Press release

Prepaid Card Market Expected to Reach $5.8 trillion by 2033

According to a new report published by Allied Market Research, titled "Prepaid Card Market," The prepaid card market size was valued at $2.8 trillion in 2023, and is estimated to reach $5.8 trillion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/1952

A prepaid card is a financial product that allows people to load a certain amount of money onto a card, offering a flexible payment option comparable to debit or credit cards. Prepaid cards, compared to regular bank cards, do not require access to a bank account, which makes them accessible for an extensive range of customers, including the unbanked and underbanked. These cards are frequently used for a number of purposes, such as making online purchases, receiving salary payments, giving gifts, and paying for travel expenditures. It offers a safe, convenient, and authorized way to handle money that does not need a credit check or a bank account. Prepaid cards also provide reloadability, which allows users to add funds as required.

The prepaid card ecosystem is evolving rapidly, fueled by fintech innovations. It offers accessible, flexible, and secure alternatives to traditional banking, particularly benefiting small businesses, consumers, and corporations. Technological advancements enable features such as multi-wallet, multi-currency, and multi-channel support, ensuring a personalized user experience. Prepaid cards are now widely used for diverse purposes, including payments for goods, corporate expenses, emergency relief, and even "Buy Now Pay Later" services. This flexibility, combined with broad acceptance (e.g. Visa), positions prepaid cards as a key enabler of fintech disruption across industries.

In addition, the technological landscape for the prepaid card industry has evolved owing to advancements in digital payments, mobile technology, and fintech innovations. Prepaid cards, once limited to physical plastic cards, are now integrated with digital wallets, offering users seamless online and offline transaction capabilities. The rise of contactless payments further enhanced the user experience, making transactions quicker and more convenient. Mobile apps and platforms that allow consumers to manage their prepaid cards, track spending, and load funds through bank transfers or other sources gained widespread adoption of prepaid cards. In addition, the incorporation of advanced security features such as EMV chip technology, biometric authentication, and tokenization bolstered fraud prevention and security in prepaid card transactions.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/1952

Cloud computing enabled scalable solutions for managing large volumes of prepaid card data, thus improving the efficiency of issuing and managing these cards for both consumers and businesses. The integration of prepaid cards with loyalty programs, gift card services, and peer-to-peer (P2P) payment systems is expanding their use, while open banking and APIs allow for further integration with other financial services. These innovations are contributing to an increasingly interconnected financial ecosystem, which is offering users more flexibility, control, and security in their financial transactions, thereby driving the prepaid card market growth.

Furthermore, the ongoing prepaid card market trends towards digital-first solutions continue to shape the future of the market, with further developments expected in blockchain and AI technologies for enhanced transaction security and personalization. For instance, the Mastercard Send Person-to-Person (P2P) services enable registered Program Participants (such as banks, issuers, and digital players) to provide P2P payment solutions that enable consumers/individuals (Senders) to transfer funds quickly, such as sending money to family and friends.

The key players adopted a range of strategies to strengthen their position in the market and provide improved services to their customers. For instance, in February 2023, Mastercard partnered with Obopay to launch an innovative prepaid card for promoting financial inclusion in rural communities. This initiative enabled farmers to digitally collect crop sale revenues, make purchases in remote areas with limited connectivity, and build a transaction history reflecting their income and expenses, facilitating access to tailored financing solutions, which drives the prepaid card market opportunity.

Based on card type, the global prepaid card market share was dominated by the closed-loop prepaid card segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to its ability to offer enhanced control, lower transaction fees, and brand loyalty incentives. Closed-loop prepaid card is widely used by retailers and specific businesses, which is driving the segment growth. However, the open-loop prepaid card segment is expected to register the highest CAGR during the forecast period. This is attributed to its broader acceptance across multiple retailers, convenience for consumers, and the flexibility to be used across various platforms such as online shopping websites, retail stores, ATMs, and mobile payment systems.

Region-wise, Asia-Pacific dominated the prepaid card market share in 2023. This was attributed to its rapidly growing digital payment ecosystem, increasing smartphone penetration, and the rising adoption of cashless transactions. In addition, the expanding e-commerce sector, coupled with favorable government initiatives supporting digital financial services, has driven the demand for prepaid cards in the Asia-Pacific. However, LAMEA is expected to exhibit the highest CAGR during the forecast period. This is attributed to the increasing financial inclusion initiatives, growing smartphone usage, and a rising preference for digital payment methods in emerging economies. In addition, improvements in internet infrastructure, a surge in e-commerce, and government efforts to promote cashless transactions are expected to drive the prepaid card market's growth in the LAMEA region.

Key Findings and Study

By offering type, the gift cards segment held the largest share in the prepaid card market for 2023.

By card type, the closed-loop prepaid card segment held the largest share in the prepaid card market for 2023.

By end users, the individual segment held the largest share in the prepaid card market for 2023.

By end-user industry, the retail segment held the largest share in the prepaid card industry for 2023

Region-wise, Asia-Pacific held the largest market share in 2023. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/1952

The prepaid card market analysis the profiles of key players operating in the prepaid card market such as JPMorgan Chase And Co., American Express Company, Mastercard, Green Dot Corporation., Travelex Foreign Coin Services Limited, Visa Inc., Mango Financial, Inc., PayPal Holdings, Inc., Netspend Visa, Kaiku Finance LLC, Bank of America Corporation., HRB Digital LLC., Discover Bank, Western Union Holdings, Inc., CaixaBank, S.A., RBL Bank Ltd., PNC Financial Services Group, Inc, The City Bank Limited, Blackhawk Network Holdings, Inc. and The Points Guy, LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the prepaid card market.

Trending Reports:

Crypto ATM Market https://www.alliedmarketresearch.com/crypto-atm-market

Commercial Insurance Market https://www.alliedmarketresearch.com/commercial-insurance-market-A11665

Trade Finance Market https://www.alliedmarketresearch.com/trade-finance-market

Personal Loans Market https://www.alliedmarketresearch.com/personal-loans-market-A07580

Finance Cloud Market https://www.alliedmarketresearch.com/finance-cloud-market-A12545

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

Insurtech Market https://www.alliedmarketresearch.com/insurtech-market-A12373

U.S. Extended Warranty Market https://www.alliedmarketresearch.com/us-extended-warranty-market-A11844

Trending Reports:

Crypto ATM Market https://www.alliedmarketresearch.com/crypto-atm-market

Commercial Insurance Market https://www.alliedmarketresearch.com/commercial-insurance-market-A11665

Trade Finance Market https://www.alliedmarketresearch.com/trade-finance-market

Personal Loans Market https://www.alliedmarketresearch.com/personal-loans-market-A07580

Finance Cloud Market https://www.alliedmarketresearch.com/finance-cloud-market-A12545

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

Insurtech Market https://www.alliedmarketresearch.com/insurtech-market-A12373

U.S. Extended Warranty Market https://www.alliedmarketresearch.com/us-extended-warranty-market-A11844

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Prepaid Card Market Expected to Reach $5.8 trillion by 2033 here

News-ID: 4394707 • Views: …

More Releases from Allied Market Research

UK Extended Warranty Market Expected to reach $9,737.13 Million by 2033

According to a recent report published by Allied Market Research, titled, "UK Extended Warranty Market by Coverage, Distribution Channel, Application, End-User: Opportunity Analysis and Industry Forecast, 2025-2034," The UK extended warranty market was valued at $3,941.90 million in 2024 and is projected to reach $9,737.13 million by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

Get a Sample Copy of this Report: https://www.alliedmarketresearch.com/request-sample/A308670

A UK extended warranty is a…

Gift Cards Market Expected to Reach $2,290.7 Billion by 2034

According to a new report published by Allied Market Research, titled, "Gift Cards Market," The gift cards market size was valued at $950.86 billion in 2024, and is estimated to reach $2,290.7 billion by 2034, growing at a CAGR of 9.0% from 2025 to 2034.

Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/4344

A gift card is a prepaid debit card loaded with a specific amount of money or credits that…

Unit-Linked Insurance Market Expected to Reach $3288.1 Billion by 2034

According to a new report published by Allied Market Research, titled, "Unit-Linked Insurance Market," The unit-linked insurance market was valued at $1.2 trillion in 2024, and is estimated to reach $3288.1 billion by 2034, growing at a CAGR of 10.5% from 2025 to 2034.

Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/A324224

Unit-linked insurance is a life insurance product that combines insurance coverage with investment opportunities. In this plan, a part…

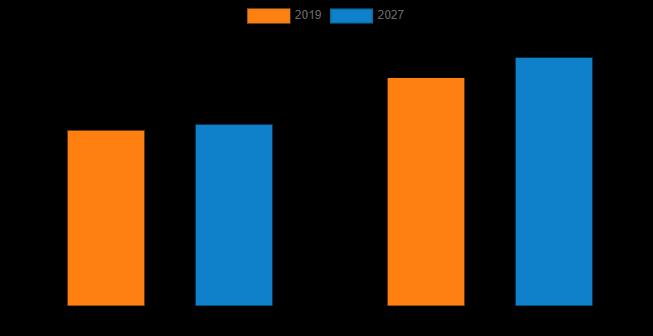

Cattle Feed Market Size worth USD 78.3 Billion Globally, by 2027 at a CAGR of 4. …

Cattle feed market size was estimated at $73.5 billion in 2019, and is expected to hit $78.3 billion by 2027, and registering with a CAGR of 4.4% from 2021 to 2027.

Replacement of traditional cattle feed with nutritionally balanced compound feed and livestock industrialization drive the growth of the global cattle feed market. On the other hand, challenges related to the gap between demand and supply of cattle feed act as…

More Releases for Prepaid

Prepaid Wireless Service Market Size Analysis by Application, Type, and Region: …

USA, New Jersey- According to Market Research Intellect, the global Prepaid Wireless Service market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

Demand for flexible, reasonably priced mobile communication options is driving the expansion of the prepaid cellular service sector. Compared to postpaid options, prepaid…

The Prepaid Card Market in China is Projected to Reach US$404.63 billion by 2026 …

According to PayNXT360, the prepaid card market (value terms) in China increased at a CAGR of 9.7% during 2017-2021. Over the forecast period of 2022 to 2026, the market is expected to record a CAGR of 9.4%, increasing from US$282.11 billion in 2022 to reach US$404.63 billion by 2026.

This report provides a detailed data centric analysis of prepaid payment instruments, covering spend through prepaid cards and digital wallets across…

According to PayNXT360's Analysis, the Strong Growth of E-Commerce Propelled the …

Singapore has been aiming to embrace e-payments and phase out cash usage gradually. The country observed many fintech companies expand their business during 2021. Conventional banks are also focusing on digital wallets and innovative prepaid cards to compete against the new-age fintech companies. The strong growth of e-commerce also propelled the growth of digital wallets and prepaid cards.

According to PayNXT360, the prepaid card market (value terms) in Singapore increased at…

According to PayNXT360's Analysis, the Thriving E-Commerce Market Fueled by the …

Strong growth of the Turkish e-commerce market also widened the prepaid card market's growth opportunity.

The e-commerce market in Turkey recorded strong growth with the rising pandemic and reached new heights in 2021. According to PayNXT360, the e-commerce sales in Turkey increased more than 65% annually during this period. Moreover, with the increasing awareness and rising usage of contactless payment methods, PayNXT360 expects, with an environment well suited for innovation…

According to PayNXT360 Analysis, the United Kingdom Prepaid Card Market is Expec …

The government of the United Kingdom is adopting different initiatives to support the county's local and independent traders primarily to help them recover from the pandemic.

According to PayNXT360, the prepaid card market (value terms) in the United Kingdom increased at a CAGR of 8.7% during 2017-2021. Over the forecast period of 2022 to 2026, the market is expected to record a CAGR of 10.5%, increasing from US$43.91 billion in 2022…

Prepaid Card Customer Analytics

Summary

Prepaid Card Customer Analytics is a powerful interactive tool providing direct answers to the questions that are central to developing a customer-centric product and marketing strategy. It speeds up the analysis of the global prepaid card customer by offering essential insight at a country and demographic level across 29 countries.

Request Sample Report Here: http://www.reportbazzar.com/request-sample/?pid=439704&ptitle=Prepaid+Card+Customer+Analytics&req=Sample

Synopsis

– See exactly where to focus product development and marketing activity based on country level data on…