Press release

Biopesticide Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Biopesticides represent one of the fastest-growing segments in the global agricultural inputs market. As crop protection solutions sourced from natural origins - including beneficial microorganisms, plant extracts, insects, and select minerals - biopesticides manage pests, weeds, and plant diseases through biological processes rather than synthetic chemicals. Their key types include microbial biopesticides, botanical formulations, biochemical agents, and pheromone-based products.With rising awareness about sustainable agriculture, tightening restrictions on chemical pesticides, and the rapid expansion of organic farming globally, biopesticides have moved from niche adoption to mainstream agricultural practice. They are increasingly favored in integrated pest management (IPM) programs and organic cultivation systems for their low toxicity, precise targeting, biodegradability, and minimal disruption to soil ecosystems and non-target organisms.

IMARC Group's report, "Biopesticide Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The biopesticide manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

The global biopesticide market was valued at USD 8.928 Billion in 2025 and is projected to reach USD 23.97 Billion by 2034, exhibiting a CAGR of 11.6% from 2026 to 2034, according to IMARC Group estimates. This robust growth trajectory makes a biopesticide manufacturing plant an exceptionally attractive investment opportunity for entrepreneurs, agribusinesses, and institutional investors alike.

Market Overview and Growth Potential

The global biopesticide market is experiencing robust growth underpinned by converging macro-level forces. The market size stood at USD 8.928 Billion in 2025 and is on a clear upward trajectory, expected to reach USD 23.97 Billion by 2034, driven by a compound annual growth rate (CAGR) of 11.6%.

Key market drivers shaping this landscape include:

• Rising awareness regarding sustainable agriculture and eco-friendly crop protection solutions among farmers and agribusinesses

• Increasing regulatory restrictions and bans on synthetic chemical pesticides across major farming regions

• Significant growth in organic farming practices worldwide, creating demand for certified-compliant crop protection

• Growing demand for residue-free produce from both domestic health-conscious consumers and export markets

Industry trend data further supports this momentum. According to the Department of Geosciences and Natural Resource Management, University of Copenhagen, China accounted for nearly 60% of global greenhouse cultivation as of around 2024, followed by Spain (5.6%), Italy (4.1%), Mexico (3.3%), and Turkey (2.4%). This intensive concentration of greenhouse farming globally intensifies the need for sustainable crop protection, directly boosting demand for biopesticides.

Grab a sample PDF of this report: https://www.imarcgroup.com/biopesticide-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed biopesticide manufacturing facility is designed with an annual production capacity ranging between 2,500-4,000 Tons. This scale has been chosen to enable meaningful economies of scale while maintaining operational flexibility to respond to market fluctuations and product mix changes.

The manufacturing process follows a structured multi-step operation:

• Microbial culture development or botanical extraction

• Fermentation or formulation processing

• Stabilization and concentration

• Quality testing for potency, purity, and safety

• Blending for uniform consistency

• Packaging and labeling for market distribution

This capacity supports market segments spanning agriculture and horticulture, organic farming, greenhouse cultivation, plantation crops, and integrated pest management (IPM) programs.

Financial Viability and Profitability Analysis

The biopesticide manufacturing project demonstrates healthy profitability potential under normal operating conditions, supported by stable and growing demand for biological crop protection inputs.

• Gross Profit: 35-45%

• Net Profit: 15-20%

Financial projections for this project have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections encompass ROI analysis, NPV calculation, profit and loss accounts, liquidity analysis, internal rate of return (IRR), sensitivity analysis, and uncertainty analysis - providing a comprehensive view of long-term financial sustainability.

Profitability typically improves substantially with capacity expansion and increasing capacity utilization rates over the project's operational years, with total operational costs expected to increase in line with inflation and market shifts by Year 5.

Operating Cost Structure

The operating cost structure of a biopesticide manufacturing plant is primarily driven by raw material consumption. In the first year of operations, the OpEx covers raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance.

• Raw Materials: 55-65% of OpEx

• Utilities: 10-15% of OpEx

Key raw materials for biopesticide manufacturing include microorganisms such as Bacillus thuringiensis, Beauveria bassiana, and Trichoderma species, along with nutrient media including molasses, yeast extract, and peptone. Additional materials include carrier substances like talc or kaolin, emulsifiers, stabilizers, solvents, preservatives, and packaging materials.

Effective cost management strategies include negotiating long-term contracts with reliable microbial culture suppliers to stabilize pricing and ensure supply continuity, selecting suppliers geographically close to the facility to minimize transportation costs, and optimizing fermentation cycle efficiency to maximize yield per input unit.

Capital Investment Requirements

Establishing a biopesticide manufacturing plant involves several key capital expenditure components. Machinery costs account for the largest portion of total CapEx, reflecting the specialized nature of biological production infrastructure.

• Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

• Equipment Costs: Equipment costs, such as those for fermenters, separation and purification units, polymerization reactors, extruders, pelletizers, and drying systems, represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery.

• Raw Material Expenses: Raw materials, including lactic acid, catalyst, and purification solvents, are a major part of operating costs. Long-term contracts with reliable suppliers will help mitigate price volatility and ensure a consistent supply of materials.

• Infrastructure and Utilities: Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan.

• Operational Costs: Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. Optimizing processes and providing staff training can help control these operational costs.

• Financial Planning: A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted. This analysis aids in securing funding and formulating a clear financial strategy.

Essential machinery and equipment required for a biopesticide manufacturing facility includes:

• Fermenters and bioreactors for microbial culture growth and multiplication

• Sterilizers and autoclaves for contamination control

• Centrifuges and filtration units for biomass separation

• Extractors for botanical active ingredient isolation

• Dryers for moisture removal and product stabilization

• Formulation tanks for carrier blending and final product preparation

• Homogenizers and blending/mixing machines for uniformity

• Bottling and sealing units for primary packaging

• Cold storage systems for microbial product preservation

• Laboratory equipment for quality assurance and analytical testing

Infrastructure requirements also include reliable transportation access for raw material intake and finished goods distribution, robust utility connections (electricity, water, steam), and effluent treatment systems to manage production waste in compliance with environmental regulations. The timeline from inception to commissioning typically ranges from 12 to 24 months, depending on site development, machinery installation, regulatory clearances, and trial runs.

Major Applications and Market Segments

Biopesticides serve a wide and growing range of agricultural applications, enabling diversified revenue streams for manufacturers:

• Control of pests and diseases in cereals, pulses, and oilseeds while preserving soil fertility and crop safetyAgriculture and Field Crops:

• Extensive use in fruits, vegetables, spices, and plantation crops to ensure residue-free produce for export and premium marketsHorticulture and Plantation Crops:

• Compliance with organic certification standards, supporting chemical-free cultivation practicesOrganic Farming Systems:

• Maintaining pest control in controlled environments without harming beneficial insects or pollinatorsGreenhouse and Protected Cultivation:

End-use sectors include agriculture and horticulture broadly, the organic farming sector, greenhouse cultivation operations, plantation crop estates, and formal integrated pest management programs run by both private and government agricultural agencies.

Why Invest in Biopesticide Manufacturing?

Biopesticide manufacturing presents a compelling investment case backed by structural market forces, regulatory momentum, and technology-driven production advantages:

• Farmers globally are adopting eco-friendly crop protection solutions to meet regulatory standards and export requirements, creating sustained, repeat demand for biopesticide productsRising Demand for Sustainable Agriculture:

• Stricter bans and usage limits on synthetic pesticides across major agricultural markets are directly driving demand for biological alternatives - a trend that is accelerating, not deceleratingRegulatory Push Against Chemical Pesticides:

• Export markets and health-conscious domestic consumers are actively supporting the shift toward biologically derived crop inputs, creating premium-priced market segmentsGrowth in Organic and Residue-Free

Produce Markets:

• Biopesticides reduce the risk of pest resistance compared to chemical formulations, providing farmers with longer-effective solutions and manufacturers with stable, non-substitutable demandLower Resistance Development:

• Biopesticide manufacturing supports scalable operations with premium pricing and repeat demand, improving margin profiles as capacity utilization increasesScalable, High-Value Production:

• Governments may offer capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote biopesticide manufacturing under national or regional industrial and agricultural policy frameworksPotential Government Incentives:

Entry barriers including specialized fermentation technology requirements, regulatory approvals, and skilled workforce need also serve as competitive moats that protect established manufacturers from rapid low-cost competition.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=17647&flag=C

Industry Leadership

The global biopesticide industry is led by several multinational companies with extensive production capacities and diverse application portfolios. Key manufacturers include:

• BASF SE

• Bayer AG

• Certis USA LLC

• FMC Corporation

• Isagro

These companies serve end-use sectors spanning agriculture, horticulture, organic farming, and integrated pest management segments. Recent market developments underscore continued industry innovation - including IPL Biologicals' Bronze Award at the 10th Bernard Blum Awards 2025 for its biopesticide Bellator, and Sumitomo Chemical's May 2025 European launch of Sumifly, an oil-dispersible biopesticide targeting whiteflies and thrips with a two-year shelf life.

Buy Now: https://www.imarcgroup.com/checkout?id=17647&method=2175

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biopesticide Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4393731 • Views: …

More Releases from IMARC Group

Lithium Iron Phosphate (LiFePO4) Battery Manufacturing Plant Cost: Feasibility S …

The global lithium iron phosphate (LiFePO4) battery manufacturing industry represents a critical technological frontier supporting the worldwide transition toward sustainable energy storage and electric mobility solutions. Lithium iron phosphate (LiFePO4) batteries are a type of lithium-ion battery that uses lithium iron phosphate as the cathode material. They are known for their high energy density, thermal stability, and safety characteristics. Unlike traditional lithium-ion batteries, LiFePO4 batteries offer excellent thermal and chemical…

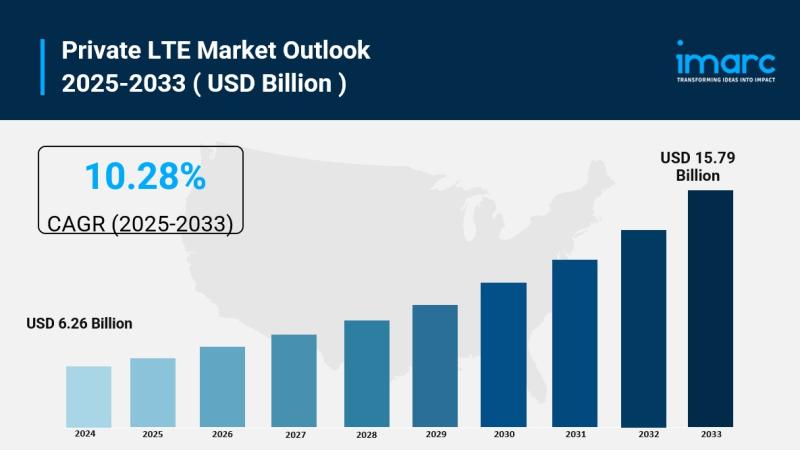

Private LTE Market is Expected to Reach USD 15.79 Billion by 2033 | At CAGR 10.2 …

Private LTE Market Overview:

The global Private LTE Market was valued at USD 6.26 Billion in 2024 and is forecast to reach USD 15.79 Billion by 2033, growing at a CAGR of 10.28% during 2025-2033. This growth is driven by rising demand for secure and reliable wireless connectivity in industrial sectors, increasing adoption of IoT and Industry 4.0 technologies, availability of shared spectrum solutions, and expanding requirements for mission-critical communications across…

Vinyl Flooring Manufacturing Plant DPR - 2026: Investment Cost, Market Growth an …

Vinyl flooring is a synthetic flooring material made from polyvinyl chloride (PVC), widely used in both residential and commercial spaces. Known for its durability, versatility, water resistance, and cost-effectiveness, vinyl flooring is available in various forms including sheets, tiles, and planks, and can convincingly mimic the appearance of premium materials such as hardwood, stone, and ceramic tile. It is extensively used in homes, offices, healthcare facilities, retail spaces, hotels, and…

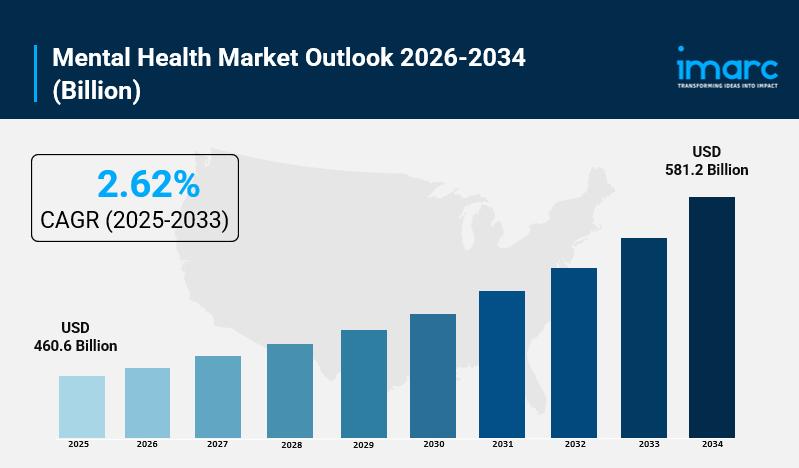

Mental Health Market Size, Share, Industry Trends, Growth Factors and Forecast 2 …

IMARC Group, a leading market research company, has recently released a report titled "Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age Group, and Region 2026-2034." The study provides a detailed analysis of the industry, including the global mental health market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Highlights:

• Mental Health…

More Releases for Biopesticide

Biopesticide Preparations Market Size & Competitive Dynamics: Global Forecast 20 …

Unlock the Future of the Biopesticide Preparations Market: Comprehensive Global Market Report 2025-2031

Global leading market research publisher QYResearch published the release of its latest report, "Biopesticide Preparations - Global Market Share, Ranking, Sales, and Demand Forecast 2025-2031". This in-depth report provides a complete analysis of the global Biopesticide Preparations market, offering critical insights into market size, share, demand, industry development status, and future forecasts. Whether you're a stakeholder, investor, or…

[Latest] China Biopesticide Market: Navigating Changes in Consumer Behavior

New Jersey, United States,- China Biopesticide Market The market is driven by the increasing demand for organic farming, growing concerns over the harmful effects of chemical pesticides, and rising government initiatives supporting sustainable agricultural practices. Furthermore, the market's growth is supported by the rising need for safer and eco-friendly alternatives to chemical pesticides among Chinese farmers. The biopesticide industry in China is also benefiting from advancements in biotechnological innovations, which…

Biopesticide Market share, Market trends, and forecasts from 2024 to 2031.

Market Overview and Report Coverage

Biopesticide is a type of pesticide derived from natural sources, such as plants, bacteria, and certain minerals, which is used to control pests and diseases in crops. It offers an eco-friendly alternative to conventional chemical pesticides, as it has minimal impact on human health and the environment.

The future outlook of the Biopesticide Market looks promising. With increasing awareness about the harmful effects of chemical…

RNA Biopesticide Market is projected to reach at a CAGR of 13.43%

The RNA Biopesticide Market was valued at 2.83 billion USD in 2022, and is projected to reach 6.60 billion USD by 2029, at a compound annual growth rate (CAGR) of 13.43% during the forecast period.

The large-scale market research conducted for this RNA Biopesticide market report assists clients in predicting investments in emerging markets, expanding market share, or launching new products successfully. The report simplifies multifarious market insights using well-established tools…

RNA Biopesticide Market Opportunities, Sales, Revenue, Gross Margin & Trends Ana …

RNA biopesticides, also known as nucleic acid biopesticides and nucleic acid interferons, are polynucleotide preparations that interfere with or inhibit the transcription of specific genes of target organisms. Through the method of cell factory or cell-free synthesis, the dsRNA that can specifically target the specific gene in the insect/bacteria (host) is prepared, and enters the host cell under the active transport or endocytosis of the midgut cell of the host,…

Biopesticide Market Analysis 2022, Business Revenues, Expansion Plans and Foreca …

The Global Biopesticide Market Size was estimated at USD 4811.40 million in 2021 and is projected to reach USD 10240.00 million by 2028, exhibiting a CAGR of 11.39% during the forecast period.

Global Biopesticide Market is projected to witness a healthy growth in the years to come. This provides a lucrative growth opportunity for the market players to generate better revenue streams by expanding their market presence in the emerging economies.…