Press release

Unit-Linked Insurance Market Expected to Reach $3288.1 Billion by 2034

According to a new report published by Allied Market Research, titled, "Unit-Linked Insurance Market," The unit-linked insurance market was valued at $1.2 trillion in 2024, and is estimated to reach $3288.1 billion by 2034, growing at a CAGR of 10.5% from 2025 to 2034.Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/A324224

Unit-linked insurance is a life insurance product that combines insurance coverage with investment opportunities. In this plan, a part of the premium paid by the policyholder is used to provide life insurance coverage, while the remaining portion is invested in various market-linked instruments like equities, bonds, or mutual funds. The value of the investment, also known as the fund value, changes based on market performance. Policyholders can choose the type of funds they want to invest in and can switch between funds based on their financial goals. The unit-linked insurance plans market is witnessing steady growth as these products offer both protection and potential for wealth creation, making them suitable for long-term financial planning such as retirement, children's education, or wealth accumulation. Looking ahead, ulip insurance market trends indicate rising demand for flexible, digital-first solutions that provide transparency, investment control, and a balanced approach to insurance and wealth management.

The unit-linked insurance market is expanding as a growing middle-class population with higher disposable incomes seeks effective ways to secure their financial future. Unit-linked insurance policies are gaining popularity as more individuals look for solutions that combine life insurance protection with long-term investment opportunities. The ability to invest in equity, debt, or balanced funds while also ensuring life cover appeals to middle-income earners aiming to build wealth over time. In addition, the increase in financial awareness, improved access to insurance products, and rising aspirations for better lifestyles are fueling market growth. Consumers are now more inclined toward flexible and affordable plans that align with their financial goals. The unit-linked insurance market share is expected to rise steadily, supported by increasing income levels, evolving financial requirements, and growing demand for investment-linked protection solution.

The rise in penetration of life insurance in emerging economies is boosting the demand for unit-linked insurance plans. A lot of people are looking for products that offer both insurance and investment benefits owing to increased awareness about the importance of financial protection. Ulips are gaining popularity because they provide life cover along with opportunities to increase wealth. More individuals are choosing ulips as a smart way to secure their future and achieve long-term financial goals with improving financial literacy, better access to insurance, and support from government initiatives. According to the unit-linked insurance market forecast, this trend is expected to accelerate further, driving sustained growth in the coming years.

Enquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/A324224

On the basis of mode, the offline segment dominated the unit-linked insurance market in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the strong presence of traditional insurance agents, financial advisors, and branch networks that continue to build trust among policyholders. Furthermore, many consumers still prefer face-to-face consultations for understanding complex ULIP features, which is driving sustained growth of the offline segment.

By region, Asia-Pacific dominated the market share in 2024 for the unit-linked insurance market. This is attributed to rising financial awareness, increasing disposable incomes, early adoption of market-linked insurance solutions, and strong government initiatives promoting long-term savings and investment security. However, Latin America is expected to record the highest unit-linked insurance market growth during the forecast period, driven by improving insurance penetration, growing demand for retirement and wealth-building products, rising digital adoption in insurance distribution, and supportive regulatory reforms. Additionally, partnerships between insurers, banks, and fintech providers are further boosting accessibility and fueling demand for flexible, investment-oriented insurance solutions in the region.

The report focuses on growth prospects, restraints, and unit-linked insurance market trends of the unit-linked insurance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the unit-linked insurance market.

The unit-linked insurance market is undergoing significant transformation, driven by rising demand for combined protection and investment, growing financial awareness, and increasing focus on long-term wealth creation. Advanced unit-linked insurance solutions are becoming the industry standard, integrating digital distribution platforms, personalized fund management, and customer-centric policy designs to deliver flexible, transparent, and goal-oriented financial products for diverse consumer segments.

The unit-linked insurance market outlook remains positive, supported by government efforts to promote life insurance awareness and financial inclusion. Moreover, unit-linked insurance policies offering features such as monthly premium payments, fund-switching options, partial withdrawals, and additional riders are attracting consumers seeking flexible, long-term solutions. These features help reduce immediate financial burdens while providing wealth-building opportunities. However, challenges persist in ensuring customers fully understand charges, lock-in periods, and market risks. Insurers must also focus on enhancing digital onboarding processes and simplifying policy communication to align with evolving customer expectations. Despite these hurdles, the unit-linked insurance market size is expected to expand steadily as individuals increasingly prioritize financial security, goal-based investments, and integrated protection within a single product.

Key Findings of The Study

By mode, the offline segment held the largest share in the unit-linked insurance market for 2024.

By distribution channel, the insurance brokers and agencies segment held the largest share in the unit-linked insurance market for 2024.

Region-wise, Asia-Pacific held the largest market share in 2024. However, Latin America is expected to witness the highest CAGR during the forecast period.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/A324224

The market players operating in the tax preparation software market are Aviva Life Insurance Company India Ltd., Kotak Mahindra Bank Limited, ICICI Prudential Life Insurance Company Ltd, HDFC Life Insurance Company Ltd, Bharti AXA, Life Insurance Company Limited, Bajaj Allianz Life Insurance Co. Ltd., SBI Life Insurance Company Ltd, Talanx, Zurich Insurance Company Ltd., PNB MetLife India Insurance Company Limited and KBC GROUP N.V. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the unit-linked insurance industry globally.

Trending Reports:

Gift Cards Market https://www.alliedmarketresearch.com/gift-cards-market

P2P Payment Market https://www.alliedmarketresearch.com/P2P-payment-market

Renters Insurance Market https://www.alliedmarketresearch.com/renters-insurance-market-A08186

Valuables Insurance Market https://www.alliedmarketresearch.com/valuables-insurance-market-A14958

Variable life Insurance Market https://www.alliedmarketresearch.com/variable-life-insurance-market-A115234

Stop Loss Insurance Market https://www.alliedmarketresearch.com/stop-loss-insurance-market-A325806

Securities Lending Market https://www.alliedmarketresearch.com/securities-lending-market-A325782

UK Extended Warranty Market https://www.alliedmarketresearch.com/uk-extended-warranty-market-A308670

Microinsurance Market https://www.alliedmarketresearch.com/microinsurance-market-A11439

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Unit-Linked Insurance Market Expected to Reach $3288.1 Billion by 2034 here

News-ID: 4394694 • Views: …

More Releases from Allied Market Research

Gift Cards Market Expected to Reach $2,290.7 Billion by 2034

According to a new report published by Allied Market Research, titled, "Gift Cards Market," The gift cards market size was valued at $950.86 billion in 2024, and is estimated to reach $2,290.7 billion by 2034, growing at a CAGR of 9.0% from 2025 to 2034.

Get a Sample Copy of this Report : https://www.alliedmarketresearch.com/request-sample/4344

A gift card is a prepaid debit card loaded with a specific amount of money or credits that…

Cattle Feed Market Size worth USD 78.3 Billion Globally, by 2027 at a CAGR of 4. …

Cattle feed market size was estimated at $73.5 billion in 2019, and is expected to hit $78.3 billion by 2027, and registering with a CAGR of 4.4% from 2021 to 2027.

Replacement of traditional cattle feed with nutritionally balanced compound feed and livestock industrialization drive the growth of the global cattle feed market. On the other hand, challenges related to the gap between demand and supply of cattle feed act as…

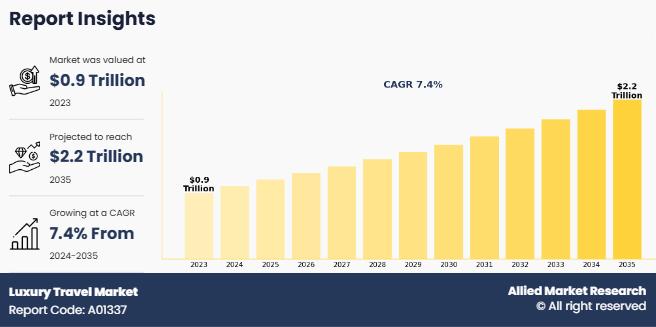

Luxury Travel Market Size to Hit US$ 2149.7 billion by 2035 at 7.4% CAGR

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Hotel Toiletries Market is likely to expand US$ 50.5 billion at 10.8% CAGR by 20 …

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…