Press release

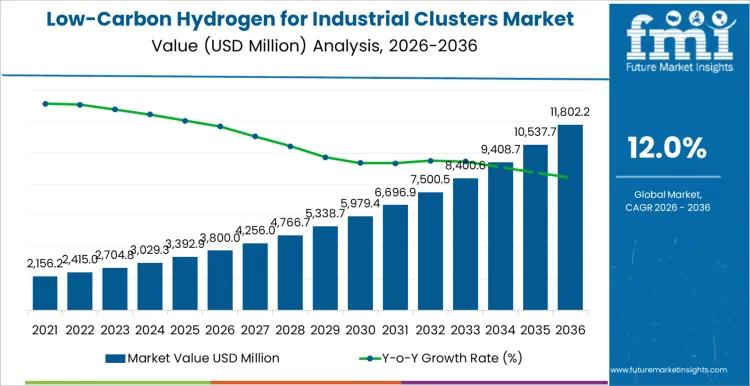

Low-Carbon Hydrogen for Industrial Clusters Market to Reach USD 11,802.2 Million by 2036 at 12.0% CAGR

The Low-Carbon Hydrogen for Industrial Clusters Market is projected to expand from USD 3,800.0 million in 2026 to USD 11,802.2 million by 2036, advancing at a robust 12.0% CAGR during the forecast period. Growth reflects the accelerating shift toward coordinated industrial cluster development, where shared hydrogen infrastructure enables economies of scale, optimized resource allocation, and collective decarbonization outcomes.The Low-Carbon Hydrogen for Industrial Clusters Market is becoming central to regional energy transition strategies as co-located facilities integrate production, storage, and distribution into synchronized hydrogen ecosystems that enhance supply reliability, operational flexibility, and investment efficiency.

Read Full Report:https://www.futuremarketinsights.com/reports/low-carbon-hydrogen-for-industrial-clusters-market

Direct Answers

Market size in 2026: USD 3,800.0 million

Market size in 2036: USD 11,802.2 million

Forecast CAGR (2026-2036): 12.0%

Leading production route: Green Hydrogen (Electrolysis) - 44%

Leading business model: Shared backbone infrastructure - 38.0%

Leading end-use segment: Refining and chemical applications - 30.0%

Largest development stage: Under-construction clusters - 42.0%

Key growth countries: China, Germany, USA, UK, South Korea, Japan

Top companies: Air Liquide, Linde, Air Products, Shell, BP, Equinor, RWE, ENGIE, Iberdrola, Ørsted

Market Momentum (2026-2036 Trajectory)

The Low-Carbon Hydrogen for Industrial Clusters Market begins its forecast cycle at USD 3,800.0 million in 2026, supported by committed under-construction cluster projects and expanding renewable integration. By 2028, scaling electrolysis capacity and shared infrastructure investments strengthen deployment momentum. Entering 2030, coordinated policy support and cost improvements in renewable electricity enhance green hydrogen competitiveness.

From 2031 onward, increased operational maturity and backbone infrastructure optimization accelerate adoption across refining and chemical complexes. By 2033, international hydrogen trade opportunities and cross-border cooperation reinforce large-scale cluster economics. The market ultimately reaches USD 11,802.2 million by 2036, reflecting sustained 12.0% CAGR growth anchored in integrated industrial decarbonization strategies.

Why the Market is Growing

The Low-Carbon Hydrogen for Industrial Clusters Market is expanding as regional decarbonization mandates increasingly favor coordinated industrial action over standalone facility transitions. Shared electrolysis facilities, integrated storage systems, and smart distribution networks reduce individual capital burdens while improving operational reliability.

Declining renewable electricity costs are improving green hydrogen economics, supporting full lifecycle carbon neutrality and access to green financing. At the same time, industrial competitiveness pressures encourage cluster-based approaches that optimize cost structures, enhance supply security, and meet regulatory compliance expectations.

Policy frameworks supporting just transition initiatives, workforce development, and regional industrial modernization further strengthen the investment case for large-scale cluster development.

Segment Spotlight

1) Production Route: Green Hydrogen Leads (44%)

Green hydrogen produced via renewable-powered electrolysis commands 44% of the Low-Carbon Hydrogen for Industrial Clusters Market. Its leadership reflects strong alignment with net-zero targets and green financing requirements. Declining solar and wind costs, combined with improving electrolysis efficiency, reinforce long-term cost stability and energy independence.

Blue hydrogen remains significant for immediate large-scale deployment and cost optimization while supporting gradual green transition pathways.

2) Business Model: Shared Backbone Infrastructure (38.0%)

Shared backbone infrastructure systems account for 38.0% adoption, highlighting coordinated development as the preferred configuration. These models enable infrastructure sharing, distributed risk, and optimized resource allocation across multiple industrial users. Participants gain access to large-scale production and storage capacity without assuming standalone project risks.

3) End Use: Refining and Chemical Applications (30.0%)

Refining and chemical applications represent 30.0% of demand, positioning petrochemical complexes and refineries as anchor customers. Their substantial hydrogen consumption and existing infrastructure provide predictable volumes that support cluster economics while enabling expansion into adjacent industrial applications.

Drivers, Opportunities, Trends, Challenges

Drivers: Regional decarbonization mandates and industrial policy frameworks increasingly prioritize cluster-based hydrogen deployment. Shared infrastructure reduces system-wide costs and simplifies regulatory compliance.

Opportunities: International hydrogen trade and cross-border cooperation create export pathways and technology leadership potential. Integrated renewable-hydrogen projects offer diversified revenue streams and improved economics.

Trends: Green hydrogen adoption is accelerating as renewable energy costs decline. Under-construction clusters (42.0%) dominate near-term deployment, while announced projects (30.0%) signal strong pipeline expansion.

Challenges: High capital requirements for production, storage, and distribution infrastructure remain a barrier. Grid connection constraints and electricity supply limitations may restrict large-scale electrolysis deployment in certain industrial regions.

Country Growth Outlook (CAGR)

China leads growth at 13.2% CAGR, driven by industrial scale and coordinated hydrogen policies. Germany advances at 11.6% through structured hydrogen strategy implementation. The USA grows at 11.8%, supported by regional hub initiatives. Japan (10.5%) emphasizes precision and reliability. South Korea (11.2%) and the UK (11.7%) strengthen cluster integration within advanced industrial ecosystems.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/brochure/rep-gb-31645

Request for Sample Report | Customize Report |purchase Full Report -https://www.futuremarketinsights.com/reports/sample/rep-gb-31645

Competitive Landscape

The Low-Carbon Hydrogen for Industrial Clusters Market features global industrial gas leaders and energy majors driving large-scale cluster development. Key participants include Air Liquide, Linde, Air Products, Shell, BP, Equinor, RWE, ENGIE, Iberdrola, and Ørsted. Competitive positioning centers on integrated project execution, infrastructure coordination, operational optimization, and stakeholder collaboration.

Scope of the Report

Market Value (2026): USD 3,800.0 million

Forecast Value (2036): USD 11,802.2 million

CAGR (2026-2036): 12.0%

Segmentation: Production Route, Business Model, End Use, Development Stage

Regions Covered: Global

Countries Analyzed: China, Germany, USA, Japan, South Korea, UK

Key Companies Profiled: Air Liquide, Linde, Air Products, Shell, BP, Equinor, RWE, ENGIE, Iberdrola, Ørsted

Explore More Related Studies Published by FMI Research:

Energy Storage High Voltage Connector Market:https://www.futuremarketinsights.com/reports/energy-storage-high-voltage-connector-market

Compressor Anti Surge Control Valve Market:https://www.futuremarketinsights.com/reports/compressor-anti-surge-control-valve-market

Decoking Control System Market:https://www.futuremarketinsights.com/reports/decoking-control-system-market

Surfactants for Enhanced Oil Recovery (EOR) Market:https://www.futuremarketinsights.com/reports/surfactants-for-enhanced-oil-recovery-eor-market

Why FMI: Decisions that Change Outcomes- https://www.futuremarketinsights.com/why-fmi

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Low-Carbon Hydrogen for Industrial Clusters Market to Reach USD 11,802.2 Million by 2036 at 12.0% CAGR here

News-ID: 4392694 • Views: …

More Releases from Future Market Insights

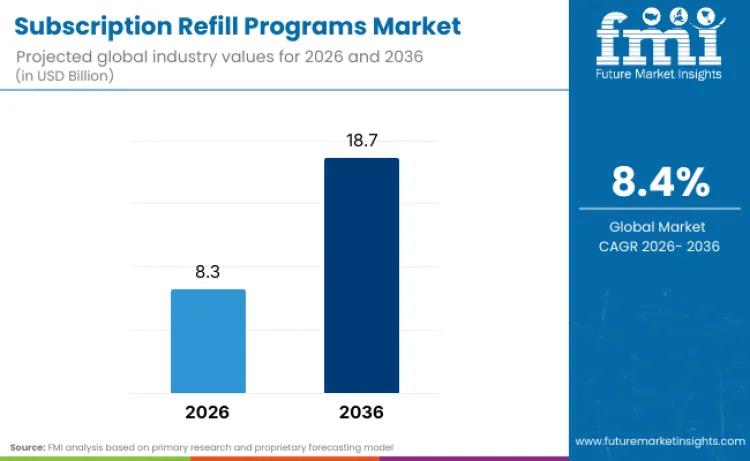

Subscription Refill Programs Market to Reach USD 18.7 Billion by 2036 at 8.4% CA …

The Subscription Refill Programs Market is projected to reach USD 8.3 billion in 2026 and expand to USD 18.7 billion by 2036, registering a CAGR of 8.4% during the forecast period. Growth reflects the rapid scaling of recurring replenishment models that reduce cart abandonment, smooth demand cycles, and strengthen customer retention across consumables and regulated categories.

As predictive refill engines replace basic repeat-order systems, brands are investing in unified platforms that…

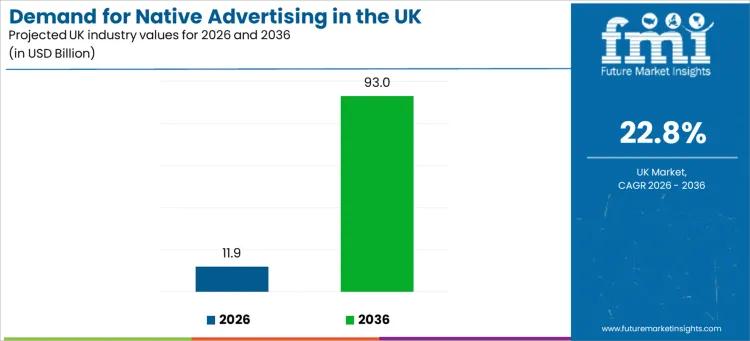

UK Native Advertising Market to Reach USD 93.0 Million by 2036 at 22.8% CAGR

Demand for native advertising in the UK is projected to grow from USD 11.9 million in 2026 to USD 93.0 million by 2036, registering a CAGR of 22.8%. Growth reflects how brands are shifting toward formats that integrate seamlessly within digital content environments where user attention is fragmented and tolerance for interruption is low.

The UK Native Advertising Market is expanding as advertisers prioritize contextual alignment, measurable engagement, and performance transparency…

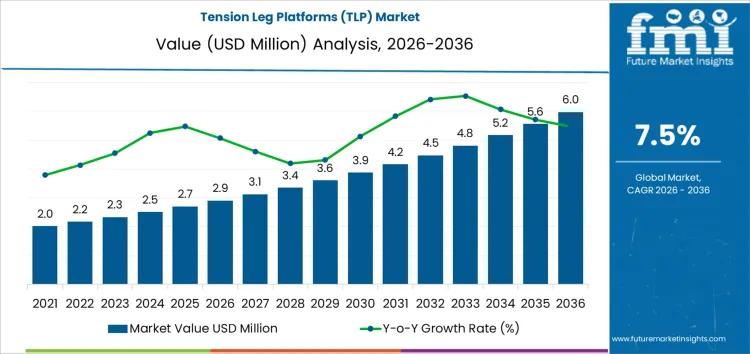

Tension Leg Platforms (TLP) Market to Reach USD 6.0 Million by 2036 at 7.50% CAG …

The global Tension Leg Platforms (TLP) Market is projected to expand from USD 2.9 million in 2026 to USD 6.0 million by 2036, registering a CAGR of 7.50%. Although absolute volumes remain limited, demand quality is reinforced by the critical role TLPs play in deepwater and ultra-deepwater production strategies. Once commissioned, these platforms operate for decades, creating sustained opportunities in inspection, integrity management, and component replacement.

The Tension Leg Platforms (TLP)…

Easy Peel Film Market to Reach USD 164.3 Billion by 2035 | Top Key Players: Berr …

The Easy Peel Film Market is estimated at USD 87.5 billion in 2025 and is projected to reach USD 164.3 billion by 2035, expanding at a CAGR of 6.5% during the forecast period. Growth is being fueled by rising demand for convenient, tamper-evident, and shelf-life-extending packaging across food, beverage, pharmaceutical, and consumer goods sectors.

As packaging becomes a core differentiator in competitive retail environments, the Easy Peel Film Market is evolving…

More Releases for Hydrogen

Green Hydrogen Boosting Hydrogen Generation Market Growth Worldwide

According to a new report published by Allied Market Research, the hydrogen generation market was valued at $136.3 billion in 2021 and is projected to reach $262.0 billion by 2031, growing at a CAGR of 6.8% from 2022 to 2031. The steady expansion of industrialization, growing environmental concerns, and strong government initiatives toward decarbonization are key factors accelerating the growth of the hydrogen generation market globally.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/1575

Hydrogen production…

White Natural Hydrogen Market Growth 2025-2032 | Clean & Renewable Hydrogen Sour …

New York, U.S. - Worldwide Market Reports unveils its latest evaluation of the White Natural Hydrogen Market, highlighting the growing interest in naturally occurring, untapped hydrogen resources that can support decarbonization initiatives and supplement green and blue hydrogen production. Increasing exploration in geological formations, coupled with rising demand for low-carbon energy carriers, is driving adoption across industrial, energy, and mobility sectors. Near-term growth is expected from subsurface hydrogen reservoirs, renewable…

Hydrogen Electrolyzer Market, Fueling the Green Hydrogen Revolution Worldwide

Overview of the Market

The hydrogen electrolyzer market is rapidly transforming into a cornerstone of the global clean energy transition, driven by increasing investments in sustainable technologies and government-led decarbonization efforts. A hydrogen electrolyzer is a device that splits water into hydrogen and oxygen using electricity, enabling the generation of green hydrogen when powered by renewable sources. This exponential rise is attributed to the surging demand for clean fuels, rising…

Hydrogen economy: hydrogen as an energy carrier is changing companies

The energy transition and climate protection have put the focus on a sustainable energy supply. Hydrogen is considered one of the most important energy sources of the future and plays a key role in the decarbonization of industry. Investments in the hydrogen economy are increasing worldwide. Germany is also increasingly focusing on promoting this technology.

But what impact will this have on companies, the labor market and the competitiveness of Germany…

Hydrogen Generator Market Growth: Powering the Green Hydrogen Economy

According to a new report published by Allied Market Research, The global hydrogen generator market size was valued at $1.2 billion in 2020, and hydrogen generator market forecast to reach $2.2 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

Global shift toward the use of eco-friendly and renewable resources and several government initiatives toward development of eco-friendly hydrogen production technologies, coupled with rapidly increasing demand for…

Hydrogen Generator Market Dynamics: Trends Shaping the Hydrogen Economy

According to a new report published by Allied Market Research, The global hydrogen generator market size was valued at $1.2 billion in 2020, and hydrogen generator market forecast to reach $2.2 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

Global shift toward the use of eco-friendly and renewable resources and several government initiatives toward development of eco-friendly hydrogen production technologies, coupled with rapidly increasing demand for…