Press release

Waste Plastic Recycling Plant DPR 2026: Cost Structure, Business Plan, and Profitability Analysis

The global waste plastic recycling sector is gaining powerful momentum as governments, industries, and consumers intensify efforts to address plastic pollution, regulatory compliance, and circular economy mandates. With rising plastic consumption across packaging and consumer goods, increasing enforcement of Extended Producer Responsibility (EPR) frameworks and single-use plastic bans, and a growing industrial demand for high-quality recycled polymers, establishing a waste plastic recycling plant positions investors at the heart of one of the most urgently needed and policy-driven manufacturing industries of the decade.IMARC Group's report, "Waste Plastic Recycling Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a recycling plant. The waste plastic recycling plant report offers insights into the recycling process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/waste-plastic-recycling-plant-project-report/requestsample

Market Overview and Growth Potential

The India waste plastic recycling market demonstrates strong volumetric growth, measured at 11.92 Million Tons in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach 25.88 Million Tons by 2034, exhibiting a robust CAGR of 9.0% from 2026-2034. This sustained expansion is driven by rising plastic consumption across packaging and consumer goods, increasing regulatory pressure to reduce landfill waste, growing demand for recycled polymers in manufacturing and construction applications, and expanding corporate sustainability commitments requiring higher recycled content targets.

Waste plastic recycling is the process of collecting, sorting, and processing plastic waste from consumer use and industrial production to create reusable plastic materials and granules. The process separates plastic materials by polymer types, undergoes cleaning for contaminant removal, and then shreds into flakes before being melted to create pellets through the extrusion process. Recycled plastic products include reprocessed polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and other polymers that retain functional properties such as durability, chemical resistance, and moldability.

Asia-Pacific, led by China and India, continues to dominate growth due to large plastic consumption volumes, expanding urban populations, and rising investments in recycling infrastructure. In October 2025, Without®, an impact-driven deep-tech materials company, inaugurated its first-of-its-kind demonstration recycling plant in Pune-among India's earliest integrated units capable of handling up to five tonnes per month of hard-to-recycle plastic waste-underscoring the accelerating investment activity in this sector.

Plant Capacity and Production Scale

The proposed waste plastic recycling facility is designed with an annual capacity of 5,000-20,000 MT, enabling economies of scale while maintaining operational flexibility. This range serves diverse end-use segments-packaging, construction, and consumer goods-delivering recycled plastic granules, sheets, containers, pipes, molded components, and industrial plastic products. The scalable capacity structure allows manufacturers to begin with focused polymer streams such as PET or PE and expand into multi-polymer operations as market demand and feedstock availability grows.

Financial Viability and Profitability Analysis

The waste plastic recycling business demonstrates solid profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 25-35%

• Net Profit Margins: 10-20%

These margins are supported by stable demand across packaging, construction, and consumer goods sectors, the competitive cost advantage of recycled polymers versus virgin plastics, government-backed EPR incentives that guarantee feedstock supply, growing brand commitments to recycled content, and the favorable entry economics of recycling versus primary petrochemical polymer production. The project demonstrates attractive ROI and NPV potential, making it a compelling proposition for sustainability-focused investors and materials manufacturers seeking circular economy exposure.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is essential for effective financial planning. The cost structure for a waste plastic recycling plant is primarily driven by:

• Raw Materials - Waste Plastic Flakes/Bales: 50-60% of total OpEx

• Utilities: 20-25% of OpEx

• Other Expenses: Including labor, transportation, maintenance, depreciation, packaging, and taxes

Waste plastic flakes and bales constitute the largest raw material cost, alongside washing chemicals required for contaminant removal. Utilities represent a significantly higher share of OpEx than typical manufacturing plants due to the energy demands of shredding, washing, drying, and extrusion processes. Establishing reliable feedstock agreements with municipal collection systems, waste aggregators, and industrial waste generators helps stabilize input costs and ensures continuous, uninterrupted production operations.

Capital Investment Requirements

Setting up a waste plastic recycling plant requires strategic capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with easy access to waste plastic feedstock sources-flakes/bales-and washing chemical suppliers. Proximity to packaging, construction, and consumer goods manufacturers minimizes distribution costs for recycled granules. The site must have robust infrastructure including reliable road transportation, utilities, water supply for washing operations, and effluent treatment systems. Compliance with local zoning laws, waste management regulations, and environmental permits must also be ensured.

Machinery and Equipment: The largest component of capital expenditure (CapEx) covers specialized recycling processing equipment:

• Plastic washing systems for multi-stage contaminant removal and material cleaning

• Shredding machines for size reduction of incoming plastic bales into uniform flakes

• Extrusion systems for melting and reforming cleaned plastic flakes into pellets

• Pelletization equipment for shaping, cooling, and sizing recycled polymer granules

• Sorting and separation systems for polymer-type classification and quality control

• Drying systems for moisture removal prior to extrusion

Civil Works: Building construction, plant layout optimization, and infrastructure development designed for large-volume material handling, water management for washing operations, and safe storage of both incoming waste bales and finished recycled granules. The layout accommodates the full process flow: collection, segregation, washing, shredding, extrusion, and pelletization.

Other Capital Costs: Pre-operative expenses, environmental clearances, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen costs during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=39065&method=2175

Major Applications and Market Segments

Recycled plastic products serve extensive and growing applications across key market segments:

Packaging: Used in recycled plastic films, bottles, containers, and flexible packaging products, driven by brand sustainability commitments and regulatory recycled content mandates.

Construction: Employed in pipes, insulation materials, plastic lumber, roofing sheets, and fittings, where recycled polymers offer cost-competitive and environmentally preferred alternatives to virgin materials.

Consumer Goods: Utilized in household items, furniture, storage products, and molded accessories, where brands increasingly integrate recycled plastics to meet ESG targets.

Industrial Products: Used in crates, pallets, bins, and automotive plastic components, where the durability, chemical resistance, and moldability of recycled PE, PP, and PET are valued.

Why Invest in Waste Plastic Recycling?

Critical Environmental Infrastructure: Waste plastic recycling reduces landfill waste, protects marine ecosystems, decreases greenhouse gas emissions, and creates a circular economy system across packaging, construction, and consumer product distribution networks-making it both essential and increasingly mandated.

Favorable Entry Economics: The recycling industry requires less initial funding than primary petrochemical polymer production, and existing collection systems and scalable processing technologies enable faster facility development and return on investment.

Alignment with Sustainability Megatrends: Global ESG commitments, corporate recycled content pledges, and growing consumer preference for sustainable products create ongoing and expanding plastic recycling demand across multiple industrial sectors.

Regulatory and Policy Support: Government regulations including Extended Producer Responsibility (EPR) frameworks, plastic waste management mandates, and single-use plastic bans are driving structured investment in recycling systems and guaranteeing a policy-supported feedstock pipeline.

Rising Preference for Local Recycling Supply Chains: Manufacturers choose domestic recyclers to ensure recycled polymer availability, reduce transportation expenses, and meet local recycling content requirements and sustainability standards.

Manufacturing Process Excellence

The waste plastic recycling process involves six sequential, precision-controlled stages:

• Collection: Aggregation of waste plastic bales and flakes from municipal systems, industrial generators, and waste aggregators

• Segregation: Sorting of plastics by polymer type-PE, PP, PET, and others-using manual and automated separation systems

• Washing: Multi-stage contaminant removal using washing chemicals and water to achieve clean, processing-ready flakes

• Shredding: Size reduction of cleaned plastic into uniform flakes suitable for extrusion

• Extrusion: Melting of shredded flakes through extruders to produce continuous streams of recycled polymer melt

• Pelletization: Shaping, cooling, and cutting of polymer melt into uniform recycled plastic granules ready for sale

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=39065&flag=C

Industry Leadership

The global waste plastic recycling industry includes established multinational companies and specialized recyclers. Key industry players include:

• Evergreen Plastics

• PolyQuest

• Phoenix Technologies

• Verdeco Recycling

• Custom Polymers

• KW Plastics

• Extrupet

• Greentech

• Veolia Polymers

• Hahn Plastics

• PLASgran

• Wellpine Plastic Industrial

• Suzhou Jiulong Recy & Tech

• Longfu Recycling Energy Scientech

These companies serve end-use sectors including packaging, construction, and consumer goods, demonstrating the broad commercial applicability and competitive depth of the global waste plastic recycling industry.

Recent Industry Developments

August 2025: Mura Technology revealed plans to establish a new advanced plastic recycling plant in Singapore with a capacity of 50 kilotonnes per year. Located on Jurong Island within the Singapore Essential Chemicals Complex, the facility strengthens Mura's Asia footprint alongside a newly opened Singapore office to support regional operations and its growing licensed network.

June 2025: EREMA Group showcased a preview of its latest plastics recycling innovations ahead of K 2025 in Düsseldorf. CEO Manfred Hackl highlighted rapid advances in recycling technologies and unveiled new machine solutions, including TwinPro and AGGLOREMA, aimed at expanding applications, improving efficiency, and keeping more plastics in circulation.

June 2025: Sika and Sulzer created an equal joint venture to strengthen plastic recycling within the construction sector. Headquartered near Zurich and scheduled to begin operations in the second half of 2025, the venture integrates Sika's polymer know-how with Sulzer's chemical recycling technologies to address construction-related plastic waste.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Waste Plastic Recycling Plant DPR 2026: Cost Structure, Business Plan, and Profitability Analysis here

News-ID: 4393596 • Views: …

More Releases from IMARC Group

Green Cement Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Mac …

The global green cement manufacturing industry is witnessing robust growth driven by the rapidly expanding construction sector and increasing demand for sustainable, low-carbon building materials. At the heart of this expansion lies a critical specialty construction material green cement. As the construction industry transitions toward eco-friendly and energy-efficient practices, establishing a green cement manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and construction material investors seeking to capitalize…

Europe Recycled Plastics Market to Hit 20.2 Million Tons by 2034 with a Robust C …

The Europe recycled plastics market size reached 13.89 Million Tons in 2025 and is forecast to reach 20.2 Million Tons by 2034, with a CAGR of 4.2% from 2026 to 2034. This growth is driven by sustainable packaging emphasis, stricter environmental regulations, and wide adoption of extended producer responsibility programs. The market is also propelled by government policies promoting recycling infrastructure across packaging, automotive, and construction industries. Consumer preference for…

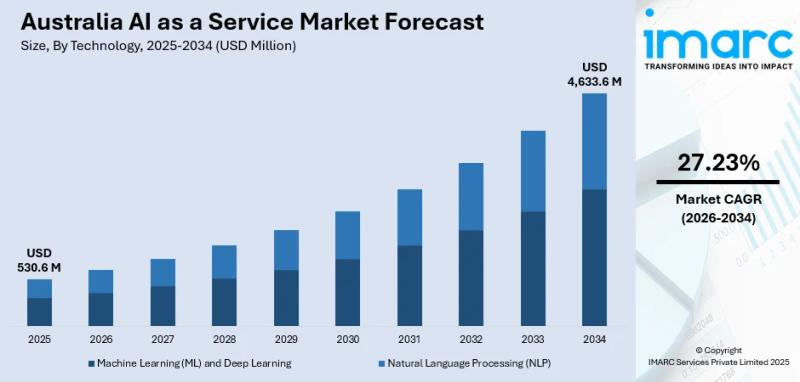

Australia AI as a Service Market Projected to Reach USD 4633.6 Million by 2034

Market Overview

The Australia AI as a Service market size reached USD 530.6 Million in 2025 and is projected to reach USD 4,633.6 Million by 2034. The market expansion is fueled by growing cloud adoption, government investments in AI research, and increased demand for AI-powered automation across multiple industries including healthcare and finance. The surge of AI startups and collaborations between tech firms and enterprises further propel the market's advancement. The…

Fuel Cells Manufacturing Plant Setup Report (DPR) 2026: Investment Guide and Dem …

The global fuel cells industry is experiencing one of the fastest growth trajectories in the clean energy sector, propelled by rising demand for hydrogen-based technologies, accelerating decarbonization commitments from major economies, and growing adoption of fuel cell electric vehicles for heavy-duty and long-range transportation. As governments worldwide deploy large-scale clean energy investment programs and industries seek reliable zero-emission alternatives to diesel generation, establishing a fuel cells manufacturing plant represents a…

More Releases for Plastic

Plastic bottles at events - Better party with plastic

Partying, dancing, camping - festivals attract hundreds of thousands of visitors every year in Germany alone. One challenge: supply and safety. For this reason, drinks in glass bottles are banned at most events due to the risk of injury. Lightweight and unbreakable plastic bottles, on the other hand, are considered a safe and practical alternative. Not only that: they can even be used to make a musical instrument.

Festivals or pageants…

Plastic Pallet With Plastic Crate Use: Efficient Material Handling

When it comes to efficient moving and storage of goods, a combination of plastic pallets [https://www.agriculture-solution.com/plastic-pallet/]and plastic crates is a popular choice. They are widely used in various industries such as manufacturing, retail, agriculture, etc. for storage and transportation of goods. Plastic pallets are designed to provide a stable base for stacking and shipping goods, while plastic crates provide safe and protective containers for stored or transported items. Plastic pallets…

Plastic Granules Market to Witness Massive Growth by Balaji Plastic, Navkar Indu …

The Worldwide Plastic Granules Market has witnessed continuous growth in the past few years and is projected to grow at a good pace during the forecast period of 2023-2029. The exploration provides a 360° view and insights, highlighting major outcomes of Worldwide Plastic Granules industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improve profitability. Additionally, the study helps venture or emerging…

Insights on the Growth of Plastic Granules Market 2018 to 2025 | Profiling Key C …

UpMarketResearch offers a Latest report on “Plastic Granules Market Analysis & Forecast 2018-2025” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 114 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Request Sample Copy of This Report@ https://www.upmarketresearch.com/home/requested_sample/49052

Plastic Granules research report delivers a close watch on leading competitors with strategic…

Agriculture Film Market SWOT Analysis of Leading Key Players Shandong Tianhe Pla …

HTF MI recently introduced Global Agriculture Film Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are British Polythene Industries (BPI), Trioplast, Berry Plastics, Armando Alvarez, Polypak, Barbier…

Building Materials Market 218 : Hepworth, National Plastic Industry, Hira Indust …

Building materials in this report covered the PVC pipes and fittings, PPR pipes and fittings, PE pipes and fittings, fabrication, ducts systems for infrastructure, valves and pumps and electrical conduits PVC systems.

At present, Hepworth, National Plastic Industry, Hira Industries, Florance Plastic Industries, Polyfab Plastic Industry, MPI, Union Pipes Industry, ANABEEB, Borouge and ACO Group are the UAE leading suppliers of the building materials, and top ten of them shared about…