Press release

Lithium Iron Phosphate (LiFePO4) Battery Manufacturing Plant Cost: Feasibility Study and Profitability Insights

The global lithium iron phosphate (LiFePO4) battery manufacturing industry represents a critical technological frontier supporting the worldwide transition toward sustainable energy storage and electric mobility solutions. Lithium iron phosphate (LiFePO4) batteries are a type of lithium-ion battery that uses lithium iron phosphate as the cathode material. They are known for their high energy density, thermal stability, and safety characteristics. Unlike traditional lithium-ion batteries, LiFePO4 batteries offer excellent thermal and chemical stability, making them less prone to overheating or combustion, and are therefore widely used in applications requiring high safety standards, such as electric vehicles, grid energy storage, and medical devices. These batteries also have a longer lifespan, with the ability to withstand thousands of charge and discharge cycles without significant degradation.The market is driven by widespread adoption in electric vehicles (EVs) and renewable energy storage, as well as increasing usage in consumer electronics. The manufacturing process encompasses cathode material preparation, battery assembly, cell formation, and packaging, requiring sophisticated production technologies and stringent quality control systems ensuring consistent performance and safety compliance. As global energy transition accelerates and electric vehicle adoption intensifies across automotive markets, lithium iron phosphate battery manufacturing presents an exceptionally compelling investment opportunity for manufacturers and entrepreneurs seeking to participate in the sustainable energy storage revolution driving decarbonization efforts worldwide.

MARKET OVERVIEW AND GROWTH POTENTIAL

The global lithium iron phosphate (LiFePO4) battery market demonstrates exceptional growth trajectory reflecting its expanding role in electric mobility and renewable energy storage applications. The global lithium iron phosphate (LiFePO4) battery market size was valued at USD 17.99 Billion in 2025, establishing a substantial foundation supporting automotive electrification, grid storage systems, and diverse energy applications. According to market projections, the market is expected to reach USD 51.68 Billion by 2034, exhibiting a CAGR of 12.44% from 2026 to 2034.

This remarkable growth reflects multiple converging market drivers including accelerating electric vehicle adoption globally driven by environmental regulations and consumer preferences, expanding renewable energy integration requiring reliable storage solutions, government incentives supporting electric transportation and clean energy systems, and technological advancements improving battery performance and cost competitiveness. The market is witnessing rapid expansion driven by the global transition toward electric vehicles and renewable energy systems.

According to the International Energy Agency, sales of electric cars are nearing 20 million in 2025, accounting for over a quarter of total cars sold worldwide. As more countries introduce policies to reduce carbon emissions, the adoption of clean energy technologies is accelerating, propelling demand for reliable, safe, and long-lasting battery solutions. The Asia-Pacific region, particularly China, remains a key manufacturing hub and consumer market, while North America and Europe are expected to see strong growth in the EV sector. The inherent safety advantages and long cycle life of LiFePO4 batteries make them particularly suitable for applications requiring robust performance and reliability, positioning this technology favorably within the broader battery market landscape supporting sustainable transportation and energy storage infrastructure development.

IMARC Group's report, "Lithium Iron Phosphate (LiFePO4) Battery Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The lithium iron phosphate (lifepo4) battery manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

PLANT CAPACITY AND PRODUCTION SCALE

The proposed lithium iron phosphate (LiFePO4) battery manufacturing facility is designed with an annual production capacity of 2 GWh, strategically positioned to achieve substantial economies of scale while maintaining operational flexibility essential for serving diverse market segments and applications. This capacity level enables efficient production supporting electric vehicle manufacturers requiring high-volume battery supplies, renewable energy storage systems for grid-scale and commercial applications, consumer electronics companies seeking reliable battery components, and grid energy storage projects supporting electrical infrastructure stability and renewable integration.

The production scale supports diverse applications including lithium iron phosphate battery packs incorporating cell interconnections, busbars, and internal current collectors, battery management systems (BMS) featuring signal wiring, sensing connections, and control circuitry, energy storage systems (ESS) with module-to-module connections, grounding, and power distribution, and electric mobility solutions encompassing electric vehicles, e-bikes, forklifts, and marine batteries utilizing LiFePO4 chemistry. The facility's capacity structure enables optimization of production planning across automotive and stationary storage applications, efficient raw material procurement through volume purchasing agreements with cathode material and component suppliers, and flexibility to respond to evolving market demands across transportation electrification and energy storage sectors. This production volume positions the plant competitively within regional and potentially global markets, capable of fulfilling both large-scale supply contracts with major automotive OEMs and energy storage system integrators while maintaining ability to serve specialized applications requiring customized battery configurations and performance specifications.

Request for a Sample Report: https://www.imarcgroup.com/lithium-iron-phosphate-battery-manufacturing-plant-project-report/requestsample

FINANCIAL VIABILITY AND PROFITABILITY ANALYSIS

The lithium iron phosphate (LiFePO4) battery manufacturing project demonstrates healthy profitability potential under normal operating conditions, supported by strong demand growth and strategic positioning within high-value energy storage applications. Gross profit margins typically range between 20-35%, reflecting efficient manufacturing operations, economies of scale advantages, and value-added battery assembly and quality control capabilities delivering performance specifications critical for electric vehicle and energy storage applications. The project achieves net profit margins within the 10-20% range, indicating strong operational efficiency and controlled cost management throughout the production cycle while maintaining competitive pricing structures serving automotive and energy storage customers.

These profitability metrics showcase the business's sustainable revenue generation capabilities and attractive investment returns for stakeholders participating in the rapidly expanding battery manufacturing sector supporting global energy transition objectives. The financial projections have been developed based on realistic assumptions related to capital investment requirements for advanced manufacturing equipment, operating cost structures dominated by raw material procurement, production capacity utilization rates reflecting market demand growth trajectories, pricing trends across automotive and stationary storage applications, and comprehensive demand outlook assessments considering electric vehicle adoption rates and renewable energy integration requirements. These projections provide stakeholders with a comprehensive view of the project's financial viability, return on investment (ROI) potential, profitability trajectories, and long-term sustainability prospects. The analysis encompasses detailed break-even calculations, net present value (NPV) assessments, and internal rate of return (IRR) projections that validate the investment's financial attractiveness across various market scenarios and technology evolution pathways supporting battery industry development.

OPERATING COST STRUCTURE

The operating cost structure of a lithium iron phosphate (LiFePO4) battery manufacturing plant is characterized by a material-intensive model reflecting the specialized components and processing requirements essential for advanced battery production. Raw materials constitute approximately 75-85% of total operating expenses (OpEx), with LFP cathode powder representing the primary cost driver supplemented by graphite anode material, electrolyte (LiPF6), separator membranes, and copper/aluminum foil current collectors. This substantial raw material component underscores the critical importance of establishing reliable supply chains for specialized battery materials, negotiating favorable procurement contracts with cathode material manufacturers and component suppliers, implementing effective inventory management systems balancing supply security against working capital requirements, and potentially developing strategic partnerships with material suppliers ensuring consistent quality while controlling input costs critical for maintaining competitive manufacturing economics.

Utilities account for 5-10% of operating expenses, covering electricity for mixing equipment, coating machinery, vacuum drying systems, cell assembly operations, formation and aging processes, and quality control testing, water for processing operations and facility cooling systems, and climate control requirements maintaining controlled manufacturing environments essential for battery quality and performance consistency. Key raw materials required include LFP cathode powder, graphite anode material, electrolyte (LiPF6), separator, and copper/aluminum foil, with sourcing strategies focusing on securing consistent quality materials meeting strict performance specifications, establishing long-term supply agreements with qualified suppliers, and monitoring global supply chain dynamics affecting material availability and pricing. Additional operational costs encompass transportation for raw material procurement and finished battery distribution to automotive and energy storage customers, packaging materials for battery protection during shipping and handling, salaries and wages for skilled production staff, process engineers, and quality control specialists, depreciation on sophisticated manufacturing equipment and specialized production facilities, taxes and regulatory compliance costs, repairs and maintenance ensuring equipment reliability and production continuity, and other miscellaneous operational requirements essential for continuous production meeting stringent quality standards and safety compliance essential for automotive and energy storage applications.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=17184&flag=C

CAPITAL INVESTMENT REQUIREMENTS

Establishing a lithium iron phosphate (LiFePO4) battery manufacturing plant requires comprehensive capital investment across multiple essential categories to ensure operational readiness, technological capability, and long-term competitive positioning within the advanced battery manufacturing sector. The total capital expenditure (CapEx) encompasses land and site development costs, civil works costs, machinery costs, and other capital costs, each representing critical investment components for successful facility establishment.

Land acquisition and site development constitute substantial initial investments, covering land registration charges, boundary development expenses, site preparation including grading and infrastructure installation, and foundational development ensuring safe and efficient plant operations with adequate space for material receiving, clean room production environments, formation and aging facilities, and finished battery storage areas.

Civil works costs include factory building construction optimized for battery manufacturing with appropriate environmental controls and clean room specifications, administrative office facilities, warehousing structures for raw material storage and finished product inventory management, and comprehensive utility infrastructure development including electrical distribution, water treatment systems, HVAC for climate control, and waste management facilities supporting specialized production requirements.

Machinery costs account for the largest portion of total capital expenditure, comprising essential processing equipment for lithium iron phosphate battery manufacturing including:

• High-precision mixers for cathode and anode material preparation

• Coating and calendaring machines for electrode manufacturing

• Vacuum dryers for moisture removal

• Slitters for electrode cutting and sizing

• Cell assembly lines for battery construction

• Electrolyte filling systems for cell completion

• Formation and aging equipment for initial charging and stabilization

• Final testing and packaging stations for quality verification

All machinery selections must comply with battery industry standards, operational efficiency requirements, and reliability benchmarks ensuring consistent production quality meeting automotive and energy storage specifications. Other capital costs cover pre-operative expenses including regulatory approvals and safety certifications, environmental compliance assessments, technology licensing if required, initial working capital requirements for raw material inventory and operational launch, and prudent contingency reserves addressing unforeseen costs during facility establishment and commissioning phases.

MAJOR APPLICATIONS AND MARKET SEGMENTS

Lithium iron phosphate (LiFePO4) batteries serve diverse applications across multiple high-growth market segments:

• Lithium Iron Phosphate (LiFePO4) Battery Packs - Incorporating cell interconnections, busbars, and internal current collectors for various applications requiring reliable energy storage with enhanced safety characteristics. This segment serves automotive, commercial vehicle, and stationary storage markets demanding robust battery systems.

• Battery Management Systems (BMS) - Featuring signal wiring, sensing connections, and control circuitry ensuring optimal battery performance, safety monitoring, and charge/discharge management. BMS integration is critical for automotive applications requiring sophisticated thermal and electrical management.

• Energy Storage Systems (ESS) - Utilizing module-to-module connections, grounding, and power distribution for grid-scale storage, commercial backup power, and renewable energy integration applications. This segment represents rapidly growing market opportunities supporting electrical grid modernization and renewable energy deployment.

• Electric Mobility Solutions - Powering electric vehicles, e-bikes, forklifts, and marine batteries using LiFePO4 chemistry for applications prioritizing safety, longevity, and thermal stability. This segment encompasses passenger vehicles, commercial transportation, material handling equipment, and marine propulsion systems driving transportation electrification.

WHY INVEST IN LITHIUM IRON PHOSPHATE (LIFEPO4) BATTERY MANUFACTURING?

• Rising EV Adoption: The increasing adoption of electric vehicles globally is a key driver of demand for LiFePO4 batteries, which offer higher safety, longer lifespans, and better thermal stability than other lithium-ion chemistries. With electric car sales nearing 20 million in 2025 and accounting for over a quarter of total cars sold worldwide, automotive electrification drives sustained battery demand growth.

• Energy Storage Growth: As more renewable energy sources like solar and wind are integrated into the power grid, the need for reliable and sustainable energy storage solutions is growing, creating additional demand for LiFePO4 batteries. Grid modernization and renewable integration requirements support expanding stationary storage markets.

• Government Support: Many governments worldwide are incentivizing the shift to electric vehicles and renewable energy systems, which is further stimulating the demand for high-quality battery solutions. Policy frameworks including emissions regulations, EV subsidies, and renewable energy mandates create favorable market conditions supporting battery manufacturing investment.

• Safety and Longevity: The inherent safety advantages and long cycle life of LiFePO4 batteries make them particularly suitable for applications requiring robust performance and reliability, such as in automotive and grid storage. Superior thermal stability reducing fire risk and extended operational lifespan exceeding thousands of charge cycles differentiate LiFePO4 technology within the battery market landscape.

Buy Now: https://www.imarcgroup.com/checkout?id=17184&method=2175

INDUSTRY LEADERSHIP

The global lithium iron phosphate (LiFePO4) battery manufacturing industry features several prominent companies with extensive production capacities, advanced manufacturing technologies, and diverse application portfolios. Leading manufacturers include:

• BYD Company Ltd.

• CATL

• A123 Systems

• LiFeBATT

• Lishen Battery Co.

All of which serve critical end-use sectors including electric vehicles (EVs), renewable energy storage, consumer electronics, and grid energy storage applications across global markets. These industry leaders demonstrate market maturity, technological capabilities, and operational benchmarks against which new entrants can evaluate their strategic positioning.

Recent industry developments illustrate ongoing capacity expansion and technological advancement strengthening market positions:

• November 2025: Contemporary Amp. Technology Co. Limited (CATL) officially commenced mass production of its fifth-generation lithium iron phosphate (LFP) batteries, marking a significant leap forward in battery technology. This new generation promises substantial improvements in energy density, charging speed, and cycle life, spearheaded by the "Shenxing PLUS" model.

• July 2024: LG Energy Solution announced that it would supply LFP pouch-type EV batteries to Ampere, the EV pure player born from Renault Group, its long-time customer.

These developments underscore the industry's dynamic nature with major battery manufacturers expanding LiFePO4 production capacity, continuous technological innovation improving energy density and charging performance, and strategic supply partnerships between battery manufacturers and automotive OEMs supporting electric vehicle production scale-up.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Iron Phosphate (LiFePO4) Battery Manufacturing Plant Cost: Feasibility Study and Profitability Insights here

News-ID: 4393780 • Views: …

More Releases from IMARC Group

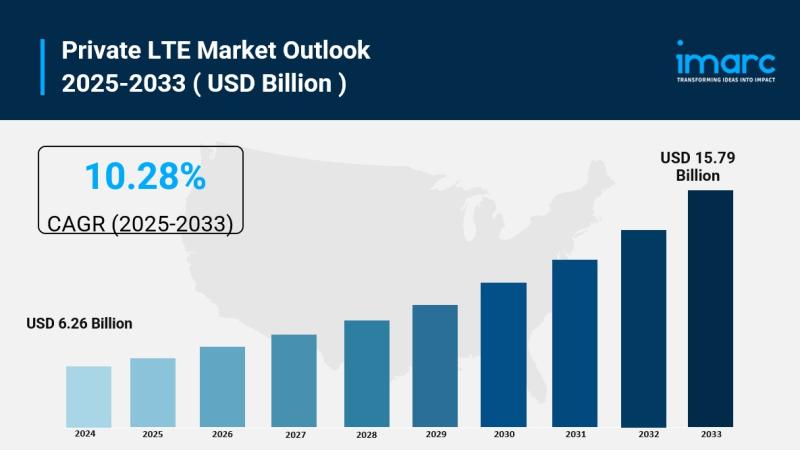

Private LTE Market is Expected to Reach USD 15.79 Billion by 2033 | At CAGR 10.2 …

Private LTE Market Overview:

The global Private LTE Market was valued at USD 6.26 Billion in 2024 and is forecast to reach USD 15.79 Billion by 2033, growing at a CAGR of 10.28% during 2025-2033. This growth is driven by rising demand for secure and reliable wireless connectivity in industrial sectors, increasing adoption of IoT and Industry 4.0 technologies, availability of shared spectrum solutions, and expanding requirements for mission-critical communications across…

Vinyl Flooring Manufacturing Plant DPR - 2026: Investment Cost, Market Growth an …

Vinyl flooring is a synthetic flooring material made from polyvinyl chloride (PVC), widely used in both residential and commercial spaces. Known for its durability, versatility, water resistance, and cost-effectiveness, vinyl flooring is available in various forms including sheets, tiles, and planks, and can convincingly mimic the appearance of premium materials such as hardwood, stone, and ceramic tile. It is extensively used in homes, offices, healthcare facilities, retail spaces, hotels, and…

Biopesticide Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pr …

Biopesticides represent one of the fastest-growing segments in the global agricultural inputs market. As crop protection solutions sourced from natural origins - including beneficial microorganisms, plant extracts, insects, and select minerals - biopesticides manage pests, weeds, and plant diseases through biological processes rather than synthetic chemicals. Their key types include microbial biopesticides, botanical formulations, biochemical agents, and pheromone-based products.

With rising awareness about sustainable agriculture, tightening restrictions on chemical pesticides, and…

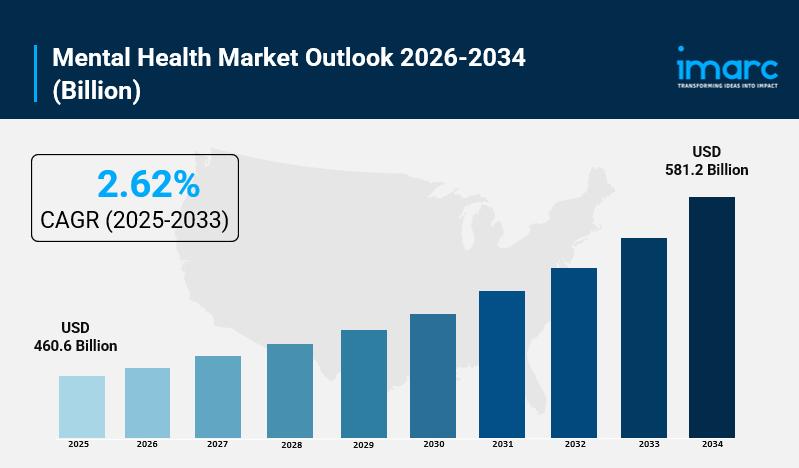

Mental Health Market Size, Share, Industry Trends, Growth Factors and Forecast 2 …

IMARC Group, a leading market research company, has recently released a report titled "Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age Group, and Region 2026-2034." The study provides a detailed analysis of the industry, including the global mental health market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Highlights:

• Mental Health…

More Releases for LiFePO4

Understanding LiFePO4 Battery Technology: Safety, Performance, and Longevity

In today's energy landscape, the LiFePO4 battery https://manlybattery.com/) short for lithium iron phosphate has become one of the most reliable and versatile power storage technologies. Known for its safety, long cycle life, and efficiency, this battery type is rapidly gaining traction across residential, industrial, and mobility applications.

● What Makes LiFePO4 Batteries Different

Unlike older chemistries such as lead-acid or traditional lithium-ion, a LiFePO4 battery uses iron phosphate as its cathode material.…

The Introduction Of 24V 100Ah LiFePO4 Battery Pack

This 24V lifepo4 battery can achieve more than 6000+ cycles, which lasts up to 4 times longer than a lead-acid battery battery. The inside BMS can automatically stop recharging under the temperature of 0 and also can prevent the battery from the most common issue, such as temperature volatility, overcharge, over-discharge, over-current, overloading, overheating.

Battery [https://www.jybattery.net/24v-100ah-lifepo4-battery-pack-product/] Performance

* Nominal Voltage25.6V

* Nominal Capacity100Ah

* Nominal Energy2560Wh

* Internal Resistance less than…

The Advantages of Kamada LiFePO4 Batteries

Introduction

Image: https://www.abnewswire.com/uploads/fccf62255a824c73f7ebd04cd736f4a7.png

[https://www.kmdpower.com/], a new generation of energy storage technology, are gradually changing our understanding of energy storage. According to market research, the global LiFePO4 battery market, valued at about $2 billion in 2021, is expected to grow to nearly $4 billion by 2026. Due to their superior performance and safety, LiFePO4 batteries are gaining increasing importance.

Basics of LiFePO4 Batteries

LiFePO4 batteries consist of an anode, a cathode, an electrolyte, and a…

EcoSol Lithium Ion LiFePO4 Batteries.

Solar Refrigerator Company offers Huge Discount Sale of EcoSol Lithium Ion Batteries.

Lithium batteries have a longer lifespan and superior performance compared to other deep cycle batteries.

Key Advantages:

1. High Energy Density: Lithium Ion Batteries boast a high energy density, allowing them to store a large amount of energy in a relatively small and lightweight package.

2. Longer Lifespan: Lithium Ion Batteries typically have…

LiFePO4 Batteries Market 2021 | Detailed Report

The LiFePO4 Batteries research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the LiFePO4 Batteries research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Get Free Sample PDF (including full…

LiFePO4 Battery Market 2021 | Detailed Report

Global LiFePO4 Battery Market 2021-2027, has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the market landscape and its growth prospects in the coming years. The report includes a discussion of the key vendors operating in this market. An exclusive data offered in this report is collected by research and industry experts team.

Get Free Sample PDF (including full TOC, Tables and Figures)…