Press release

Outsourced Semiconductor Assembly and Test Market Trends Shaping AI, Automotive, and 5G Chips | DataM Intelligence

The Outsourced Semiconductor Assembly and Test (OSAT) Market represents a critical segment of the global semiconductor value chain, focusing on back-end manufacturing services such as semiconductor packaging, assembly, wafer bumping, burn-in, and final testing. As chip architectures grow increasingly complex and demand for high-performance devices accelerates, OSAT providers have become indispensable partners to fabless semiconductor companies and integrated device manufacturers (IDMs). By outsourcing assembly and testing processes, semiconductor firms can reduce capital expenditure, improve operational efficiency, and accelerate time-to-market while focusing on chip design and innovation.According to DataM Intelligence, the Outsourced Semiconductor Assembly and Test Market is estimated to grow at a CAGR of 3.6% during the forecast period 2024-2031. The market's steady growth trajectory is supported by expanding semiconductor demand across consumer electronics, automotive electronics, industrial automation, 5G infrastructure, artificial intelligence (AI), and high-performance computing (HPC). The advanced packaging segment leads the market due to growing demand for compact, power-efficient, and high-speed semiconductor devices. Geographically, Asia-Pacific dominates the OSAT market, driven by strong semiconductor manufacturing clusters, cost advantages, government incentives, and proximity to major wafer fabrication facilities.

The evolution from traditional wire bonding to advanced packaging technologies such as system-in-package (SiP), flip-chip, fan-out wafer-level packaging (FOWLP), and 2.5D/3D integration has significantly transformed the OSAT landscape. As semiconductor miniaturization and heterogeneous integration continue to gain traction, OSAT companies are investing heavily in advanced testing capabilities, automation, and AI-driven quality inspection systems. The industry is increasingly characterized by strategic collaborations, technology upgrades, and geographic expansion to meet rising global demand.

Get a Exclusive Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/outsourced-semiconductor-assembly-and-test-market?rk

Key Highlights from the Report:

➤ The Outsourced Semiconductor Assembly and Test Market is projected to grow at a CAGR of 3.6% during 2024-2031.

➤ Advanced packaging technologies account for the largest revenue share in the OSAT industry.

➤ Asia-Pacific leads the market due to strong semiconductor ecosystems and cost competitiveness.

➤ Automotive electronics and 5G applications are emerging as high-growth segments.

➤ Increasing fabless semiconductor production is driving outsourcing demand.

➤ Strategic investments in automation and AI-based defect detection are enhancing operational efficiency.

Recent Developments:

October 2025: ASE Technology Holding expanded its advanced packaging capacity for 2.5D and 3D IC integration to support AI accelerators and high-performance computing (HPC) chipsets. The investment strengthens its position in heterogeneous integration and chiplet-based architectures, addressing rising demand from data centers and generative AI applications.

September 2025: Amkor Technology announced the development of next-generation wafer-level packaging (WLP) solutions optimized for automotive ADAS and electric vehicle power semiconductors. The move aligns with growing semiconductor content in EV platforms and autonomous driving systems.

August 2025: JCET Group introduced high-density fan-out (HDFO) packaging platforms for 5G and AIoT devices. The innovation focuses on miniaturization, improved thermal management, and enhanced electrical performance for next-generation consumer electronics.

July 2025: Powertech Technology Inc. expanded its memory testing capabilities for advanced DRAM and HBM products, supporting increasing requirements from AI servers and cloud infrastructure providers.

Mergers & Acquisitions:

November 2025: Tongfu Microelectronics completed the acquisition of a specialty automotive semiconductor packaging firm to strengthen its presence in power modules and EV traction systems.

September 2025: Intel expanded strategic OSAT collaborations to enhance advanced packaging ecosystems, focusing on chiplet integration and foundry services under its IDM 2.0 strategy.

June 2025: ChipMOS Technologies acquired a regional testing facility in Southeast Asia to increase capacity for display driver IC and memory testing services.

May 2025: Siliconware Precision Industries Co., Ltd. invested in AI-driven inspection and smart factory automation technologies to improve yield rates and reduce time-to-market for advanced semiconductor packages.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=outsourced-semiconductor-assembly-and-test-market?rk

Competitive Landscape:

ASE Technology Holding Co., Ltd

Amkor Technology, Inc.

Powertech Technology Inc.

ChipMOS TECHNOLOGIES INC.

King Yuan Electronics Co Ltd.

Formosa Advanced Technologies Co., Ltd.

Jiangsu Changjiang Electronics Technology Co., Ltd.

UTAC Holdings Ltd.

Lingsen Precision Industries Ltd.

TongFu Microelectronics

The competitive landscape of the Outsourced Semiconductor Assembly and Test (OSAT) market is moderately consolidated, with a few large players accounting for a significant share of global revenue, particularly in advanced packaging and high-volume testing services. Market competition is primarily driven by technological capabilities, pricing efficiency, geographic presence, production scale, and long-term partnerships with fabless semiconductor companies and integrated device manufacturers (IDMs). As semiconductor complexity increases with AI, 5G, automotive electronics, and high-performance computing, OSAT providers are heavily investing in advanced packaging technologies and automation to maintain competitive advantage.

ASE Technology Holding Co., Ltd. is widely recognized as the global market leader, offering a comprehensive portfolio of packaging and testing services. The company benefits from strong economies of scale, advanced system-in-package (SiP) capabilities, and deep integration across the semiconductor supply chain. Its broad customer base across consumer electronics, automotive, and communications segments strengthens its competitive positioning. Continuous R&D investment in heterogeneous integration and 2.5D/3D packaging further reinforces its leadership.

Amkor Technology, Inc. remains one of the most prominent global OSAT providers, with a strong presence in North America and Asia-Pacific. The company focuses on advanced packaging solutions such as flip-chip, wafer-level packaging, and BGA technologies. Amkor has built long-standing partnerships with leading semiconductor designers and automotive electronics suppliers. Its diversified application exposure across consumer electronics, automotive, and networking supports revenue stability.

JCET Group Co., Ltd. has rapidly expanded its footprint, supported by China's push toward semiconductor self-sufficiency. The company has strengthened its advanced packaging capabilities and strategic alliances with domestic and international chipmakers. JCET's competitive edge lies in cost efficiency, growing R&D capabilities, and strong government-backed ecosystem support.

Powertech Technology Inc. and ChipMOS Technologies Inc. are key mid-to-large tier players specializing in memory packaging and testing services. Their focus on niche segments such as DRAM, NAND, and display driver IC testing allows them to maintain strong client relationships and technical expertise. Meanwhile, Tongfu Microelectronics Co., Ltd. and Hana Micron Inc. are expanding aggressively in advanced packaging and automotive semiconductor applications.

Competitive dynamics in the OSAT market are shaped by ongoing capacity expansions in Asia-Pacific, particularly Taiwan, China, and Southeast Asia, alongside strategic collaborations with foundries and fabless chip designers. Companies are increasingly focusing on high-value advanced packaging solutions, including system-in-package (SiP) and 3D integration, to capture growth opportunities in AI accelerators, electric vehicles, and 5G infrastructure. As semiconductor outsourcing continues to rise, players that combine technological innovation, operational efficiency, and strong customer ecosystems are expected to maintain leadership throughout the 2024-2031 forecast period.

Market Segmentation

By Service

The market is segmented into Packaging 65% and Testing 35%, with packaging dominating due to rising demand for advanced packaging technologies supporting miniaturization and high-performance chips. Growth in AI processors, 5G chipsets, and automotive semiconductors drives advanced packaging demand. Testing services hold a significant share due to increasing complexity of integrated circuits requiring reliability, performance, and quality validation before deployment.

By Types of Packaging

The market includes Ball Grid Array (BGA) 30%, Chip-Scale Package (CSP) 25%, Stacked Die 18%, Multi-Package 15%, and Quad & Dual Packages 12%, with BGA leading due to its superior electrical performance and thermal efficiency in high-density devices. CSP is witnessing strong growth driven by compact consumer electronics and mobile devices. Stacked die and multi-package solutions are expanding rapidly due to demand for system-in-package (SiP) and heterogeneous integration. Traditional quad and dual packages continue to serve legacy and cost-sensitive applications.

By Application

The market is segmented into Consumer Electronics 40%, Automotive 25%, Networking & Communication 20%, and Others 15%, with consumer electronics dominating due to high demand for smartphones, laptops, wearables, and IoT devices. Automotive applications are growing significantly driven by electric vehicles (EVs), ADAS, and in-vehicle infotainment systems. Networking and communication benefit from 5G infrastructure expansion and data center growth. Industrial and healthcare electronics contribute to the "others" segment.

Regional Analysis

Asia Pacific - 55% Share

Asia Pacific leads with 55% share due to strong semiconductor manufacturing ecosystems in China, Taiwan, South Korea, Japan, and Southeast Asia. The presence of major OSAT providers and large consumer electronics production hubs drives regional dominance. Government incentives supporting semiconductor self-sufficiency further strengthen growth.

North America - 18% Share

North America accounts for 18% share, supported by advanced chip design companies and increasing investments in domestic semiconductor manufacturing. Growth in AI, automotive electronics, and defense applications fuels demand.

Europe - 15% Share

Europe holds 15% share, driven by strong automotive semiconductor demand and industrial automation growth in Germany, France, and the Netherlands. EU semiconductor initiatives support regional expansion.

Latin America - 7% Share

Latin America captures 7% share, supported by expanding electronics assembly operations and growing telecom infrastructure in Brazil and Mexico.

Middle East & Africa - 5% Share

The Middle East & Africa region holds 5% share, driven by increasing digital infrastructure development and smart city initiatives across GCC countries.

Market Dynamics

Market Drivers

One of the primary drivers of the Outsourced Semiconductor Assembly and Test Market is the continued expansion of semiconductor applications across diverse industries. The proliferation of AI-enabled devices, 5G infrastructure, IoT sensors, and electric vehicles has significantly increased the demand for high-performance chips. Advanced packaging solutions are essential to meeting power, size, and speed requirements, thereby boosting demand for specialized OSAT services.

The growing popularity of the fabless semiconductor model also fuels outsourcing. By focusing on design and innovation while delegating manufacturing processes to OSAT providers, companies can reduce operational risks and capital investments. Furthermore, the push for chiplet architectures and heterogeneous integration necessitates advanced packaging and precise testing capabilities, strengthening the role of OSAT firms.

Market Restraints

Despite positive growth prospects, the market faces certain challenges. The high capital expenditure required for advanced packaging equipment and cleanroom facilities can limit the entry of new players. Additionally, semiconductor industry cyclicality can create demand fluctuations, impacting OSAT revenue streams.

Geopolitical tensions and supply chain disruptions also pose risks, particularly given the industry's heavy concentration in Asia-Pacific. Maintaining high yield rates and ensuring consistent quality amid increasing chip complexity remains another operational challenge.

Market Opportunities

Emerging technologies such as AI accelerators, high-bandwidth memory (HBM), autonomous vehicles, and edge computing present substantial opportunities for OSAT providers. The rise of chiplet-based designs and 3D packaging opens new revenue streams for companies offering specialized assembly and testing capabilities.

Regional diversification initiatives in North America and Europe provide opportunities for expansion beyond traditional Asia-Pacific hubs. Additionally, sustainability-focused manufacturing practices and eco-friendly packaging materials can serve as competitive differentiators in the evolving semiconductor landscape.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/outsourced-semiconductor-assembly-and-test-market?rk

Reasons to Buy the Report

✔ Comprehensive analysis of the global Outsourced Semiconductor Assembly and Test Market with accurate forecasts.

✔ Detailed segmentation insights across service type, packaging technology, and applications.

✔ In-depth regional outlook covering Asia-Pacific, North America, and Europe.

✔ Competitive landscape analysis featuring leading OSAT companies.

✔ Strategic evaluation of market drivers, restraints, and growth opportunities.

Frequently Asked Questions (FAQs)

◆ How big is the global Outsourced Semiconductor Assembly and Test Market?

◆ What is the projected CAGR of the Outsourced Semiconductor Assembly and Test (OSAT) Market from 2024 to 2031?

◆ Who are the key players operating in the OSAT market?

◆ Which region dominates the global semiconductor assembly and test services industry?

◆ What factors are driving growth in the Outsourced Semiconductor Assembly and Test Market?

Conclusion

The Outsourced Semiconductor Assembly and Test (OSAT) Market remains a vital pillar of the semiconductor industry, supporting the production of increasingly complex and high-performance chips. With a projected CAGR of 3.6% during 2024-2031, the market demonstrates steady growth driven by advanced packaging demand, AI applications, 5G deployment, and automotive electronics expansion.

Asia-Pacific continues to dominate due to its strong semiconductor ecosystem, though regional diversification efforts may reshape the competitive landscape. As chip complexity intensifies and heterogeneous integration becomes mainstream, OSAT providers that invest in advanced technologies, automation, and strategic collaborations will be best positioned to capitalize on emerging opportunities in this evolving market.

Related Reports:

Power Semiconductor Market

https://www.datamintelligence.com/download-sample/power-semiconductor-market?rk

Automotive Semiconductor Market

https://www.datamintelligence.com/download-sample/automotive-semiconductor-market?rk

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Outsourced Semiconductor Assembly and Test Market Trends Shaping AI, Automotive, and 5G Chips | DataM Intelligence here

News-ID: 4397346 • Views: …

More Releases from DataM Intelligence 4market Research LLP

Software-as-a-Service (SaaS) Market to Reach US$ 424.3 Billion by 2029 at 14.1% …

The Software-as-a-Service (SaaS) Market reached approximately US$ 195.6 billion in 2024 and is expected to grow to around US$ 424.3 billion by 2029, expanding at a CAGR of about 14.1% from 2025 to 2029 as enterprises worldwide accelerate cloud adoption to improve agility, scalability, and operational efficiency.

Growth is supported by increasing demand across key applications such as customer relationship management (CRM), enterprise resource planning (ERP), human capital management (HCM), collaboration…

Cyber Security Market to Reach US$ 555.9 Billion by 2032 at 12% CAGR, Led by Nor …

The Cyber Security Market reached approximately US$ 224.6 billion in 2024 and is expected to grow to around US$ 555.9 billion by 2032, expanding at a CAGR of about 12% from 2025 to 2032 as organizations globally step up investments in advanced security technologies to defend against escalating cyber threats and protect critical digital infrastructure.

Growth is supported by increasing demand across key segments such as network security, cloud security, endpoint…

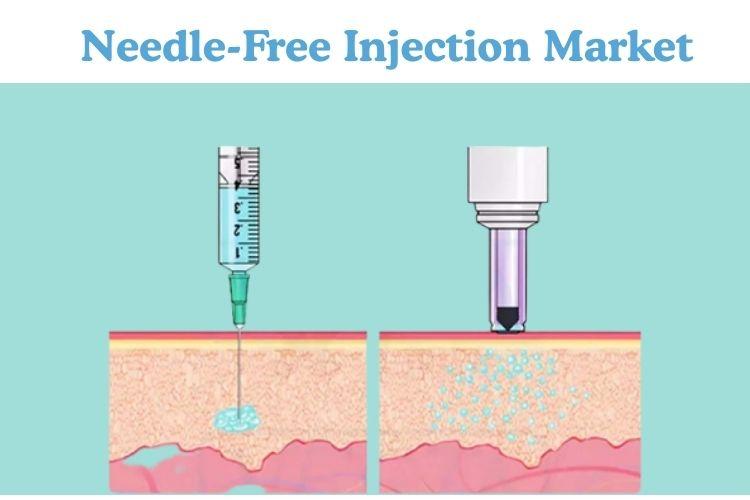

Needle-Free Injection Market Size, Share & Forecast 2024-2031 | Market Dynamics: …

The Needle-Free Injection Market is witnessing significant momentum as healthcare providers, pharmaceutical companies, and public health agencies increasingly shift toward safer and more patient-friendly drug delivery technologies. Needle-free injection systems, often referred to as needleless injectors or jet injectors, deliver medications through a high-pressure stream that penetrates the skin without the use of conventional hypodermic needles.

These devices are gaining strong traction due to their ability to minimize needle-stick injuries,…

Nutraceutical Ingredients Market to Reach USD 327.5 Billion by 2030 at 8.4% CAGR …

The Global Nutraceutical Ingredients Market reached USD 174.5 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 327.5 billion by 2030. the global nutraceutical ingredients market is expected to exhibit a CAGR of 8.4% from 2025 to 2032 as demand for health-boosting dietary ingredients continues to rise globally.

Growth is supported by increasing demand across key segments such as vitamins & minerals, probiotics & prebiotics,…

More Releases for OSAT

Advanced Electronics Surge: Fueling Industry Growth in OSAT Services

The demand for advanced electronic devices is skyrocketing, prompting significant advancements and growth in the Outsourced Semiconductor Assembly & Test Services (OSAT) industry. As technology continues to evolve, there is an insatiable appetite for smarter, faster, and more capable gadgets. This trend is not only captivating consumers but also transforming how the semiconductor industry operates.

Technological Fervor Driving the Demand

Today's consumers are tech-savvy, seeking devices that can perform multiple functions efficiently.…

Market Insight-Global OSAT Market Overview 2024

Global OSAT Market Was Valued at USD 36.87 Billion in 2023 and is Expected to Reach USD 53.47 Billion by the End of 2030, Growing at a CAGR of 5.58% Between 2024 and 2030.- Bossonresearch.com

Outsourced Semiconductor Assembly and Test (OSAT) refers to companies that provide semiconductor assembly, packaging, and testing services to integrated circuit (IC) manufacturers. These services include the assembly of individual semiconductor components into packaged devices, such as…

Outsourced Semiconductor Assembly and Test (OSAT) Market Report & Forecast 2023- …

The global Outsourced Semiconductor Assembly and Test (OSAT) revenue was US$ 59770 million in 2022 and is forecast to a readjusted size of US$ 85590 million by 2029 with a CAGR of 5.2% during the review period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-34K15635/Global_and_India_Outsourced_Semiconductor_Assembly_and_Test_OSAT_Market_Report_Forecast_2023_2029

Global Outsourced Semiconductor Assembly and Test (OSAT) key players include ASE Group, Amkor, JECT, SPIL, etc. Global top four manufacturers hold a share over 30%.

United States is the largest market,…

Global and India Outsourced Semiconductor Assembly and Test (OSAT) Market Size

Global and India Outsourced Semiconductor Assembly and Test (OSAT) Market Size

The global Outsourced Semiconductor Assembly and Test (OSAT) revenue was US$ 59770 million in 2022 and is forecast to a readjusted size of US$ 85590 million by 2029 with a CAGR of 5.2% during the review period (2023-2029).

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-34K15635/Global_and_India_Outsourced_Semiconductor_Assembly_and_Test_OSAT_Market_Report_Forecast_2023_2029

Report Scope

Outsourced Semiconductor Assembly and Test (OSAT) market is segmented in regional and country level, by players, by Type and by…

Outsourced Semiconductor Assembly And Test (OSAT) Market

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- Outsourced Semiconductor Assembly And Test (OSAT) Market was valued at USD 30,679.0 Million in 2023 and is projected to reach USD 44,047.6 Million by 2030, growing at a CAGR of 4.65% from 2024 to 2030.

The Outsourced Semiconductor Assembly and Test (OSAT) market presents substantial opportunities for growth and expansion. As the semiconductor industry continues to evolve, OSAT companies play a pivotal role in the supply chain…

OSAT Market 2023 Driving Factors Forecast Research 2029

Outsourced Semiconductor Assembly and Test Services (OSAT) market is anticipated to grow at a considerable CAGR of 8.4% during the forecast period. The increasing usage of OSAT in different industrial vertical is a key factor driving the growth of the global OSAT market. The considerable rise in the number of connected devices and consumer electronics, and the emphasis on quality improvement and end-to-end testing solutions by companies is a major…