Press release

Competitive Analysis: Key Market Leaders and New Entrants in the Decentralized Exchange Sector

The decentralized exchange market is rapidly evolving as blockchain technology and decentralized finance (DeFi) gain wider acceptance. This market's trajectory is strongly influenced by innovations that enhance security, interoperability, and user control. Let's explore the current market size, key players, emerging trends, and the important segments that define this expanding sector.Projected Growth and Market Size of the Decentralized Exchange Market

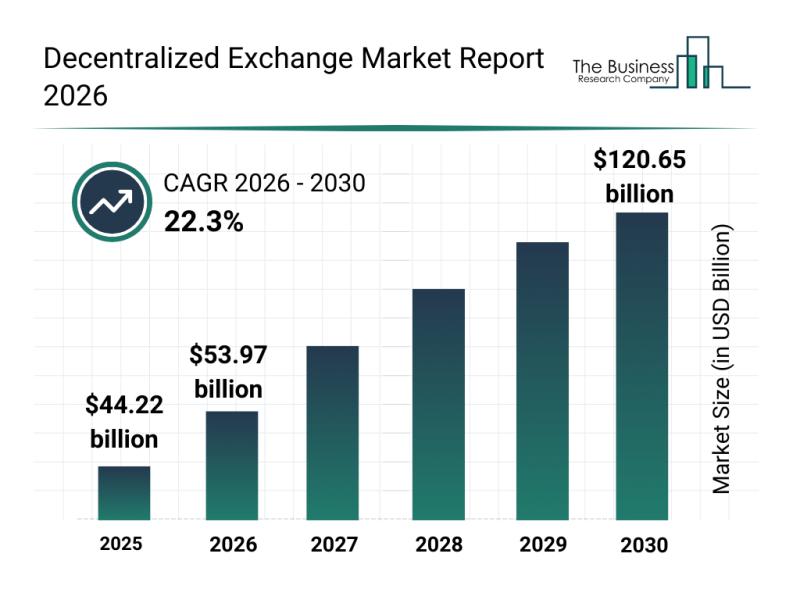

The decentralized exchange market is poised for remarkable expansion, expected to reach a value of $120.65 billion by 2030. This represents an impressive compound annual growth rate (CAGR) of 22.3%. Several factors are driving this growth, including clearer regulatory frameworks surrounding cryptocurrencies, increasing participation from institutional players in DeFi, improvements in cross-chain interoperability, and the development of scalable blockchain networks. Additionally, the growing preference for user-controlled financial services supports this upward trend. Key innovations anticipated to shape the market over the forecast period include automated market maker protocols, non-custodial trading platforms, liquidity pool-based trading, cross-chain asset swaps, and governance through smart contracts.

Download a free sample of the decentralized exchange market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=32577&type=smp&utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Key Players Making an Impact in the Decentralized Exchange Market

A range of notable companies are actively shaping the decentralized exchange space. Leading market participants include SundaeSwap Labs Inc., Raydium, Uniswap Labs, Beamswap Corporation, Rhinofi LLC, PancakeSwap, Loopring Foundation, Ooki Protocol, SpookySwap, ZeroEx Inc., Bybarter Fintech Ltd., OpenOcean Technologies Private Limited, ParaSwap, ThorSwap, WingRiders Ltd., dYdX Trading Inc., Monox Ltd., STON.fi, Saros Finance, and AdaSwap Development Ltd.

One significant development took place in February 2023 when SushiSwap, a US-based decentralized exchange provider, acquired Singapore's Vortex Protocol. This strategic move was intended to broaden SushiSwap's offerings into decentralized derivatives trading by incorporating Vortex's on-chain perpetual exchange technology. The acquisition enables SushiSwap to build a fully on-chain perpetuals trading platform, extending beyond its initial focus on spot trading.

Emerging Trends Reshaping the Decentralized Exchange Industry

Companies within the decentralized exchange sector are increasingly focused on blending centralized and decentralized trading functionalities. This integration aims to enhance liquidity, widen asset availability, and maintain robust trading volumes. The concept involves embedding decentralized liquidity pools within centralized exchange platforms, allowing users to trade non-custodially while enjoying simpler interfaces and access to a broader range of tokens-without relying on traditional order books.

As an example, in August 2025, Coinbase, a major US cryptocurrency exchange, launched decentralized exchange trading features for US customers. This offering lets users trade thousands of on-chain assets directly via decentralized liquidity pools within the Coinbase interface. It supports wallet-based, non-custodial trading, grants access to new tokens often unavailable on centralized platforms, and routes trades through decentralized protocols to optimize liquidity and asset discovery. This initiative reflects a broader shift toward integrated decentralized trading as centralized exchanges face volume declines and user demand shifts toward decentralized models.

View the full decentralized exchange market report:

https://www.thebusinessresearchcompany.com/report/decentralized-exchange-market-report?utm_source=OpenPR&utm_medium=Paid&utm_campaign=Feb_PR

Breakdown of Segments in the Decentralized Exchange Market Report

The decentralized exchange market is analyzed across several detailed segments:

1) Component: Includes Platforms and Services

2) Type: Encompasses Automated Market Makers, Order Book Decentralized Exchanges, Decentralized Exchange Aggregators, and other types

3) Application: Covers Cryptocurrency Trading, Token Swapping, Staking, Yield Farming, and additional applications

4) End User: Divided into Retail Traders, Institutional Traders, and other end users

Further subcategories refine the analysis:

- Platforms are classified as Web Based, Mobile Based, or Hybrid Based

- Services include Consulting, Development, Integration, Support and Maintenance, and Training

This segmentation provides a comprehensive view of the decentralized exchange ecosystem, highlighting the diversity of offerings and user profiles within the market.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Competitive Analysis: Key Market Leaders and New Entrants in the Decentralized Exchange Sector here

News-ID: 4391512 • Views: …

More Releases from The Business Research Company

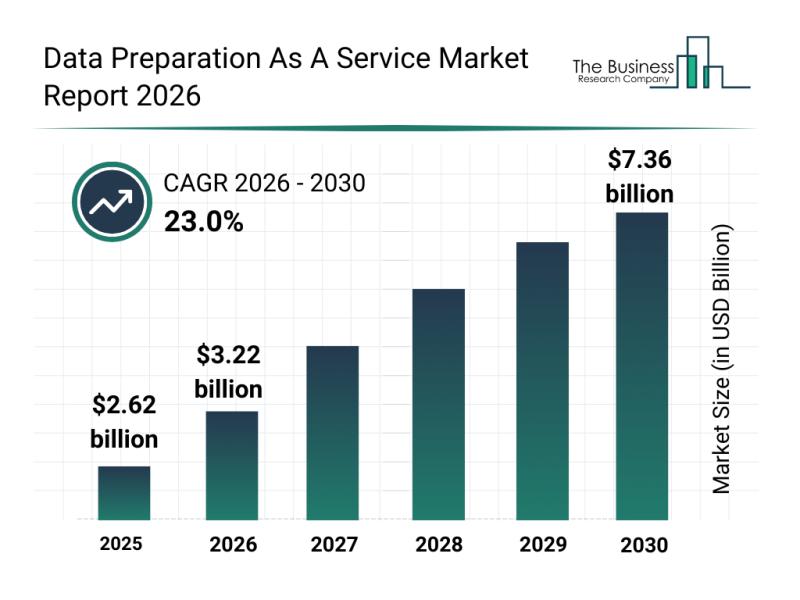

Segment Analysis and Major Growth Areas in the Data Preparation As a Service Mar …

The data preparation as a service market is poised for significant expansion, driven by increasing demand for streamlined data management and AI integration across enterprises. As businesses become more data-centric, the need for efficient and automated data preparation solutions is rapidly rising. This report explores the market's projected growth, key players, emerging trends, and segmentation to provide a thorough understanding of the sector's trajectory.

Projected Market Growth of the Data Preparation…

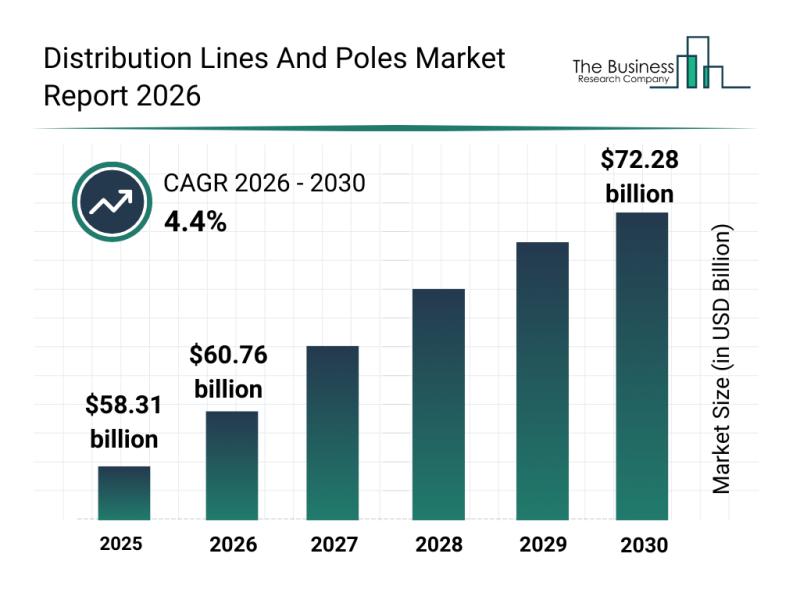

Market Trend Insights: The Impact of Recent Developments on the Distribution Lin …

The distribution lines and poles market is positioned for steady advancement as we approach 2030, driven by technological upgrades and evolving infrastructure needs. This sector is responding to the increasing demand for smarter, more efficient power distribution systems and advancements in materials and monitoring technologies. Let's explore the current state, key players, evolving trends, and market segmentation to get a clearer picture of this growth trajectory.

Projected Growth Outlook for the…

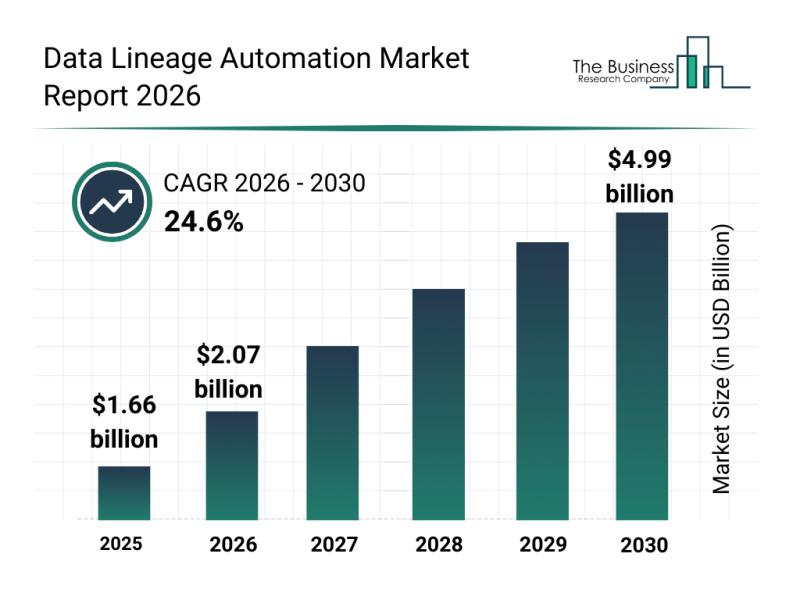

Key Strategic Trends and Emerging Changes Shaping the Data Lineage Automation Ma …

The data lineage automation market is gaining considerable attention as organizations seek greater transparency and control over their data ecosystems. With the rising demand for real-time data tracking and governance, this sector is set to experience remarkable growth in the coming years. Let's explore the current market valuation, key players, emerging trends, and detailed segmentation shaping this dynamic industry.

Strong Market Expansion Expected for Data Lineage Automation by 2030

The…

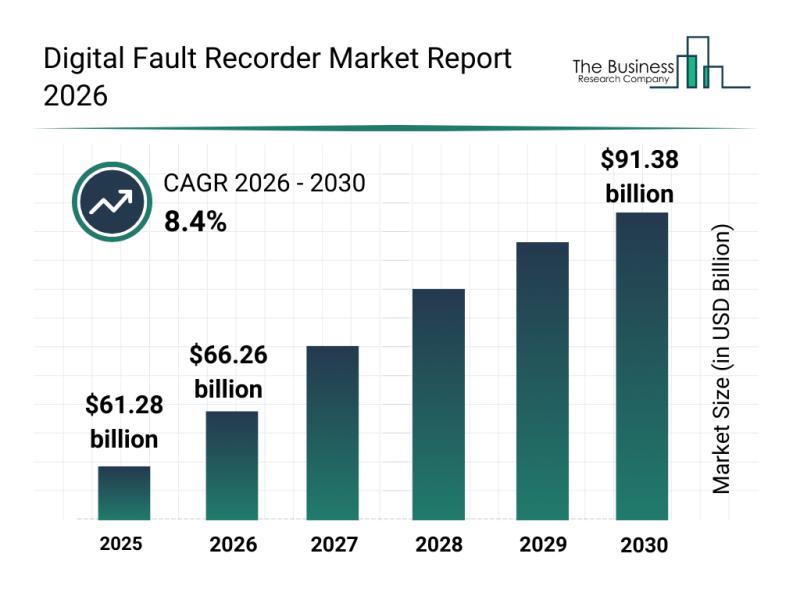

Digital Fault Recorder Market Overview, Key Trends, and Major Player Analysis

The digital fault recorder market is positioned for impressive growth as advancements in energy technology and infrastructure continue to accelerate. With increasing emphasis on grid reliability and smart energy management, this sector is expected to expand significantly over the coming years. Below is a detailed overview of the market's projected size, key players, and segment classifications shaping its development.

Projected Market Size of the Digital Fault Recorder Industry by 2030 …

More Releases for Decentralized

Decentralized Finance (DeFi) Market From Lending to Prediction: Diverse Applicat …

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Decentralized Finance (DeFi) Market Shaping the Future of Finance: The Expanding …

Decentralized Finance (DeFi) Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Decentralized Finance (DeFi) Market" in terms of revenue was estimated to be worth $20.22 billion in 2023 and is poised to reach $398.77 billion by 2031, growing at a CAGR of 45.36% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1607

Current…

Decentralized Finance Market Reviews Analysis Report 2024

Decentralized Finance Market

Decentralized Finance Market to reach over USD 398.77 billion by the year 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Decentralized Finance Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Payments, Data & Analytics, Decentralized Exchanges, Prediction…

Blockchain development: Building decentralized applications (DApps)

Blockchain technology is the new buzzword in today's digital landscape. It has revolutionized the way we conceive and interact with digital assets. And what do you think about these decentralized applications? It is another transformation in blockchain technology that offers transparency, security, and autonomy. Let's delve into the key aspects of building DApps.

Understanding Smart Contracts: Solidity and Ethereum

Smart contracts are agreements that automatically carry out their obligations because…

MULTI CHAIN DECENTRALIZED PROTOCOLS & SERVICES

Upbit.Finance is a project that dates back to 2018. It was launched with a focus on the decentralized finance industry and Its multi-chain ecosystem, where it continues to offer a growing suite of services in this sector. The core objective is to bring value to the Crypto space by delivering disruptive, flexible, and audit technology. This protocol was created with Web3 developers and traders in mind. It is designed to…

Data Scientist Invents Cryptocurrency Decentralized Banq

Meet Anade, he's a Former Uber and Lyft Driver turned Financial Data Scientist.

Almost Five years removed from helping people get from one place to another. He is now helping people build wealth using Blockchain Technology with his company "Cryptoshare Banq".

"In 2018, after I gave up Uber I made a decision to build Wealth and help others in the process.

Our Target Market is the Creditless, Unbanked, and Underbanked (over 25% of…