Press release

Fuel Cells Manufacturing Plant Setup Report (DPR) 2026: Investment Guide and Demand Analysis

The global fuel cells industry is experiencing one of the fastest growth trajectories in the clean energy sector, propelled by rising demand for hydrogen-based technologies, accelerating decarbonization commitments from major economies, and growing adoption of fuel cell electric vehicles for heavy-duty and long-range transportation. As governments worldwide deploy large-scale clean energy investment programs and industries seek reliable zero-emission alternatives to diesel generation, establishing a fuel cells manufacturing plant represents a high-value, strategically timed opportunity for investors ready to lead in the hydrogen-powered energy transition.IMARC Group's report, "Fuel Cells Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a processing plant. The fuel cells manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/fuel-cells-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global fuel cells market demonstrates exceptional growth trajectory, valued at USD 7.97 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 43.71 Billion by 2034, exhibiting a remarkable CAGR of 20.8% from 2026-2034. This explosive expansion is driven by rising demand for clean energy solutions, increasing adoption of hydrogen-based technologies, supportive government policies for decarbonization, growth in fuel cell electric vehicles for heavy-duty mobility, and expanding industrial and commercial adoption of fuel cells as reliable alternatives to diesel generators.

Fuel cells function as electrochemical energy conversion devices that produce electricity through the chemical reaction between hydrogen or other fuels and oxygen, generating electricity, heat, and water as by-products. They provide clean power generation because they operate at high efficiency while producing very low emissions. The market currently offers multiple fuel cell types, including proton exchange membrane fuel cells, solid oxide fuel cells, molten carbonate fuel cells, and alkaline fuel cells, each functioning in particular conditions and specific uses. The technology enables uninterrupted energy output with minimal sound, system scalability, and lower carbon emissions, finding application in electric vehicles, backup power systems, distributed power generation, industrial facilities, and hydrogen energy system development.

Reinforcing the industry's momentum, India's Ministry of Power and MNRE reported that non-fossil energy capacity reached about 262.74 GW, accounting for nearly 51.5% of total power capacity by November 2025. Achieving this milestone ahead of schedule has strengthened clean energy momentum and accelerated demand for fuel cells in grid support and green hydrogen applications, signaling a powerful and supportive policy environment for fuel cell manufacturing investments.

Plant Capacity and Production Scale

The proposed fuel cells manufacturing facility is designed with an annual production capacity of 50-500 MW stack capacity, enabling economies of scale while maintaining operational flexibility. This scalable range serves diverse end-use segments-including the automotive and transportation sector, stationary power generation, data centers, industrial energy systems, defense and aerospace, and portable power applications-delivering fuel cell electric vehicles, backup and prime power systems, combined heat and power units, off-grid energy solutions, and hydrogen energy infrastructure.

Financial Viability and Profitability Analysis

The fuel cells manufacturing business demonstrates strong profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 40-50%

• Net Profit Margins: 15-30%

These margins are supported by the high-value nature of fuel cell technology products, strong pricing power in transportation and stationary power segments, growing government-backed procurement programs, ongoing technological improvements that reduce manufacturing costs, and the modular and scalable nature of fuel cell production that enables efficient capacity utilization. The project demonstrates strong ROI and NPV potential, making it an attractive proposition for clean energy-focused investors and industrial manufacturers expanding into hydrogen technology.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is essential for effective financial planning. The cost structure for a fuel cells manufacturing plant is primarily driven by:

• Raw Materials - MEA and Components: 60-70% of total OpEx

• Utilities: 5-10% of OpEx

• Other Expenses: Including labor, transportation, maintenance, depreciation, packaging, and taxes

Membrane electrode assemblies (MEA) constitute the dominant raw material cost driver, alongside bipolar plates and gaskets. Establishing long-term supply agreements with specialist MEA manufacturers and component suppliers helps stabilize costs, reduce supply chain risk, and ensure consistent material quality critical for meeting stringent fuel cell performance and durability specifications.

Capital Investment Requirements

Setting up a fuel cells manufacturing plant requires strategic capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic access to key raw materials including membrane electrode assemblies (MEA), bipolar plates, and gaskets. Proximity to automotive, industrial, and data center markets minimizes distribution costs. The site must have robust infrastructure including reliable transportation, utilities, and waste management systems, along with compliance with local zoning laws and environmental regulations.

Machinery and Equipment: The largest component of capital expenditure (CapEx) covers specialized precision manufacturing equipment:

• Advanced coating machines for catalyst and membrane layer application

• Cell assembly lines for precise component integration and stack building

• Testing stations for electrochemical performance and durability verification

• Automation systems for high-volume, consistent manufacturing output

• Quality inspection equipment for defect detection and certification compliance

Civil Works: Building construction, cleanroom facilities, and plant layout optimization designed to support precision manufacturing, ensure contamination control, and enable efficient workflow across all seven production stages: electrode preparation, membrane fabrication, catalyst coating, cell assembly, stack integration, performance testing, and system packaging.

Other Capital Costs: Pre-operative expenses, R&D and technology licensing fees, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen costs during plant establishment and commissioning.

Buy Now: https://www.imarcgroup.com/checkout?id=22217&method=2175

Major Applications and Market Segments

Fuel cells find extensive high-value applications across rapidly expanding market segments:

Automotive and Transportation Sector: Used in electric vehicles and buses to provide zero-emission transportation with extended driving range and fast refueling times compared to batteries, particularly suited for heavy-duty and long-range mobility applications.

Stationary Power Generation: Used in commercial buildings, data centers, and industries to provide efficient and clean continuous power generation with high reliability and negligible greenhouse gas emissions.

Industrial and Backup Power Systems: Used in critical applications to provide uninterrupted power in remote areas and during outages, serving as a clean and dependable alternative to diesel generators.

Portable and Specialized Power Applications: Miniature fuel cell systems are used in defense, aerospace, and portable applications for clean, silent energy generation in mission-critical environments.

Why Invest in Fuel Cells Manufacturing?

Exceptional Market Growth Rate: With a projected CAGR of 20.8% and a market expanding from USD 7.97 Billion to USD 43.71 Billion by 2034, fuel cells represent one of the highest-growth manufacturing investment opportunities available in the clean energy sector.

Increasing Demand for Clean Energy: The global need for clean energy and decarbonization is driving the adoption of hydrogen and fuel cells across transportation, industry, and power generation sectors worldwide.

High Efficiency and Zero Emissions: Fuel cells have higher efficiency rates with negligible greenhouse gas emissions, positioning them as the premium clean energy solution for industries subject to tightening environmental regulations.

Growing Hydrogen Infrastructure: Development of hydrogen infrastructure including production, storage, and transportation is increasing the adoption of fuel cells across all application segments, supported by major government investment programs.

Scalable and High-Value Manufacturing: Modular manufacturing capabilities allow for scalability and high-value market applications in industries such as transportation, where fuel cell systems command premium pricing and strong government procurement support.

Manufacturing Process Excellence

The fuel cells manufacturing process consists of seven precision-controlled stages:

• Electrode Preparation: Fabrication of anode and cathode electrode structures with precise material composition

• Membrane Fabrication: Production of proton exchange or other membrane types with controlled thickness and ionic conductivity

• Catalyst Coating: Application of catalyst layers to membrane surfaces using advanced coating machines

• Cell Assembly: Integration of MEA, bipolar plates, and gaskets into individual fuel cells on automated assembly lines

• Stack Integration: Combining individual cells into complete fuel cell stacks with target power output specifications

• Performance Testing: Comprehensive electrochemical testing and calibration at dedicated testing stations to verify output, efficiency, and durability

• System Packaging: Final integration of balance-of-plant components and secure preparation for delivery to end customers

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=22217&flag=C

Industry Leadership

The global fuel cells industry is led by pioneering companies with extensive technology portfolios and diverse application capabilities. Key industry players include:

• Ballard Power Systems

• Bloom Energy

• Ceres Power Holdings PLC

• Doosan Fuel Cell America, Inc.

• FuelCell Energy, Inc.

These companies serve diverse end-use sectors including automotive, stationary power, industrial, and infrastructure segments, establishing the competitive benchmark for new entrants and demonstrating the commercial breadth of fuel cell applications across global markets.

Recent Industry Developments

September 2025: SFC Energy AG presented a concept study at the Defence and Security Equipment International (DSEI) exhibition in London, highlighting next-generation EMILY fuel cells. The EMILY 12000 expands the DMFC portfolio, delivering up to 500 watts or 12,000 watt-hours daily-quadrupling the EMILY 3000. Clustered systems reach 5 kW, supporting mobile, vehicle, and stationary use with silent emission-free operations, with manufacturing across Germany, India, and a future US site, targeting a 2026 launch.

February 2025: Toyota Motor Corporation developed a third-generation fuel cell system targeting commercial applications, matching diesel-engine durability while delivering higher fuel efficiency and lower costs than earlier versions. Deployment extends beyond passenger vehicles to heavy-duty commercial vehicles, with rollout planned after 2026 across Japan, Europe, North America, and China.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fuel Cells Manufacturing Plant Setup Report (DPR) 2026: Investment Guide and Demand Analysis here

News-ID: 4393537 • Views: …

More Releases from IMARC Group

Biomass Power Plant Cost Report 2026: Demand Analysis, CapEx/OpEx, & ROI Insight …

The global biomass power sector is experiencing accelerating growth, driven by rising demand for reliable and dispatchable renewable energy, government initiatives to reduce greenhouse gas emissions, and a growing focus on waste-to-energy solutions. As nations worldwide ramp up renewable energy capacity and phase out fossil fuels, biomass power plants-capable of delivering continuous, controllable electricity unlike intermittent solar and wind sources-present a strategically compelling business opportunity for energy investors and independent…

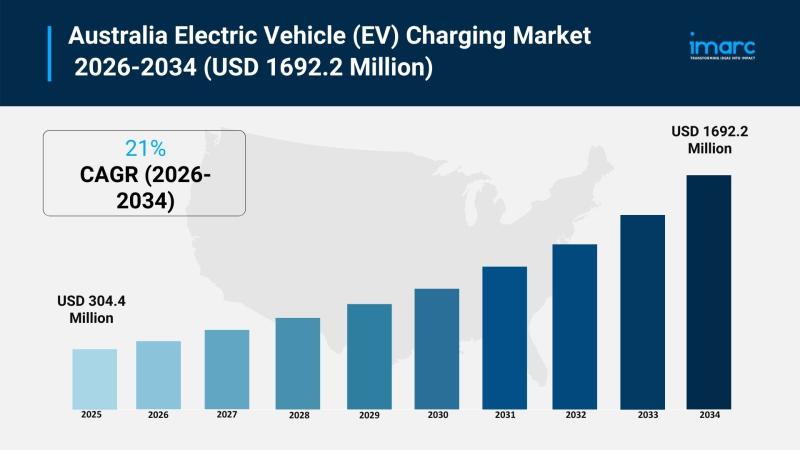

Australia Electric Vehicle (EV) Charging Market Projected to Reach USD 1692.2 Mi …

Market Overview

The Australia electric vehicle (EV) charging market was valued at USD 304.4 million in 2025 and is projected to reach USD 1,692.2 million by 2034, growing at a rate of 21.00% over the forecast period 2026-2034. Growth is driven by rapid expansion of urban and rural charging infrastructure, the rise of smart charging technologies like vehicle-to-grid systems, and supportive government incentives promoting widespread EV charger installation. The market advances…

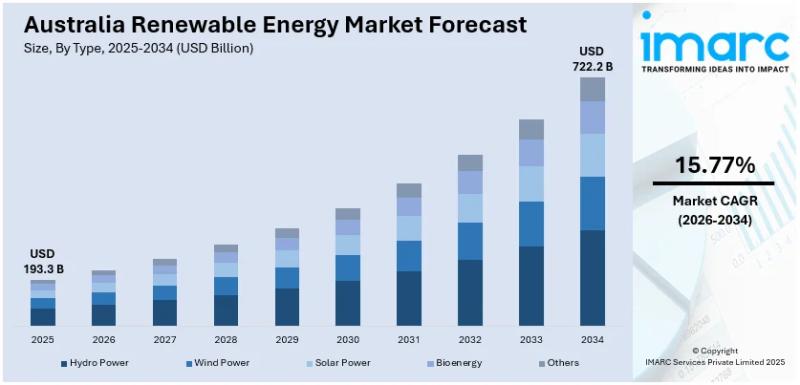

Australia Renewable Energy Market Projected to Reach USD 722.2 Billion by 2034

Market Overview

The Australia renewable energy market size reached USD 193.3 Billion in 2025 and is forecast to expand to USD 722.2 Billion by 2034. The market will grow at a compound annual growth rate of 15.77% during the forecast period of 2026-2034. This growth is primarily driven by advances in energy storage and smart grid technologies, which enhance renewables' integration into the country's energy infrastructure. Renewable sources including solar, wind,…

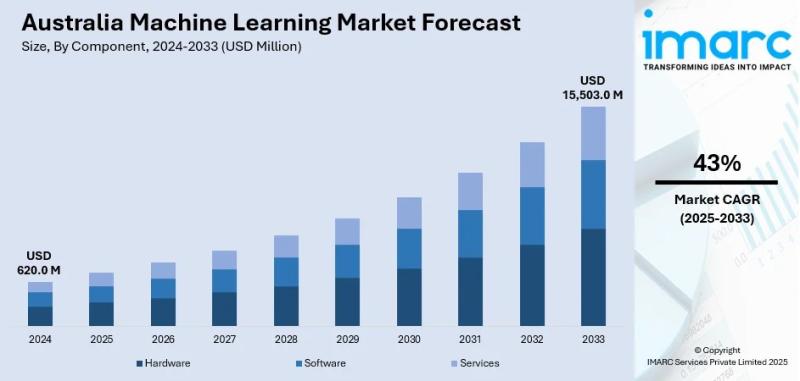

Australia Machine Learning Market 2026 | Worth USD 15,503.0 Million by 2034

Market Overview

The Australia machine learning market size was USD 620.0 Million in 2024 and is projected to reach USD 15,503.0 Million by 2033, demonstrating a robust growth rate of 43% during the forecast period of 2025-2033. Growth is driven by increasing usage of machine learning in healthcare diagnostics, financial fraud detection, and e-commerce personalization. Government support through AI funding and a strong startup ecosystem further boost adoption. Additionally, the rollout…

More Releases for Fuel

Fuel Cell Market to Expand Significantly by 2024 | Horizon Fuel Cell Technologie …

The "Fuel Cell Market" intelligence report, just published by USD Analytics, covers insurers' micro-level study of important market niches, product offers, and sales channels. In order to determine market size, potential, growth trends, and competitive environment, the Fuel Cell Market provides dynamic views. Both primary and secondary sources of data were used to generate the research, which has both qualitative and quantitative depth. Several of the major figures the study…

Electronic Fuel Management System Market Share and Future Forecast 2022 to 2028 …

The global Electronic Fuel Management System market revenue is expected to register a CAGR of 8.8% during the forecast period.

Latest Study on Industrial Growth of Electronic Fuel Management System Market 2022-2028. A detailed study accumulated to offer current insights about important features of the Electronic Fuel Management System market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, value chain optimization, price, and other substantial factors. While emphasizing…

Marine Gensets Market: Information by Vessel Type (Commercial Vessel, Defense Ve …

A marine genset is a power unit generator that supplies electricity to ships. It offers reliable and fuel-efficient electric power generation for onboard power, emergency gensets, and diesel-electric propulsion. It can be fueled by gas, diesel, hybrid fuel, and others. It has application in offshore commercial vessels, defense vessels, and offshore vessels, among others. Nowadays, most of the marine gensets are fueled by diesel. However, the introduction of alternative fuels…

Fuel Card Market to 2027 - Global Analysis and Forecasts By Type (Branded Fuel C …

The global fuel card market is estimated to account US$ 6.29 Bn in 2018 and is expected to grow at a CAGR of 5.8% during the forecast period 2019 – 2027, to account to US$ 10.39 Bn by 2027.

Request Sample Pages of “Fuel Card Market” Research Report @ www.theinsightpartners.com/sample/TIPRE00003099/?utm_source=openpr&utm_medium=10387

Fuel Card Market: Key Insights

Fuel Card Market Size 2021, by manufacturer, region, types, and application, forecast till 2028 is analyzed and researched on…

Clean Fuel Technology Market – Development Assessment 2025 | Clean Fuel Develo …

Global Clean Fuel Technology Market: Overview

Clean technology in general implies the use of any service, product, or system that has as little of a negative impact on the environment as possible. Aspects of clean technology include the conservation of energy, sustainable resources, and clean sources of fuels. Clean fuels can refer to the use of renewable fuels such as biogas, or also blended fuels such as fossil fuels with renewable…

Fuel Cell Interconnectors Market By Product Type Ceramic based, Metal based; By …

Global Fuel Cell Interconnectors Market Introduction

A fuel cell is a battery that generates electricity through an electrochemical reaction where the fuel cell interconnector is a layer made up of either ceramic or metallic material, which combines the electricity generated by each individual cell. Fuel cell interconnectors are placed between each individual cell to connect the cells in the series. Ceramic fuel cell interconnectors are more suitable for high-temperature working conditions…