Press release

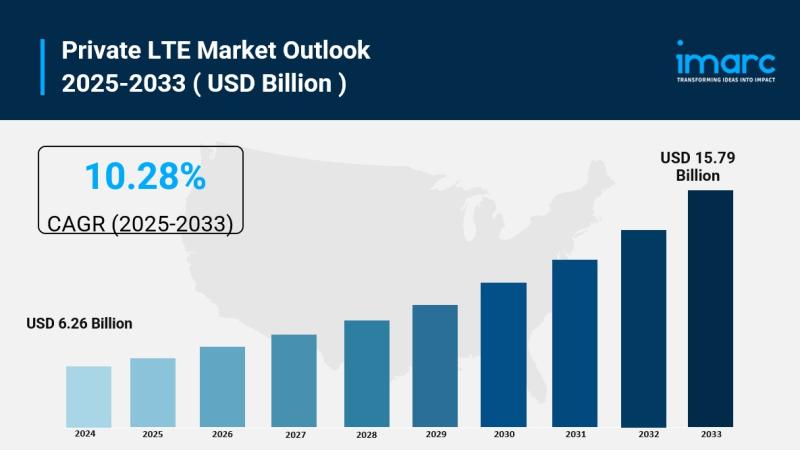

Private LTE Market is Expected to Reach USD 15.79 Billion by 2033 | At CAGR 10.28%

Private LTE Market Overview:The global Private LTE Market was valued at USD 6.26 Billion in 2024 and is forecast to reach USD 15.79 Billion by 2033, growing at a CAGR of 10.28% during 2025-2033. This growth is driven by rising demand for secure and reliable wireless connectivity in industrial sectors, increasing adoption of IoT and Industry 4.0 technologies, availability of shared spectrum solutions, and expanding requirements for mission-critical communications across enterprises.

The private LTE market size is expanding rapidly driven by rising demand for dedicated wireless networks, secure communication infrastructure, low-latency connectivity, and high-performance industrial automation across manufacturing, energy, mining, logistics, and public safety sectors. Growing adoption in smart infrastructure projects, critical operations management, IoT device integration, and edge computing applications is accelerating commercial deployment. Advancements in network infrastructure, spectrum allocation frameworks, enhanced security protocols, scalable architecture designs, and integration with automation systems, robotics, and real-time monitoring platforms are driving market innovation. The growth of digital transformation initiatives, Industry 4.0 adoption, mission-critical application requirements, and availability of unlicensed and shared spectrum options is boosting mass market adoption. Increasing focus on network control and data privacy further supports future global market expansion.

Access Detailed Sample Report: https://www.imarcgroup.com/private-lte-market/requestsample

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Years: 2025-2033

Private LTE Market Key Takeaways

• Current Market Size (2024): USD 6.26 Billion

• CAGR (2025-2033): 10.28%

• Forecast Period: 2025-2033

• The market is propelled by the growing need for secure, dedicated wireless networks for mission-critical operations.

• Increasing adoption in industrial automation and IoT applications is driving product usage.

• Technological advancements in LTE infrastructure and edge computing are enhancing network performance.

• Expansion into manufacturing, energy, defense, and logistics sectors is broadening market horizons.

• High deployment costs and spectrum availability challenges present market obstacles.

Market Growth Factors

The private LTE market is significantly driven by the escalating demand for secure, reliable, and high-performance wireless connectivity across industrial and enterprise sectors. Organizations require dedicated networks that offer complete control over coverage, latency, data security, and quality of service, which public cellular networks cannot guarantee. Private LTE networks enable enterprises to support mission-critical applications in manufacturing plants, mining operations, ports, transportation hubs, and utility facilities where uninterrupted connectivity is essential. The ability to customize network parameters, prioritize traffic, and ensure data remains within enterprise boundaries addresses growing cybersecurity concerns. This demand for controlled, secure communication infrastructure is expected to sustain robust market growth throughout the forecast period.

Technological advancements in IoT, automation, and Industry 4.0 initiatives are another major growth factor enhancing the market. The proliferation of connected devices, sensors, and automated machinery in industrial environments requires wireless networks capable of handling massive data volumes with minimal latency. Private LTE provides the bandwidth, reliability, and scalability necessary to support real-time operations, predictive maintenance, remote monitoring, and autonomous systems. Integration with edge computing capabilities further enhances network efficiency by enabling local data processing and reducing dependence on cloud connectivity. These technological developments are driving enterprises across manufacturing, logistics, energy, and transportation sectors to invest in private LTE infrastructure to modernize their operations and achieve digital transformation objectives.

The availability of shared and unlicensed spectrum, particularly Citizens Broadband Radio Service (CBRS) in the United States, also fuels market growth. Regulatory frameworks enabling spectrum access at reduced costs have significantly lowered barriers to private LTE deployment. Organizations can now establish dedicated networks without the prohibitive expenses traditionally associated with licensed spectrum acquisition. This democratization of spectrum access has opened opportunities for enterprises of various sizes to implement private LTE solutions tailored to their specific operational needs. The flexibility to deploy networks in remote locations, industrial zones, and campus environments, combined with improving LTE infrastructure capabilities, presents significant opportunities for market expansion across diverse industries and geographic regions.

Market Segmentation

Component:

• Infrastructure: Infrastructure represents the largest segment, encompassing base stations, core networks, backhaul systems, and associated hardware essential for establishing private LTE networks. Enterprises and governments are investing heavily in robust wireless infrastructure to support mission-critical operations in large-scale industrial environments including manufacturing facilities, mining sites, ports, and transportation hubs. The demand for ultra-low latency, high data throughput, and complete control over network operations drives infrastructure deployment as the foundation for enterprise-grade wireless communication systems.

• Service: Service components include network deployment, integration, management, maintenance, and consulting services supporting private LTE implementations.

Technology:

• FDD (Frequency Division Duplex): FDD leads the technology segment due to its ability to provide stable, high-quality communication with minimal latency using separate frequency bands for uplink and downlink transmission. This technology is particularly suited for wide-area coverage scenarios and environments requiring consistent, uninterrupted connectivity, making it preferred for utilities, manufacturing, and defense applications.

• TDD (Time Division Duplex): TDD technology offers flexible spectrum utilization and is gaining traction in specific deployment scenarios.

Frequency Band:

• Licensed: Licensed spectrum dominates the market, offering exclusive access that ensures interference-free communication, guaranteed quality of service, and enhanced security for critical operations. Organizations in sectors such as oil and gas, utilities, transportation, and public safety prefer licensed spectrum for its reliability and regulatory backing.

• Unlicensed: Unlicensed spectrum provides cost-effective deployment options but with potential interference challenges.

• Shared Spectrum: Shared spectrum, including CBRS, enables flexible and affordable private network deployment with dynamic spectrum allocation.

Deployment Model:

• Centralized: Centralized deployment models concentrate network functions in single locations for simplified management.

• Distributed: Distributed deployment models lead the market by spreading network functions across multiple locations, enhancing flexibility, scalability, and reliability across complex operational areas. This architecture improves local processing, reduces latency, and ensures service continuity even during node failures, making it ideal for industries with multiple facilities or expansive field operations.

Industry Vertical:

• Government and Defense: Government and defense dominates the market, requiring secure, reliable, and independent communication networks for national security operations, emergency response, surveillance, border security, and military communications. Private LTE offers enhanced control, encryption, and priority access essential for mission-critical scenarios.

• Healthcare: Healthcare facilities deploy private LTE for secure patient data management and connected medical devices.

• IT and Telecom: IT and telecom sectors utilize private LTE for enterprise connectivity and service delivery.

• Manufacturing: Manufacturing industries implement private LTE for automation, robotics, and smart factory operations.

• Retail and E-commerce: Retail operations leverage private LTE for inventory management and customer experience enhancement.

• Energy and Utility: Energy and utility sectors deploy private LTE for smart grid management and infrastructure monitoring.

• Oil and Gas: Oil and gas industries utilize private LTE for remote operations and asset tracking.

• Education: Educational institutions implement private LTE for campus-wide connectivity.

• Others: Additional verticals include transportation, logistics, mining, and construction sectors.

Distribution Channel:

• Direct Vendor Sales

• System Integrators: Predominant channel providing end-to-end deployment and integration services.

• Telecom Operators

• Technology Partners

Region:

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa

Regional Insights

North America is the leading regional market for private LTE, holding the largest market share globally. The region's dominance is driven by early availability and adoption of Citizens Broadband Radio Service (CBRS) spectrum in the United States, which has enabled cost-effective enterprise network deployments. North America benefits from a strong ecosystem of telecom providers, technology vendors, and system integrators supporting comprehensive private LTE solutions. High industrial adoption of IoT and automation technologies, particularly in manufacturing, logistics, mining, and energy sectors, creates substantial demand for dedicated, secure wireless networks. The region's robust digital infrastructure, advanced edge computing capabilities, and increasing cybersecurity concerns are prompting enterprises to invest significantly in private LTE solutions, supporting continued market leadership and expansion.

Recent Developments & News

In March 2025, OneLayer and Ericsson launched a Zero Trust Network Access (ZT-ZTNA) solution for private LTE and 5G networks, enhancing automated device onboarding and eliminating manual provisioning to strengthen security across industrial sectors. In March 2025, Ubiik unveiled the Maverick 220, the industry's first high-power LTE-M/NB-IoT module tailored for utility and private LTE applications, significantly expanding long-range IoT connectivity capabilities. In March 2025, Quectel launched the EG950A-ENL LTE Cat 4 module offering cost-effective LTE connectivity for smart metering applications on private LTE networks. In February 2025, Ericsson was appointed to deploy private LTE for the Lower Colorado River Authority (LCRA) to support smart-grid operations across Texas counties, enhancing grid resilience through IoT monitoring and secure infrastructure.

Key Players

• Affirmed Networks

• Airspan

• AT&T

• Comba Telecom Systems Holdings Ltd

• Druid Software

• Future Technologies

• Huawei Technologies Co., Ltd

• Mavenir

• Motorola Solutions, Inc

• Nokia Corporation

• RUCKUS Networks

• Sierra Wireless

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Expert Insights Available - Connect With Our Analysts: https://www.imarcgroup.com/request?type=report&id=4833&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private LTE Market is Expected to Reach USD 15.79 Billion by 2033 | At CAGR 10.28% here

News-ID: 4393770 • Views: …

More Releases from IMARC Group

Lithium Iron Phosphate (LiFePO4) Battery Manufacturing Plant Cost: Feasibility S …

The global lithium iron phosphate (LiFePO4) battery manufacturing industry represents a critical technological frontier supporting the worldwide transition toward sustainable energy storage and electric mobility solutions. Lithium iron phosphate (LiFePO4) batteries are a type of lithium-ion battery that uses lithium iron phosphate as the cathode material. They are known for their high energy density, thermal stability, and safety characteristics. Unlike traditional lithium-ion batteries, LiFePO4 batteries offer excellent thermal and chemical…

Vinyl Flooring Manufacturing Plant DPR - 2026: Investment Cost, Market Growth an …

Vinyl flooring is a synthetic flooring material made from polyvinyl chloride (PVC), widely used in both residential and commercial spaces. Known for its durability, versatility, water resistance, and cost-effectiveness, vinyl flooring is available in various forms including sheets, tiles, and planks, and can convincingly mimic the appearance of premium materials such as hardwood, stone, and ceramic tile. It is extensively used in homes, offices, healthcare facilities, retail spaces, hotels, and…

Biopesticide Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pr …

Biopesticides represent one of the fastest-growing segments in the global agricultural inputs market. As crop protection solutions sourced from natural origins - including beneficial microorganisms, plant extracts, insects, and select minerals - biopesticides manage pests, weeds, and plant diseases through biological processes rather than synthetic chemicals. Their key types include microbial biopesticides, botanical formulations, biochemical agents, and pheromone-based products.

With rising awareness about sustainable agriculture, tightening restrictions on chemical pesticides, and…

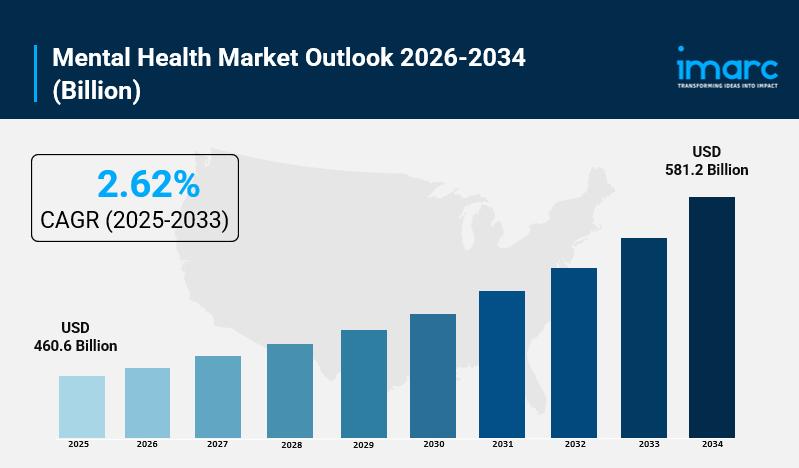

Mental Health Market Size, Share, Industry Trends, Growth Factors and Forecast 2 …

IMARC Group, a leading market research company, has recently released a report titled "Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age Group, and Region 2026-2034." The study provides a detailed analysis of the industry, including the global mental health market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Highlights:

• Mental Health…

More Releases for LTE

LTE CPE Market the Falling Prices of LTE-Capable Devices

LTE CPE stands for Long Term Evolution Customer Premises Equipment. It is a type of customer premises equipment (CPE) that is used to connect to an LTE network. LTE CPE can be used for both home and business applications. LTE CPE typically includes an LTE modem, WiFi router, and LTE antenna.

LTE is the latest and greatest in wireless data technology, and LTE CPE devices are the customer-premise equipment (CPE) that…

Perle IRG5521 LTE Routers provide LTE coverage when WiFi is unavailable

When the power goes down, so does the WiFi. Cellular systems, however, keep working. A Case Study about Winning Strategies’ new stand-alone multi-power-source wireless surveillance system.

PRINCETON, N.J. (Mar. 30, 2021) Establishing a contingency plan to recover IT services after an emergency, or system disruption, is a critical step in the network design process. IT systems are vulnerable to a variety of interruptions that range from short-term power outages to severe…

2018-2025 LTE Communication Market analysis report with Leading players, Applica …

LTE Communication Market

The Global LTE Communication Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The report also analyzes the development proposals and the feasibility of new investments. The LTE Communication Market report has been collated in order to provide guidance and direction to the companies and individuals interested in buying this research report.

To Access PDF…

LTE-Advanced (LTE-A) Mobile Technologies Market 2017 Emerging Trends

This report studies the global LTE-Advanced (LTE-A) Mobile Technologies market, analyzes and researches the LTE-Advanced (LTE-A) Mobile Technologies development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Nokia Solutions and Networks

Alcatel-Lucent

EE Limited

Cisco

Ericsson

AT&T

SK Telecom

Royal KPN

Samsung

NTT Docomo

LG

Huawei

ZTE

For more information about this report at http://www.reportsweb.com/global-lte-advanced-lte-a-mobile-technologies-market-size-status-and-forecast-2022

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast Asia

Market segment by Type, LTE-Advanced…

Global LTE (LTE-FDD, TD-LTE and LTE Advanced) Market Analysis, Size, Share, Grow …

Researchmoz added Most up-to-date research on "LTE (LTE-FDD, TD-LTE and LTE Advanced) Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 - 2019" to its huge collection of research reports.

LTE, an initial of Long Term Evolution and marketed as 4G LTE, is a wireless communication standard for high-speed data for data terminals and mobile phones. LTE technology reduces the cost per gigabyte with enhanced capacity per site.…

The LTE, LTE-Advanced & 5G Ecosystem Technology Advancement, Emerging Evolution

As a natural upgrade path for carriers from the previously detached GSM, CDMA and TD-SCDMA ecosystems, LTE has emerged as the first truly global mobile communications standard. Commonly marketed as the “4G” standard, LTE promises to provide higher data rates and lower latency at a much lower TCO (Total Cost of Ownership) than 3G technologies.

The TCO and performance is further enhanced by deployment of small cells and the LTE-Advanced standard.…