Press release

Investment Requirements for HDPE Pipe Manufacturing Plant Setup 2026

HDPE (High-Density Polyethylene) pipes are thermoplastic piping solutions manufactured from polyethylene resin with a high strength-to-density ratio. Produced through extrusion processes, these pipes are lightweight, flexible, corrosion-resistant, and chemically inert, exhibiting excellent resistance to impact, abrasion, and environmental stress cracking along with superior pressure-handling capability.Their smooth internal surface ensures low friction losses and a long service life, often exceeding 50 years. Due to their durability and leak-proof jointing methods, HDPE pipes are widely used in water supply, sewerage, gas distribution, industrial fluid transfer, and agricultural irrigation systems.

With rising investments in water supply and sanitation infrastructure, expanding irrigation networks in agriculture, and the growing replacement of conventional metal piping systems in industrial and municipal applications, HDPE pipe manufacturing represents a strategically compelling and financially viable investment opportunity for manufacturers and infrastructure-focused investors.

IMARC Group's report, "HDPE Pipe Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The HDPE pipe manufacturing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Market Overview and Growth Potential

The global HDPE pipe market has demonstrated steady growth and continues to offer substantial expansion potential. According to IMARC Group, the global HDPE pipe market was valued at USD 22.0 Billion in 2025 and is projected to reach USD 30.9 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 3.88% during 2026-2034.

Key market drivers include government-led investments in smart cities, water supply schemes, irrigation expansion, and gas pipeline networks across both emerging and developed economies. The material's superior corrosion resistance, flexibility, and long service life have positioned HDPE pipes as the preferred alternative to traditional PVC, steel, and concrete pipelines.

Rapid urbanization and population growth continue to elevate demand for reliable fluid transport systems. According to the UNFPA, more than half of the world's population now lives in cities and towns, and by 2030, this number is estimated to increase to approximately 5 billion. Technological advancements in extrusion equipment and jointing methods are further improving product performance and cost efficiency, strengthening long-term market prospects.

Grab a sample PDF of this report: https://www.imarcgroup.com/hdpe-pipe-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed HDPE pipe manufacturing facility is designed with an annual production capacity ranging between 20,000-100,000 MT, enabling economies of scale while maintaining operational flexibility. This scalable design allows manufacturers to serve diverse market segments-including water and wastewater systems, gas distribution, construction and infrastructure, agriculture, and industrial applications-while adjusting production volumes to align with project-based demand cycles and regional infrastructure development timelines.

Financial Viability and Profitability Analysis

The HDPE pipe manufacturing project demonstrates healthy profitability potential under normal operating conditions. The plant's financial performance is supported by stable infrastructure-driven demand and diversified end-use applications:

• Gross Profit Margins: 20-30%, supported by consistent demand from government and private infrastructure projects

• Net Profit Margins: 8-15%, reflecting efficient raw material management and scalable production operations

Profit margins typically improve with capacity expansion and increased capacity utilization rates. The break-even period for an HDPE pipe manufacturing plant typically ranges from 3 to 5 years, depending on plant capacity, market demand, raw material costs, and operational efficiency. Strong distribution networks and government infrastructure projects can further accelerate profitability.

Operating Cost Structure

The operating cost structure of an HDPE pipe manufacturing plant is primarily driven by raw material consumption, particularly HDPE granules. Key cost components include:

• Raw Materials (HDPE granules, carbon black, and additives): 75-85% of total OpEx

• Utilities (electricity, water, steam): 5-10% of total OpEx

HDPE pipe production requires High-Density Polyethylene resin (in the form of pellets or granules), along with additives such as UV stabilizers, antioxidants, and pigments to enhance durability, weather resistance, and color. Effective cost management strategies include securing long-term contracts with reliable suppliers to stabilize pricing, conducting sustainability and supply chain risk assessments, and minimizing transportation costs through strategic supplier proximity.

Capital Investment Requirements

Establishing an HDPE pipe manufacturing plant involves several capital expenditure components. Machinery costs account for the largest portion of total CapEx, followed by land and site development, civil works, and other capital cost. The key equipment requirements include:

• Resin silos for raw material storage and handling

• Material loaders for automated feeding systems

• Single or twin-screw extruders for pipe molding and shaping

• Pipe dies for dimensional precision and profile control

• Vacuum calibration tanks for size and shape stabilization

• Cooling troughs for controlled temperature reduction

• Haul-off units for continuous pipe pulling and speed control

• Cutting saws for precision sizing to required lengths

• Printing or marking machines for product labeling and identification

Additional capital investments cover land acquisition, site preparation, infrastructure development, quality control laboratories, and utility systems. The typical timeline for plant establishment ranges from 12 to 18 months, depending on land readiness, machinery procurement and installation, utility setup, regulatory approvals, and staff onboarding. Turnkey solutions may help reduce the setup time.

Major Applications and Market Segments

HDPE pipes serve critical infrastructure needs across diverse end-use industries:

• Water & Sewer Systems: Potable water pipelines, wastewater lines, and drainage networks

• Gas Distribution: Natural gas and industrial gas transport pipelines

• Construction & Infrastructure: Underground utilities, ducting, and conduit systems

• Agriculture: Irrigation pipelines and water management systems

• Industrial Applications: Chemical transport lines, slurry pipelines, and process piping

Why Invest in HDPE Pipe Manufacturing?

HDPE pipe manufacturing presents multiple strategic advantages for investors and infrastructure-focused entrepreneurs:

• Essential Infrastructure Material: HDPE pipes are integral to modern water management, sanitation, irrigation, and gas distribution systems, making them a critical component of urban and rural infrastructure development worldwide.

• Strong Replacement Demand: The increasing replacement of aging metal and concrete pipelines with corrosion-free HDPE systems is accelerating market penetration across municipalities and industrial sectors.

• Alignment with Sustainability Goals: HDPE pipes are recyclable, energy-efficient to manufacture, and enable water conservation through leak-proof joints, supporting global sustainability and ESG initiatives.

• Policy and Infrastructure Push: Government-led investments in smart cities, water supply schemes, irrigation expansion, and gas pipeline networks are significantly boosting HDPE pipe demand across emerging and developed economies.

• Localized Manufacturing Advantage: Proximity to infrastructure projects reduces transportation costs, improves delivery timelines, and enhances competitiveness for domestic manufacturers serving large-scale projects.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=7699&flag=C

Industry Leadership

The global HDPE pipe industry features several leading manufacturers with extensive production capacities and diverse application portfolios.

• JM Eagle

• Aliaxis Group

• WL Plastics

• Prinsco

• China Lesso Group

These companies collectively serve end-use sectors spanning water and wastewater, agriculture, oil and gas, construction, and industrial processing.

Buy Now: https://www.imarcgroup.com/checkout?id=7699&method=2175

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Requirements for HDPE Pipe Manufacturing Plant Setup 2026 here

News-ID: 4393667 • Views: …

More Releases from IMARC Group

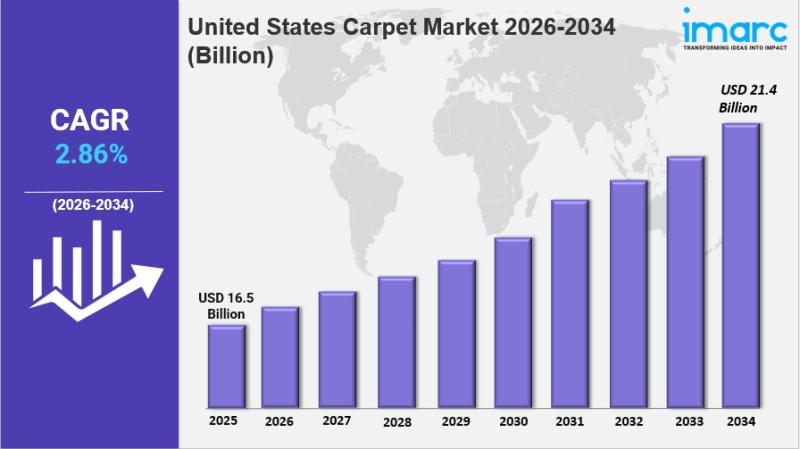

United States Carpet Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "United States Carpet Market Size, Share, Trends and Forecast by Material, Price Point, Sales Channel, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Carpet Market Overview

The United States carpet market size was valued at USD 16.5 Billion in 2025.…

Instant Coffee Processing Plant DPR & Unit Setup Cost 2026: Machinery Requiremen …

Instant coffee is a widely consumed beverage product created by processing brewed and concentrated coffee from roasted beans into powder or granule form. Produced through spray drying or freeze-drying processes, instant coffee preserves its aroma, flavor compounds, and solubility properties while dissolving rapidly in hot or cold water. Available in multiple formats-including powder, granules, agglomerates, and single-serve sachets-instant coffee offers a convenient and time-saving alternative to traditional brewed coffee, serving…

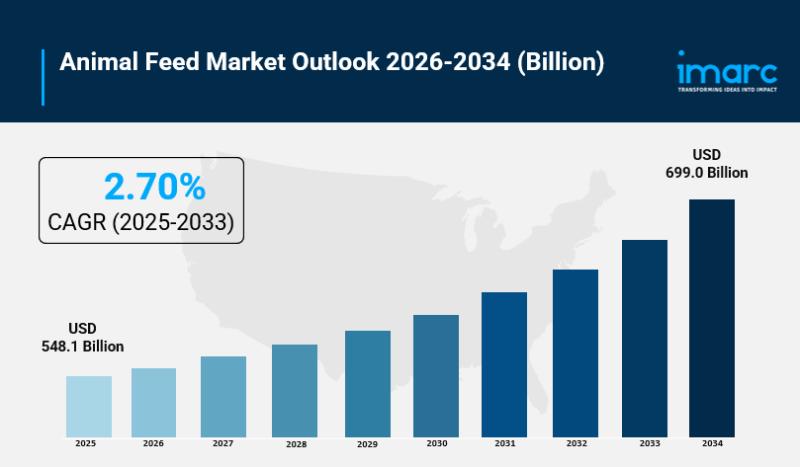

Animal Feed Market Size, Trends, Key Players, Latest Insights and Forecast 2026- …

IMARC Group, a leading market research company, has recently released a report titled "Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the global animal feed market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Animal Feed Market Highlights:

• Animal Feed…

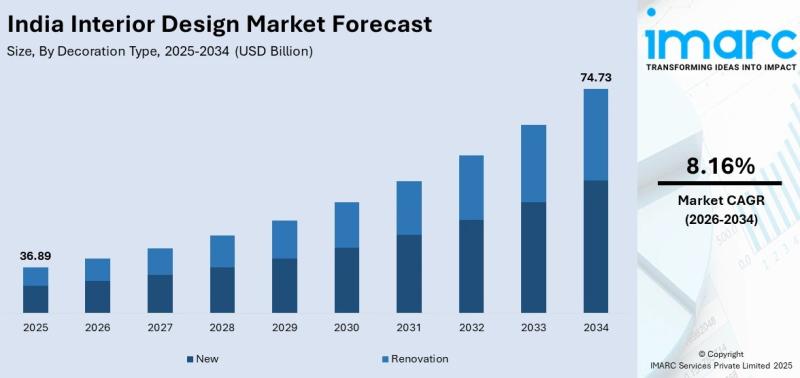

India Interior Design Market 2026-2034: Industry Trends, Size, Share, Growth Dri …

Report ID: SR112026A6173 | Format: PDF + Excel | Verified by: IMARC Group

Market At-A-Glance: Key Statistics (2026-2034):

• Market Size (2025): USD 36.89 Billion

• Forecast Value (2034): USD 74.73 Billion

• Growth Rate (CAGR): 8.16% (2026-2034)

• Leading Segment: Residential (60% Share)

• Key Trend: Smart Homes & Sustainable Desig

What is the India Interior Design Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group, the interior design market size in India reached USD…

More Releases for HDPE

Beyond Numbers: Understanding PCR HDPE Market Size

In this comprehensive report, analysts conduct an in-depth study of the global PCR HDPE market, delving into key factors such as drivers, challenges, recent trends, opportunities, advancements, and the competitive landscape. Utilizing research techniques like PESTLE and Porter's Five Forces analysis, the researchers provide a clear understanding of both the current and future scenarios within the global PCR HDPE industry. Accurate data on PCR HDPE production, capacity, price, cost, margin,…

Latest Trends In Global Recycled HDPE Market

Recycled HDPE, or High-Density Polyethylene, is a versatile and environmentally friendly material derived from the recycling of plastic products made from HDPE.

HDPE is a type of plastic commonly used for items like milk jugs, detergent bottles, and plastic bags. The recycling process for HDPE involves collecting, cleaning, and melting down these used plastic items to create new products.

Request for Sample@

https://mobilityforesights.com/contact-us/?report=20042

Recycled HDPE is valued for its durability, resistance…

Geomembrane manufacturer, HDPE geomembrane factory, geosynthetics supplier

MTTVS® Geosynthetics company specializes in research ,development,production,promotion and application of geosynthetics.And is the world's leading supplier of geosynthetics. Founded in 2014,located in Shandong China.With ISO9001,ISO14001,ISO45001 international authoritative management system certification of powerful large manufucture.We have more than 10 international advanced equipment production lines and a huge professional engineering and technical team.and has successfully consolideated and developed core markets to maximize value for customers.Through the processing of synthetic raw materials.we develop,manufacture…

hdpe geomembrane liner fabric manufacturer,geotextile manufacturer Company,HDPE …

GD Geosynthetics Company is a comprehensive processing enterprise of composite geosynthetics, geotextiles, geomembranes, geogrids, geounits, three-dimensional composite drainage nets, ecological bags, drainage boards. High-level management, high-level scientific research team, conform to the trend of domestic and international chemical fiber market, constantly innovate and update, cater to the market and meet the needs of consumers. Gained the trust of consumers.

Geosynthetics are widely used in anti-seepage treatment of roads, bridges, reservoirs, tunnels,…

Research Focuses on Global HDPE Geomembrane

HDPE Geomembrane Report by Material, Application, and Geography – Global Forecast to 2021 is a professional and in-depth research report on the world's major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, united Kingdom, Japan, South Korea and China).

The report firstly introduced the HDPE Geomembrane basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures,…

Global HDPE Decking Market Research Report 2017

HDPE Decking Revenue, means the sales value of HDPE Decking This report studies HDPE Decking in Global market, especially in North America, Europe, China, Japan, Southeast Asia and India, focuses on top manufacturers in global market, with capacity, production, price, revenue and market share for each manufacturer, covering UPM Kymmene Universal Forest Products Advanced Environmental Recycling Technologies Fiberon Azek Building Products Cardinal Building Products Certainteed Corporation Duralife Decking and Railing…