Press release

India Car Insurance Market Report 2026-2034: Size, Share, Growth, Trends and Industry Forecast

According to IMARC Group's report titled "India Car Insurance Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.India Car Insurance Market Outlook

The India car insurance market size reached USD 30.7 Billion in 2025. It is projected to grow at a CAGR of 12.15% during the forecast period 2026-2034, reaching a market size of USD 88.8 Billion by 2034. Growth is driven by digitalization, customized pricing schemes, AI-driven solutions, usage-based insurance, and rising electric vehicle adoption.

Note: To access the most recent data, insights, and industry updates, please request a free sample report.

• Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.imarcgroup.com/india-car-insurance-market/requestsample

India Car Insurance Market Growth Factors

Car insurance is a meaningful category of motor insurance in India, governed by legislative frameworks, changes to consumer preferences and automobile penetration. As mandated by the motor vehicle laws of India, third-party liability insurance is necessary for all cars registered in India, for operation on roads or public places. As such the statutory system has provided a constant baseline level of demand for car insurance policies covering both privately and commercially owned cars and over the last few decades this baseline has steadily expanded as middle-class households have bought personal cars in greater numbers. Since then, Indian insurers have expanded their motor vehicle insurance products beyond the statutory minimum policy to meet the financial risk-management needs of car owners including compensation for losses due to accidents, theft, natural calamities and third-party liability. The Indian market for motor vehicle insurance has been strengthened by increasing purchases of cars outside the country's urban centres within semi-urban and rural markets where the penetration of insurance is comparatively low.

Such geographic shifts are an opportunity for carriers, brokers and digital aggregators, and to improve financial inclusion and risk sharing across under-insured populations. Additional regulatory changes and broader reform of the insurance sector are creating new opportunities for growth. These changes have taken the form of liberalization of foreign investment and greater capacity and competition within the insurers. The market has seen a broader breadth of consumer offerings, with a proliferation of the number of policies sold and a diversification of policy types, distribution channels, and partnerships between insurers and automotive OEMs or technology platforms. As a result, the India car insurance market has transformed from a narrow compliance-driven product into a broad-based and increasingly mature financial services market catering to diversified consumer needs.

India Car Insurance Market Trends

Some of the trends that are shaping the Indian car insurance industry are rapid digitization of insurance distribution and servicing, evolving customer needs and expectations, changing regulations, and evolving risk landscape. Increasing numbers of customers buy, renew and manage car insurance policies through online and mobile channels because of their convenience and the availability of options together with price comparison sites. Insurers are investing in better digital experiences, onboarding journeys and integrated services which make it easier to settle claims and manage policies. Another topical trend is the increasing demand for an all-in-one policy which offers more than just the compulsory third party liability. As the Indian vehicle pool diversifies with new, young, and middle-income buyers, demand for insurance products that cover own-damage, act-of-God events, theft, and various add-ons increases. Many insurers are adapting to this by expanding their insurance product range to become more customer-focused through the introduction of usage-based products and risk-adjusted products.

Driving risk and underwriting portfolios can be assessed and adjusted based on better analytics and telematics systems. Data-driven policies and experiments with usage-based (mileage-linked) vehicle insurance propositions are changing the customary actuarial processes and making automotive insurance more consumer-centric. Finally, regulatory and other ecosystem factors are also important. Regulatory factors include regulatory environment encouraging foreign investment, as well as changes in the insurance ecosystem that create room for new entrants and new product variants. In addition, awareness of the value of financial protection provided by car insurance appears to be increasing, and there still exist areas of the car segment that are uninsured, creating the opportunity for better education, awareness, and enforcement.

India Car Insurance Market Recent Developments & News

• In May 2025, InsuranceDekho merged with insurtech startup Renew Buy, positioning the combined entity among India's top three physical insurance distributors, boosting premium volume and digital reach.

• Magma General Insurance partnered in May 2025 with Toyota Tsusho Insurance Broker India Pvt. Ltd. to distribute motor insurance via a network of 150 dealers.

• Park+ entered motor insurance in May 2025 through ICICI Lombard partnership, targeting revenue of Rs 500-700 crore and expansion into the used car market.

• In June 2024, Kotak General Insurance formed a strategic partnership with Zurich, with Zurich acquiring a 70% stake to strengthen general insurance offerings.

• In March 2024, ACKO released a campaign promoting hassle-free renewals and debunking dealer-forced insurance myths featuring brand ambassadors Saif and Sara Ali Khan.

If you have any questions or need assistance, feel free to ask our expert analysts: https://www.imarcgroup.com/request?type=report&id=31437&flag=C

India Car Insurance Market Segmentation

Coverage Insights:

• Third-Party Liability Coverage

• Collision/Comprehensive/Other Optional Coverage

Application Insights:

• Personal Vehicles

• Commercial Vehicles

Distribution Channel Insights:

• Direct Sales

• Individual Agents

• Brokers

• Banks

• Online

• Others

Regional Insights

• North India

• South India

• East India

• West India

India Car Insurance Market Key Players

The report offers an in-depth examination of the competitive landscape, including market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Discuss Your Requirements With an Analyst and Get Your Customized Market Report Now: https://www.imarcgroup.com/request?type=report&id=31437&flag=E

India Car Insurance Market Key Highlights of the Report

Q1. How big is the car insurance market in India?

A1. The car insurance market in India was valued at USD 30.7 Billion in 2025.

Q2. What is the future outlook of the car insurance market in India?

A2. The India car insurance market is projected to exhibit a CAGR of 12.15% during 2026-2034, reaching a value of USD 88.8 Billion by 2034.

Q3. What are the key factors driving the India car insurance market?

A3. Key factors driving the India car insurance market include rising vehicle ownership, stricter regulatory mandates (such as third-party insurance), and growing consumer awareness about coverage benefits. Additionally, digital distribution channels, simplified claim processes, and the introduction of tailored usage-based and add-on policies are enhancing accessibility and market penetration.

Explore More Research Reports & Get Your Free Sample Now:

India Digital Banking Market: https://www.imarcgroup.com/india-digital-banking-market/requestsample

India Vehicle Financing Market: https://www.imarcgroup.com/india-vehicle-financing-market/requestsample

India Auto Financing Market: https://www.imarcgroup.com/india-auto-financing-market/requestsample

India Gold Loan Market: https://www.imarcgroup.com/india-gold-loan-market/requestsample

India Peer To Peer Lending Market: https://www.imarcgroup.com/india-peer-to-peer-lending-market/requestsample

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact. The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Car Insurance Market Report 2026-2034: Size, Share, Growth, Trends and Industry Forecast here

News-ID: 4395691 • Views: …

More Releases from IMARC Group

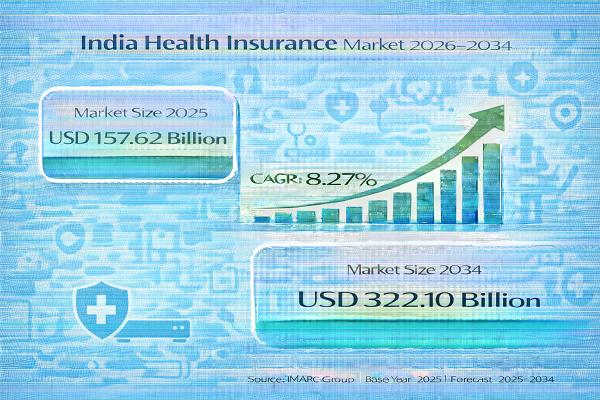

India Health Insurance Market Projected to Reach USD 322.10 Billion by 2034, Dri …

India Health Insurance Market : Report Introduction

According to IMARC Group's report titled "India Health Insurance Market Size, Share | Growth [2034]" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-health-insurance-market/requestsample

India Health Insurance Market Overview

The India health insurance market size was valued at USD 157.62 Billion in 2025 and is projected to reach USD…

Europe Anime Market Revenue Update: Internet Distribution Leads with 32% Share i …

Market Overview

The Europe anime market size was valued at USD 9.06 Billion in 2025 and is projected to reach USD 16.40 Billion by 2034. It is expected to grow at a compound annual growth rate (CAGR) of 6.82% during the forecast period from 2026 to 2034. The market expansion is driven by digital streaming services making Japanese animation widely accessible, supported by localization efforts such as multilingual dubbing and subtitling.…

Brazil Neobanking Market to Reach USD 147.9 Billion by 2034, Expanding at 42.56% …

Market Overview

The Brazil neobanking market size was USD 6.1 Billion in 2025 and is forecast to reach USD 147.9 Billion by 2034. The market is expected to grow at a CAGR of 42.56% during the forecast period 2026-2034. Growth is driven by increasing smartphone penetration, surging demand for digital financial services, a growing tech-savvy population, continuous fintech innovation, regulatory support for digital banking, and rising online transactions. These factors collectively…

Brazil Third-Party Logistics Market Growth Spotlight: Manufacturing Holds 25% Sh …

Market Overview

The Brazil third-party logistics market was valued at USD 31.42 Billion in 2025 and is forecasted to reach USD 59.04 Billion by 2034. It is expected to grow at a compound annual growth rate (CAGR) of 7.26% during the forecast period from 2026 to 2034. The growth is driven by increasing e-commerce penetration, urbanization, and demand for efficient supply chain solutions.

Download a sample copy of the report: https://www.imarcgroup.com/brazil-third-party-logistics-market/requestsample

Study Assumption…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2019 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2019 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2019 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…