Press release

AI Fintech Market Projected To Reach USD 18.04 Billion 2032, at a CAGR of 16.40% From 2025 to 2032

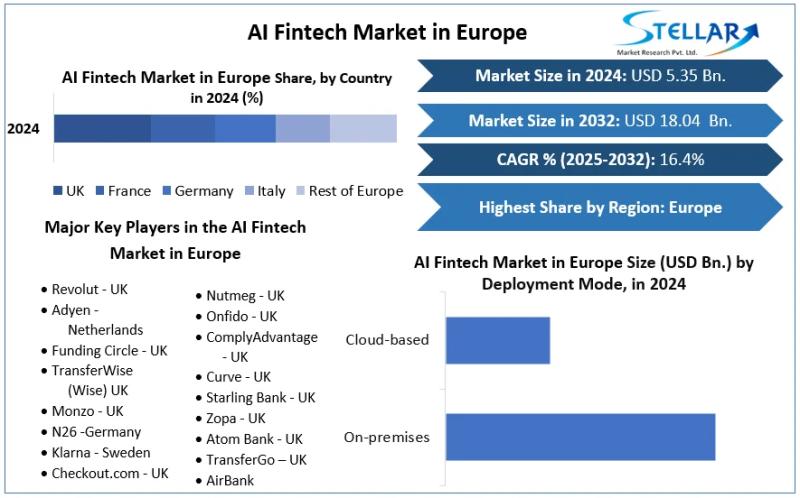

The AI Fintech Market size in Europe was valued at USD 5.35 Billion in 2024 and the total AI Fintech Market size in Europe is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.Artificial intelligence is rapidly becoming the backbone of modern financial services, and nowhere is this transformation more visible than in Europe. The region hosts a dense ecosystem of digital banks payment platforms lending specialists and enterprise software providers that are embedding AI into everyday financial workflows. From real time fraud detection to personalized credit offers and automated customer support, AI is moving from experimentation to core infrastructure.

➤ Request Sample Copy Report at: https://www.stellarmr.com/report/req_sample/AI-Fintech-Market-in-Europe/1692

Well known innovators such as Revolut, Klarna, Adyen, and SAP are setting benchmarks for how data and machine learning can improve speed accuracy and customer experience across payments lending and financial operations. At the same time, regulators and central institutions including the European Central Bank are encouraging innovation while strengthening oversight around data protection and model risk.

The market spans software platforms analytics engines cloud infrastructure and embedded AI services that banks and fintech firms use to modernize their stacks. It also includes a growing services layer focused on model development compliance tooling and integration. What makes the region distinctive is the combination of strong consumer adoption of digital finance and a regulatory framework that pushes for transparency and fairness in algorithmic decision making. Together, these forces are shaping a market that values both performance and trust.

Market Dynamics

The dynamics of the AI fintech market in Europe are defined by rapid digital adoption and careful governance. On the demand side, consumers expect instant onboarding real time payments and personalized financial advice. Businesses want faster credit decisions better cash flow visibility and automated compliance checks. AI provides the tools to deliver these outcomes at scale.

On the supply side, competition is intense. Fintechs move quickly, while established banks invest heavily to modernize legacy systems. Cloud providers and software vendors offer pre built AI services, which lowers entry barriers but also raises the bar for differentiation. Another dynamic factor is regulation. Strong data protection rules and emerging AI governance frameworks influence how models are trained, deployed, and monitored. This increases development costs but also builds confidence among users and enterprise buyers.

Partnerships are becoming more common. Banks collaborate with startups for speed, while startups rely on banks for distribution and trust. Cross border expansion within the region further shapes the market, because AI models must adapt to different languages, consumer behaviors, and regulatory nuances. The result is a landscape where technical excellence, compliance readiness, and local market understanding all matter at the same time.

Key Drivers

One of the most powerful drivers is the ongoing shift toward digital first finance. Mobile banking, contactless payments, and online lending generate massive volumes of data. AI turns this data into actionable insights, enabling smarter pricing, better risk management, and more relevant customer interactions.

Fraud prevention and cybersecurity are another major driver. As digital transactions grow, so do attempts at fraud. Machine learning models that analyze patterns in real time are far more effective than rule based systems, and this pushes continuous investment in AI across payments and banking platforms.

Cost efficiency also plays a role. Automation of customer service, document processing, and compliance checks reduces operating expenses and improves scalability. In a competitive market with pressure on margins, these efficiency gains are strategically important. Finally, innovation in areas such as open banking and embedded finance creates new use cases for AI, from personalized financial marketplaces to real time credit scoring inside non financial apps.

➤ Get Instant Access! Purchase This Premium Research Report: https://www.stellarmr.com/report/buy_now_report/AI-Fintech-Market-in-Europe/1692

Market Segmentation

By Deployment Mode

On-premises

Cloud-based

By Application

Virtual Assistants

Business Analytics and Reporting

Customer Behavioral Analytics

Fraud Detection

Quantitative and Asset Management

Other

By End User

Banking

Insurance

Securities

Regional Analysis

Within the region, the United Kingdom remains a major hub for fintech innovation, supported by a deep talent pool and a strong venture capital ecosystem. London continues to attract startups focused on payments digital banking and capital markets technology, many of which are built around AI from day one.

Germany plays a central role in enterprise focused fintech and banking infrastructure, with strong demand for AI in compliance risk management and back office automation. France is emerging as a center for deep tech and AI research applied to finance, supported by government initiatives and large financial institutions.

The Nordic region, including Sweden, stands out for consumer adoption of digital payments and innovative lending models, while the Netherlands is a key player in cross border payments and merchant services. Southern and Eastern European markets are catching up, driven by mobile first consumers and increasing investment in digital infrastructure.

➤ Request Sample Copy Report at: https://www.stellarmr.com/report/req_sample/AI-Fintech-Market-in-Europe/1692

Opportunities

The next phase of growth in the AI fintech market will be shaped by trust, integration, and new business models. One major opportunity lies in explainable AI and governance tooling. As regulations evolve, institutions will need systems that not only make decisions but also clearly explain them to regulators and customers. Providers that can combine performance with transparency will gain a strong competitive advantage.

Another opportunity is embedded finance. As more non financial platforms offer payments, lending, and insurance, AI will be essential to manage risk personalize offers and ensure compliance at scale. This opens new distribution channels for fintech technology providers beyond traditional banks.

There is also significant potential in small and medium enterprise services. Many smaller businesses remain underserved in areas such as credit, cash flow management, and financial planning. AI driven tools can fill this gap with affordable and scalable solutions.

In the long run, the AI fintech market in Europe is about more than efficiency. It is about building a financial system that is faster more inclusive and more responsive to real world needs, while staying aligned with strong standards for safety and fairness. With its mix of innovation talent and regulatory leadership, the region is well positioned to shape how intelligent finance works for millions of people and businesses.

AI Fintech Market in Europe Key Players

Revolut - UK

Adyen - Netherlands

Funding Circle - UK

TransferWise (Wise) UK

Monzo - UK

N26 -Germany

Klarna - Sweden

Checkout.com - UK

OakNorth - UK

Lemonade - Netherlands

iZettle (now PayPal) - Sweden

Raisin -Germany

Nutmeg - UK

Onfido - UK

ComplyAdvantage - UK

Curve - UK

Starling Bank - UK

Zopa - UK

Atom Bank - UK

TransferGo - UK

AirBank

Finleap Connect

Finanzcheck.de

Raisin DS

N26

wefox Group

Pendix

Frequently Asked Questions

1. What are the growth drivers for the AI Fintech in Europe Market?

Rising health awareness is expected to be the major driver for the market.

2. What is the major restraint for the AI Fintech Market in Europe growth?

High Cost are expected to be the major restraining factors for the market growth.

3. Which Country is expected to lead the global AI Fintech Market in Europe during the forecast period?

United Kingdom is expected to lead the AI Fintech Market in Europe during the forecast period.

4. What is the projected AI Fintech Market in Europe size & and growth rate of the Market?

The Market size was valued at USD 5.35 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 16.40% from 2025 to 2032, reaching nearly USD 18.04 Billion.

5. What segments are covered in the Market report?

The segments covered in the market report are By Deployment Type, Application, and End User.

Explore Research Reports:

Radio-Frequency Identification (RFID) Market https://www.stellarmr.com/report/radio-frequency-identification-rfid-market/2328

Network as a Service Market https://www.stellarmr.com/report/network-as-a-service-market/2332

Industrial Control Systems Security Market https://www.stellarmr.com/report/industrial-control-systems-security-market/2338

Retail Analytics Market https://www.stellarmr.com/report/retail-analytics-network-market/2346

Retail E-Commerce Market https://www.stellarmr.com/report/retail-e-commerce-market/2371

E-Commerce International Market https://www.stellarmr.com/report/e-commerce-international-market/2377

Cloud Radio Access Network Market https://www.stellarmr.com/report/cloud-radio-access-network-market/2380

Communication Platform as a Service Market https://www.stellarmr.com/report/communication-platform-as-a-service-market/2383

Phase 3, Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor, Near,

Navale Brg, Narhe,

Pune, Maharashtra 411041

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI Fintech Market Projected To Reach USD 18.04 Billion 2032, at a CAGR of 16.40% From 2025 to 2032 here

News-ID: 4389925 • Views: …

More Releases from Stellar Market Research. PVT. LTD

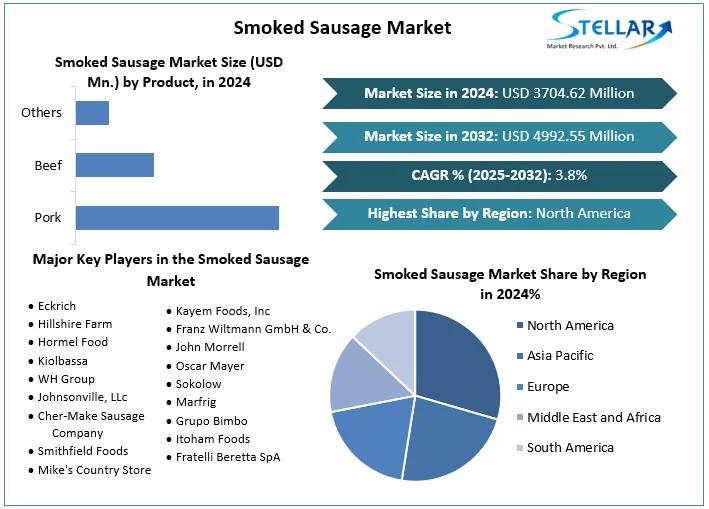

Smoked Sausage Market Tradition Meets Modern Convenience in a Flavor Driven Indu …

The Smoked Sausage Market size was valued at USD 3704.62 Mn. in 2024 and the total Global Smoked Sausage revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 4992.55 Mn. by 2032.

Smoked sausage has a long culinary history rooted in preservation and flavor, yet today it stands as a modern, globally traded food category shaped by convenience, branding, and evolving consumer tastes.…

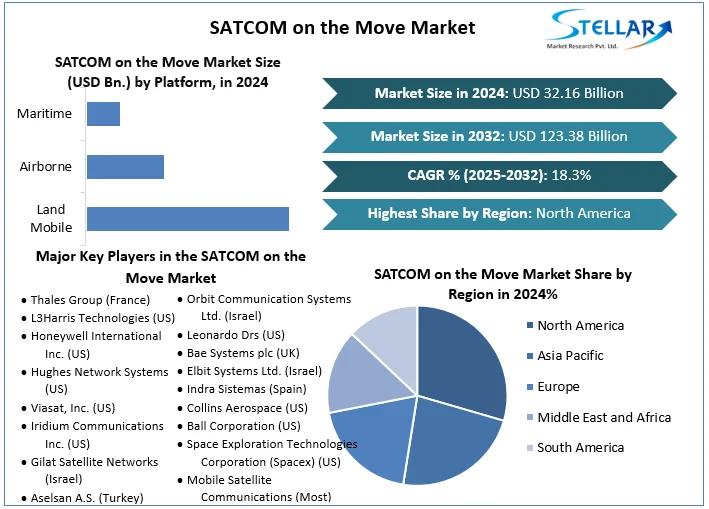

SATCOM on the Move Market Estimated To Grow at a CAGR of 18.3%, Reach USD 123.38 …

The SATCOM on the Move Market size was valued at USD 32.16 Bn. in 2024. The global SATCOM on the Move Market is estimated to grow at a CAGR of 18.3% over the forecast period.

SATCOM on the Move refers to satellite communication systems that provide reliable broadband connectivity to platforms in motion such as aircraft ships trains military vehicles and emergency response units. Unlike fixed satellite links these solutions are…

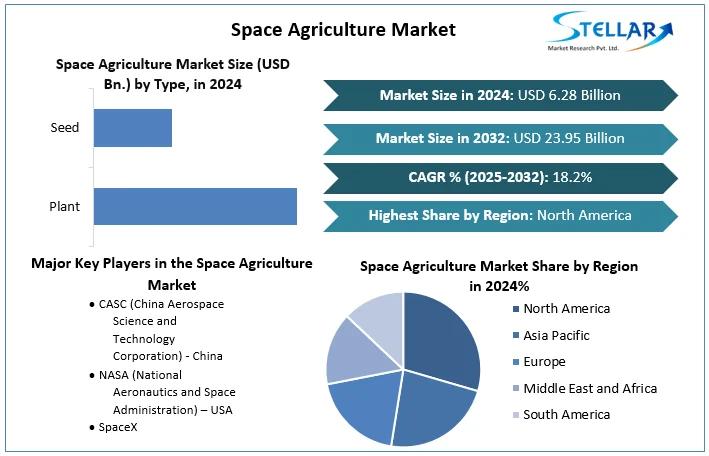

Space Agriculture Market Growing at CAGR of 18.20 % From 2025 to 2032, To Reach …

The Space Agriculture Market size was valued at USD 6.28 Bn. in 2024 and the total Global Space Agriculture revenue is expected to grow at a CAGR of 18.20 % from 2025 to 2032, reaching nearly USD 23.95 Bn. by 2032.

Space agriculture is no longer a concept limited to science fiction. It is becoming a strategic field that connects space exploration, advanced biotechnology, controlled environment farming, and food security. The…

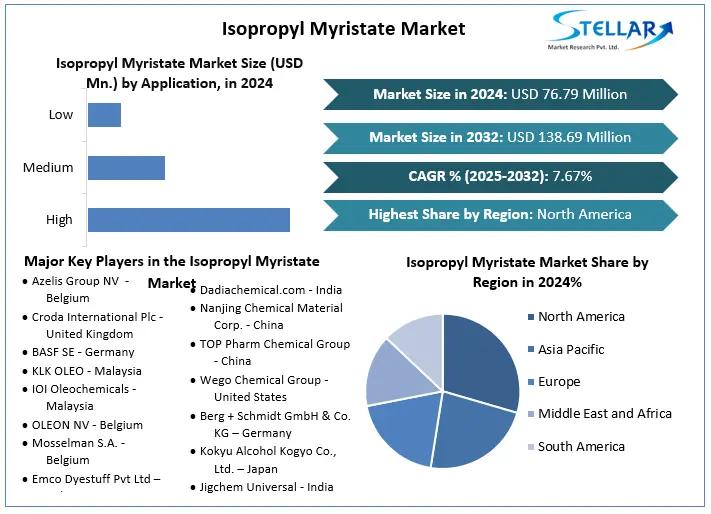

Isopropyl Myristate Market The Lightweight Emollient Powering Modern Beauty and …

The Isopropyl Myristate Market size was valued at USD 76.79 Mn. in 2024 and the total Isopropyl Myristate Market size is expected to grow at a CAGR of 7.67% from 2025to 2032, reaching nearly USD 138.69 Mn. by 2032.

Isopropyl myristate is a clear, low viscosity ester widely used to improve skin feel, spreadability, and sensory performance in personal care, pharmaceuticals, and select industrial applications. It is valued for its ability…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…