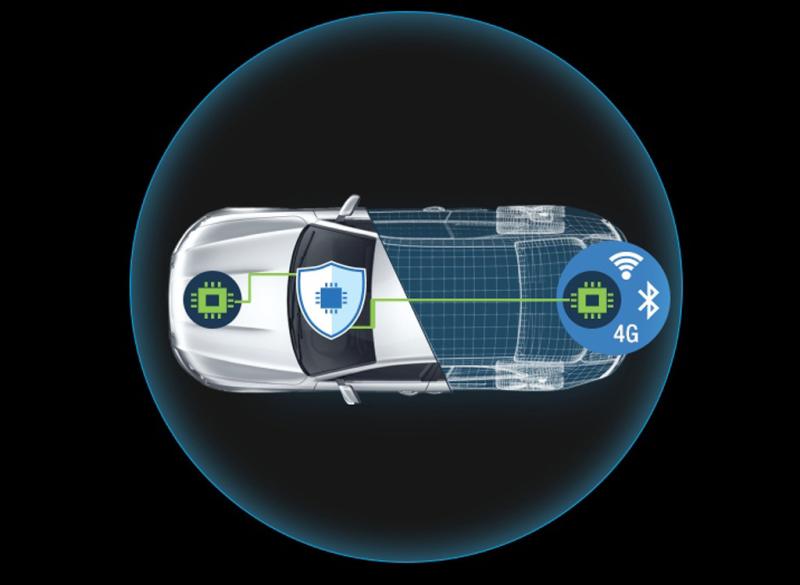

Automotive Cyber security Market Sales Estimated to Hit USD 10.5 Billion by 2031 …

The latest research study released by Transparency Market Research on "𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐲𝐛𝐞𝐫 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Automotive Cyber security industry, as…

Ready-mix Concrete Market to Witness Exponential Growth with a CAGR of 6.1% from …

The latest research study released by Transparency Market Research on "𝐑𝐞𝐚𝐝𝐲-𝐦𝐢𝐱 𝐂𝐨𝐧𝐜𝐫𝐞𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Ready-mix Concrete industry, as well as…

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…