Press release

Cyber Security Market to Reach US$ 555.9 Billion by 2032 at 12% CAGR, Led by North America (35% Share) and Key Players including Palo Alto Networks, Inc., Fortinet, Inc., and Microsoft Corporation

The Cyber Security Market reached approximately US$ 224.6 billion in 2024 and is expected to grow to around US$ 555.9 billion by 2032, expanding at a CAGR of about 12% from 2025 to 2032 as organizations globally step up investments in advanced security technologies to defend against escalating cyber threats and protect critical digital infrastructure.Growth is supported by increasing demand across key segments such as network security, cloud security, endpoint protection, AI-driven threat detection, and identity & access management, driven by the rising frequency and sophistication of cyberattacks, rapid digital transformation, and expansion of connected devices. Adoption of real-time monitoring, machine learning-based analytics, and zero-trust architectures further accelerates market expansion by enhancing threat visibility and automated response capabilities. Additionally, stringent regulatory compliance requirements, growing awareness of data privacy, and investment in cybersecurity frameworks across sectors such as BFSI, healthcare, government, and telecommunications continue to propel broad adoption of cyber security solutions and services worldwide.

Download your exclusive sample report today (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/cyber-security-market?sindhuri

Cyber Security Market: Competitive Intelligence

Palo Alto Networks, Inc., Fortinet, Inc., IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Check Point Software Technologies Ltd., CrowdStrike Holdings, Inc., Proofpoint, Inc., Sophos Ltd., and others.

The Cyber Security Market is strongly driven by leading cybersecurity solution and technology providers such as Palo Alto Networks, Fortinet, IBM, Microsoft, and Cisco, who deliver comprehensive security platforms including next-generation firewalls, endpoint protection, cloud security, identity and access management (IAM), and threat intelligence services that help organizations defend against escalating cyber threats and maintain data, network, and application integrity.

Increasing volume and sophistication of cyberattacks, rapid digital transformation, widespread cloud adoption, and stringent regulatory compliance requirements (such as GDPR and CCPA) are key factors fueling market demand. The rise of AI-driven attacks and the need for zero-trust architectures, real-time monitoring, and automated response mechanisms are further accelerating investment in advanced cybersecurity solutions across enterprise, government, healthcare, and financial sectors worldwide.

These companies' complementary strengths including AI-enabled threat detection and response from Palo Alto Networks and CrowdStrike; integrated network and cloud security from Fortinet, Cisco, and Microsoft; global threat intelligence and analytics from IBM; robust firewall and IAM capabilities from Check Point; and comprehensive managed security services from Proofpoint and Sophos enhance competitive positioning across the cybersecurity landscape. Strategic focus areas include expansion of cloud-native security services, adoption of zero-trust security frameworks, real-time anomaly detection using machine learning, expansion of managed detection and response (MDR) offerings, and strategic partnerships with cloud providers, regulatory bodies, and technology integrators to address evolving cyber risks and compliance mandates.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/cyber-security-market?sindhuri

Recent Key Developments - United States & North America

✅ June 2025: Palo Alto Networks expanded its AI-driven security operations platform with advanced threat detection and autonomous response capabilities, helping enterprises combat sophisticated ransomware and cloud-based attacks.

✅ May 2025: CrowdStrike enhanced its Falcon platform with generative AI-powered threat intelligence and identity protection features, strengthening endpoint and cloud workload security across North America.

✅ 2025: U.S. enterprises increased cybersecurity spending amid rising ransomware incidents, zero-day vulnerabilities, and stricter regulatory compliance requirements across financial services, healthcare, and critical infrastructure sectors.

Recent Key Developments - Japan & Asia-Pacific

✅ July 2025: Trend Micro launched next-generation XDR (Extended Detection and Response) solutions in Japan and Southeast Asia, integrating AI-based anomaly detection and cloud-native security controls.

✅ Early 2026: NTT Security introduced managed security services with advanced SOC automation and real-time threat intelligence analytics across Asia-Pacific enterprises.

✅ 2025: Governments and enterprises across China, India, Australia, and South Korea accelerated cybersecurity modernization programs, focusing on critical infrastructure protection, 5G network security, and cloud resilience.

Recent Key Developments - Product & Technology Innovation

✅ 2025: AI & Automation in Threat Detection: Security platforms increasingly leverage machine learning and generative AI for proactive threat hunting, automated incident response, and predictive risk assessment.

✅ Zero Trust Architecture Expansion: Adoption of zero trust security frameworks strengthened identity verification, network segmentation, and continuous authentication across hybrid and remote work environments.

✅ Cloud & OT Security Integration: Next-generation cybersecurity solutions now provide unified visibility across cloud environments, IoT devices, and operational technology (OT) systems to mitigate emerging attack surfaces.

✅ 1. M&A / Strategic Activity

Major acquisitions and consolidation shaping the global cybersecurity landscape:

Cisco Systems - Acquisition of Splunk

Cisco completed its acquisition of Splunk, strengthening its capabilities in security analytics, threat detection, and observability. This move enhances Cisco's AI-driven security and SIEM (Security Information and Event Management) offerings.

Palo Alto Networks - Platform expansion strategy

Palo Alto Networks continued its acquisition-driven strategy by integrating cloud security and AI-based threat intelligence startups into its Prisma and Cortex platforms to deliver unified security operations.

Thoma Bravo - Cybersecurity portfolio expansion

Thoma Bravo increased investments in cybersecurity firms, focusing on identity management, endpoint protection, and SaaS security platforms, reflecting strong investor confidence in the sector.

IBM - Security consulting and hybrid cloud focus

IBM strengthened its cybersecurity consulting capabilities within its hybrid cloud and AI portfolio, integrating threat intelligence and zero-trust services for enterprise clients.

✅ 2. New Product Launches & Technology Developments

Recent innovations enhancing enterprise cyber resilience:

Microsoft - AI-powered Security Copilot expansion

Microsoft expanded its AI-driven Security Copilot capabilities across Microsoft Defender and Sentinel platforms, enabling automated threat investigation, response orchestration, and predictive analytics.

CrowdStrike - Falcon platform enhancements

CrowdStrike introduced advanced identity threat detection and cloud workload protection modules within its Falcon platform, leveraging AI and behavioral analytics.

Fortinet - Unified SASE solutions

Fortinet launched enhanced Secure Access Service Edge (SASE) solutions integrating SD-WAN, firewall-as-a-service, and zero-trust network access (ZTNA).

Check Point Software Technologies - AI-driven prevention technologies

Check Point introduced AI-based threat prevention systems aimed at proactively stopping ransomware and advanced persistent threats.

✅ 3. R&D & Technological Advancements

AI & Machine Learning in Threat Detection

Cybersecurity vendors are investing heavily in generative AI and machine learning models to improve anomaly detection, automate incident response, and reduce false positives in security operations centers (SOCs).

Zero-Trust Architecture Adoption

Organizations are transitioning toward zero-trust frameworks, emphasizing identity verification, least-privilege access, and continuous authentication across hybrid work environments.

Cloud-Native & Multi-Cloud Security

With rapid cloud adoption, companies are developing CNAPP (Cloud-Native Application Protection Platform) solutions to secure containers, APIs, and Kubernetes environments.

Quantum-Resistant Cryptography

R&D efforts are underway to develop post-quantum cryptographic algorithms to future-proof enterprise data against quantum computing threats.

Market Drivers & Emerging Trends

» Rising Ransomware & Nation-State Attacks - Increasing frequency and sophistication of cyberattacks are driving enterprise security investments.

» Cloud & Remote Work Expansion - Hybrid work models require secure remote access and endpoint protection solutions.

» Regulatory Compliance & Data Privacy Laws - GDPR, CCPA, and global data protection mandates are accelerating adoption of compliance-focused cybersecurity services.

» AI Integration Across Security Stacks - Automation and AI-driven security analytics are reducing operational burdens and improving response times.

» SME Digital Transformation - Small and mid-sized enterprises are increasingly adopting managed security services (MSSP) solutions.

Segments Covered in the Cybersecurity Market:

By Component

The market is segmented into solutions (65%) and services (35%).Solutions dominate due to rising adoption of firewalls, endpoint protection, identity & access management (IAM), encryption, and threat intelligence platforms. Organizations are investing heavily in advanced security software to prevent cyberattacks and data breaches. Services, including consulting, system integration, managed security services (MSS), and support & maintenance, are growing rapidly as enterprises seek expert-driven security management and 24/7 threat monitoring.

By Deployment

Deployment models include cloud-based (55%) and on-premises (45%).Cloud-based deployment leads due to rapid digital transformation, remote work adoption, and increasing migration to cloud infrastructure. Cloud security solutions provide scalability, real-time monitoring, and cost efficiency. On-premises deployment remains significant among government agencies, financial institutions, and large enterprises requiring high data control and regulatory compliance.

By Security Type

Security types include network security (25%), endpoint security (20%), application security (15%), cloud security (15%), data security (10%), identity & access management (10%), and others (5%).Network security dominates due to the need to secure enterprise networks from malware, ransomware, and unauthorized access. Endpoint and cloud security are witnessing rapid growth as remote work and cloud adoption expand. IAM and data security solutions are increasingly critical for regulatory compliance and zero-trust security frameworks.

By Enterprise Size

Enterprise sizes include large enterprises (60%) and small & medium enterprises (SMEs) (40%).Large enterprises dominate due to higher IT budgets, complex infrastructure, and increased exposure to cyber threats. SMEs are increasingly investing in cybersecurity solutions due to rising cyberattacks, ransomware incidents, and affordable cloud-based security offerings tailored to smaller organizations.

By End-User

End-users comprise BFSI (20%), IT & telecom (18%), government & defense (15%), healthcare (12%), retail & e-commerce (10%), manufacturing (10%), and others (15%).The BFSI sector leads due to high sensitivity of financial data and strict regulatory requirements. IT & telecom companies invest heavily in advanced threat detection systems. Government & defense prioritize national security, while healthcare and retail sectors focus on protecting sensitive customer and patient information. Growing cyber threats across industries drive adoption.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=cyber-security-market?sindhuri

Regional Analysis

North America - 35% Share

North America leads due to high cybersecurity spending, strong regulatory frameworks, and presence of major cybersecurity vendors in the U.S. and Canada. Increasing ransomware attacks and data protection regulations fuel market growth.

Europe - 25% Share

Europe holds a significant share driven by GDPR compliance, rising cybercrime incidents, and digital transformation initiatives across Germany, the U.K., and France.

Asia-Pacific - 28% Share

Asia-Pacific is experiencing rapid growth due to increasing digitalization, expanding internet penetration, and rising cyber threats in China, India, Japan, and Southeast Asia. Government initiatives supporting cybersecurity infrastructure accelerate regional growth.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?sindhuri

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Security Market to Reach US$ 555.9 Billion by 2032 at 12% CAGR, Led by North America (35% Share) and Key Players including Palo Alto Networks, Inc., Fortinet, Inc., and Microsoft Corporation here

News-ID: 4397314 • Views: …

More Releases from DataM Intelligence 4Market Research LLP

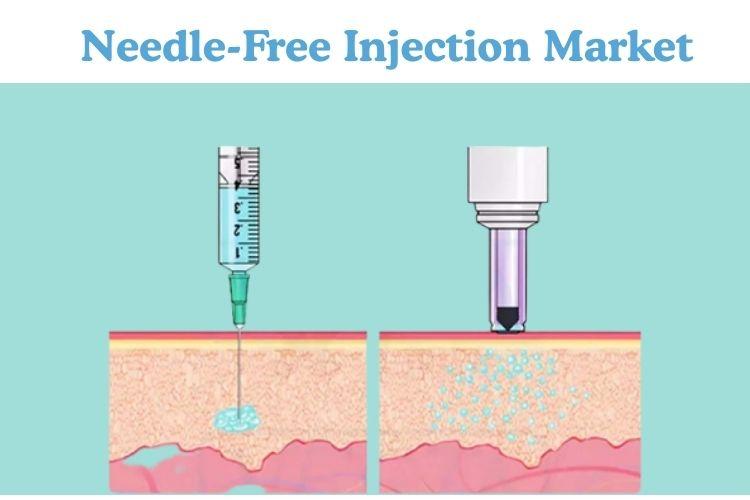

Needle-Free Injection Market Size, Share & Forecast 2024-2031 | Market Dynamics: …

The Needle-Free Injection Market is witnessing significant momentum as healthcare providers, pharmaceutical companies, and public health agencies increasingly shift toward safer and more patient-friendly drug delivery technologies. Needle-free injection systems, often referred to as needleless injectors or jet injectors, deliver medications through a high-pressure stream that penetrates the skin without the use of conventional hypodermic needles.

These devices are gaining strong traction due to their ability to minimize needle-stick injuries,…

Nutraceutical Ingredients Market to Reach USD 327.5 Billion by 2030 at 8.4% CAGR …

The Global Nutraceutical Ingredients Market reached USD 174.5 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 327.5 billion by 2030. the global nutraceutical ingredients market is expected to exhibit a CAGR of 8.4% from 2025 to 2032 as demand for health-boosting dietary ingredients continues to rise globally.

Growth is supported by increasing demand across key segments such as vitamins & minerals, probiotics & prebiotics,…

Food Safety Testing Market to Reach US$40.1 Billion by 2029 at 9.0% CAGR, Led by …

The Food Safety Testing Market reached approximately US$ 24.5 billion in 2024 and is expected to grow to around US$ 40.1billion by 2029, expanding at a CAGR of about 9.0% from 2025 to 2029 as food industry stakeholders and regulatory bodies intensify efforts to ensure product safety, quality, and compliance across global supply chains.

Growth is supported by increasing demand across key segments such as microbiological testing, chemical residue analysis, allergen…

Food Ingredients Market to Reach US$538.68 Billion by 2032 at 5.45% CAGR, Driven …

The Food Ingredients Market Size reached US$ 352.34 billion in 2024 and is expected to reach US$ 538.68 billion by 2032, growing with a CAGR of 5.45% from 2025 to 2032. as food and beverage manufacturers intensify investments in value‐added and functional ingredients to meet evolving consumer preferences and regulatory standards.

Growth is supported by increasing demand across key categories such as flavors & fragrances, sweeteners, proteins & amino acids, emulsifiers,…

More Releases for Security

Aerospace Cyber Security Market : Network security, Wireless security, Cloud sec …

According to a new report published by Allied Market Research, titled, "Aerospace Cyber Security Market," The aerospace cyber security market was valued at $39.7 billion in 2021, and is estimated to reach $92.0 billion by 2031, growing at a CAGR of 9.0% from 2022 to 2031.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 : https://www.alliedmarketresearch.com/request-sample/9433

Aerospace cybersecurity is a security driven technology which is dedicated towards the safety & security of aircrafts, spacecrafts and drones…

Healthcare Cyber Security Market by Type (Service and Solution), Security (Appli …

Healthcare Cyber Security Market: 2023

The global Healthcare Cyber Security Market size was valued at USD 4,591 Million in 2016, and is projected to reach at USD 12,467 Million by 2023, with a CAGR of 15.6% from 2017 to 2023.

Covid-19 latest section covered in this report.

Get Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-1J168/Healthcare_Cyber_Security

Cyber security solutions and services enable healthcare organizations to protect their business-critical infrastructure and patient data, and meet regulatory compliance.

Increase…

Aerospace Cyber Security Market Analysis and Forecasts by Security Type (Network …

The aviation industry is one of the sophisticated industries across the globe and the industry is integrated with advanced technological solutions. This has created a major concern towards securing the enormous quantity of data being generated every day. With the advancements in the different technological fields, the cyber attackers are also finding newer process to gain desired insights. In the current market scenario, aerospace industry is also witnessing substantial upswing…

Security Assessment Market Report 2018: Segmentation by Security Type (Endpoint …

Global Security Assessment market research report provides company profile for Kaspersky (Russia), IBM (US), FireEye (US), Optiv Security (US), Qualys (US), Trustwave (US), Veracode (US), Check Point (Israel), Absolute Software (Canada), Rapid7 (US), CynergisTek (US) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth…

The Mobile Security (mSecurity) Bible: 2014 - 2020 - Device Security, Infrastruc …

Mobile networks around the globe generate more than 86 Exabytes of traffic annually. The immense volume of traffic together with the growing adoption of open source Operating System (OS) platforms such as Android has opened up new security threats. Mobile malware, SMS spam, cyber attacks and unlawful eavesdropping are an ever-increasing problem for enterprises, consumers and mobile network operators around the globe.

This has in turn led to significant investments in…

Mobile Security (MSecurity) Market Analysis To 2020 - Device Security, Infrastru …

Mobile networks around the globe generate more than 86 Exabytes of traffic annually. The immense volume of traffic together with the growing adoption of open source Operating System (OS) platforms such as Android has opened up new security threats. Mobile malware, SMS spam, cyber attacks and unlawful eavesdropping are an ever-increasing problem for enterprises, consumers and mobile network operators around the globe.

This has in turn led to significant investments in…